September 2024

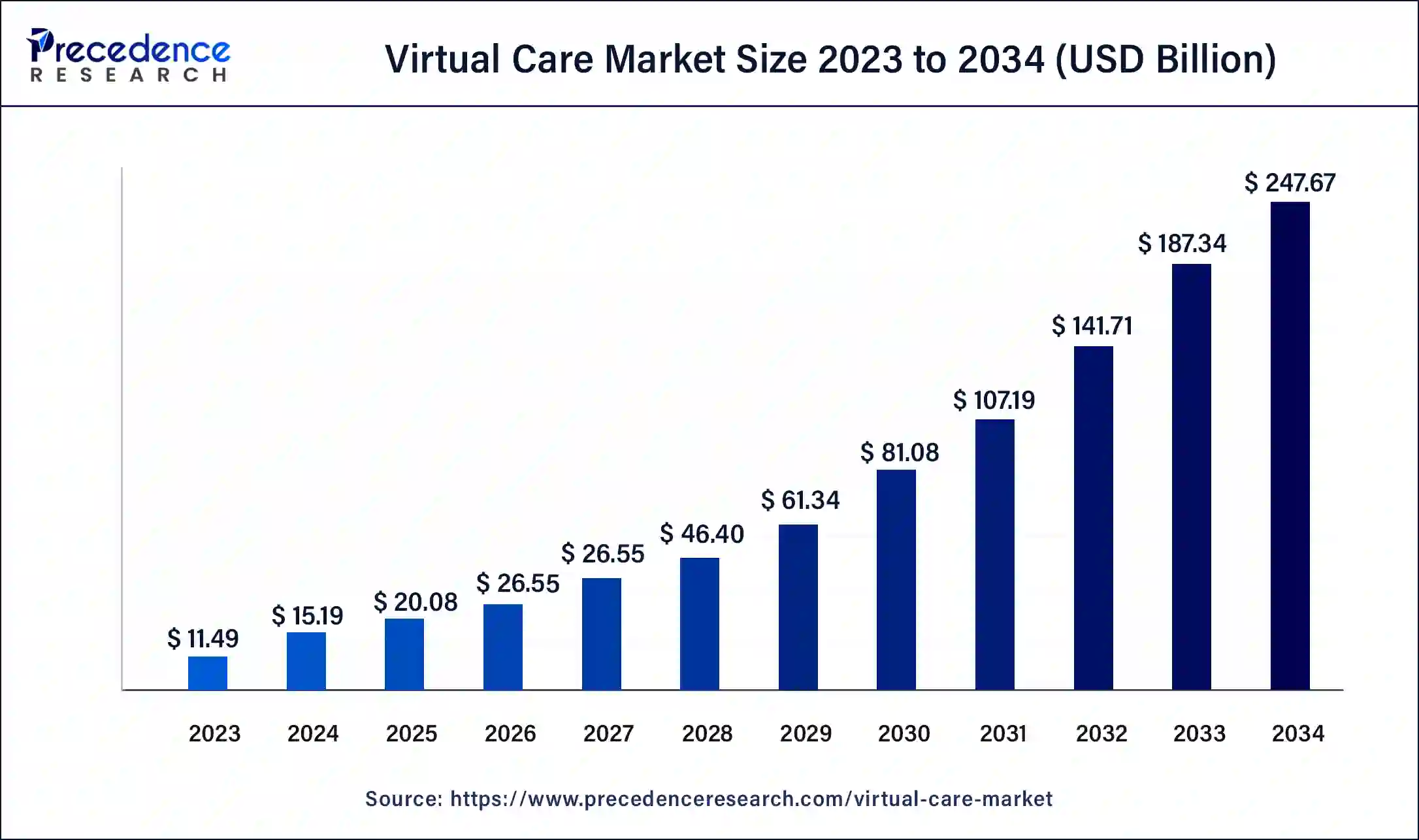

The global virtual care market size was USD 11.49 billion in 2023, calculated at USD 15.19 billion in 2024 and is projected to surpass around USD 247.67 billion by 2034, expanding at a CAGR of 32.2% from 2024 to 2034.

