February 2025

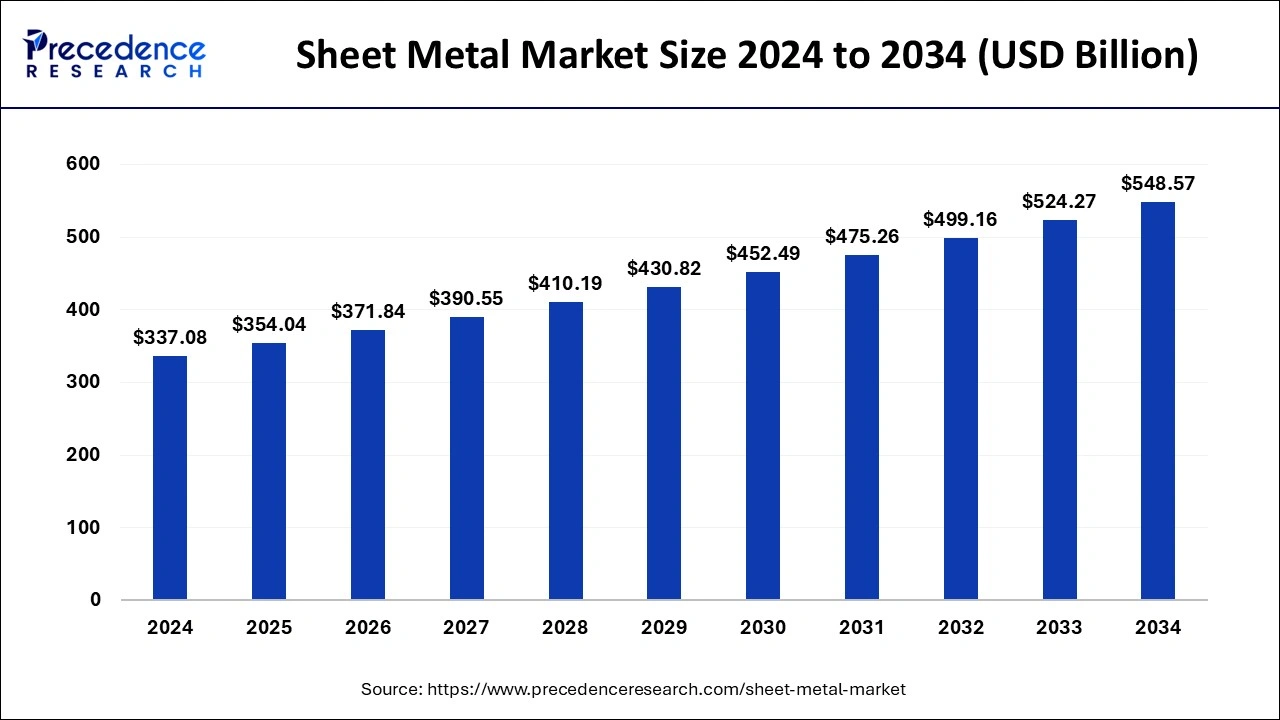

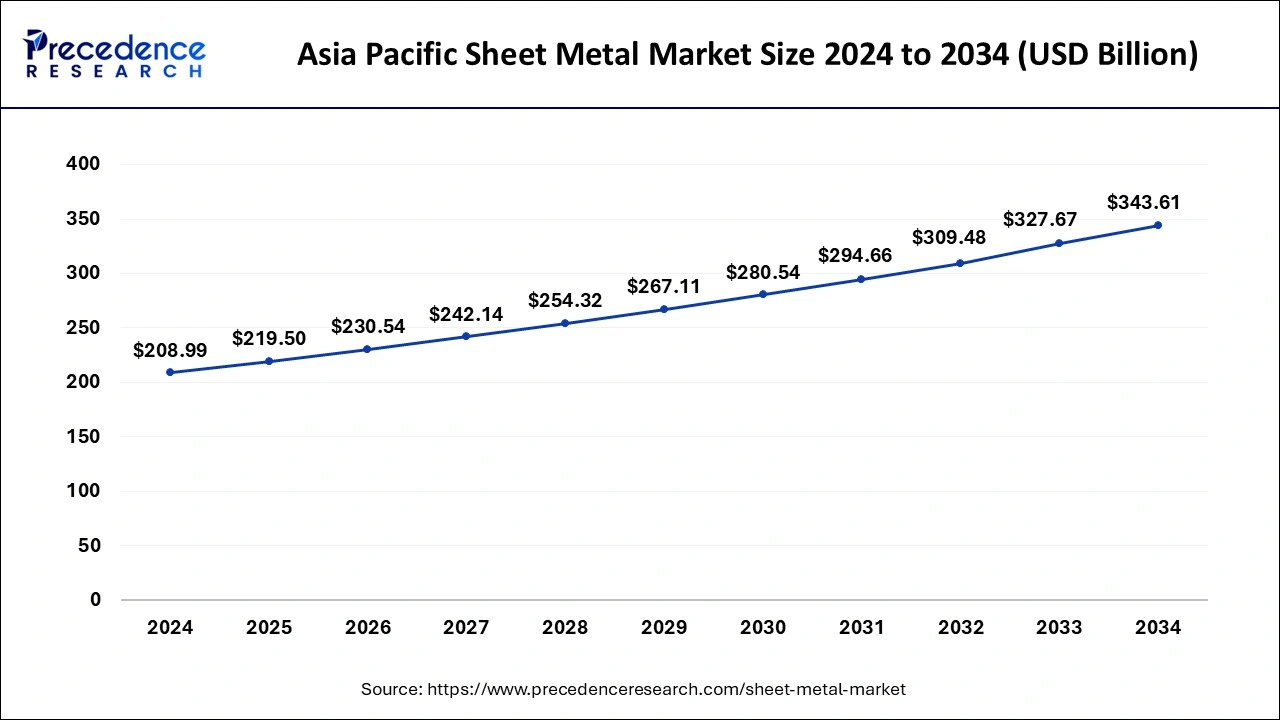

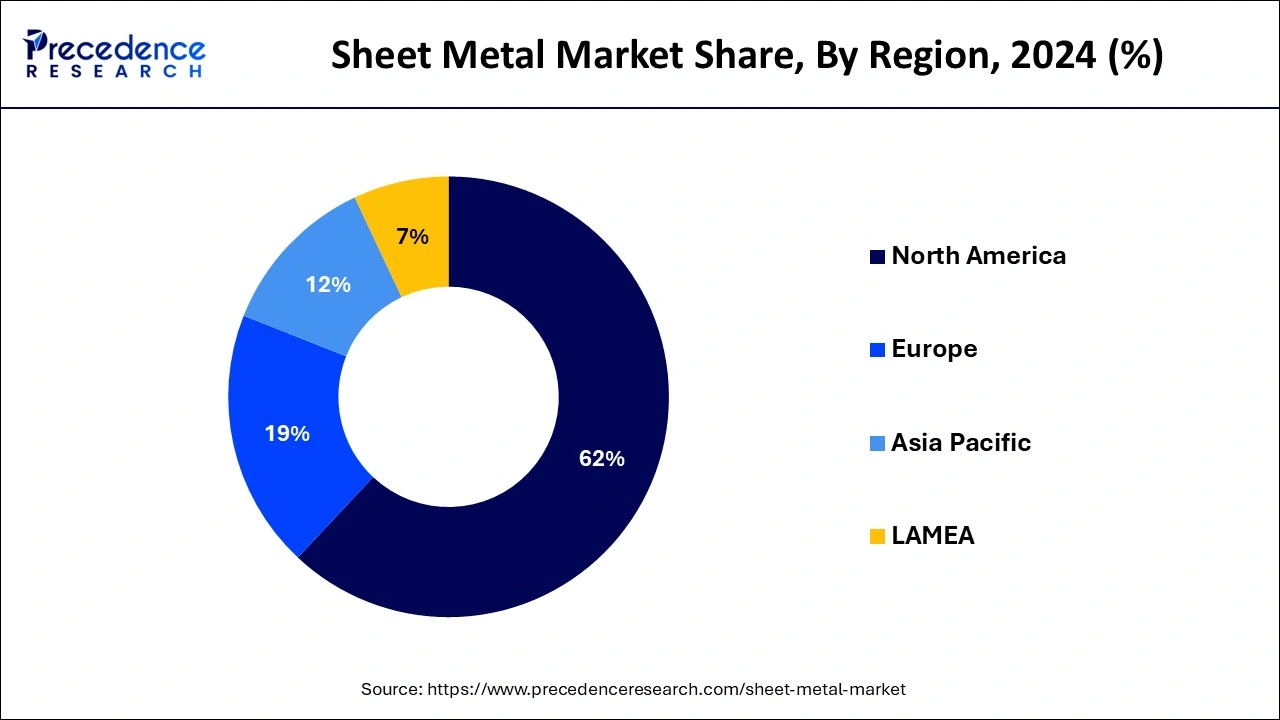

The global sheet metal market size is calculated at USD 354.04 billion in 2025 and is forecasted to reach around USD 548.57 billion by 2034, accelerating at a CAGR of 4.99% from 2025 to 2034. The Asia Pacific sheet metal market size surpassed USD 219.50 billion in 2025 and is expanding at a CAGR of 5.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sheet metal market size was estimated at USD 337.08 billion in 2024 and is predicted to increase from USD 354.04 billion in 2025 to approximately USD 548.57 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The rising popularity of lightweight, energy efficiency and cost-effectiveness materials acts as a driver for the sheet metal market.

The Asia Pacific sheet metal market size surpassed USD 208.99 billion in 2024 and is projected to attain around USD 343.61 billion by 2034, poised to grow at a CAGR of 5.09% from 2025 to 2034.

Asia Pacific dominated the sheet metal market in 2024. In the Asia Pacific region, sheet metal is highly used in the construction of motor vehicle parts. The increasing automotive production leads to the demand for sheet metals. India and China are the leading countries in the market in the Asia Pacific region because of the high demand for sheet metal in this region. In India, sheet metal is highly used for construction and manufacturing. These factors help to the growth of the market in the Asia Pacific region.

North America is estimated to be the fastest-growing during the forecast period of 2025-2034. The U.S. is the leading country in North America, which helps to the growth of the market. In the North American region, sheet metal is highly used in the automotive, aerospace, transportation, and marine industries. Increased expansion of the aerospace sector leads to high demand for sheet metal, which helps the growth of the market. In the United States, sheet metal is used for exterior facades, shingle roofing, and stamped ornamental ceilings. These factors help the growth of the sheet metal market in this region.

