February 2025

Server Market (By Product: Rack, Blade, Tower, Micro, Open Compute Project; By Enterprise Size: Micro, Small, Medium, Large; By Channel: Direct, Reseller, Systems integrator, Others; By End-User: IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

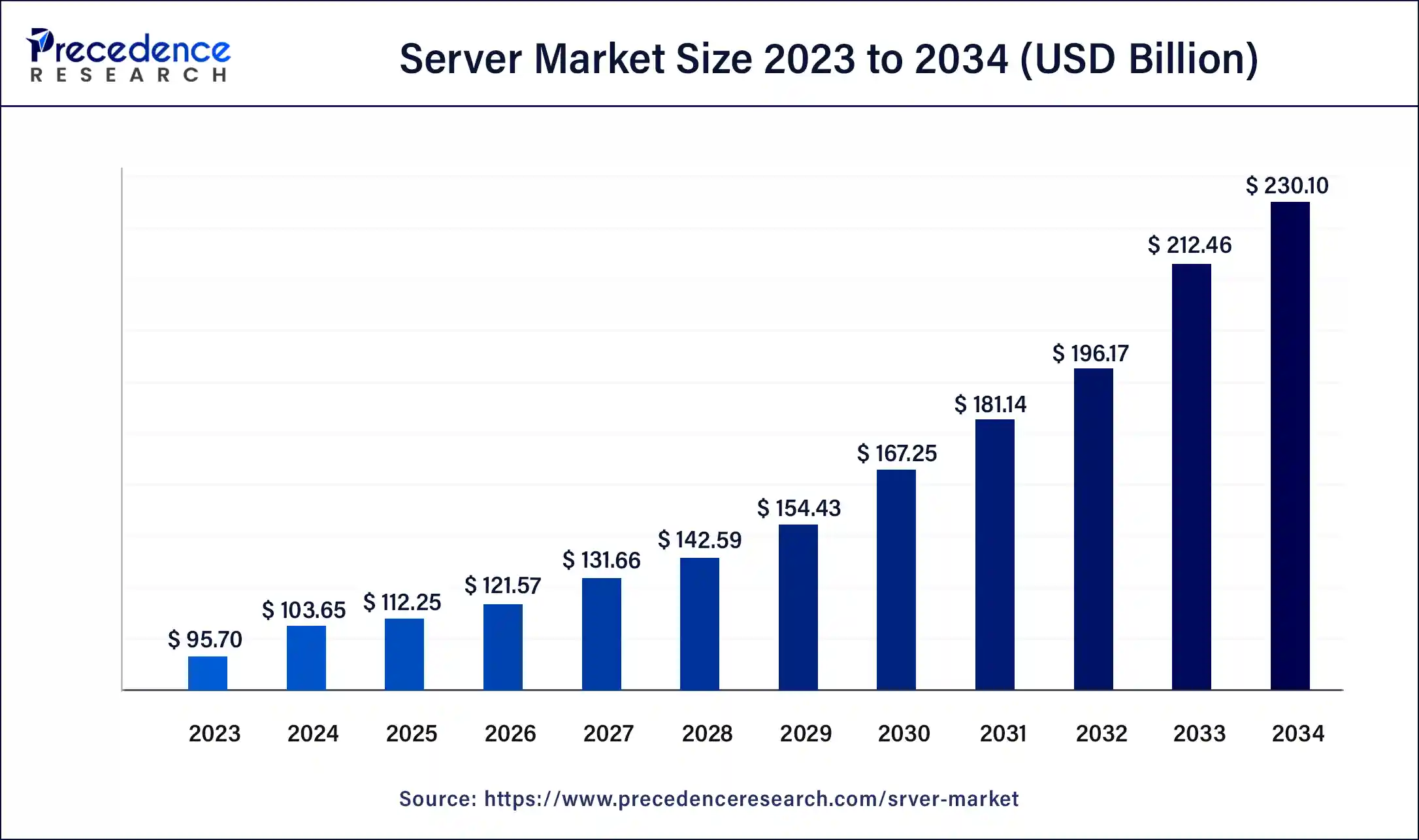

The global server market size was USD 95.7 billion in 2023, accounted for USD 103.65 billion in 2024 and is expected to reach around USD 230.10 billion by 2034, expanding at a CAGR of 8.30% from 2024 to 2034. The North America Server market size reached USD 41.44 billion in 2023. The rising IT infrastructure globally that driving the growth of the market.

