September 2024

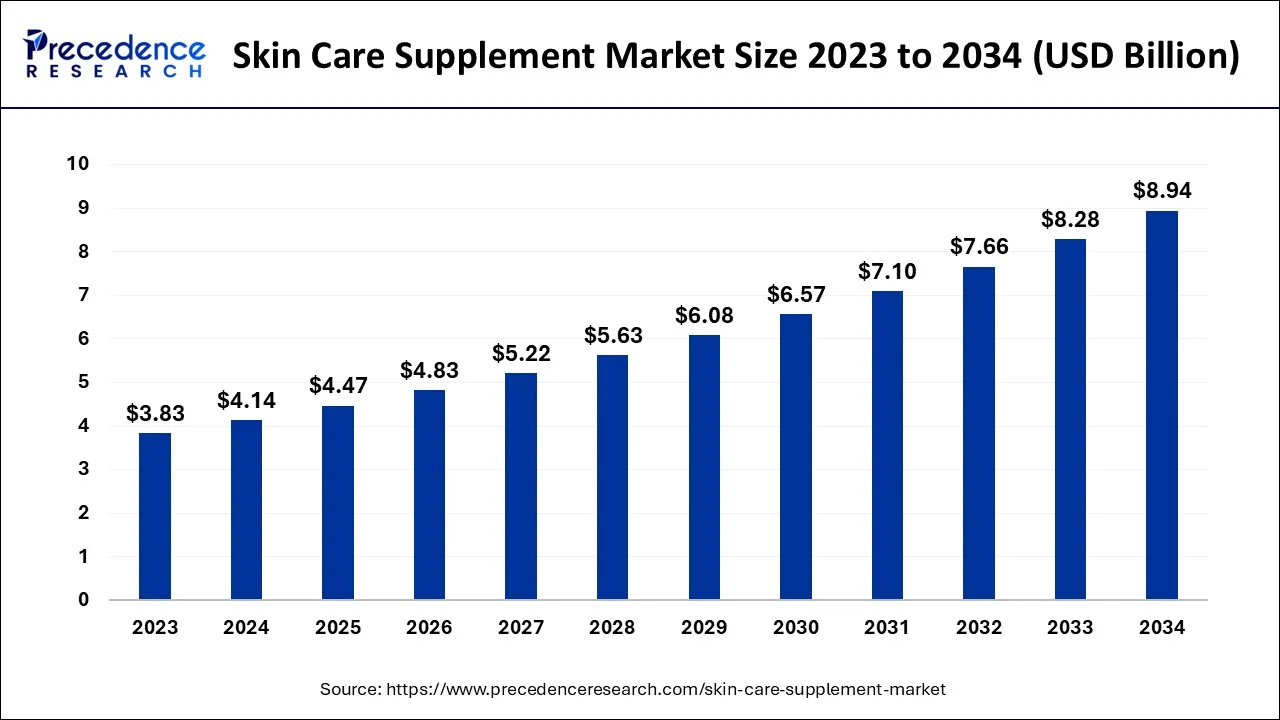

The global skin care supplement market size is calculated at USD 4.14 billion in 2024, grew to USD 4.47 billion in 2025, and is predicted to hit around USD 8.94 billion by 2034, poised to grow at a CAGR of 8% between 2024 and 2034. The Asia Pacific skin care supplement market size accounted for USD 1.95 billion in 2024 and is anticipated to grow at the fastest CAGR of 8.12% during the forecast year.

The global skin care supplement market size is expected to be valued at USD 4.14 billion in 2024 and is anticipated to reach around USD 8.94 billion by 2034, expanding at a CAGR of 8% over the forecast period from 2024 to 2034.

The skin care supplements market is a rapidly growing industry that encompasses a wide range of products, from vitamins and minerals to herbal extracts and collagen. The market is driven by the growing awareness of the importance of maintaining healthy skin and the desire for effective and natural skin care solutions.

The skin care supplements market is segmented by product type, target audience, distribution channel and region. Some of the main product categories include vitamins and minerals, antioxidants, collagen, hyaluronic acid, and plant extracts. The market is also segmented by target audience including men, women and age groups. Regarding distribution channels, the market for skin care supplements is mainly sold through retail channels such as pharmacies, supermarkets and online retailers. Marketplaces are also sold through direct-to-consumer channels, such as a company's website. The skin care supplement market is highly competitive, with a large number of industry players.

