February 2025

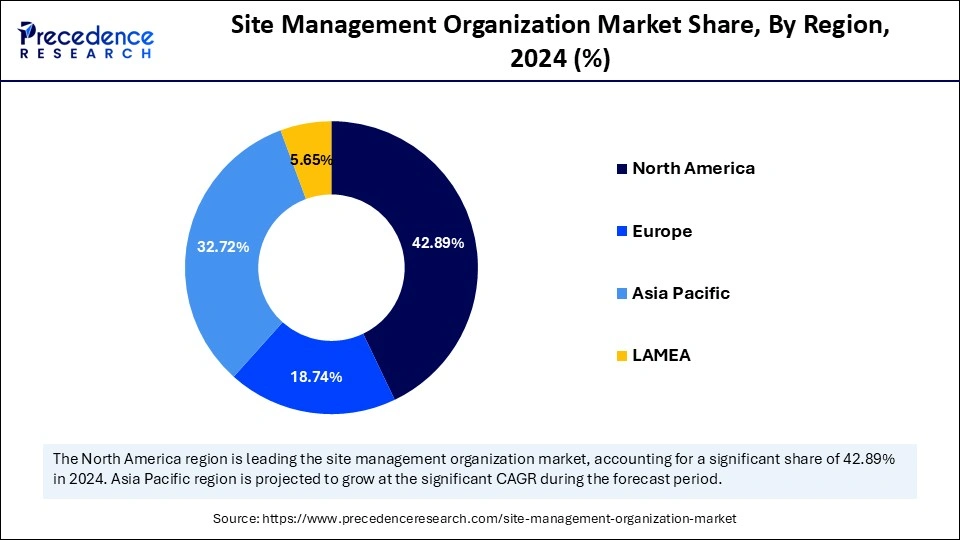

The global site management organization market size is calculated at USD 10.66 billion in 2025 and is forecasted to reach around USD 27.44 billion by 2034, accelerating at a CAGR of 11.07% from 2025 to 2034. The North America market size surpassed USD 4.31 billion in 2024 and is expanding at a CAGR of 10.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global site management organization market size accounted for USD 10.04 billion in 2024 and is predicted to increase from USD 10.66 billion in 2025 to approximately USD 27.44 billion by 2034, expanding at a CAGR of 11.07% from 2025 to 2034. The growth of the site management organization market is driven by rising healthcare expenditures, increasing clinical trial activities, and increasing requirements for efficient site management support from pharmaceutical companies.

Site management organizations can improve their operations through AI technologies. These technologies can enhance the efficiency of clinical trials by automating various tasks, such as patient enrollment and recruitment, data entry, and data analysis. Artificial Intelligence can analyze large datasets generated during clinical trials. This further helps in informed decision-making. AI also helps with site selection, quality improvement, and risk management.

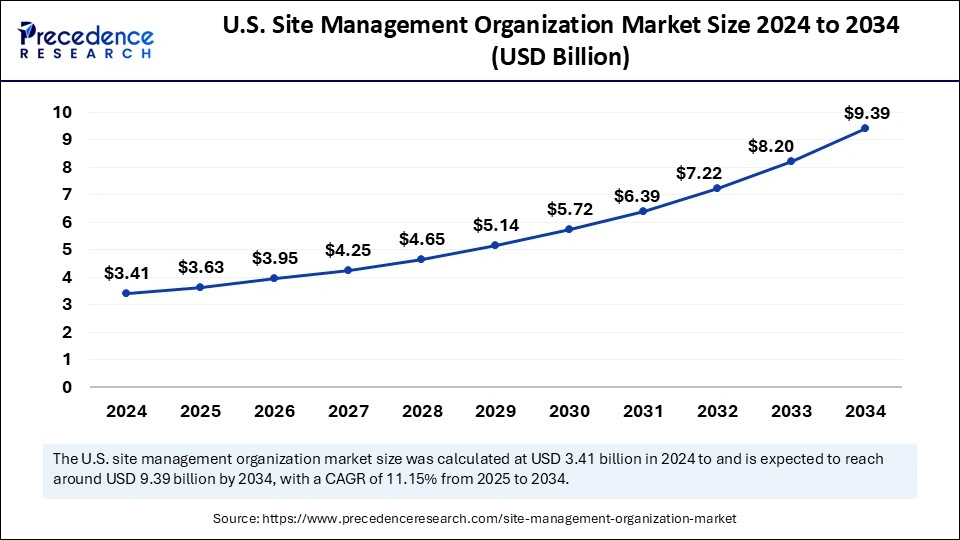

The U.S. site management organization market size was exhibited at USD 3.41 billion in 2024 and is projected to be worth around USD 9.39 billion by 2034, growing at a CAGR of 11.15% from 2025 to 2034.

