January 2025

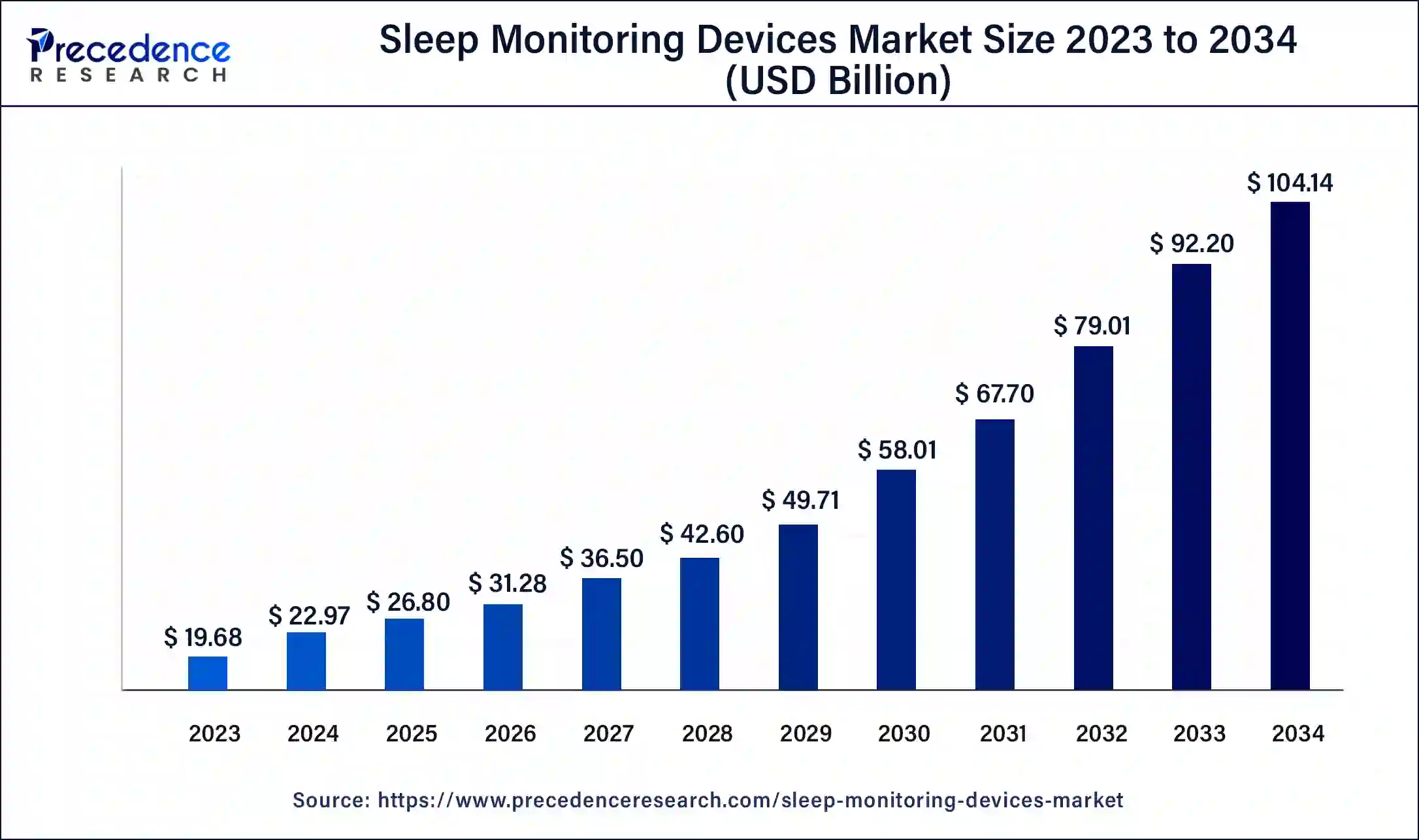

The global sleep monitoring devices market size was USD 19.68 billion in 2023, estimated at USD 22.97 billion in 2024 and is anticipated to reach around USD 104.14 billion by 2034, expanding at a CAGR of 16.32% from 2024 to 2034.