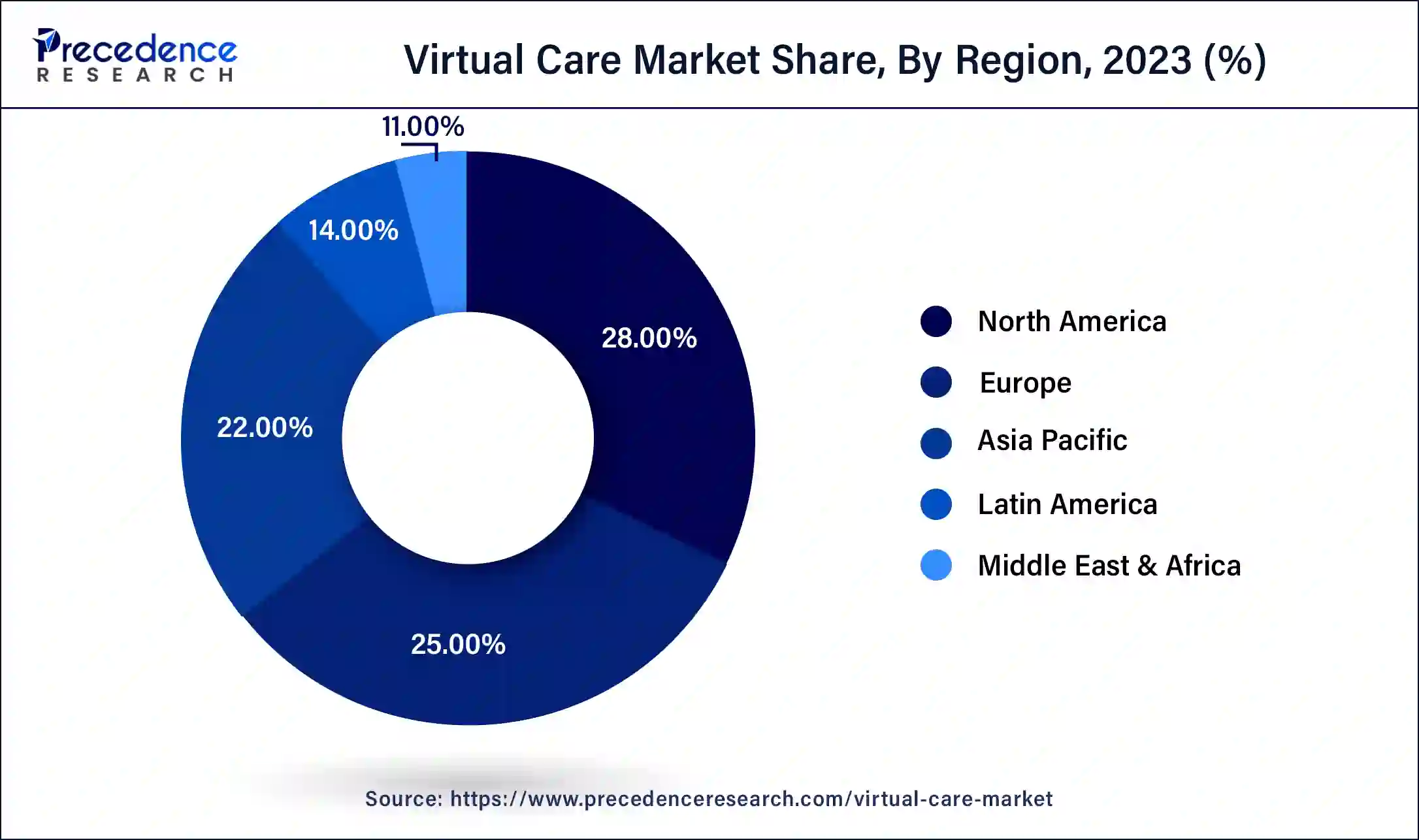

The global virtual care market size accounted for USD 15.19 billion in 2024 and is expected to be worth around USD 247.67 billion by 2034, at a CAGR of 32.2% from 2024 to 2034. The North America virtual care market size reached USD 3.22 billion in 2023. The rising developments in the healthcare industry across the world are driving the growth of the virtual care market.