The market for skin care supplements offers a variety of products in different forms, including capsules, tablets, powders, and liquids. However, capsules and tablets are the most commonly used forms. Capsules are popular because they provide flexibility to manufacturers and are convenient to take and store. They also have a longer shelf life compared to liquids or powders. The demand for skin care supplements is expected to grow significantly by 2024 due to increasing awareness of natural and organic products and the growing aging population who want to maintain youthful-looking skin, Increasing popularity of E-Commerce platform.

The beauty and skincare industry continuous innovation and research efforts have also contributed to the market's growth. Advances in formulation technologies and scientific research on the effectiveness of certain ingredients have increased consumer confidence in skin care supplements. Companies are developing products that target various skin types and concerns, which further expands the market's appeal.

The market for skin care supplements offers a variety of products in different forms, including capsules, tablets, powders, and liquids. However, capsules and tablets are the most commonly used forms. Capsules are popular because they provide flexibility to manufacturers and are convenient to take and store. They also have a longer shelf life compared to liquids or powders. The demand for skin care supplements is expected to grow significantly by 2030 due to increasing awareness of natural and organic products and the growing aging population who want to maintain youthful-looking skin.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.14 Billion |

| Market Size by 2034 | USD 8.94 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8% |

| Largest Market | Asia Pacific |

| Second Largest Market | North America |

| Third Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Formulation and By Formulation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing popularity of E-commerce platform

The skin care supplement market has been greatly affected by the rise of e-commerce platforms. The increasing popularity of online shopping has made it easier for consumers to find a wider variety of skin care supplements that cater to their specific needs and preferences. Online shopping provides convenience as consumers can buy products from the comfort of their own homes and have them delivered directly to their doorstep. This is especially beneficial for busy individuals who don't have the time to visit physical stores or prefer the convenience of online shopping.

E-commerce platforms offer a greater range of product options, allowing consumers to compare prices and read reviews before making a purchase. This has created more competition in the market and given consumers more control over their spending. The emergence of social media and influencer marketing has made it easier for companies to reach a larger audience and promote their products. Skincare supplement brands can utilize social media platforms to showcase their products, share customer reviews, and interact with their followers. This has resulted in increased brand awareness and boosted sales.

Consumer scepticism

There is limited scientific evidence to support claims that beauty supplements can improve skin health. Some studies have shown that certain supplements such as collagen and vitamin C can help improve certain aspects of skin appearance. However, further studies are needed to confirm these results. The FDA does not regulate beauty supplements in the same way it does prescription drugs. This means beauty supplements don't have to go through the same rigorous testing and approval process as prescription drugs. Therefore, there is a risk that beauty supplements may not contain the ingredients they claim to contain or may not be safe to use. Regulatory frameworks for beauty supplements can vary from country to country. This may make it difficult for companies in some regions to market and sell their products.

Beauty supplements can be expensive, which can make them less attractive to some consumers. Despite these concerns, there are also several reasons why consumers choose to take beauty supplements. These include, Beauty supplements are a convenient way to improve skin health. Since it can be taken orally, no special application or removal is required. Many beauty supplements are made from natural ingredients and may appeal to consumers seeking a more holistic approach to skincare. Some consumers simply prefer to take beauty supplements over other forms of skin care such as creams and serums.

Diverse product offerings

The growth potential of the skin care supplement market lies in its ability to cater to diverse consumer needs of different age groups and skin conditions. Companies can capitalize on this opportunity by creating rich and diverse product portfolios that address specific problems faced by individuals. For example, a dietary supplement formulation to combat acne may be aimed at teens and young adults. while an anti-aging solution would appeal to a more mature demographic. Additionally, hyperpigmentation products may appeal to those looking to even out their skin tone and general skin health supplements may appeal to a broader demographic looking to maintain healthy and glowing skin.

Offering a wide range of solutions, companies can effectively attract the attention of consumers with different skin types and concerns about increasing customer loyalty and satisfaction. In addition, by tailoring each product's marketing and messaging to the individual needs of its target audience, it strengthens the brand's presence in the market and makes it the number one choice for individuals seeking effective, specialized skin care supplements.

