December 2024

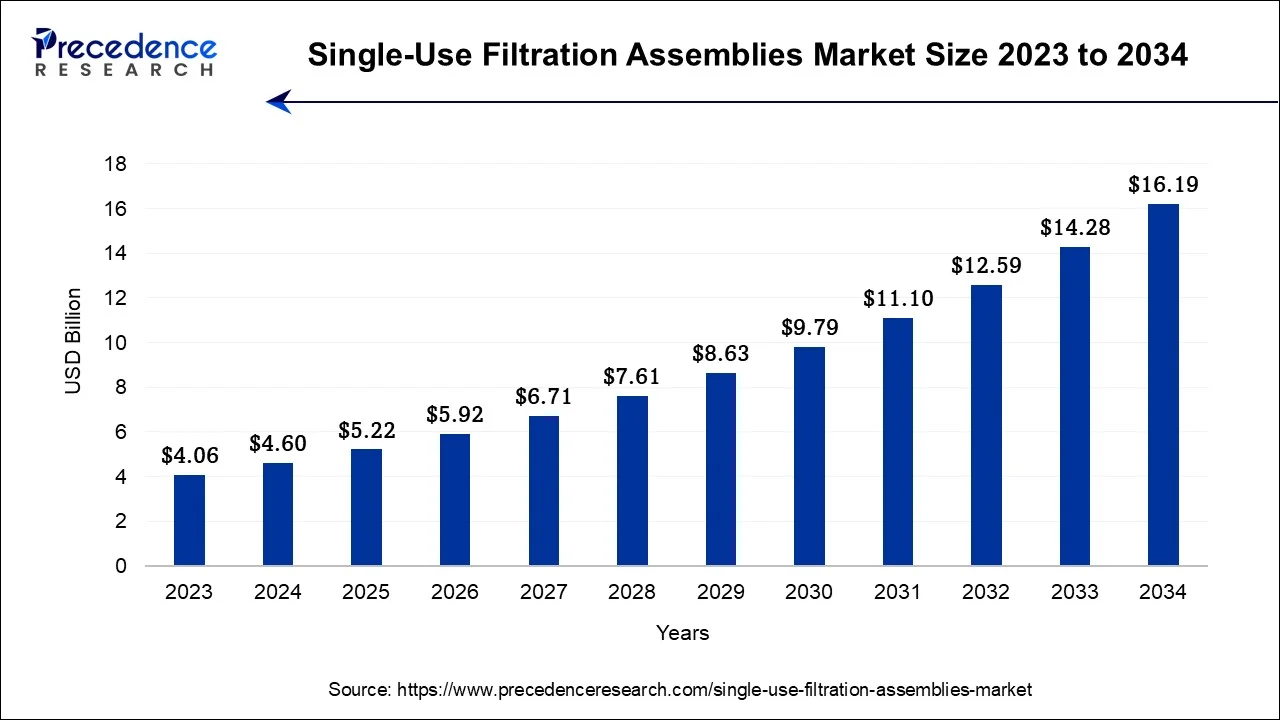

The global single-use filtration assemblies market size accounted for USD 4.6 billion in 2024, grew to USD 5.22 billion in 2025 and is projected to surpass around USD 16.19 billion by 2034, representing a healthy CAGR of 13.40% between 2024 and 2034. The North America single-use filtration assemblies market size is worth around USD 1.79 billion in 2024 and is expected to grow at a fastest CAGR of 13.42% during the forecast period.

The global single-use filtration assemblies market size is calculated at USD 4.6 billion in 2024 and is projected to reach around USD 16.19 billion by 2034, ragistaring a healthy CAGR of 13.40% from 2024 to 2034.

