September 2024

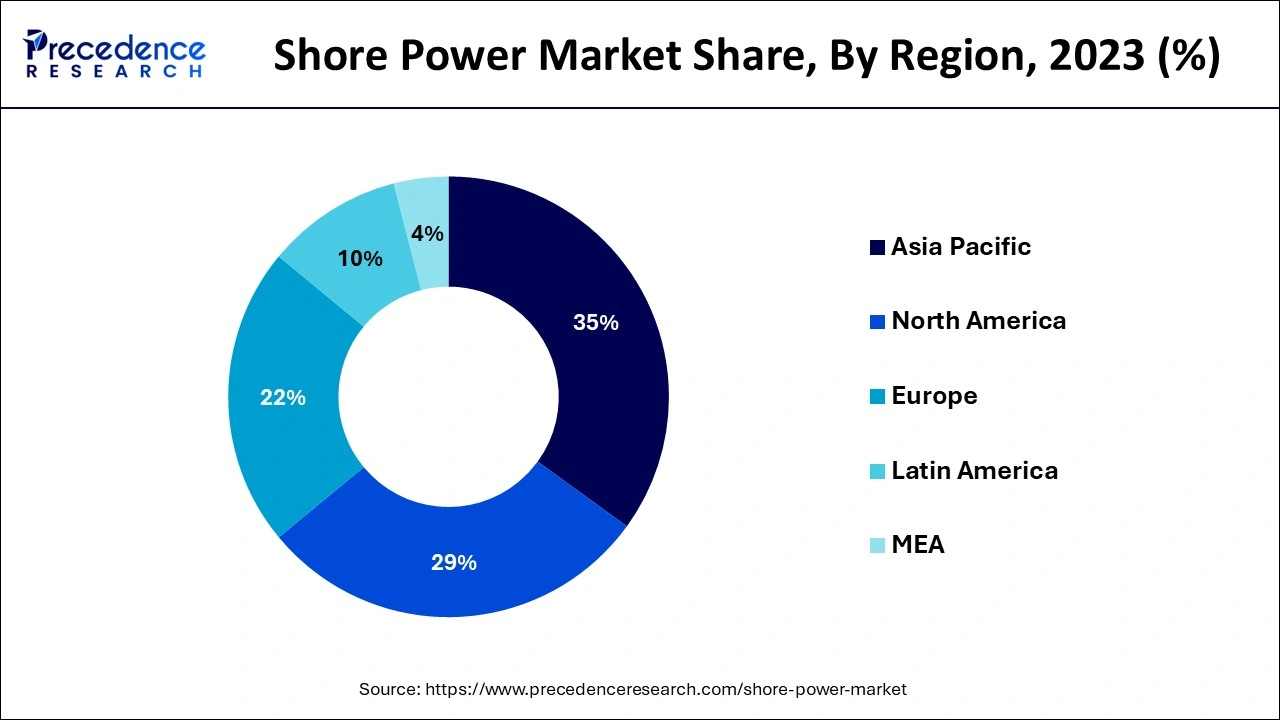

The global shore power market size accounted for USD 2.25 billion in 2024, grew to USD 2.49 billion in 2025 and is estimated to hit around USD 6.08 billion by 2034, registering a CAGR of 10.44% between 2024 and 2034. The North America shore power market size is calculated at USD 790 million in 2024 and is expected to grow at a CAGR of 10.50% during the forecast year.

The global shore power market size is worth around USD 2.25 billion in 2024 and is anticipated to reach around USD 6.08 billion by 2034, growing at a CAGR of 10.44% from 2024 to 2034. The shore power market is growing rapidly due to strict emission standards, the initiative to reduce harmful emissions from vessels, as well as the introduction of new ports. Ports shift to shore power systems as demand for clean and efficient energy solutions grows and contributes to environmental protection improvements.

Artificial intelligence (AI) is one of the main drivers of this revolution, and it supports proactive changes in several aspects of the shore power market operations. Artificial intelligence is increasingly being used to enhance output productivity, cut operating expenses, enhance safety, and facilitate the shift from fossil energy sources to green energy solutions. Certainly, AI can assist with predictive maintenance. It also helps to decrease the amount of human interference needed in maintenance, which improves the effectiveness of shore power systems in general and contributes to supporting environmentally friendly port operations.