North America’s Stronghold on the Market

North America held the dominant share of the market in 2024. This is mainly due to its well-established research infrastructure. The region also boasts well-known research centers, educational institutions, and medical facilities. This led to an increased volume of clinical trials, boosting the demand for SMO services. Moreover, North American SMOs use innovative technologies for obtaining patient and site operations, leading to the successful execution of trials.

The U.S. is a major contributor to the North American site management organization market. The country is home to some of the world’s leading pharmaceutical and biopharmaceutical companies that are actively engaged in clinical trials. The U.S. government supports clinical research activities. Stringent regulatory standards set by the U.S. FDA encourage research institutes and pharmaceutical companies to outsource clinical trials to SMOs.

Asia Pacific Site Management Organization Market Trends

Asia Pacific is expected to witness the fastest growth during the projected timeframe. The rising healthcare expenditure, stringent regulatory frameworks regarding pharmaceutical safety, and expansion of the pharmaceutical industry support regional market growth. The rising government investments in drug discovery and development lead to increased clinical trials. This, in turn, boosts the demand for SMO services.

China is expected to lead the market in the region in the foreseeable future. This is mainly due to the increasing clinical trial activities. Chinese SMOs are partnering with CROs to expand their footprints, contributing to market expansion.

Europe Site Management Organization Market Trends

Europe is expected to observe notable growth in the near future. The growth of the European market is driven by increasing investments in research and clinical trials. Stringent regulations set by the European Union for clinical trials create immense opportunities for SMOs. In addition, the increasing focus on the development of novel therapeutics supports regional market growth.

Site management organizations (SMOs) serve as specialized third parties that provide support services to companies engaged in clinical trials. SMOs manage clinical trials efficiently through their supporting regulatory standards and quality control practices while optimizing operational efficiency. Complexity in clinical trials has made SMOs essential because their specialized expertise supports site operations and ensures trial performance success.

Drug discovery requirements have risen because of the increased prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders, thus leading to more clinical trials. The increasing production of pharmaceuticals, with new therapeutic drug clinical trials, boosts the need for SMO services to accelerate production.

| Report Coverage | Details |

| Market Size by 2034 | USD 27.44 Billion |

| Market Size in 2025 | USD 10.66 Billion |

| Market Size in 2024 | USD 10.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacfic |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Phase of Clinical Trials, Therapeutic Area, End-user, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Clinical Trial Complexity

The rising complexities in clinical trials boost the need to outsource clinical trial management to SMOs, driving the growth of the site management organization market. The successful execution of any clinical trial requires specialized knowledge and improved operational efficiency. SMOs offer skilled personnel and specialized services for managing these complexities. Outsourcing clinical trials to SMOs streamline trial processes. The demand for SMO services is expected to keep rising because they help improve the efficiency of trials and reduce the associated costs.

Regulatory Compliance and Data Security Concerns

Clinical trial operators face pressure to adhere to stringent regulations that govern clinical trials, ensure patient data security, and manage patient consent procedures. Changing regulatory requirements requires ongoing protocol revisions, practice updates, and staff training, which requires major financial support with specialized expertise. The widespread digitization of clinical trials pressurizes SMOs to establish strong security measures for protecting sensitive information, which can be challenging. Moreover, increasing competition from CROs restraints the growth of the site management organization market.

Rising Global Healthcare Expenditure

Healthcare spending is steadily increasing, especially in emerging economies. Rising healthcare investment often translates into developing new therapeutics, leading to increased clinical trials. This creates opportunities for SMOs to tap into new marketplaces, especially emerging countries. Moreover, strategic partnerships between SMOs and CROs enable them to offer comprehensive services and expand their businesses worldwide.

The patient recruitment & retention segment dominated the site management organization market with the largest share in 2024. With the increased volume of clinical trials, the need for patient recruitment has increased, since patient recruitment is a vital step to commence trial. Strategies for recruiting patients remain essential because they determine the attainment of target study populations and the proper duration of clinical trials. SMOs utilize digital platforms to enhance patient recruitment and retention. These services help pharmaceutical and biopharmaceutical companies to find eligible patients to keep trials on schedule.

Patient retention plays a vital role because leaving the participants delays trials as well as affects trial outcomes. Through optimized recruitment and retention processes, SMOs decrease the time and costs required for clinical trials. These services guarantee successful clinical trials by improving patient engagement and retention strategies.

