June 2025

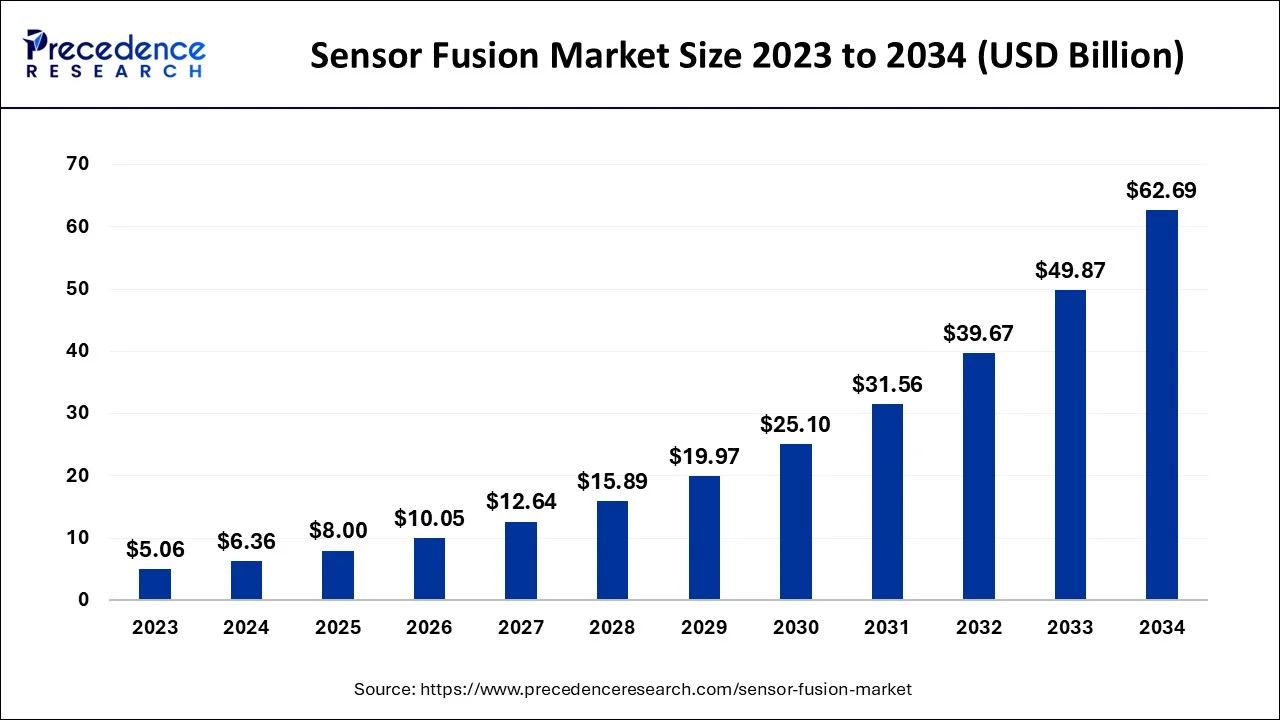

The global sensor fusion market size is estimated at USD 6.36 billion in 2024 and is anticipated to reach around USD 62.69 billion by 2034, growing at a CAGR of 25.71% from 2024 to 2034.

Sensor fusion is software that combines data from multiple sensors to improve an application's or system's performance. It combines data from various sensors, and the inability of a single sensor to determine the accurate position and orientation information can be compensated. Sensor fusion technology is becoming increasingly popular in consumer electronics and automotive applications helps in propelling the industry forward.

The growing trend of self-driving or automated cars is one of the major factors driving the use of sensor fusion and it provides advanced driver assistance (ADAS) features and automatic driving functions. Furthermore, road safety authorities around the world are implementing a variety of measures to reduce fatal road accidents, which is fueling the market growth. In navigation-based applications, sensor fusion combines global positioning systems (GPS) with phone data such as compass, gyroscope, and accelerometer resulting in increasing demand for mobile mapping technologies positively influencing the industry growth.

Furthermore, the increasing Use of Internet of Things (IoT) devices in smart water meters and internal temperature monitoring systems is increasing global demand for sensor fusion. Data from IoT sensors is shared and aggregated. Sensor fusion technology is becoming more popular in wearable fitness devices as the emphasis on health and fitness grows. In addition, industry participants are working on software solutions to improve user experience in high-speed, intuitive gaming. This software can also be used for industrial control, oil exploration, and climate monitoring, propelling the market forward.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.36 Billion |

| Market Size by 2034 | USD 62.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 25.71% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology, By Product Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The growing use of image sensors in intelligent devices driving the market growth

The growing demand for next-generation smartphones with advanced features and modern integrated sensors drives the sensor fusion market forward. Manufacturers of various smart devices are increasing their demand for image sensors. Most digital cameras now use the standard configuration: A pixel array sits on top of a 2D Bayer array of RGB color filters. Each pixel contains a photodetector, which absorbs filtered light to produce one of the primary colors.

Moreover, Image sensors are becoming the backbone of new vehicles, innovative medical devices, driver assistance systems, automated production technologies, innovative building technologies, and power supply systems. Furthermore, sensors are becoming more robust, specific, precise, often more innovative, communicative, and affordable, making them more popular to deploy in developing smart infrastructure. The image sensors are expanding rapidly as demand for cameras, camcorders, multimedia mobile phones, and security cameras rises. The critical player heavily invested in image sensors; Sony is leading the image sensors with more than 45% market share.