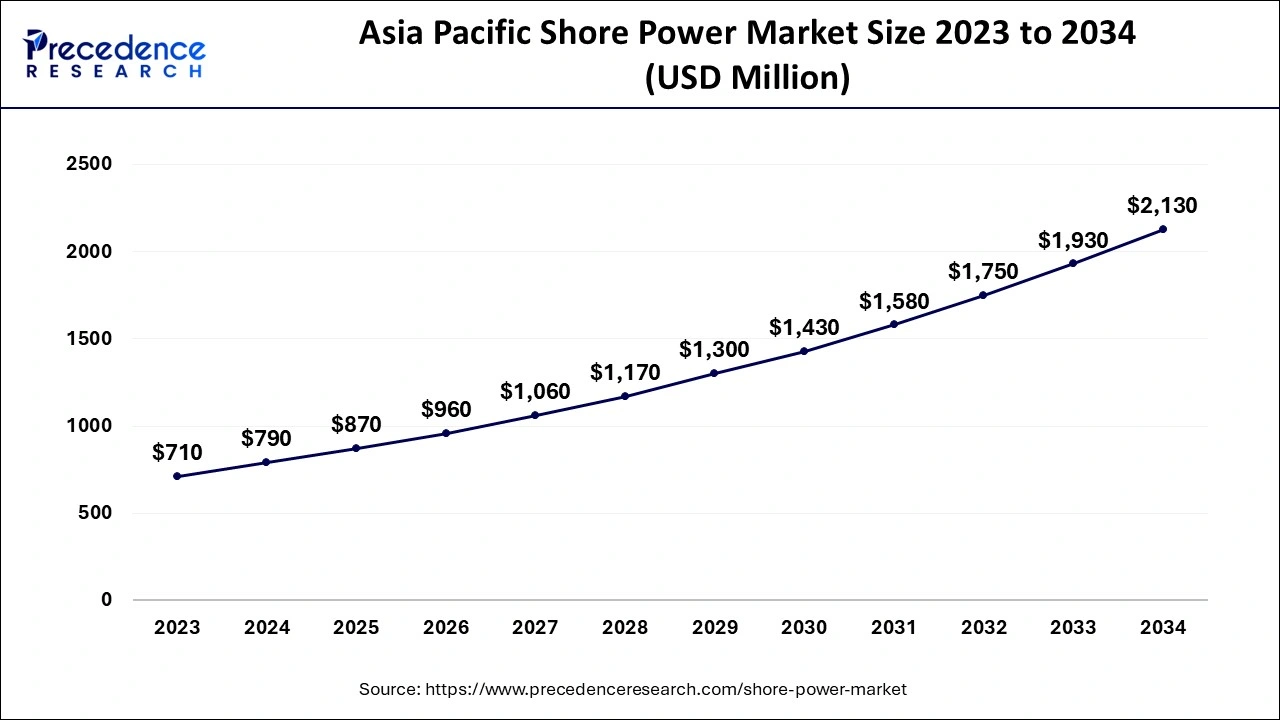

The Asia Pacific shore power market size is exhibited at USD 790 million in 2024 and is projected to be worth around USD 2,130 million by 2034, growing at a CAGR of 10.50% from 2024 to 2034.

Asia Pacific accounted for the largest share of the shore power market in 2023. The increased economic development and urbanization, hence, a high demand for energy in the region. This effort has a positive impact on lowering air pollution at the ports and greenhouse gases as well. The countries of Japan, South Korea, Singapore, and Australia have supported shore power programs to achieve targets regarding sustainability. This indicates that air quality and environmental factors in most Asian cities are equally demanding solutions like shore-power installations to address pollution and enhance environmental situations. Shore power solutions are easy and affordable to implement in the region due to the technological developments witnessed in various sectors, such as energy and maritime.

North America is anticipated to witness the fastest growth in the shore power market during the forecasted years. Increasing transportation costs and increasing investments in marine trade and transportation are expected to drive the market during the forecast period. In developments, ports may install shore-power systems to improve environmental status. Ports in North America are experiencing reconstruction and development to provide accommodations for larger vessels and a rise in capacity. The Environmental Protection Agency (EPA) and the Coast Guard in the United States have been actively pushing shore power programs through various regulatory measures.