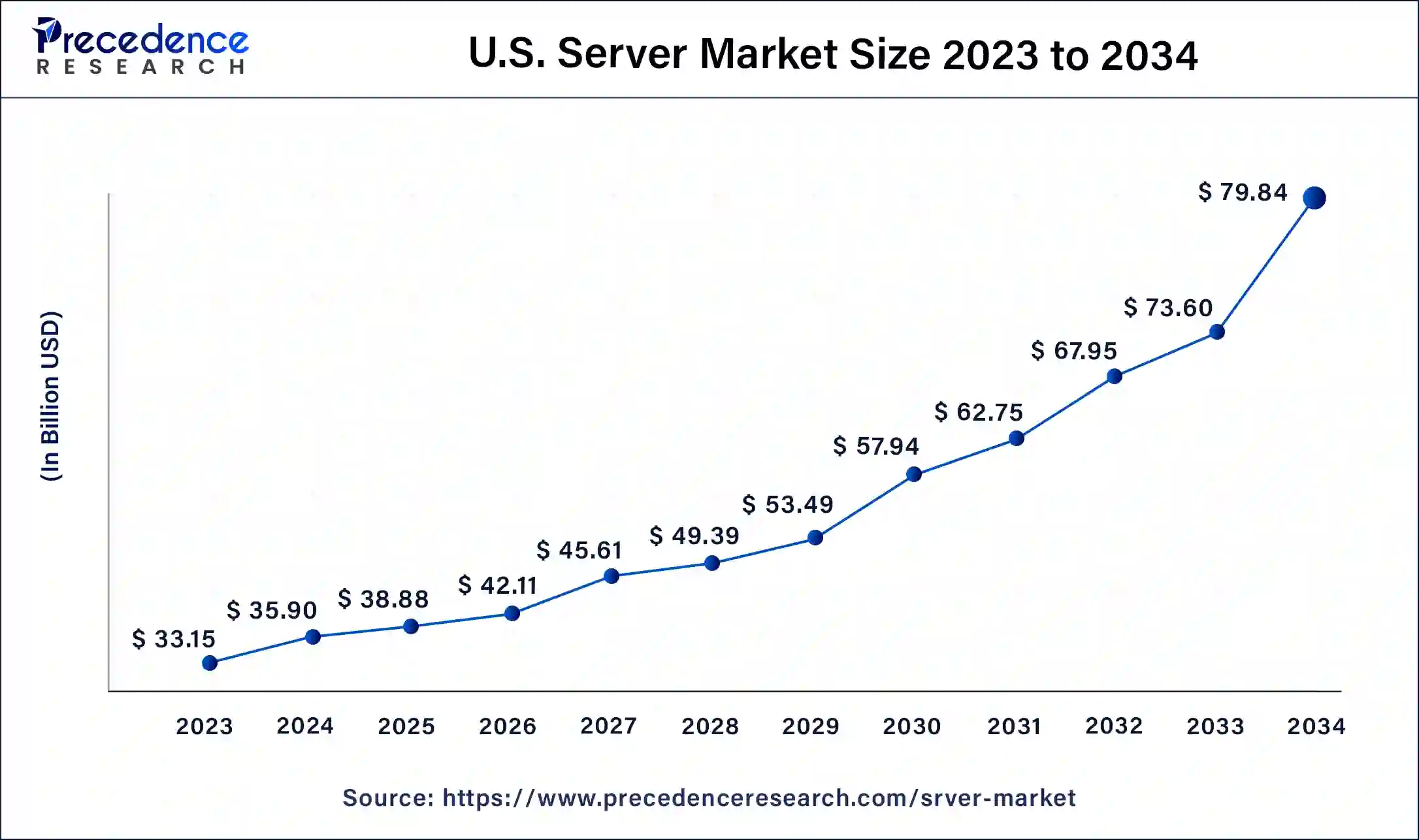

The U.S. server market size was exhibited at USD 33.15 billion in 2023 and is projected to be worth around USD 79.84 billion by 2034, poised to grow at a CAGR of 8.31% from 2024 to 2034.