The global sleep monitoring devices market size accounted for USD 22.97 billion in 2024 and is predicted to reach around USD 104.14 billion by 2034, growing at a CAGR of 16.32% from 2024 to 2034.

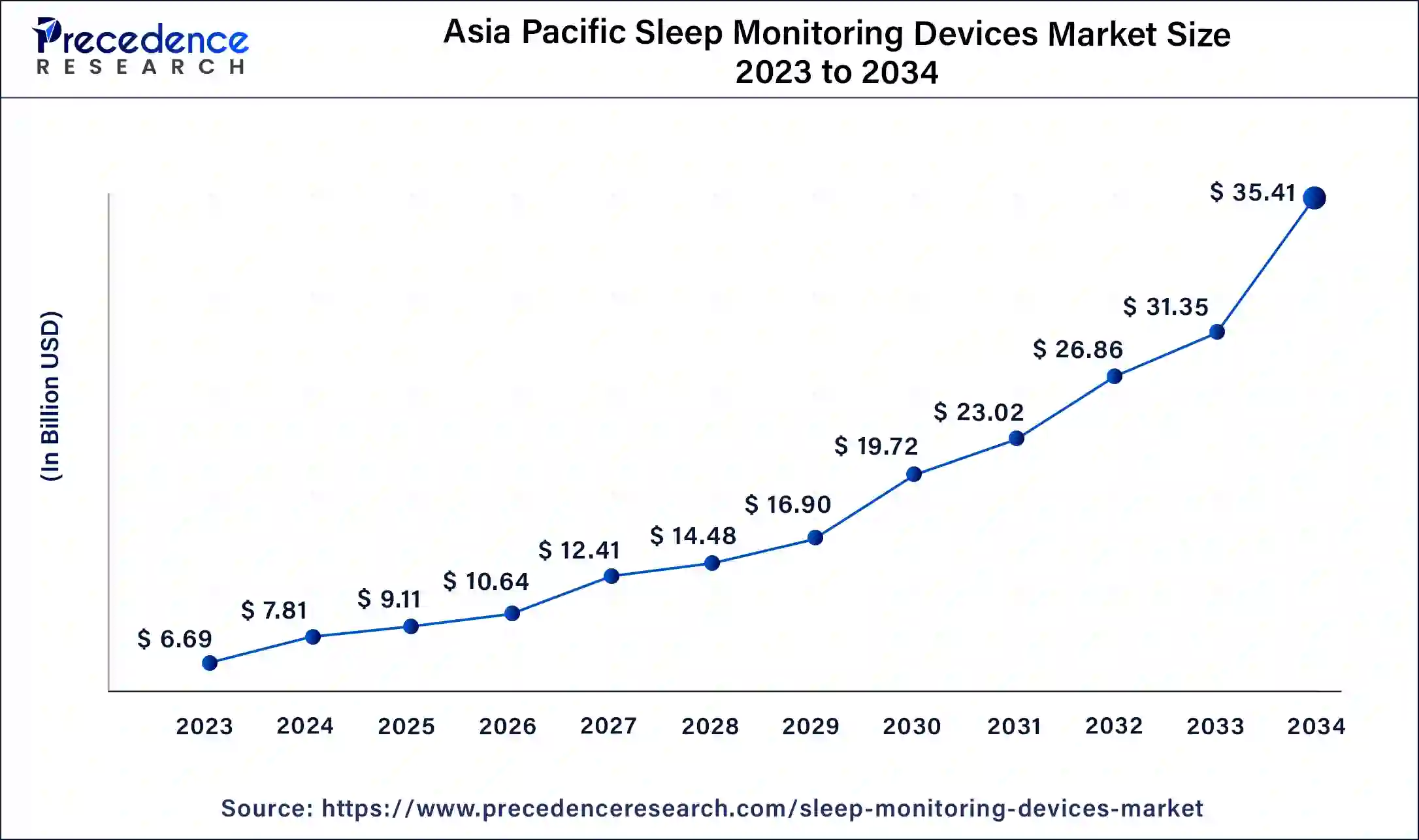

The Asia Pacific sleep monitoring devices market size was valued at USD 6.69 billion in 2023 and is expected to be worth around USD 35.41 billion by 2034, growing at a CAGR of 17% from 2024 to 2034.

