January 2025

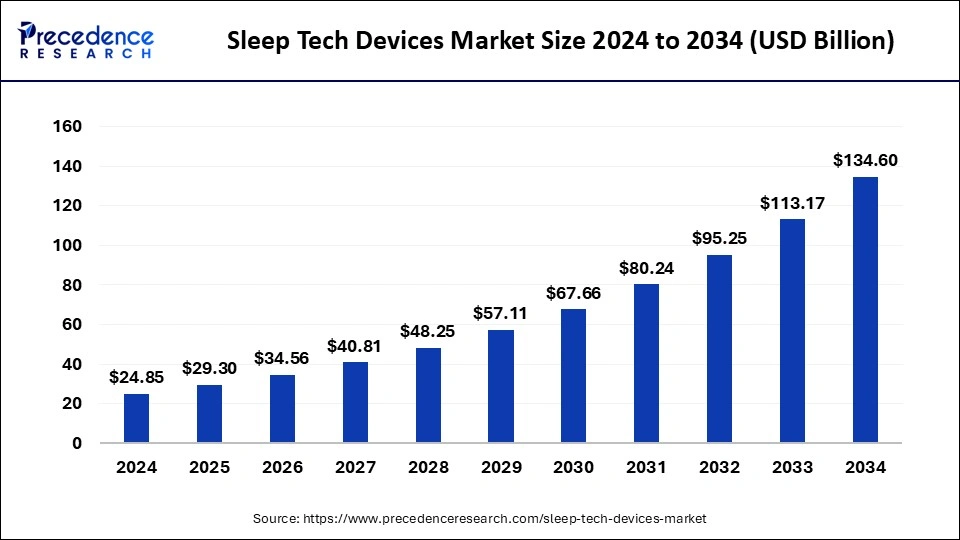

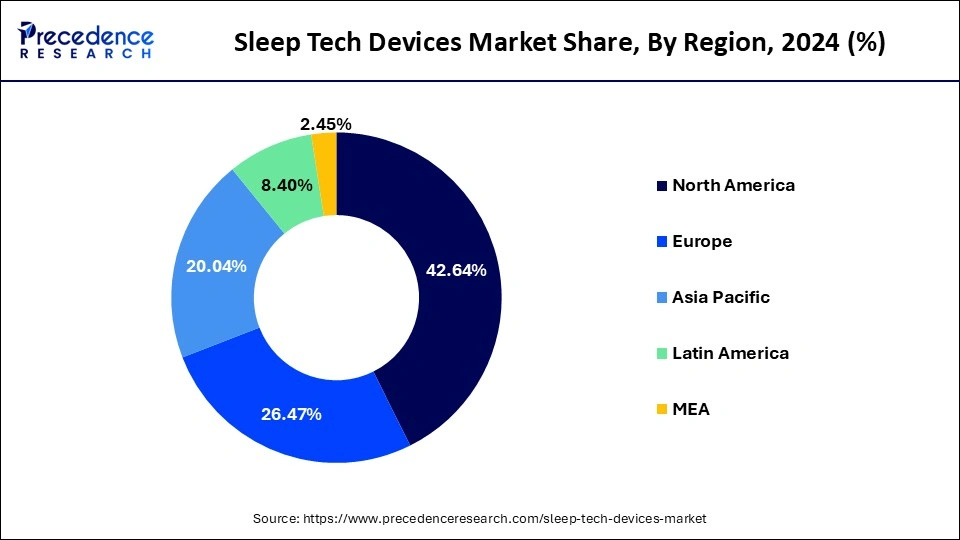

The global sleep tech devices market size is evaluated at USD 29.30 billion in 2025 and is forecasted to hit around USD 134.60 billion by 2034, growing at a CAGR of 18.46% from 2025 to 2034. The North America market size was accounted at USD 10.60 billion in 2024 and is expanding at a CAGR of 18.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sleep tech devices market size was estimated at USD 24.85 billion in 2024 and is predicted to increase from USD 29.30 billion in 2025 to approximately USD 134.60 billion by 2034, expanding at a CAGR of 18.46% from 2025 to 2034.