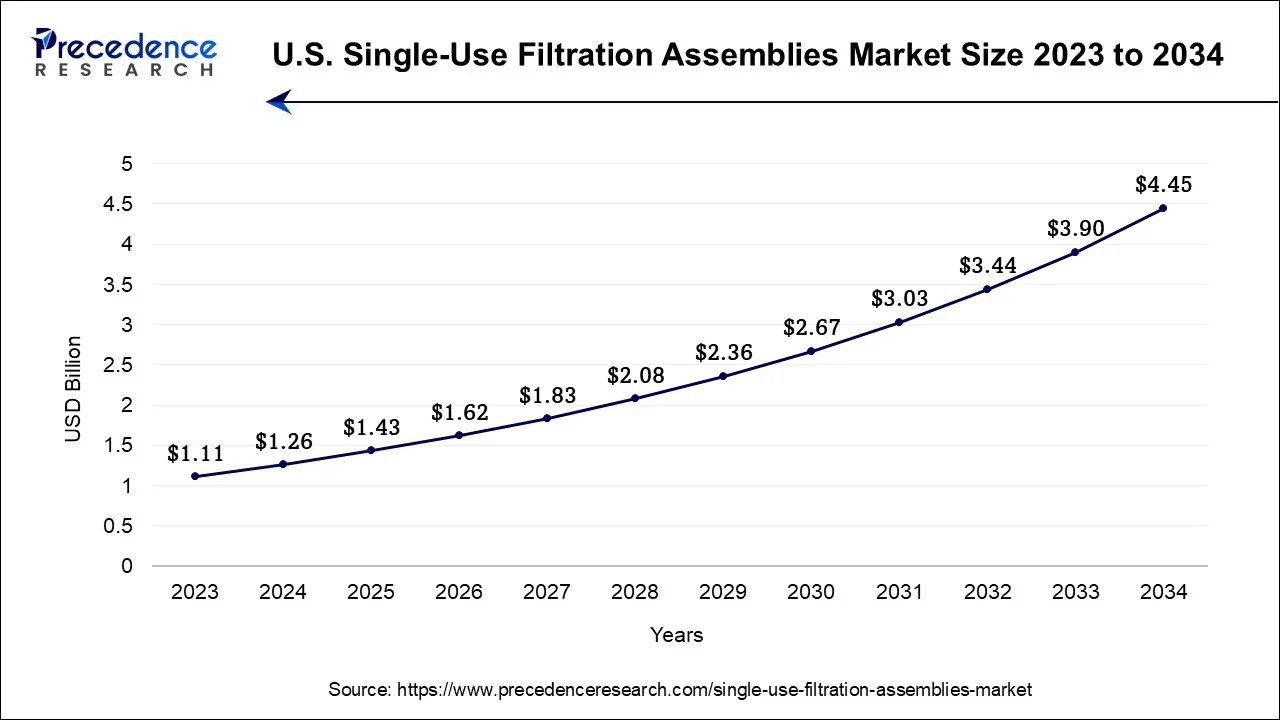

The U.S. single-use filtration assemblies market size was exhibited at USD 1.26 billion in 2024 and is estimated to to be worth around USD 4.45 billion by 2034, growing at a CAGR of 13.44% from 2024 to 2034.