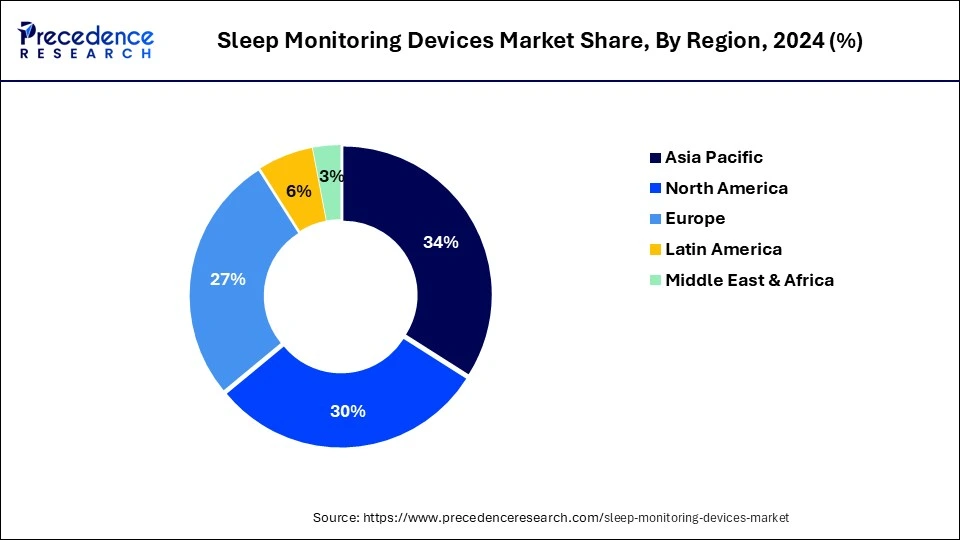

Asia-Pacific has held the largest revenue share 35% in 2023. Asia-Pacific holds a major share in the sleep monitoring devices market due to a combination of factors. The region's large population, rising awareness of health and wellness, and increasing prevalence of sleep disorders contribute to high market demand. Additionally, technological advancements, particularly in countries like Japan and South Korea, drive the adoption of innovative sleep monitoring solutions. The growing middle-class population's disposable income and a proactive approach towards personal health further fuel the market's expansion in the Asia-Pacific region.

North America is estimated to observe the fastest expansion. North America holds a major share in the sleep monitoring devices market due to factors like a robust healthcare infrastructure, high awareness of health and wellness, and substantial investments in technological advancements. The region's aging population, prevalence of sleep disorders, and a proactive approach towards preventive healthcare contribute to the demand. Additionally, the presence of key market players and a tech-savvy consumer base further propels North America's dominance, making it a hub for the adoption and innovation of sleep monitoring devices.

Sleep monitoring devices are innovative tools designed to observe and assess an individual's sleep patterns. These devices, which include wearables, smart mattresses, and associated apps, employ sensors to gather data on aspects such as movement, heart rate, and breathing during sleep. By utilizing sophisticated algorithms, these devices offer users comprehensive insights into their sleep duration, cycles, and overall quality, often accompanied by personalized recommendations to enhance sleep habits based on the collected data.

The increasing awareness of the crucial role sleep plays in overall health has driven the popularity of these devices. Users can leverage the information provided to recognize patterns, identify sleep disturbances, and make informed lifestyle adjustments for improved sleep quality. Advancements in artificial intelligence and machine learning further enhance the accuracy and sophistication of these analyses, positioning sleep monitoring devices as integral components in the proactive management of individual health.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 16.32% |

| Market Size in 2023 | USD 19.68 Billion |

| Market Size in 2024 | USD 22.97 Billion |

| Market Size by 2034 | USD 104.14 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | Component, Operating System, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technological advancements and prevalence of sleep disorders

The surge in demand for sleep monitoring devices is fueled by both technological advancements and a growing prevalence of sleep disorders. Continuous improvements in sensor technologies, wearables, and data analytics have equipped these devices with advanced features, offering users more accurate and personalized insights into their sleep patterns. This aligns with consumer preferences for sophisticated solutions that contribute to effective sleep management, driving the market forward.