Shore power, cold ironing, or alternative maritime power (AMP) means the connection of ships to an onshore power supply while they are docked at port, thus enabling the Shutdown of their onboard generators. This system eliminates the dependency of the ships on fuel combustion to produce power for some of their operations, hence minimizing emissions of pollutants and greenhouse gases. Shore power is a very useful environmental tool, especially for those cities faced with great congestion in ports due to increased global shipping, since it reduces air pollution and makes the maritime industry more sustainable.

Funding and Investment in the Shore Power Market

| Program | Region | Funding | Purpose |

| A&P Falmouth | UK Government | £ 12 million | The shore power project aids in revolutionizing emissions reduction in ports, offering sustainable shore power solutions to vessels. |

| European Commission | European Union | € 570 million | This incentivizes ship operators to connect to shore-side electricity infrastructure when at berth in maritime ports to power onboard services, systems, and equipment. |

| Green Shipping Corridor Program | Canada | USD 25.2 million | Funded under the Green Shipping Corridor Program to support both shore power and alternative fuel solutions in the maritime sector. |

| EPA’s Clean Ports Program | United State | USD 47.6 million | To develop vessel shore power, a battery energy storage system, and electrical infrastructure upgrades. |

| Report Coverage | Details |

| Market Size by 2034 | USD 6.08 Billion |

| Market Size in 2024 | USD 2.25 Billion |

| Market Size in 2025 | USD 2.49 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.44% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Installation Type, Connection, Component, Power Rating, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Decrease in low-frequency noise and operating expenses

Marine power that is employed in the electric supply of ships that are docked to the shore is useful in minimizing the noise produced by ships. Shore-side electricity charges all the electrical appliances in the vessel without starting the auxiliary engine, which is used to power cargo pumps, ventilators, communication, and light, among others. This helps with low-frequency noise and vibration, which will allow the crew to save fuel requirements for the ship's diesel engines.

The shore power market is cheap as costs are reduced when engines are switched off, and in many cases, ships adapting to shore power are given priority. Moreover, the relative fuel price has been equally high at many of the ports, which raises operational expenses. This operational cost can be minimized by the use of shore power installations.

Increase in offshore mining

Expansion in the shore power market by an increase in offshore mining. Shore power systems can be clean, reliable systems that can be used to supply electricity for offshore mining. Issues arising from mining companies off shores also involve different types of plants and equipment on vessels and offshore platforms. Shore power solutions can be effective methods to conserve power, making offshore mining operations more energy-efficient. This reduces the impacts associated with mining activities and respects the environmental policies in force.

Expenses on installation and maintenance of shore power system

Shore power solutions require a significant initial investment on the part of ports and vessels that require modification to be equipped with the necessary technology to connect to shore power. For ports, this incorporates the cost of electrical structures that include transformers, cables, and power managing infrastructure to gear up to cater to the power needs of several ships at the port. All these factors are expected to hamper the shore power market growth. The largest costs associated with beach facilities are frequency conversion equipment and high-voltage power supply.

Increasing Port Infrastructure

Emerging new port facilities to the escalating trade traffic of cargo between the nations marked enhanced construction of new ports across the globe. The various governments of fast-growing economies and developed countries have been investing in the expansion of the existing ports and new ports. For ports, this involves aspects such as the cost of strengthening the electrical networks, transformers, cables, and power control systems and guaranteeing that the infrastructure can cope with the power needs of several ships.

Funding for modernization and expansion projects increases with the installation of shore power facilities for ships. This trend is further supported by environmental legislation for controlling emissions of maritime activities and shore power awareness regarding its efficiency and economic as well as environmental aspects.