The sheet metal market encompasses a broad spectrum of metal manufacturing, focusing on the production of flat or thin metal products. Sheet metal is the term for thin, flat pieces of metal that have been shaped into different dimensions for different uses. Copper, aluminum, and steel are the common materials used for sheet metal-making. There are different types of sheet metals, including aluminum, galvanized, copper, steel, brass, titanium, bronze, tinplate, lead, nickel, etc. Different fabrication techniques are used, including cutting, bending, forming, welding, and assembly. There are many advantages of sheet metal compared to other materials, including recyclability, durability, formability with different shapes, strength-to-weight ratio, excellent strength with lightweight metal, and cost-effectiveness. These factors help the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 354.04 Billion |

| Market Size by 2034 | USD 548.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing construction of commercial buildings & infrastructure development

In India's rapid infrastructure development in the last ten years, there has been a high use of sheet metal, which contributes to the growth of the market. In infrastructure development, sheet metal plays an important role, mainly in transportation and construction projects. This includes bridges and tunnels in which sheet metals are used due to their quality, sturdiness, and durability properties. Sheet metals are used in building construction for roofing and cladding due to their corrosion-resistant properties.

In energy-efficient building envelopes, due to sustainability quality and the low weight of steel sheet metals, construction speed will be increased, and disruption and construction time will be minimized. It has an adaptability property, which allows for creative design structures like airports, car parks, and train stations, and due to its sustainability properties, it is used for many purposes. It may be reused, recycled, or refurbished. These factors help the growth of the sheet metal market.

Disadvantages of sheet metal

The disadvantages of sheet metal include being boxy and its rudimentary appearance, not being suitable for high-temperature use, noise and contraction or expansion issues, the post-fabrication process, such as painting, deburring, and finishing, slow production process, high cost for complex designs, and high tooling and equipment costs. The sheet metal may have a limited thickness, which makes it less suitable for applications that require heavy or thick materials. Sheet metal may lead to corrosion depending on the material. The sheet metal limitations also include limited complex shapes, susceptibility to corrosion, limited strength in thin sheets, and high tooling costs. These factors may restrict the growth of the sheet metal market.

Research & development opportunities

Research and development in sheet metal have an opportunity in the future in various sectors like defense, automation technology, aerospace, and advancement in sheet metal forming technique. Focusing on sheet metal’s specific areas, like construction, welding, structure designs, etc., helps the growth of the market. Also, by gaining certifications and specialization, giving back through teaching, improving technology, pursuing lifelong service, improving soft skills, exploring entrepreneurship, and networking that help to job opportunities, sheet metal manufacturers may produce new paths and strengthen their value in the market, by arranging apprenticeship programs to learn the basics of sheet metal work. These programs will provide valuable skills and hands-on experience. These research & development opportunities factors help the growth of the sheet metal market.