Simultaneously, the increasing occurrence of sleep disorders, such as insomnia and sleep apnea, has heightened awareness regarding the significance of monitoring and addressing sleep health. As more individuals seek tools for early detection and management of sleep-related issues, Sleep monitoring devices have become crucial. This confluence of technological progress and a rising need for sleep-related health solutions establishes sleep monitoring devices as indispensable contributors to the pursuit of improved sleep and overall well-being.

Privacy concerns and user compliance

Privacy concerns and user compliance pose significant restraints to the market demand for sleep monitoring devices. The collection of sensitive health data during sleep monitoring raises apprehensions about privacy among users. Fear of potential data breaches or unauthorized access to personal health information can deter individuals from adopting these devices, especially in an era of heightened awareness about data security.

Additionally, user compliance is crucial for the effective functioning of sleep monitoring devices. Consistent and prolonged usage is necessary to gather meaningful data for accurate insights into sleep patterns. However, factors such as discomfort, inconvenience, or a lack of understanding about the importance of continuous monitoring may hinder users from consistently using these devices. Overcoming these challenges requires addressing privacy concerns through robust data protection measures and designing devices with user-friendly features to enhance compliance and encourage widespread adoption of sleep monitoring technology.

Corporate wellness programs and wearable technology

Corporate wellness programs and wearable technology trends are creating significant opportunities in the sleep monitoring devices market. Employers are increasingly recognizing the impact of employee well-being on productivity and are incorporating sleep monitoring devices into corporate wellness programs. This integration allows employees to monitor and manage their sleep health, fostering a more comprehensive approach to workplace wellness. The workplace emphasis on sleep contributes to increased adoption, driving demand for devices that seamlessly fit into individuals' daily routines.

Simultaneously, the wearable technology trends, where consumers are embracing smart and stylish wearables, provide a favorable environment for sleep monitoring devices. The convergence of fashion and functionality in wearable technology attracts users looking for devices that not only deliver accurate sleep insights but also align with their personal style preferences. By tapping into these trends, sleep monitoring devices can position themselves as not just health tools but as lifestyle accessories, expanding their market presence and attracting a broader consumer base.