The regulatory compliance segment is expected to grow at the fastest rate in the coming years. SMOs serve clinical research institutes by providing operational and administrative assistance, which maintains activities according to regional and international regulatory standards. Research institutes and clinical trial organizations must follow several regulations that regulate patient protection, clinical trial documentation, and privacy protection rules. SMOs with dedicated regulatory teams help guide through complex regulations, reducing penalties and trial delays.

Site Management Organization Market Revenue, By Service Type, 2022-2024 (USD Million)

| Service Type | 2022 | 2023 | 2024 |

| Site Selection | 1,384.2 | 1,474.0 | 1,578.4 |

| Patient Recruitment and Retention | 2,124.0 | 2,242.1 | 2,379.9 |

| Site Training and Support | 903.9 | 966.9 | 1,039.9 |

| Data Management | 1,224.1 | 1,281.2 | 1,348.3 |

| Regulatory Compliance | 858.8 | 926.2 | 1,004.2 |

| Monitoring Services | 1,767.9 | 1,859.5 | 1,966.7 |

| Project Management | 639.0 | 677.1 | 721.6 |

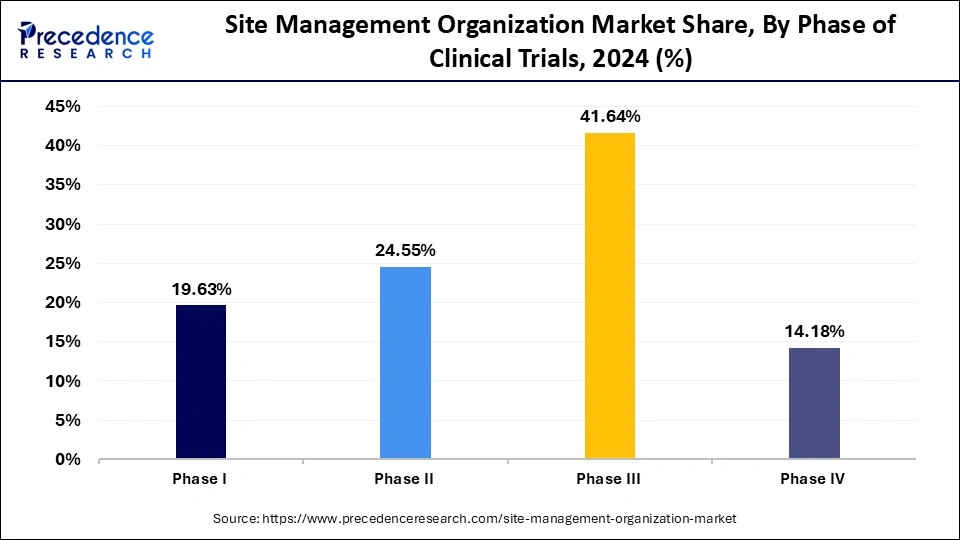

The Phase III segment accounted for the largest share of the site management organization market in 2024. Site management organizations offer necessary services for conducting complex trials. Phase III trials are typically more complex and involve a larger patient population. Stringent regulations create complexities that boost the necessity for specialized services to handle trial operations. SMOs assist in navigating these complexities by providing necessary support.

The Phase II segment is expected to grow at a rapid growth rate during the forecast period. Phase II trials involve drug assessment to ensure safety and efficacy, requiring potential patients to evaluate the drug’s efficiency and side effects. SMOs provide necessary services, including patient enrollment and regulatory compliance, to complete phase II trials successfully. Success in Phase II trials depends on on-site management to execute trials while effectively obtaining data because trials frequently use sophisticated research. The rising number of early-stage drug trials and escalating demand for targeted treatments support segmental growth.

Site Management Organization Market Revenue, By Phase of Clinical Trials, 2022-2024 (USD Million)

| Phase of Clinical Trials | 2022 | 2023 | 2024 |

| Phase I | 1,756.7 | 1,855.2 | 1,970.2 |

| Phase II | 2,193.0 | 2,318.4 | 2,464.6 |

| Phase III | 3,659.6 | 3,900.6 | 4,180.6 |

| Phase IV | 1,292.7 | 1,352.9 | 1,423.6 |

The oncology segment dominated the site management organization market. The increased cancer burden across the globe has boosted the need for novel therapeutics. According to the World Health Organization (WHO) projections, 30.2 million people will undergo cancer diagnoses in 2040, while cancer stands among the leading causes of mortality worldwide. Inactive lifestyle patterns increased cancer prevalence, driving the necessity for thorough research and clinical experiments.