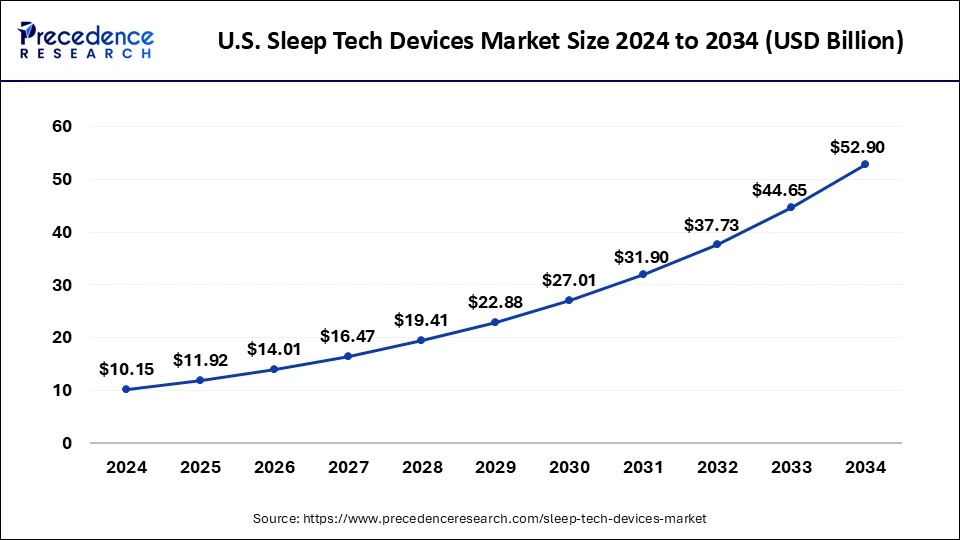

The U.S. sleep tech devices market size was evaluated at USD 10.15 billion in 2024 and is projected to be worth around USD 52.90 billion by 2034, growing at a CAGR of 18.00%.

North America led the market with the biggest market share of 42.6% in 2024. The region is observed to sustain the position throughout the forecast period. The regional growth is attributable to growing product releases, the existence of important competitors, rapid technical breakthroughs, and the increased frequency of sleeping disorders. The elderly are more likely to suffer from sleeplessness.

As a result, these variables are expected to have a beneficial influence on the regional market's growth. Some of the reasons propelling the growth of the sleep tech devices market in the United States are the high incidence of sleep disorders, the high concentration of manufacturers or market participants, and the introduction of major new products.

The sleep tech devices market revolves around the production, innovation and distribution of electronic gadgets that are used to track and enhance sleep for those suffering from insomnia, narcolepsy, and sleep apnea. The market is filled with a wide range of technologically advanced sleep technology products, such as earplugs, headbands, rings, sleep pads, mattresses, and wearable smart watches and bands.

Over the past several years, there have been major advancements in sleep enhancement applications that have completely changed the sleep tech sector. Newly developed sleep technology can regulate temperatures that may otherwise disrupt sleep in addition to recording sleep. The market for sleep technology gadgets will expand favorably as more of these modernized sleep aids become available.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.46% |

| Market Size in 2025 | USD 29.30 Billion |

| Market Size by 2034 | USD 134.60 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing incidence of sleep disorders

Over the projected period, the rising incidence of sleep disorders worldwide is expected to propel market expansion. For instance, the American Sleep Association (ASA) reported in January 2022 that between 50.0 and 70.0 million individuals in the US experience sleep issues annually. Additionally, it stated that between 30 and 40 percent of persons have insomnia symptoms annually at some point in their lives. Additionally, it was stated that one in three persons may experience sleep disturbances at some point in their lives, making them among the most difficult medical diseases. Throughout the forecast period, the increasing frequency of sleep disorders is anticipated to drive up demand for sleep tech devices.