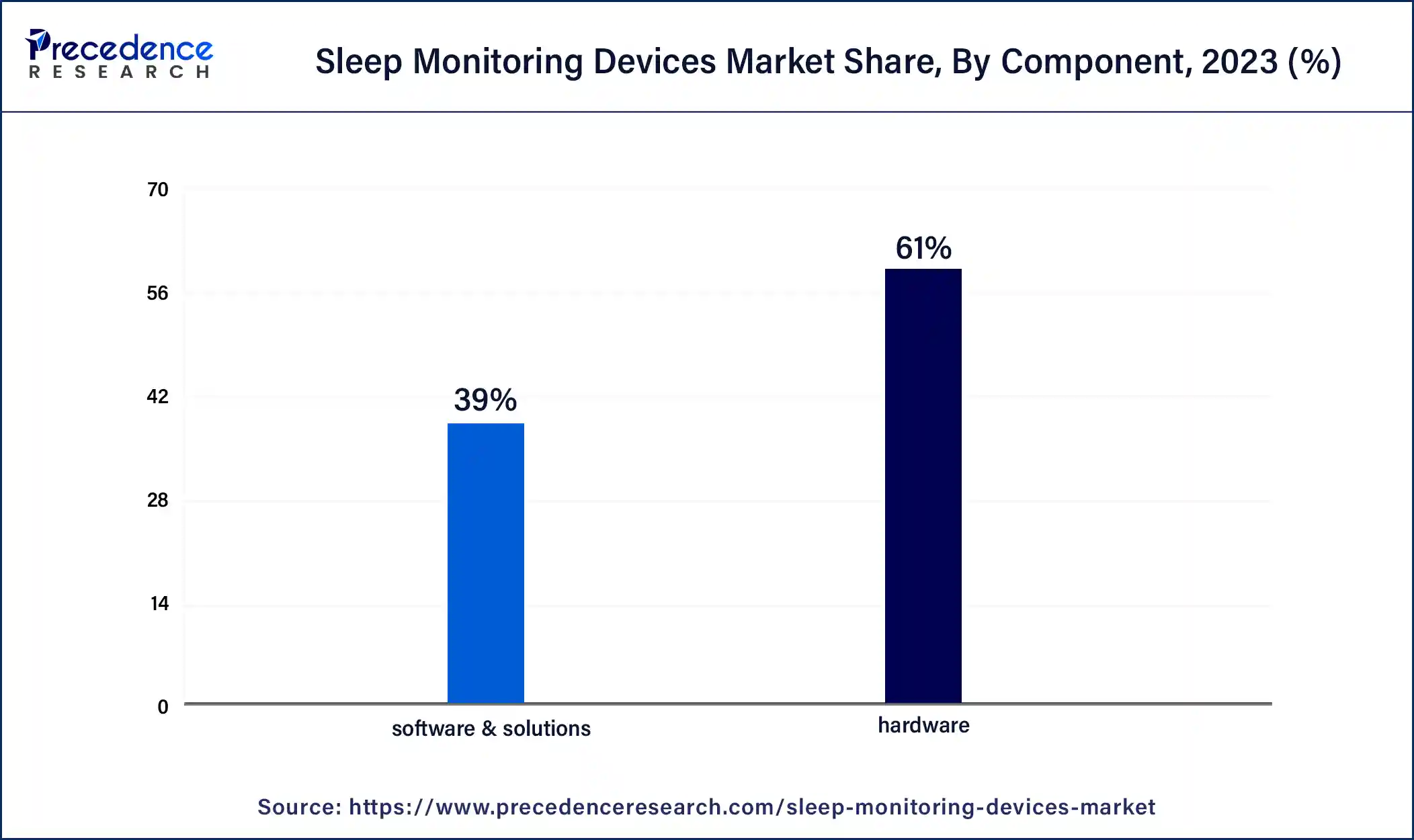

In 2023, the hardware segment had the highest market share of 61% on the basis of the component. In the sleep monitoring devices market, the hardware segment encompasses the physical components of monitoring devices, including sensors, wearables, and processing units. Hardware trends focus on miniaturization for increased wearability, improved sensor accuracy for precise data collection, and extended battery life for uninterrupted monitoring.

Innovations in lightweight materials and compact designs contribute to user comfort, while integration with smart home ecosystems remains a key trend. The hardware segment's evolution reflects a commitment to enhancing user experience and overall device effectiveness in monitoring and improving sleep quality.

The software & solutions segment is anticipated to expand at a significant CAGR of 17.4% during the projected period. In the sleep monitoring devices market, the software and solutions segment encompass the digital components that facilitate data analysis, interpretation, and user engagement. This includes sleep tracking algorithms, mobile applications, and cloud-based platforms. Trends in this segment focus on enhancing user experience through user-friendly interfaces, personalized insights, and real-time feedback. Advanced analytics, artificial intelligence, and machine learning are increasingly integrated to provide more accurate sleep pattern analyses and actionable recommendations, reflecting the industry's commitment to delivering comprehensive and sophisticated solutions for improved sleep health.

According to the operating system, the android segment has held a 72% revenue share in 2023. In the sleep monitoring devices market, the Android segment refers to devices compatible with the Android operating system. The Android segment is witnessing a growing trend with the development of user-friendly sleep monitoring apps and wearables. Manufacturers are leveraging the flexibility of the android OS to create seamless integrations with smartphones and tablets, enhancing user convenience. The android segment in sleep monitoring devices caters to a wide user base, offering diverse options for tracking and improving sleep patterns through accessible and customizable applications.

The IOS segment is anticipated to expand fastest over the projected period. In the sleep monitoring devices market, the iOS segment specifically caters to users of Apple's operating system. As iOS devices, including iPhones and Apple Watches, gain popularity, sleep monitoring apps compatible with iOS have become prevalent. The trend involves the seamless integration of sleep tracking features into Apple's Health app, offering users comprehensive insights into their sleep patterns. The user-friendly interface, coupled with continuous updates and improvements in sleep tracking algorithms, positions iOS as a significant player in the evolving landscape of sleep monitoring technology.

Segments Covered in the Report

By Component

By Operating System

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

December 2024

March 2025