Development and maintenance costs will limit growth

The development and maintenance cost of sensors is very high as it is very sensitive and requires more time for development, in a 2019 teardown of the Samsung Galaxy S10 5G SM-G977N, Tech Insights estimated the cost of the category “sensors” at $2.50, or roughly 0.5% of the total hardware cost of $490.06. Moreover, A lack of standardization in software design and hardware platforms can result in higher development and maintenance costs hindering market growth.

Increasing technological advancement provides lucrative opportunities

Sensor fusion is becoming more popular as technology advances, as it aids in creating more accurate sensor mechanisms to improve advanced system performance or fix modern applications. Sensor fusion technology, also known as multisensory data fusion or progressive sensor-data fusion, is a sub-discipline of data fusion. This sensor-data fusion is used in various scientific research setups, current camera systems, and primary image processing and is also used in autonomous vehicles. Recent technological advances have also enabled the generation or collection of large amounts of valuable data from various sources in various real-world applications. Sensor data, for instance –, can be easily generated and collected in a variety of Internet of Things (IoT) applications such as smart homes, smart grids, smart retail, intelligent cars, and smart cities.

Furthermore, Industry 4.0 has influenced OEMs to implement IoT across their operations. According to Maryville University, over 180 trillion gigabytes of data will be created globally each year by 2025. Industrial IoT (IIoT)-enabled industries are expected to generate a significant amount of data. According to a survey conducted by the industrial IoT (IIoT) behemoth Microsoft, 85% of businesses have at least one IIoT use case project. This figure is likely to rise, as 94% of respondents and planned to implement IIoT strategies by 2021.

The MEMS segment dominated the sensor fusion market in 2022

Based on technology, the sensor fusion market is categorized into MEMS and Non-MEMS. The non-MEMS segment dominated the sensor fusion market in 2023. Owing to the rising demand for image and radar-based products to improve vehicle safety systems, the level of complexity is very high when integrating it into automotive applications such as lights and engines.

On the other hand, the MEMS segment is estimated to dominate the market in the forecast period. MEMS are widely used in vehicle safety applications, as well as step counting, gesture recognition, mobile device screen rotation, and personal navigation. MEMS are also widely used for monitoring and controlling various utilities, including lighting, automation appliances, the environment, and security. This factor is expected to drive market growth during the forecast period.

The IMU segment dominated the sensor fusion market in 2023. The increased high-volume production of smartphones and increased smartphone sales and shipment across the globe is the key factor driving the IMU market growth. The increased use of auto vehicles and automated devices boosted the market growth in the forecast period.

On the other hand, the Image sensors segment is growing with the increased use of image sensors in hospitals and labs. The rising number of patients with cardiovascular and lung diseases demand X-ray and CT scans, resulting in a demand for image sensors.

The automotive segment dominated the sensor fusion market in 2023. Sensor fusion market growth is fueled by rising demand for automotive safety features, electric and connected vehicle advancements, and government regulations governing vehicle safety and emissions. Furthermore, internal sensors are used to regulate and measure the motion of the vehicle. In contrast, external sensors measure the things in their environment, and some communicate with other vehicles and infrastructure.

As a result, these factors are expected to drive demand for sensor fusion in automotive applications during the forecast period. For instance, according to the World Economic Forum, by 2035, more than 12 million fully autonomous cars will be sold yearly, with autonomous vehicles accounting for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day, and sensor fusion solutions can significantly utilize this massive data in real time.

On the other hand, the consumers electronics segment will be estimated to grow in the forecast period. The electronics segment is influenced by rising demand for EV vehicles and electronic devices. For instance, according to the World Economic Forum, by 2035, more than 12 million fully autonomous cars will be sold yearly, with autonomous vehicles accounting for 25% of the global automotive market. According to Intel, a single autonomous vehicle can generate an average of 4 terabytes of data per day, and sensor fusion solutions can significantly utilize this massive data in real-time.

Asia pacific will dominates the market in the forecast period

During the forecast period, the Asia-Pacific region is expected to be the largest market for sensor fusion in the automotive sector. The Asian Region market is expected to grow because of the increased Use of advanced ADAS features such as automated emergency braking (AEB), lane departure warning (LDW), adaptive cruise control (ACC), and other similar technologies.

China and Japan now have the largest sensor fusion markets in the Asia Pacific. The primary driving change in these two countries is the rising vehicle production rate combined with stringent safety requirements that require ADAS capabilities to be included in vehicle models. The region's market is expected to be driven by rising demand for premium and luxury vehicles and advancements in sensor fusion hardware.

On the other hand, Europe dominated the sensor fusion market in 2022. The market is influenced by the expansion of government programs and policies for automobiles, healthcare IT equipment, and increased investment in research and development centers, which are the main factors for market expansion in the European region.

Moreover, the increasing development of new treatments and rising medical technology and protocols help the area expand for medical gadgets and equipment, which increases the demand for sensors. In addition, it is expected that the Europe region will experience growth in the market for pressure sensors owing to the rising government spending on healthcare. As Germany is leading in this field, the automotive sector is expanding significantly. The demand for pressure sensors in the region is expected to experience significant expansion due to rising electric vehicle production and rising connected vehicle infrastructure in Europe.

Segments Covered in the Report:

By Technology

By Product Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2025

July 2025

July 2025