December 2024

The global shipping containers market size is calculated at USD 10.98 billion in 2025 and is forecasted to reach around USD 15.01 billion by 2034, accelerating at a CAGR of 3.54% from 2025 to 2034. The Asia Pacific market size surpassed USD 5.30 billion in 2024 and is expanding at a CAGR of 3.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

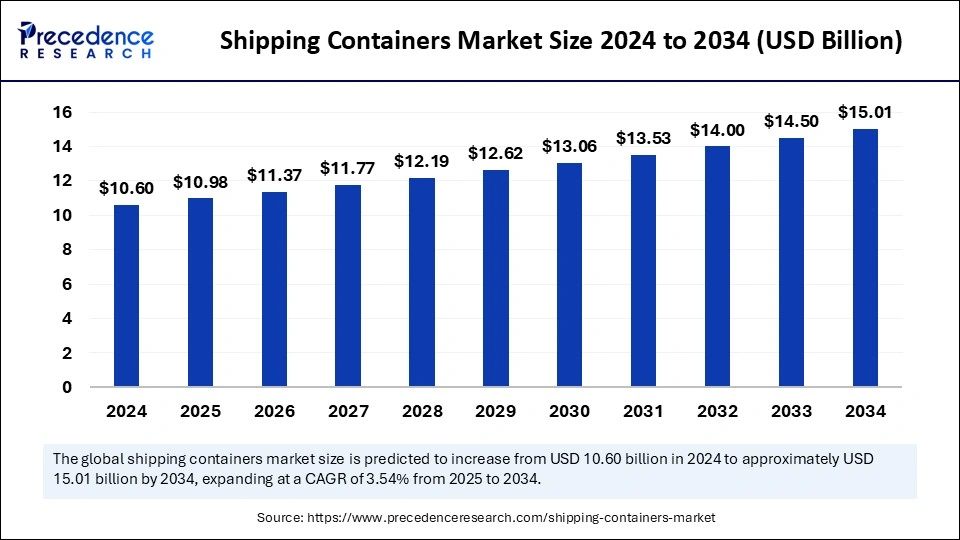

The global shipping containers market size accounted for USD 10.60 billion in 2024 and is predicted to increase from USD 10.98 billion in 2025 to approximately USD 15.01 billion by 2034, expanding at a CAGR of 3.54% from 2025 to 2034. The growth of the shipping containers market can be linked to the surge in sea-borne trade, modernization of existing ports and implementation of automated technologies.

Incorporation of artificial intelligence is transforming the shipping containers market by enhancing the productivity and efficiency of operations while reducing the costs and improving the safety. With the integration of AI-driven sensors, real-time monitoring of containers is enabling better cargo monitoring and quality control by providing data on factors such as humidity, pressure and temperature, especially in case of perishable goods and sensitive cargo. AI can be applied for predictive maintenance of container and its components as well as for tracking them and generating estimated arrival times (ETA) in real-time for enhancing the communication and transparency with customers further streamlining the efficiency of operations and security.

Furthermore, optimization of cargo handling and logistics, development of automated processes like yard management and crane operations, improved resource allocation, and implementation of sustainable practices like reduced carbon emissions by utilizing fuel alternatives and upgrading trade routes with the help of AI algorithms and machine learning is reducing downtime and saving costs.

For instance, in July 2024, CMA CGM, a global leader in sea, air, land and logistics solutions, entered into a strategic alliance with Google for accelerating the integration of artificial intelligence (AI) throughout CMA CGM’s worldwide operations with the aim of improving the adaptability and efficiency in shipping and logistics.