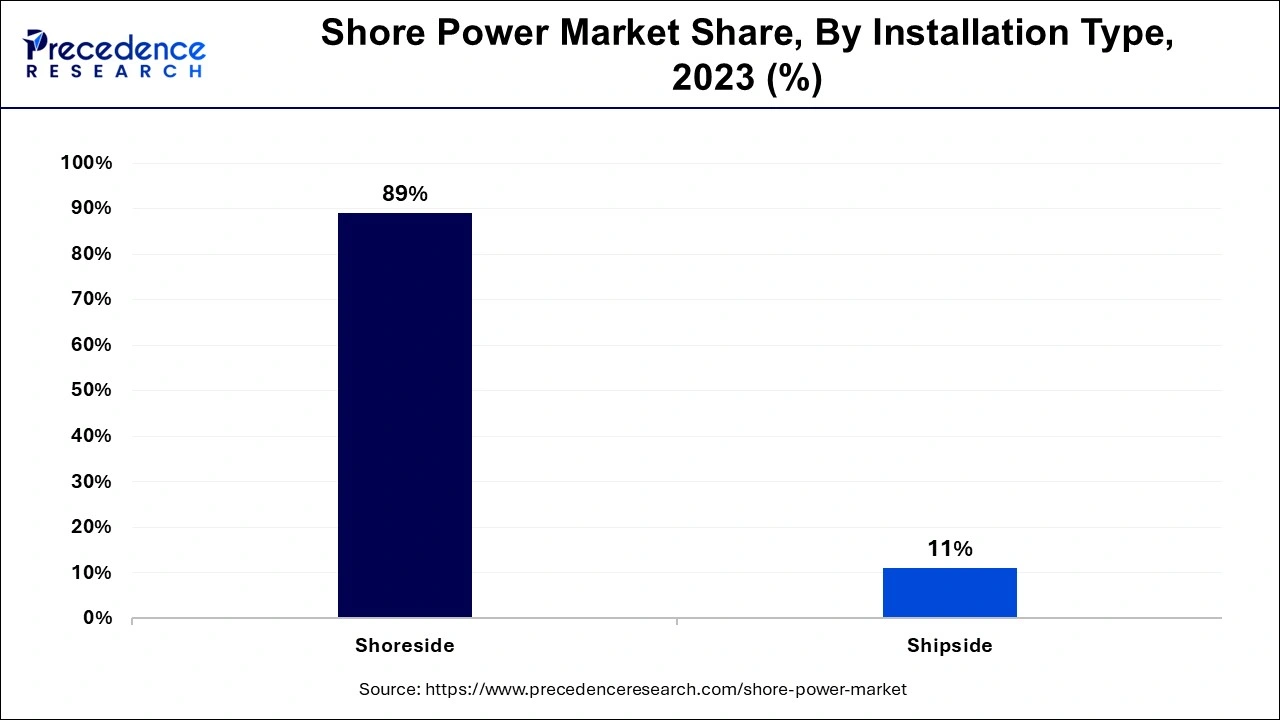

The shoreside segment noted the largest share of the shore power market in 2023. Shoreside power, or ‘‘cold ironing,’’ is a technology that enables ships to plug into shoreside power supply while in port. This will enable the ships to switch off their engines, relying on the shore supply electrical power for aspects that include lighting, pumping, and refrigeration. There is growing concern about emissions of air pollution and greenhouse gases at the ports during the docking of the ships. This has resulted in an increase in demand for shore power solutions as compared to shipboard power generation.

The shipside segment is projected to witness the fastest growth in the shore power market during the forecast period. Shore power is an important opportunity to replace fossil fuels with cleaner grid electricity. Industry and public awareness of the environmental impact of ports are steadily increasing, and therefore, there is a demand for cleaner solutions like shore power.