Accuracy and privacy concerns

The accuracy of sleep monitoring devices can vary, and some consumers may be skeptical about the reliability of the data provided. Concerns about false readings or misinterpretation of sleep metrics may impact adoption. In addition, sleep tech devices often collect sensitive health data. Privacy concerns regarding the storage, sharing, and potential misuse of this information can deter some individuals from using these devices. Thereby, such accuracy and privacy concerns are observed to create a significant restraint for the sleep tech devices market.

Growing partnership

The growing partnership and other business activities around the industry are expected to offer a lucrative opportunity for the sleep tech devices market during the forecast period. Business activities including partnerships, collaborations or acquisitions offer a set of chances for new product innovation and launches in the market. For instance, in April 2023, LG Electronics and Asleep, a South Korean sleep-tech AI firm that specializes in sleep diagnostics, teamed together to develop next-generation smart home appliances that are tailored and optimized for the unique sleep circumstances of individual customers.

To develop new smart home products that employ Asleep's AI technology to identify sleep phases based on users' breathing noises while they are asleep, the firms signed a memorandum of understanding (MOU) for "sleep research cooperation. Users may monitor the four phases of sleep based on their breathing sounds with Asleep's AI technology by using microphone-equipped devices, such as smartphones and smart TVs. LG intends to incorporate this technology into further appliances, such as washing machines, refrigerators, air conditioners, air purifiers, and TVs.

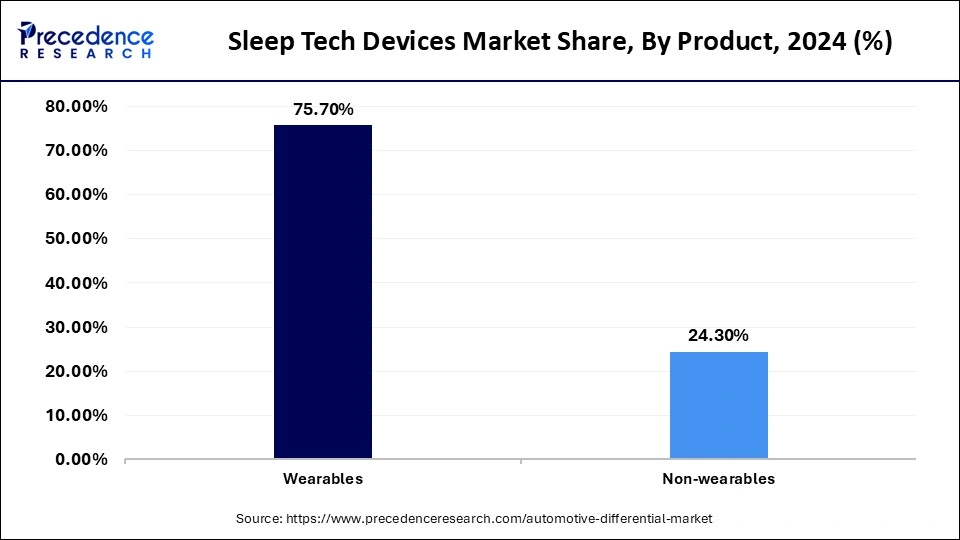

The wearables segment held the largest market share of 75.7% in 2024. The segment is observed to continue dominance throughout the forecast period. Wearable sleep tech devices offer the advantage of convenience and accessibility. Users can wear these devices throughout the day and night, providing continuous monitoring without the need for additional equipment.

Additionally, wearables often offer a holistic approach to health tracking by combining sleep data with other metrics like physical activity, heart rate, and stress levels. This integrated approach provides users with a comprehensive overview of their well-being. Furthermore, the growing product launches in wearables sleep devices are expected to drive the segment expansion. For instance, in July 2022, the introduction of the Boult Drift and Boult Cosmic Smartwatches in India signifies Boult Audio's foray into the wearable market. Additionally, these gadgets have sleep trackers that offer in-depth sleep monitoring.