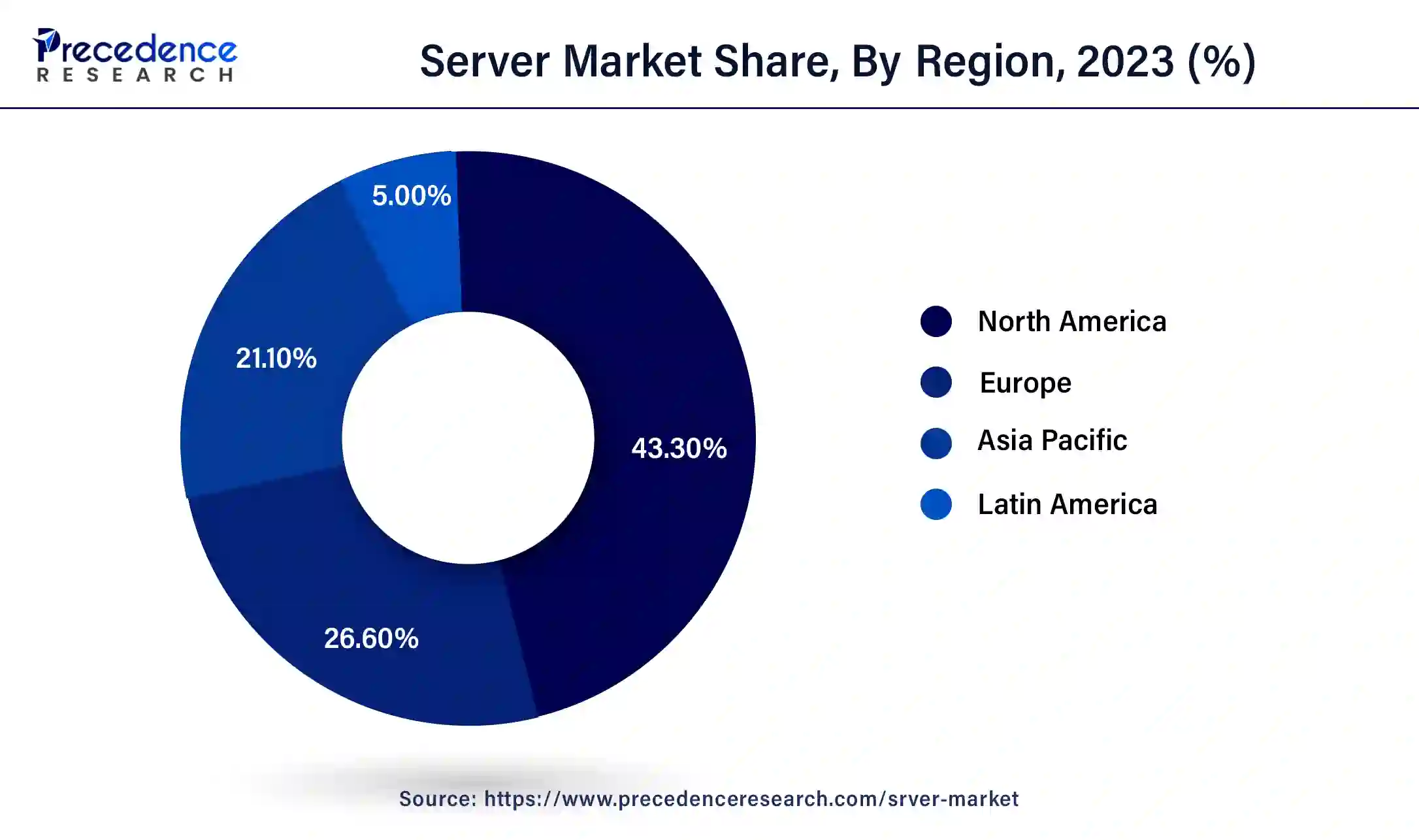

North America dominated the market with the largest market share in 2023. The growth of the market is attributed to the presence of a well-developed IT infrastructure, which is driving the growth of the server market. The higher presence of the technology giants is driving the demand for the market. The increasing demand for servers from data centers from regional countries like the United States and Canada and the increasing adoption of cloud-based services instead of on-premise services by the major companies and the integration of artificial intelligence, IoT (Internet of Things), and sensors that are driving the growth of the server market across the region.

North America is leading in with the accounting for the highest data center investments with 62% of the total in 2023 and 69% of the investment up to April 2024, in which the United States took the largest share of the total number with, equating to the $15 billion investment.

Asia Pacific is expected to have significant growth during the forecast period. The region is expecting the fastest growth in the demand for servers due to the rising industrial infrastructural development, such as the rise in the development of the IT sector, banking, and financial services, and the rise in the start-up culture in the corporate industry, which is driving the growth of the server market. The rising competition among the manufacturers and distributors of the server and other associate technologies is driving the growth of the market in the region.

The server is the software or hardware device that offers the functionality for called clients. Servers are the single computational system that provides services to multiple devices or processes. The servers provide distributed services like sharing resources and data with multiple clients. The single clients can be used by multiple servers, and the single server can serve multiple clients. There are several types of servers, such as mail servers, print servers, file servers, database servers, web servers, game servers, and application servers. Every server has some common components, including server OS, hardware, network connectivity, server software, management and monitoring tools, and high availability features. All these components are used to share data and resources with clients. The rising IT infrastructure and the adoption of cloud-based services by several end-use industries are driving the growth of the server market.

| Report Coverage | Details |

| Market Size by 2034 | USD 230.10 Billion |

| Market Size in 2023 | USD 95.70 Billion |

| Market Size in 2024 | USD 103.65 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.30% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Enterprise Size, Channel, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of cloud-based services