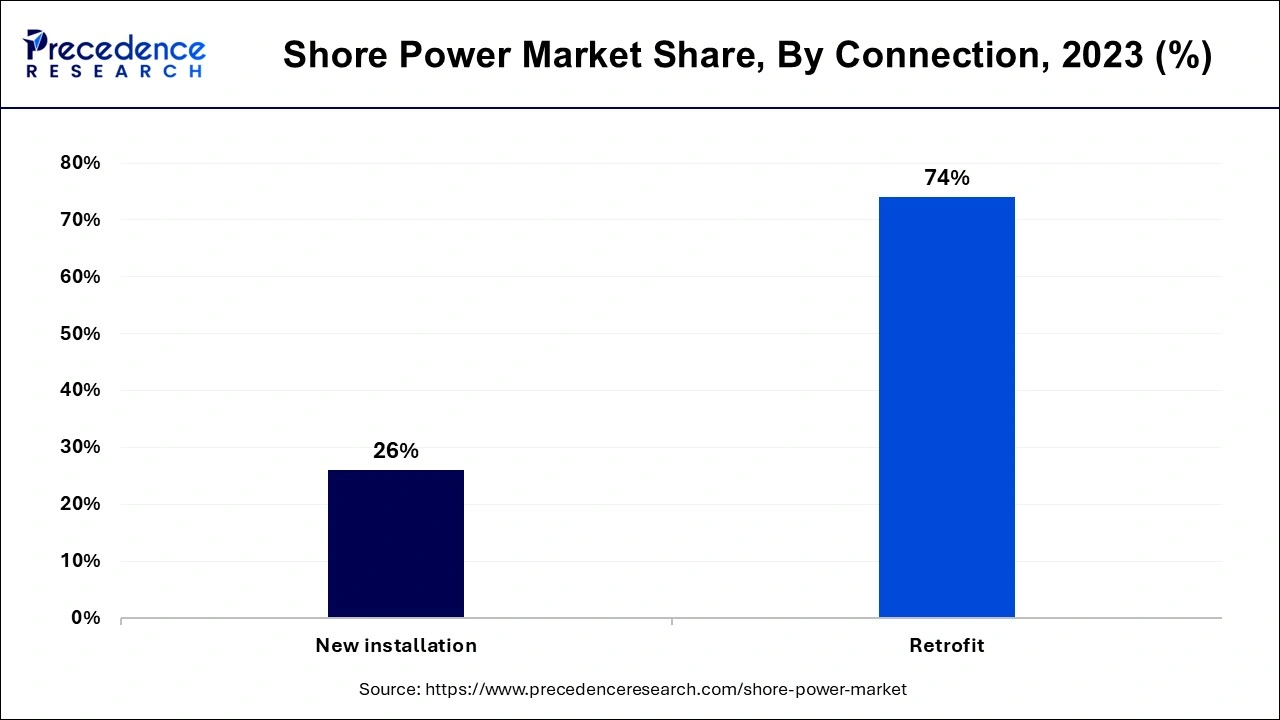

The retrofit segment has contributed the largest share of the shore power market in 2023. There are reports of governments and organizations creating incentives to compel ports and ships to install shore power technologies. These incentives can assist the taxpayer to cut the total costs of retrofitting. Shipping companies are fitting marine power to their newly built ships and retrofitting them to the old ones as more ports have it and the rules are changing. More money will be spent on upgrading the ports, which will increase the market pull of its service. Beyond reducing emissions, shore power retrofits offer an additional benefit.

The frequency converters segment noted the largest share of the shore power market in 2023. Inshore power systems, frequency converters are applied to tie the ships to the public grid to maintain a consistent voltage and frequency for the ship. Frequency converters act as the channel, adapting the incoming grid power to the specific requirements of the ship, allowing a safe and efficient connection. A frequency converter is an apparatus used for transforming electric power from one frequency to another, and the shore power converter is the model of the frequency converter used to connect a ship to a land electricity supply. Ports and shipping firms are constantly seeking shore-power solutions to help them limit emissions or meet set environmental standards.

The transformers segment is projected to witness the fastest growth in the shore power market during the forecast period. Transformers are part of the shore power systems that convert Voltage from the land that is suitable for a docked ship. They aid in the safe and efficient transfer of power to the ship from the shore. They are expected to rectify the voltage level of electricity that serves vessels from the on-shore electrical utility infrastructure to the appropriate voltage level required to serve the docked vessel. Different types of transformers are suitable for different uses in this market. Both new and replacement ones are installed and can be utilized in various vessels with different volumetric and power requirements.

The up to 30 MVA segment has contributed the largest share of the shore power market in 2023. The small to middle size boats, including ferry boats, container boats, cruise boats, and other boats, need electric power. This trend also relates to the rise of mega-ship employment in the international sea transport system. These large ships use far more electricity than relatively smaller ships and hence need far more powerful shore power systems. Shore power systems up to 30MVA are developing because they are more compact and have low capital costs.

The low MVA (up to 30 MVA) segment is projected to witness the fastest growth in the shore power market during the forecast period. Shore power systems supplying low MVA (up to 30MVA) are employed to provide electric power to smaller vessels such as ferries, passenger ships, and tugs. Shore power is the system whereby ships draw power from the landside rather than accelerating their engines. Self-conveying systems are dominant in inland waterways and harbors where the turnover of small boats is comparatively high.

By Installation Type

By Connection

By Component

By Power Rating

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

August 2024