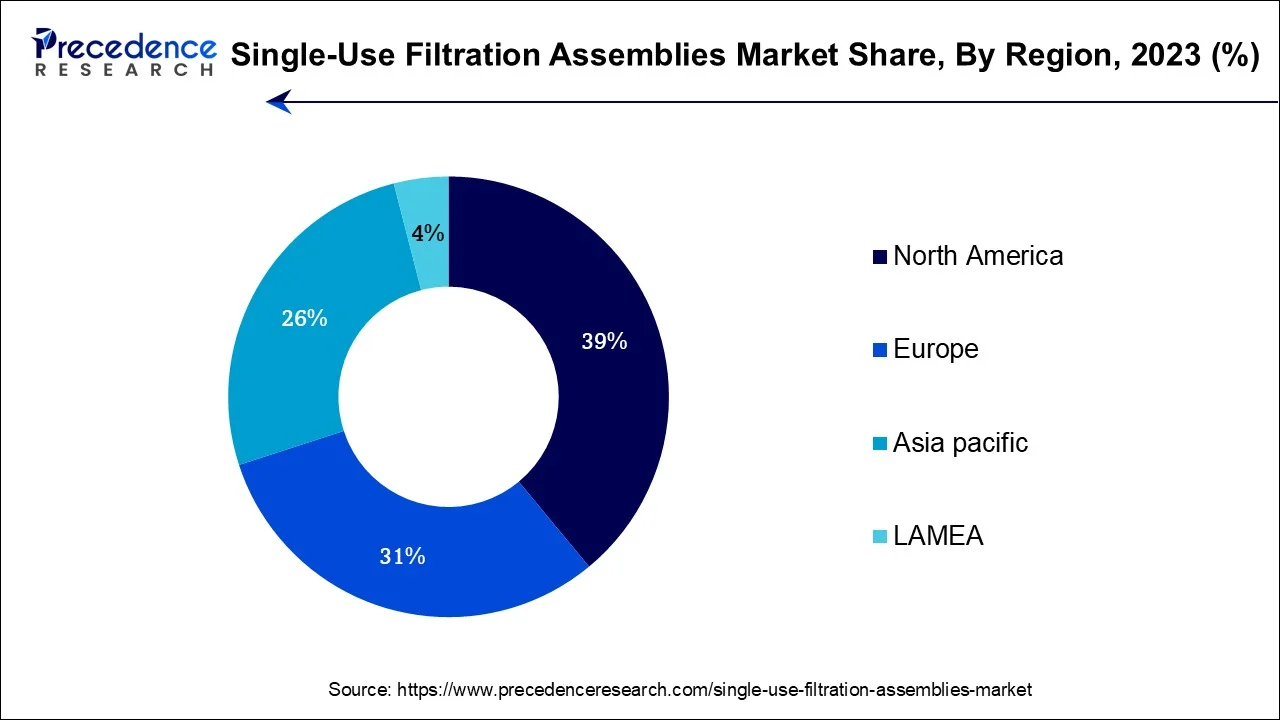

North America has held the largest revenue share of 39% in 2023. In North America, the single-use filtration assemblies market is marked by several noteworthy trends. The region exhibits a strong emphasis on biopharmaceutical research and manufacturing, driving the demand for efficient and flexible single-use filtration solutions. Regulatory compliance and adherence to stringent quality standards remain paramount. The COVID-19 pandemic accelerated the adoption of these systems, with pharmaceutical companies seeking rapid production of vaccines and therapeutics. Furthermore, there is a growing focus on sustainability, prompting innovations in recyclable single-use components to address environmental concerns while maintaining the market's growth trajectory.

Asia-Pacific is estimated to observe the fastest expansion in the Asia-Pacific region, the single-use filtration assemblies market is witnessing notable trends. The expansion of the biopharmaceutical industry in nations such as China and India are propelling the need for cost-efficient and effective filtration solutions. Moreover, the emphasis on quality and regulatory compliance in pharmaceutical manufacturing is fueling the adoption of single-use systems. As the region becomes a global hub for pharmaceutical production, single-use filtration assemblies are increasingly recognized as essential components in ensuring sterile and efficient bioprocessing operations, further contributing to market growth.

In Europe, the single-use filtration assemblies market is witnessing notable trends. Stringent regulatory standards and a focus on product quality are driving the adoption of single-use systems in biopharmaceutical manufacturing. Additionally, the region's commitment to environmental sustainability is promoting the development of eco-friendly single-use components. The COVID-19 pandemic has accelerated the acceptance of these systems, particularly in vaccine production. Europe's growing biopharmaceutical sector, along with an emphasis on cost-effective and flexible manufacturing processes, further contributes to the demand for single-use filtration assemblies in the region.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.19 Billion |

| Market Size in 2024 | USD 4.6 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.40% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The flexibility offered by single-use filtration assemblies for smaller batches is a significant market driver. As the demand for niche and personalized medicine markets grows, manufacturers require cost-effective solutions that can efficiently process smaller production runs. Single-use filtration assemblies enable precisely that, making them a compelling choice for pharmaceutical companies seeking to meet the needs of these specialized markets while maintaining operational efficiency and cost-effectiveness.

Moreover, Operational flexibility is a driving force behind the increased demand for single-use filtration assemblies. These assemblies simplify processes, reduce downtime, and minimize the need for extensive cleaning and validation procedures. This flexibility allows biopharmaceutical manufacturers to adapt swiftly to changing production requirements and accommodate diverse products and batch sizes. As a result, companies can enhance efficiency, reduce costs, and respond more effectively to market dynamics, making single-use filtration assemblies a preferred choice in the industry.

Limited compatibility, paradoxically, drives market demand for single-use filtration assemblies. As biopharmaceutical processes become more diverse and specialized, manufacturers seek adaptable solutions. The exclusivity of single-use systems for certain applications fosters demand as companies recognize the need for a versatile portfolio of filtration options. While not universally compatible, single-use filtration assemblies cater to specific requirements, providing tailored solutions for processes where traditional systems fall short, ultimately enhancing their appeal in niche segments of the industry.

Moreover, Complex biopharmaceutical processes drive the demand for single-use filtration assemblies. These processes require advanced filtration solutions capable of meeting intricate manufacturing needs. Single-use assemblies offer the flexibility to adapt to complex workflows, reducing downtime associated with cleaning and validation in comparison to traditional stainless-steel systems. Consequently, they enhance operational efficiency, making them an attractive choice for biopharmaceutical companies navigating intricate production processes while ensuring cost-effectiveness.