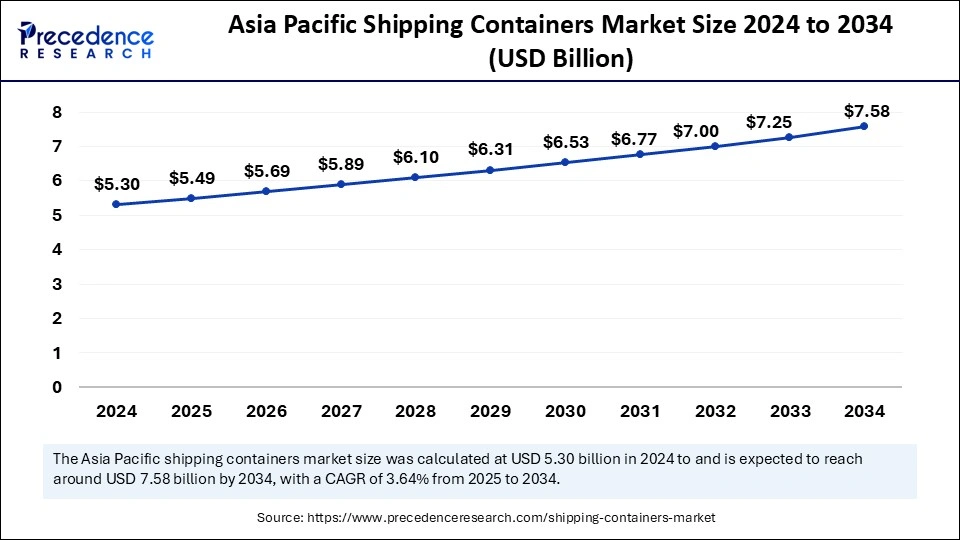

The Asia Pacific shipping containers market size was exhibited at USD 5.30 billion in 2024 and is projected to be worth around USD 7.58 billion by 2034, growing at a CAGR of 3.64% from 2025 to 2034.

Asia Pacific dominated the global shipping containers market with the largest share in 2024. The region’s market dominance is driven by the rising investments for developing new container terminals and mega-ports in countries like India and China, robust manufacturing base fostering trade activities, surge in intra-regional agreements, geographical edge, implementation of intelligent technology in container manufacturing and flourishing global trades making the Asia-Pacific region a hub for containe transshipment.

Furthermore, contributions made by key regional players like India, South Korea and Japan as well as increased adoption of sea-faring containers for transporting goods by ASEAN nations contributes to the market’s growth.

Europe is anticipated to grow at a considerable rate during the forecast period. The market growth is driven by the surge in maritime trade activities, optimization of better trade routes, advancements in ships, increased demand for dry storage containers and adoption of efficient logistics for international trade.

The Netherlands is major contributing player in the Europe shipping container market owing to the presence of the Port of Rotterdam which is the largest container port in Europe. The large inland waterways, strategic location with access to the Atlantic Ocean and the North Sea, high-tech ports, strong maritime industry, presence of robust logistics infrastructure are the factors fostering the market growth.

How U.S. Government Sanctions are Affecting Shipping Containers Market?

On April 2, 2025, U.S. President Donald Trump announced the Reciprocal Tariffs policy for regulating imports and rectifying trade practices. The announcement violating international regulations and trade policies has largely impacted the shipping containers industry with a potential for disruption of global supply chains, trade wars in the future. The tariffs have resulted in decreased rates of ocean container bookings and announcements or implementation of retaliatory measures by several countries. Manufacturers, shippers and other industries need to stay updated with these changes to take adequate measures for avoiding major economic losses.

A shipping container or an intermodal freight container (also known as a sea can) is described as container made to withstand shipment, storage and handling with its suitable strength and durability facilitating the easy, secure and cost-effective transportation of goods through different modes of transport such as ships, trucks and trains without the need for unloading and reloading the cargo.