The increasing adoption of cloud-based instead of on-premise services by several end-use industries such as healthcare, telecommunication, IT, automotive, and others due to its enhanced efficiency and affordability. Many major industries are adopting cloud-based services due to their beneficial properties, including advanced security, improved flexibility, cost savings, decentralized collaboration, increased scalability, environmental efficiency, and disaster recovery. There are several benefits associated with cloud computing in the business.

Cloud computing is used for cloud backup, cloud storage, cloud hosting, and software as a service. There are several benefits that are also included in cloud servers, such as providing higher scalability, allowing limitless access to computing power, and making it easy to upgrade memory and space to support more users, which makes the cloud server ideal for businesses experiencing growth.

Cloud servers are more affordable than any other traditional type of servers; they minimize hardware expenses and provide lower energy costs. It provides uninterrupted and reliable connections and rapid authorized access. It plays an important role in building applications, environments, and tools. Thus, all these benefits make cloud servers the ideal choice for implementation in the businesses that fuel the growth of the server market.

Security issues

There are increasing cases of cyberattacks and security breaches in which hackers intentionally try to steal or disrupt online business operations, misuse customer information, or intercept online transactions. Organizations need to deploy robust counterattack software to reduce the risk of potential security threats. Thus, the rising cases of cyberattacks and security issues are restraining the growth of the server market.

Technological evaluation in the server market

The continuous evaluation of the server technologies, including artificial intelligence optimization, advancements in edge computing, quantum computing, software-defined infrastructure, security, memory-centric computing, hybrid cloud-edge integration, energy efficiency, containerization, and customized solutions. All these emerging technologies help maintain and build resilient, agile, and efficient IT infrastructure for innovation and digital transformation of businesses. The rising demand for edge computing is driving the demand for edge servers that are installed near the point of data generation. The rise in the integration of AI in the server allows organizations to use machine learning algorithms for tasks like pattern recognition, data analytics, and predictive maintenance.