SMOs specialized in oncology help in cancer research and trials because they provide operational support that enhances trial efficiency. Oncology trials tend to be complex and require many participants, requiring SMO services to navigate complexities and successfully complete research.

The neurology segment is expected to expand at the fastest rate over the studied period. The rising neuroscience research is a major factor boosting the growth of the segment. With the growing prevalence of neurological disorders, the development of novel therapeutics is increasing, leading to increased clinical trials for evaluating the efficacy of these therapies. Effective site management and patient retention remain paramount in neurological trials, boosting the need for specialized SMO services.

Site Management Organization Market Revenue, By Therapeutic Area, 2022-2024 (USD Million)

| Therapeutic Area | 2022 | 2023 | 2024 |

| Oncology | 2,897.6 | 3,103.8 | 3,342.9 |

| Cardiovascular | 1,782.1 | 1,884.5 | 2,003.9 |

| Neurology | 1,385.0 | 1,476.7 | 1,583.2 |

| Infectious Diseases | 1,117.3 | 1,166.8 | 1,225.1 |

| Metabolic Disorders | 953.2 | 1,003.0 | 1,061.1 |

| Others | 766.7 | 792.3 | 822.8 |

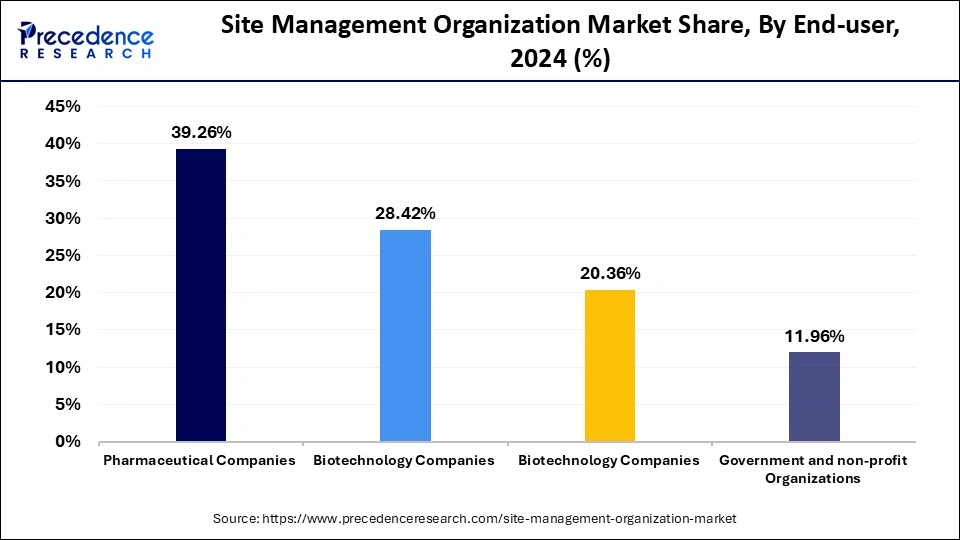

The pharmaceutical companies segment accounted for the largest market share in 2024. Pharmaceutical companies often engage in research and development to discover new drugs, leading to a surge in clinical trials. This requires SMO services for the successful execution of clinical trials. Outsourcing clinical trials to SMOs enables pharmaceutical companies to focus on other core areas. SMOs help these companies navigate complexities during trials and getting drug approval. SMOs provide essential solutions that help pharmaceutical companies adhere to strict regulations while successfully achieving trials. The rising investment by these companies in R&D further supports segmental growth.

The biotechnology companies segment is anticipated to witness the fastest growth over the projection period. Biotechnology companies depend on SMOs for their key services, which include site management, patient recruitment, regulatory compliance, and data management to deliver efficient trials with regulatory standards. Due to the increasing demand for personalized medicine and rising innovations in biotechnology, the complexity of biotech clinical trials is growing, which boosts the need for SMOs. The characteristics of biotechnology products with novel approaches require specialized support from SMOs.

Site Management Organization Market Revenue, By End-User, 2022-2024 (USD Million)

| End-User | 2022 | 2023 | 2024 |

| Pharmaceutical Companies | 3,502.4 | 3,705.0 | 3,941.3 |

| Biotechnology Companies | 2,469.4 | 2,647.0 | 2,852.8 |

| Academic Institutions | 1,841.6 | 1,934.8 | 2,043.8 |

| Government and Non-Profit Organizations | 1,088.6 | 1,140.4 | 1,201.1 |

By Service Type

By Phase of Clinical Trials

By Therapeutic Area

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

April 2025

April 2025