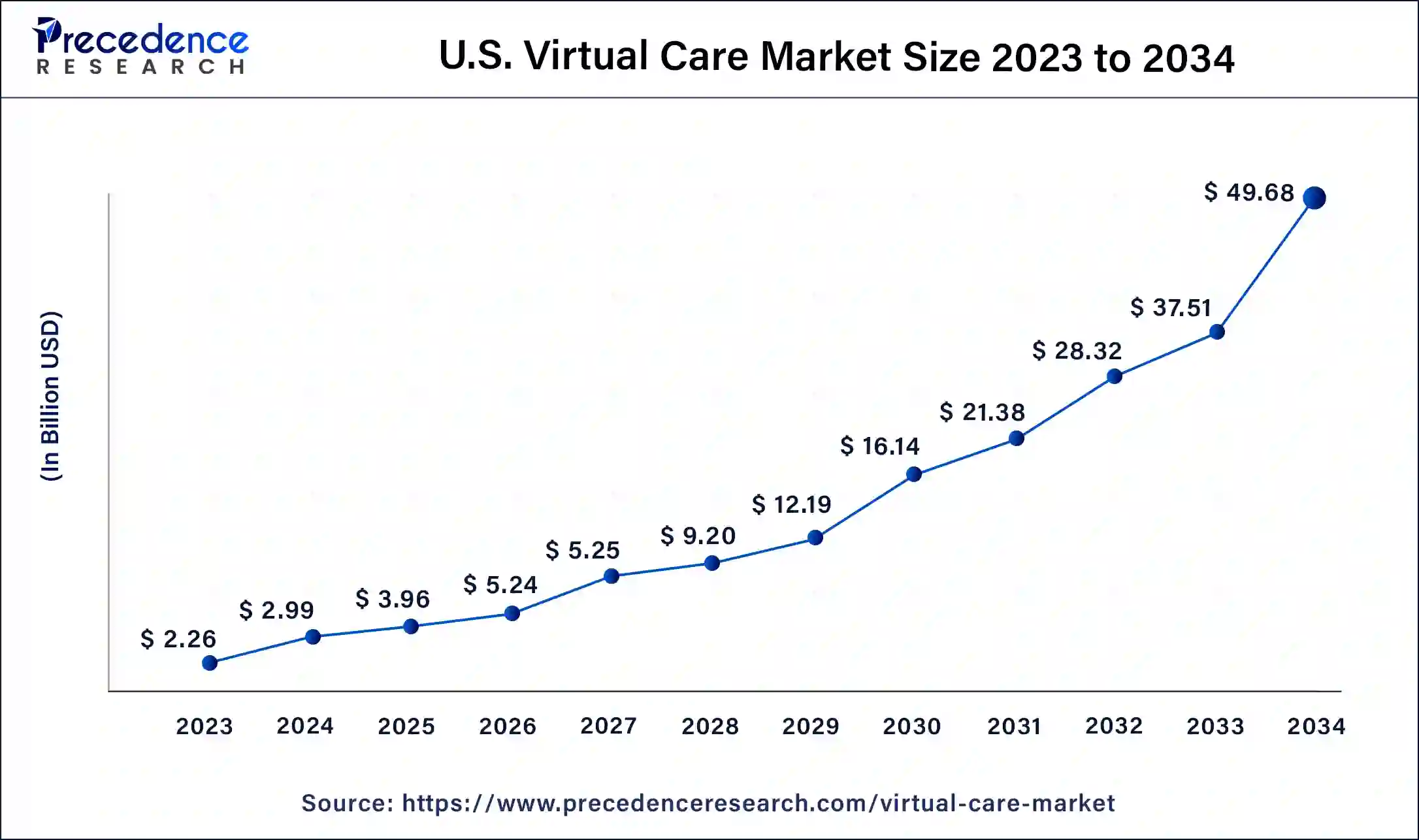

The U.S. virtual care market size was estimated at USD 2.26 billion in 2023 and is predicted to be worth around USD 49.68 billion by 2034, at a CAGR of 32.5% from 2024 to 2034.

North America held the largest virtual care market share in 2023 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by the rising government initiatives in countries such as the US, Canada, and Mexico to develop the remote healthcare sector in this region. Also, growing advancements in science and technology, along with the high disposable income of the people, are likely to boost the market growth. The rising developments in the telecommunication sector, along with the presence of a well-developed IT industry, are driving the market growth in this region. Moreover, the availability of high-grade internet facilities, along with the growing penetration of smartphones, has boosted the market growth in this region. The growing adoption of e-consultation services, along with rising developments in AI infrastructure, propels the market growth in this region. Furthermore, the presence of several virtual care companies, such as AMD Global Telemedicine, American Well, Wheel, Teladoc Health, BioTelemetry, and others, boost the growth of the virtual care market.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The growth of this region is mainly driven by the rising developments in the medical devices industry across countries such as India, China, Japan, Israel, and others. Also, the growing interest from the public and private sectors in development & research for developing virtual care industries has boosted the market growth. The rise in a number of government initiatives to develop the healthcare sector, along with increasing government investment in strengthening the healthcare sector, is driving the market growth. Furthermore, the presence of several local virtual care market players, such as Intouch Technologies, Halodoc, Speedoc, Jio Health, and others, drives the growth of the virtual care industry.