The rack segment dominated the server market with the largest share in 2023. The growth of the segment is owing to its beneficial properties, such as higher efficiency, lower space, and other factors that drive the adoption of the rack server in various organizations. Rack servers are further known for their design, which is to be mounted in the severe rack. A rack server works by using the data from the organizational level computing environment and data center of the organization. This type of server is highly efficient, scalable, and reliable. These types of servers allow for efficient space in data centers. The rack server is comparatively wider in shape and resembles the PCs; the rack servers can be mounted by using screws or rails.

It has the lowest installation cost, so it is considered the most economical and efficient option for the server type. Rack servers are highly powerful and convenient for installation and maintenance due to their design, and they save lots of room. It has an increased capacity for cooling, and this is the ideal type for the requirement of the lowered number of servers.

The open compute project segment is projected to be the fastest-growing segment in 2023. The higher demand for the open compute object server from small and medium-sized enterprises drives the growth of the segment. These types of servers are designed to enable efficient data centers for small and medium-sized organizations. The open compute objects enable minimized material use, build times, and increased efficiency.

The large enterprise segment accounted for the largest share of the market during the anticipated period. The increasing demand for higher quality servers by large enterprises for maintaining the larger databases of the enterprises that drives the growth of the market. Large enterprises can continually deal with high workloads and user requirements; it demands higher scalability in the server to maintain the growing IT infrastructure. Reliability, management, and security are the major concerns of large enterprises in terms of server selection.

The selection of highly powerful servers for the number of industrial operations and maintenance of ample memory, databases, applications, and virtual environment of the company is driving the demand for the server market by large enterprises. There are many leading companies that are highly investing in the development and launch of efficient servers for large enterprises' data. Thus, the rising competition in the server market is also fueling its growth.

The medium enterprise segment is expected to see significant growth in the market during the forecast period. The rising adoption of technological advancements in medium-sized enterprises, such as cloud services, big data analytics, green data centers, and various complex business tools, is driving the growth of the server market in the segment. The increasing adoption of cloud, IoT (internet of things), and big data analytics are boosting the operational efficiency of the business and reducing the manual labor and operational costs that fuel the growth of the server market.

The direct segment dominated the market with the largest market share in 2023. The rising adoption of buying servers from direct sales channels, such as original design manufacturers, is driving the growth of the segment. The direct sales channel provides competitive, affordable prices with personalized designs in the server as per the requirements of the buyers. These types of sales channels offer reduced prices compared to other sources. This type of channel reduces the intermediate and promotional cost of the product because the manufacturer directly sells the server to the customers. Thus, the reduced cost, customizable designs, and other associated benefits are boosting the growth of the direct segment in the server market.

The reseller segment is expected to expand significantly in the market during the forecast period. The growth of the segment is attributed to the increased customer relation bond between the resellers and the various organizations. Working with resellers offers many benefits to the organization in terms of finding products faster and with higher quality. Resellers deal with various manufacturers and have a wide customer base in the IT enterprise. Many large and medium enterprises need to buy a number of technologies, so the adoption of resellers as retailers is the single solution for buying many services. The resellers work as both retailers and wholesalers as per the demand for the technological demand from the enterprises.