The cosmetic industry faces the challenge of meeting consumer needs in a world where stress and environmental pollutants are common. It is important for companies to ensure the safety and effectiveness of their products while also maintaining a clean label. To adapt to these changing lifestyles, skincare brands like PROVEN Skincare are now utilizing artificial intelligence (AI) to track daily changes in the skin and provide personalized recommendations.

One example of this is Skin Dossier, a SaaS platform that uses AI to address consumer concerns about their skin. This company's technology and extensive database utilize 3D imaging and consumer health data to analyse the user's skin and hair characteristics. By doing so, they can match the user with the most suitable products to address issues such as dryness and sensitivity. This platform was launched in June 2023.

The skin care supplement market can be divided into capsules, tablets, powders, and liquids. Capsules and tablets are popular because they are easy to take and have a long shelf life. Powders are often used in smoothies or shakes and can be personalized to meet individual needs. Liquids are a convenient option for those who struggle with swallowing pills or want a quick and easy way to take their supplements. Each formulation has its own advantages and disadvantages, and the choice depends on personal preferences and health needs.

Capsules are a commonly used form of skin care supplements. They are made of gelatine or plant-based materials and contain the active ingredients. Capsules are easy to swallow and provide precise dosing. They also have a longer shelf life, which makes them popular among consumers.

Tablets are another popular option for skin care supplements. They are made by compressing the active ingredients into a solid form and come in different shapes and sizes. Tablets often include additional substances to aid in the compression process. Some people prefer tablets because they are familiar and easy to take.

Powdered supplements are becoming more popular, especially among those who want flexibility in dosing or have difficulty swallowing capsules or tablets. Powders can be mixed with water, juice, or smoothies, allowing for a convenient and customizable way to consume the supplements.

Liquid formulations, such as syrups or drops, are another choice for skin care supplements. These formulations are easy to take, especially for people who have trouble swallowing or prefer a different method of intake. Liquids can also be flavored to make them more enjoyable.

The online distribution channel has experienced significant growth in recent years, primarily due to the rise of e-commerce platforms and the increasing popularity of online shopping. Online platforms like Amazon, Flipkart, and Myntra offer a wide range of branded skin care products. The convenience of online shopping, discounted offers, cashback options, and easy return policies contribute to the growth of this segment. Many skin care supplement companies have established their official websites or partnered with online retailers to directly sell their products to consumers. Online distribution offers convenience, a wide product selection, and the ability to reach a global audience. Furthermore, digital marketing and social media platforms play a crucial role in promoting and advertising skin care supplements online.

Offline distribution includes traditional brick-and-mortar retail stores, pharmacies, health food stores, and specialty beauty shops. These physical locations allow consumers to see and touch products before making a purchase, which can enhance consumer trust and satisfaction. Additionally, some consumers prefer shopping in physical stores, where they can seek advice from knowledgeable staff and receive immediate assistance.

Both online and offline distribution channels complement each other and cater to different customer preferences. Online channels offer convenience and accessibility, while offline channels provide a personalized shopping experience. Companies in the skin care supplement market often adopt an omnichannel approach, combining both online and offline strategies to maximize their reach and meet the diverse demands of consumers.

Asia Pacific is the largest market for skin care supplements. This region is expected to continue to grow in the coming years, driven by the increasing demand for natural and holistic beauty products, the growing awareness of the benefits of taking skin care supplements, and the rising disposable income of consumers.

North America is the second largest market for skin care supplements. This region is expected to grow at a steady pace in the coming years, driven by the same factors as Asia Pacific.

Europe is the third largest market for skin care supplements. This region is expected to grow at a slower pace than Asia Pacific and North America, but is still expected to see growth in the coming years.

Latin America is a growing market for skin care supplements. This region is expected to grow at a faster pace than Europe, driven by the increasing demand for natural and holistic beauty products and the rising disposable income of consumers.

The Middle East and Africa is a small but growing market for skin care supplements. This region is expected to grow at a slower pace than other regions but is still expected to see growth in the coming years.

Segments Covered in the Report

By Formulation

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

November 2024

February 2025