The virtual care market is an important industry in the healthcare domain. This industry deals in providing remote monitoring of patients across the world. The virtual care market is expected to grow significantly with the increase in government initiatives to develop the healthcare sector in different parts of the world. This industry mainly consists of several components, including software, hardware, and services. Virtual care comprises several modes of communication that mainly include real-time virtual health, remote patient monitoring, and store and forward. It also consists of several delivery modes, such as web/app-based, cloud-based, and on-premises. This industry comprises many end users that mainly include healthcare providers, patients, employer groups government organizations, and payers. This industry is likely to grow exponentially with the growth in the healthcare and IT sector.

| Report Coverage | Details |

| Market Size by 2034 | USD 247.67 Billion |

| Market Size in 2023 | USD 11.49 Billion |

| Market Size in 2024 | USD 15.19 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 32.2% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Service Type, Technology Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing use of smartphones for telehealth

The growing demand for telemedicine across the world increases the demand for smartphones with superior features. Also, the rising proliferation of smartphones has increased the demand for online consulting services for patients suffering from various diseases. By using smartphones, patients can seek advice from the best doctors remotely. This, in turn, boosts the market growth. The advancements in IT sectors associated with the development of healthcare applications for smartphones have developed rapidly in present times. Moreover, virtual care companies have started launching new mobile applications to provide superior telemedicine services to people across the world.

Rising adoption of virtual care services by military officials

The demand for virtual care services has increased in the military department due to the rise in warfare across different parts of the world. During warfare, the soldier may get injured at any time and require emergency treatment to be cured, which, in turn, drives the growth of the virtual care market in military operations. Moreover, several government initiatives for developing telemedicine services for military purposes are likely to boost the market growth.

Data breaches and the high cost of telemedicine

The virtual care industry is developing significantly with the growing trend of online healthcare across the world. However, there are various problems associated with virtual care. Firstly, there are security issues due to data breaches and online consultations between doctors and patients. Secondly, the deployment of virtual care systems in hospitals and other organizations is also growing rapidly in present times. Thus, security issues, along with the high cost associated with virtual care systems, are expected to restrain the growth of the virtual care market.

Integration of AI in virtual care

The virtual care industry has developed rapidly due to the advancements in modern sciences and technologies. The ongoing development of modern technologies, such as AI, has contributed significantly to the development of the telemedicine sector. The integration of AI in virtual care helps to enhance the overall quality of remote medical consulting. Thus, the integration of AI technologies in the virtual world is expected to create ample growth opportunities for market players in the future.

The telemedicine segment dominated the virtual care market in 2023, accounting for the largest market share. The segment growth is mainly attributed to the increasing adoption of telemedicine due to its ability to provide remote medical treatment and consultations. This service enables patients to connect with physicians and doctors through video calls, making healthcare more accessible, particularly in remote areas. The timesaving and convenient aspects of telemedicine increased its popularity. It minimizes the need for physical hospital visits, reducing costs and travel time for patients.

The telehealth segment is anticipated to expand rapidly during the forecast period, owing to the rising demand for convenient and accessible healthcare services. Telehealth encompasses a wide range of services, including clinical as well as non-clinical services, such as health education, continuing medical education, and administrative meetings. It accelerates the overall efficiency of healthcare services by streamlining information and communication sharing. Moreover, it provides continuous follow-up care and monitoring, supporting chronic disease management.

The video conferencing segment led the market in 2023 due to the increased demand for remote consultation. This advanced technology enables face-to-face or live consultations between healthcare providers and patients. Video conferencing platforms like Microsoft Teams, Zoom, and specialized telehealth software have become essential in the virtual care industry. The HD audio and video quality offered by these platforms guarantees clear communication, which is necessary for accurate treatment and diagnosis.

The mobile health applications segment is expected to expand at the fastest growth rate in the near future. Mobile health apps provide various services, such as virtual consultations, medication reminders, health tracking, and appointment scheduling. The increasing number of health apps and widespread use of smartphones are contributing to segmental growth. Mobile health applications empower patients and offer convenience to manage their health more effectively.

Moreover, the growing adoption of wearable devices is projected to drive the segment. Wearable devices, such as smartwatches and fitness trackers, gather health data like sleep patterns and physical activity. This data is valuable for both healthcare providers and patients, enabling timely and personalized interventions, thereby enhancing the quality of care.

The patients segment dominated the market in 2023 due to the increased awareness about the benefits of virtual care among patients. Virtual care solutions reduce frequent visits to hospital, reducing travel time and enhancing convenience. The increased use of remote monitoring devices, mobile health apps, and telemedicine has made healthcare more accessible, particularly in underdeveloped and remote areas. Moreover, the heightened patient demand for personalized care contributed to the segment's growth.

The healthcare providers segment is expected to expand at a rapid pace during the forecast period. Healthcare providers use virtual care solutions to manage health records, monitor patients remotely, and offer consultations efficiently. Virtual care apps help healthcare providers reduce the burden on physical health facilities, improve care coordination, and reach more patients. The ability to provide remote monitoring services and telemedicine has become a vital element of modern healthcare practices.

Segments Covered in the Report

By Service Type

By Technology Type

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

September 2024