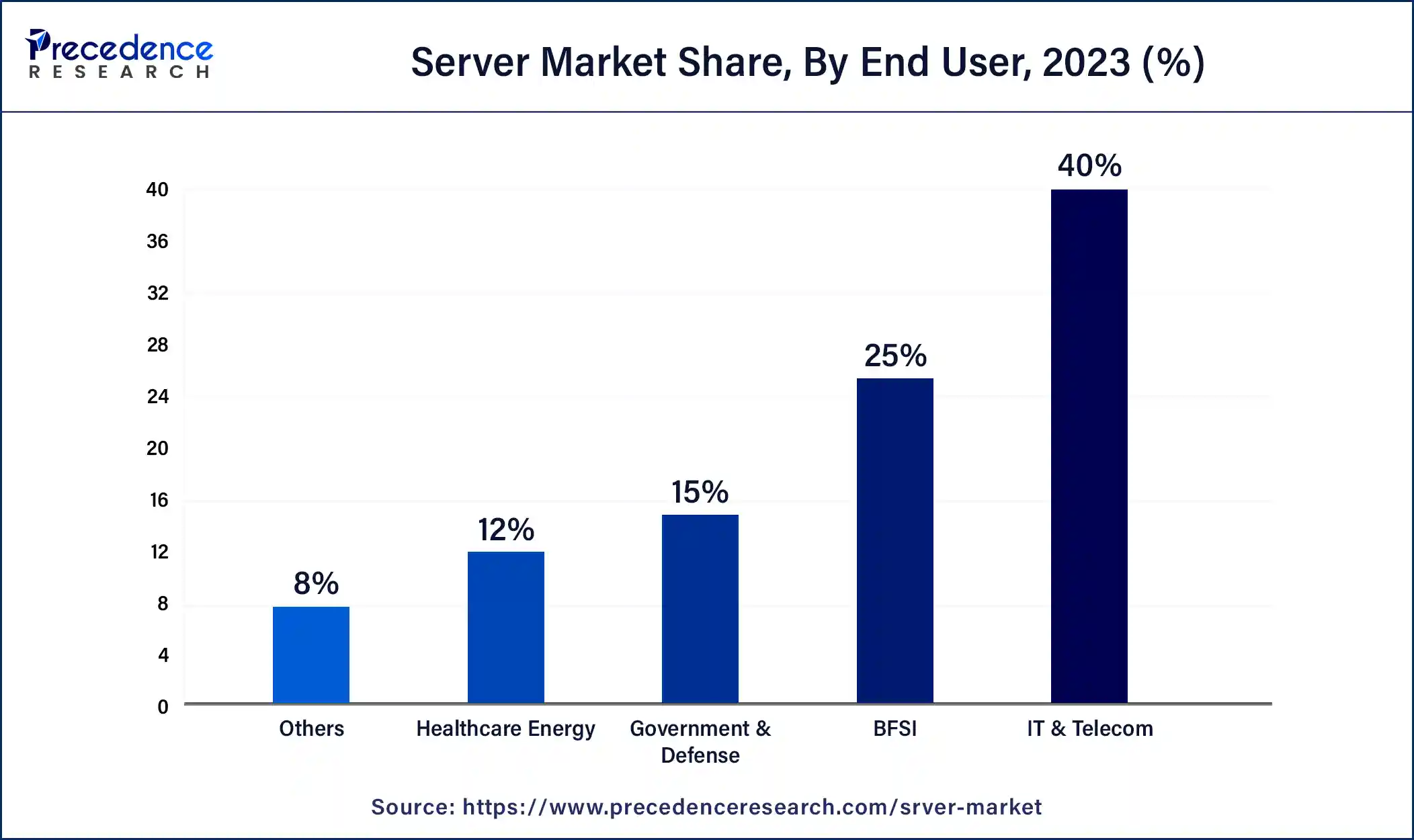

The IT and telecom segment dominated the server market in 2023. The rising infrastructural development of the IT and telecom industry due to the rising consumer base all around the world is accelerating the growth of the segment. The IT and telecom sectors have revolutionalized in recent periods of time. The adoption of cloud-based services and fixed-to-mobile broadband services results in large databases that drive the efficient server demand for the maintenance of the data. Additionally, the conscious development in the telecommunication industry and the rising consumer bases of mobile phones are further contributing to the expansion of the market. The rising development in mobile applications and multimedia capabilities by leading telecom companies that boost the demand for high-quality service are driving the growth of the market.

The BFSI segment expected significant growth in the market during the predicted time. The rising implementations of web-based banking solutions by customers and providers are driving the demand for servers. The servers are responsible for efficient and secure transactional activities in the banking sector. Secure servers are helpful in the secure transaction of information and capital between sellers, buyers, and other financial institutions. It helps in enhancing business efficiency and minimizes the risk of financial loss. Thus, the rising demand for servers in daily operational activities in banking and financial services, along with enhanced scalability and reliability, accelerates the growth of the server market.

Segments Covered in the Report

By Product

By Enterprise Size

By Channel

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024