The rising consumer demand across the globe, optimization of trade routes, free trade agreements favouring the expansion of global trade, surge in import/export of manufactured goods, implementation of advanced technologies such as remote container management (RCM) solutions, digitalization and automation of the shipping industry, growing collaborations between shipping companies and technology providers as well as the increased investments in infrastructure development such as port facilities and transportation hubs for connecting previously neglected regions to the global market ultimately accelerating international trade are the factors driving the shipping containers market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 15.01 Billion |

| Market Size in 2025 | USD 10.98 Billion |

| Market Size in 2024 | USD 10.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.54% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Size, Flooring, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Surge in International Trade

The ongoing advancements with new transportation and communication technologies, reduced trade barriers with initiatives such as low tariffs and free trade agreements, growing economic integration between developing countries as well as a huge number of emerging markets in various regions is accelerating cross-border movement of goods, capital, services and technology further expanding the global trade. Additionally, the rising demand for cargo transportation, increased adoption of standardized containers, and the growth of e-commerce is enabling efficiency logistics leading to streamlined operations and enhanced capability of meeting consumer expectations for rapid delivery, ultimately driving the market growth.

Stringent regulations and limitations in infrastructure

The environmental regulations set by the International Maritime Organization (IMO) leading to increased costs for reducing carbon emissions and adoption of eco-friendly practices, delays and inflated process in cross-border shipping due to trade disputes and complex custom regulations as well as strict safety and security regulations imposed on containers and vessels are the factors restraining the market growth. Moreover, infrastructural limitations such as port congestion due to outdated infrastructure, limited shipping frequency and capacity leading to longer turnaround times for vessels due to inadequate docking facilities, shortages in labour and surge in operational costs can lead to potential disruptions in global supply chains impacting profitability.

Development of new business models

Utilization of digital platforms is being applied for directly connecting shippers with owners of containers, further streamlining the rental process offering flexible leasing periods and access to customized container types. Development of smart containers integrated with sensors and Internet of Things (IoT) technologies enabling real-time tracking of location, condition and temperature resulting in enhanced visibility in supply chain.

Furthermore, shift of businesses towards outsourcing container services or Container as a Service (CoAS) models which offers an approach of paying for access to containers instead of owning them, ultimately reducing capital expenditure for businesses allowing them to focus in core competencies. Additionally, shippers are implementing collaborative logistics models and shared services such as collaborative warehousing and arrangement of transportation for streamlining operations by minimizing carbon footprint and enabling optimization of resource utilization. The incorporation of these business models is helping shippers and businesses in understanding logistical needs and allowing them to anticipate and adapt to the upcoming industry trends.

The ISO containers segment dominated the market with the largest share in 2024. ISO shipping containers are designed specifically to meet the standardized dimensions and construction set by the International Organization for Standardization (ISO) further enabling efficient and cost-effective intermodal transportation of goods. Expansion of global trade, swift development of e-commerce sector, growing emphasis on containerization, enhancing the efficiency of supply chain with the adoption of smart container technologies enabling real-time tracking and remote management solutions, initiatives for green shipping and increased implementation of automated and digitalized processes at container terminals are the factors driving the market dominance of this segment.

Non-standardized containers segment is anticipated to witness lucrative growth over the forecast period. The growth of global trade with emerging markets in various regions created the demand for specialized containers such as non-standardized containers which are made for addressing the limitations of standardized containers by handling the varying cargo types and particular requirements by clients, further enhancing the cargo safety, optimizing space utilization and adherence to regulatory standards.

The surging demand for just-in-time delivery models, development of containers with specific features such as ventilation or temperature control (refrigerated containers) for transporting materials like perishable goods or hazardous materials, availability of flexible containers with open sides or tops for smooth loading and unloading of heavy or irregularly shaped items as well as the integration of specialized designs and technologies such as Internet of Things (IoT), blockchain and Radio-Frequency IDentification (RFID) are the factors boosting the market growth of this segment.

Dry containers segment accounted for the largest market share in 2024. The market growth of this segment is driven by the increased adaptability, versatility and cost-effectiveness offered by dry containers making them acceptable for shipping a wide range of cargo including general and non-perishable goods such as electronics, machinery, textiles among others. Furthermore, increased maritime shipping activities, dominance of dry cargo in sea transport, surging demand for dry containers in emerging economies, expansion of trade routes and rising investments for infrastructure development are the factors favouring the market growth of this segment.