The steel segment dominated the sheet metal market in 2024. The steel sheet metal is made from many steel grades and is known for its versatility and strength. Steel sheet metals are used in many industries, such as construction and manufacturing. The properties of steel sheet metal include affordability, exceptional strength, corrosion resistance, and durability. The applications of steel sheet metal also include appliance production, automotive manufacturing, kitchen utensils, the aerospace industry, vehicle bodies, smaller components, and building construction like building sheds, garages, and many other industrial structures.

The steel automotive body panels are made from steel sheet metal due to their impact resistance and structural integrity properties. The types of steel sheet metal include stainless steel sheet, alloy steel sheet, carbon steel sheet, cold-rolled steel sheet, total steel sheet, and galvanized steel sheet for many applications. Galvanized steel sheets have corrosion resistance properties, which are highly used in shipping for building ship hulls and marine vessels and also used in agriculture for things such as greenhouse equipment and irrigation pipes because they may be exposed to water. These factors help to the growth of the steel material type segment and contribute to the growth of the sheet metal market.

The aluminum segment is expected to grow at the fastest rate during the forecast period. Aluminum is highly used for sheet metal due to its corrosion resistance and lightweight properties. Aluminum is important for businesses like automobiles and aerospace, which need light and strong materials. Aluminum sheet metal has many advantages, such as having a strength-to-weight ratio, being 100% recyclable, being corrosion-resistant, and being lightweight. Aluminum sheet metal is generally used for the body panels of automobiles, aerospace parts, and appliances. Aluminum sheet metals are used in building construction materials in roofing panels.

The properties of aluminum sheet metal also include versatility, ductility, fireproofing or resistance to burning, reflectivity, formability, eco-friendliness, being offered in many thicknesses, being affordably priced, etc. It is used in industrial applications like kitchen fitting, building cladding, artwork, and vehicle paneling. Its structural and chemical properties make it highly useful and desirable than the other sheet metals. It is also used for sensitive applications like chemical and food packaging. Aluminum sheet metal does not react with other materials easily and does not negatively affect the food. These factors help the growth of the aluminum material type segment and contribute to the market's growth.

The building and construction segment dominated the sheet metal market in 2024. In the building and construction industries, sheet metals are used in many projects. They may be used for building sheds, garages, and many other industrial structures. Sheet metals have many properties, including cost-effectiveness, malleability, stability, lightness, high durability, 100% recyclability, environmentally friendly, ductility, resistance to corrosion, moisture, or sunlight, etc., to help the growth of the building and construction segment. Sheet metal is an outstanding building and construction material.

Sheet metals offer many attractive features and are ideal for building because they may be easily repaired, long-lasting, and recycled. Sheet metal has various applications, including in the exteriors or interiors of buildings, as a functional and decorative element. Sheet metals may be used for roofing or cladding of buildings. It is highly used in construction materials with applications in medical, shipping, transportation, manufacturing, farming, mining, and construction. Sheet metals like aluminum, steel, and mild iron have many benefits for construction engineers, workers, and the average person. These factors help the growth of the building and construction end-use type segment and contribute to the growth of the market.

The automotive and transportation segment is estimated to be the fastest-growing during the forecast period. In automotive and transportation, end-use sheet metal is highly used. Sheet metals are used in automotive and transportation parts like fascias, mounts, grills, instrumental panels, fluid tanks, body panels, fan cowls, boxes, and brackets. All these parts help modern cars to go further, faster, and lightweight, and help to save people’s lives. Benefits of sheet metals for automotive and transportation components include design flexibility and recyclability, which makes them environmentally friendly, improved corrosion resistance, sheet metals help to better fuel efficiency, and aluminum sheet metal may help to reduce the weight of the vehicle.

Sheet metal’s weight-to-thickness ratio is low, which makes it easier to transport and work with than other heavy metal materials. In the transportation sector, aluminum sheet metals are the key component in the production of aircraft, vehicles, and boats. In the transportation sector, sheet metals are used due to their lightweight properties. They can be shipped in large amounts at the same time and help reduce costs. These factors help the growth of the automotive and transportation end-use type segment and contribute to the growth of the sheet metal market.

By Material Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025

January 2025

January 2025