Diversification within the single-use filtration assemblies market fuels demand as it caters to a wide array of applications. These assemblies can be customized to suit various processes, from large-scale bioprocessing to smaller niche markets. This adaptability ensures that single-use filtration solutions are relevant across diverse sectors of the biopharmaceutical and pharmaceutical industries, making them a preferred choice for manufacturers seeking versatile and efficient filtration solutions for different production needs.

Moreover, Customization and specialization are significant drivers of demand in the single-use filtration assemblies market. Manufacturers require tailored solutions that align precisely with their unique bioprocessing needs and product requirements. Single-use filtration assemblies offer the flexibility to customize components and configurations, optimizing performance and efficiency for specific applications. This ability to address diverse and specialized processes effectively makes single-use systems a compelling choice for biopharmaceutical companies, propelling market growth.

The membrane filtration segment has held a 51% revenue share in 2023. Membrane filtration is a critical type within the single-use filtration assemblies market. It involves using semipermeable membranes to separate particles, microorganisms, and contaminants from liquids or gases in pharmaceutical and bioprocessing applications. Recent trends indicate a growing preference for membrane filtration due to its effectiveness in achieving precise separations, enhanced product quality, and reduced maintenance compared to traditional methods. Moreover, advancements in membrane materials and designs are continually improving filtration efficiency and expanding the scope of applications, reinforcing its pivotal role in the single-use filtration assemblies market.

The depth filtration segment is anticipated to expand at a significant CAGR of 16.8% during the projected period. Depth filtration, a key type in the single-use filtration assemblies market, involves the use of porous matrices to trap particles and contaminants. This method is widely employed in biopharmaceutical manufacturing to remove impurities from liquids and gases. Current trends in depth filtration include the development of enhanced filter media for greater efficiency, scalability, and reduced maintenance. Single-use depth filtration assemblies are gaining popularity due to their flexibility and cost-effectiveness, enabling seamless integration into bioprocessing operations while meeting stringent regulatory standards.

The bioprocessing/biopharmaceuticals segment is anticipated to hold the largest market share of 43% in 2023. Within the context of the single-use filtration assemblies market, "bioprocessing" refers to their application in the biopharmaceutical industry. This usage encompasses filtration and separation processes integral to producing biologics, monoclonal antibodies, and other biopharmaceutical products. Noteworthy trends in this sector include a rising demand for biologics, personalized medicines, and biosimilars. Additionally, the industry is increasingly favoring cost-effective, scalable manufacturing approaches, with a demonstrated need for rapid scale-up capabilities during critical situations such as the COVID-19 pandemic. These factors are driving the heightened adoption of single-use filtration assemblies in bioprocessing.

The Laboratory Use segment is projected to grow at the fastest rate over the projected period. In laboratory use, single-use filtration assemblies refer to disposable filtration systems employed for various applications, such as sample preparation, clarification, and sterilization. A notable trend in this segment is the increasing preference for single-use systems in laboratory workflows. Laboratories are adopting these assemblies to streamline processes, reduce contamination risks, and enhance operational efficiency. The convenience, cost-effectiveness, and scalability of single-use filtration solutions align well with the evolving needs of laboratories, making them an integral component of modern research and development practices.

The filters segment had the highest market share of 26.8% in 2023. In the single-use filtration assemblies market, filters play a central role in separating particles and contaminants from pharmaceutical and biopharmaceutical products. Recent trends in filter technology include the development of high-capacity, high-flow filters to accommodate larger batches and faster processing times. Moreover, there's a growing emphasis on improving the filtration of smaller particles, such as viruses and nanoparticles, to enhance product purity. Additionally, there is a shift toward using innovative materials that offer enhanced biocompatibility and reduced extractables, ensuring the highest product quality and patient safety.

The cartridges is anticipated to expand at the fastest rate over the projected period. In the single-use filtration assemblies market, cartridges are essential components used for the filtration of liquids and gases. These disposable filtration units consist of filter media encased in a housing and are designed for one-time use. Cartridges are available in various sizes and configurations to accommodate diverse biopharmaceutical and pharmaceutical applications. Trends in cartridge technology include the development of high-capacity and high-efficiency designs, customization options, and the integration of advanced materials to enhance filtration performance. These trends cater to the growing demand for efficient and precise filtration solutions in bioprocessing and pharmaceutical manufacturing.

Segments Covered in the Report

By Type

By Application

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

January 2025

November 2024