Reefer containers segment is expected to grow at the fastest rate during the forecast period. The implementation of advanced insulation materials, adoption of energy-saving cooling systems, integration of real-time monitoring and IoT technologies, employment of atmospheric control systems, utilization of sustainable materials and integration of blockchain technology for enhancing transparency in supply chains of reefer containers is driving their demand across various industries. Moreover, the surging demand for perishable goods such as fresh produce and frozen foods, expansion of the pharmaceutical industry driving the need for transportation of temperature-sensitive pharmaceuticals and biological products, advancements in refrigeration technologies as well as enhanced efficiency and reliability on cold chain logistics is boosting the segment’s market growth.

The 40’ shipping containers segment dominated the market with the largest share in 2024. The growth of the large containers or 40-foot shipping containers can be attributed to their ability for transporting larger as well as lightweight cargo volumes such as industrial equipment and consumer goods offering versatility. These containers are used widely for optimizing economies of scale and also integrate seamlessly to various industrial needs like in e-commerce and modular housing.

The high cube containers segment is expected to grow at the fastest rate during the forecast period. High cube containers are similar to large or standardized containers except they provide more vertical space or an extra foot which makes them ideal for transporting bulkier goods such as vehicles and machinery among others allowing optimized space utilization. These containers are flexible and can be customized to specific needs such as refrigeration or additional layers.

The 20’ containers segment is expected to grow at a notable rate during the predicted timeframe. The rise in marine transportation activity due to increased consumer demand, globalization, growth of e-commerce and surging population creating the need for efficient logistics solutions at reduced costs. Small or 20-foot shipping containers act as a standardized, secure, scalable and cost-effective alternative for cross-border movements which makes indispensable in the global supply chain. Moreover, their flexibility and suitability for handling less-than-container-load (LCL) shipments makes them a popular option.

Wood flooring segment held a dominant presence in market in 2024. The cost-effectiveness compared to other flooring materials, sufficient strength, natural and aesthetic appeal, durability for handling and withstanding hardships in shipping as well as suitability for carrying various types of cargo, especially dry goods are the factors marking the dominance of the wood flooring segment in the shipping containers market. Keruing and Apitong are the most widely used tropical woods for shipping container floors owing to their ability to resist humidity, high temperatures and different types of cargo load.

Bamboo flooring segment is anticipated to witness fastest growth during the forecast period. Bamboo is a quickly renewable resource and biodegradable in nature which makes it a better and sustainable alternative to plastic or wood. The low costs, robust strength, easy availability and environmental benefits are increasing demand for bamboo products. Furthermore, advancements in manufacturing processes like strand-woven bamboo with improved durability and water resistance, supportive government initiatives encouraging sustainable building practise as well as increased use of bamboo flooring for specific applications in different types of shipping containers such as open-top containers, dry containers and 45ft European containers are the factors driving the market growth.

For instance, in April 2024, SITC Line, a Chinese containership operator declared the launch of its newly acquired 10,000 TEU (Twenty-Foot Equivalent Unit) dry containers. The new batch of containers is made from eco-friendly materials such as bamboo flooring, waterborne paint and MS sealant.

Industrial transport segment held the largest market share in 2024. The market dominance of this segment can be attributed to the rising investments for industrial expansion across the globe, emerging economies, demand for cost-effective and streamlined cross-border transportation of industrial raw materials and manufactured goods and increased emphasis on infrastructure development.

The consumer goods segment is anticipated to witness significant growth over the forecast period owing to the growth of e-commerce sector and increased consumer access to digital platforms and applications. Increased focus of manufacturers and shippers on adopting smart container technologies such as real-time tracking and monitoring, data analytics for analyzing shipping patterns and identification of operational inefficiencies as well as enhancing supply chain visibility during transit through route optimization and inventory management are driving the market growth.

By Product

By Type

By Size

By Flooring

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024