Besides, the non-wearables segment is expected to grow at a moderate rate over the projected period in the sleep tech devices market. These devices incorporate sensors into mattresses, mattress toppers, and bedding to monitor sleep patterns. They may provide insights into factors such as sleep duration, heart rate, and body movement, offering a non-intrusive alternative to wearables. When compared to wearable sleep monitors, non-wearable ones are more understated, practical, and usually don't need to be charged. Non-wearable trackers, however, could not offer as thorough of a sleep pattern analysis as wearable trackers, depending on the type or brand.

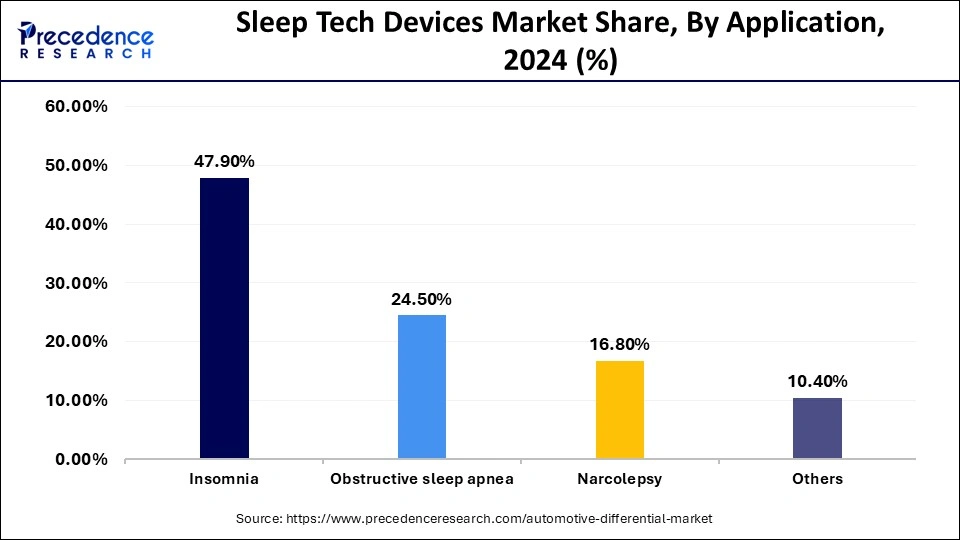

The insomnia segment held the dominating market share of 47.9% in 2024. The segment is observed to sustain the position during the forecast period. The segment expansion is attributed to the growing prevalence of insomnia. For instance, according to the American Sleep Association:

The obstructive sleep apnea is expected to grow at a significant rate over the projected period. Obstructive sleep apnea (OSA) is a common sleep disorder characterized by repeated episodes of partial or complete blockage of the upper airway during sleep, leading to disrupted breathing.

The sleep tech devices market addresses the needs of individuals with obstructive sleep apnea through various technologies aimed at monitoring, diagnosing, and managing the condition. CPAP machines are among the most common and effective devices for managing obstructive sleep apnea. These devices deliver a continuous stream of air to keep the airway open, preventing interruptions in breathing during sleep.

The sleep centers and fitness centers segment dominated the sleep tech devices market with the largest share in 2024. Sleep centers and fitness centers often use advanced sleep monitoring devices for diagnosing sleep disorders, including polysomnography (PSG) equipment that records multiple physiological parameters during sleep. These devices help healthcare professionals assess and diagnose conditions such as sleep apnea, insomnia, and restless legs syndrome. Additionally, some sleep centers and fitness centers provide patients with home sleep testing devices for monitoring sleep in a familiar environment. These devices may include portable monitoring equipment that measures specific physiological parameters to assist in diagnosing sleep disorders.

The e-commerce segment is expected to grow at the highest CAGR in the sleep tech devices market during the forecast period. E-commerce allows consumers to explore a diverse range of sleep tech devices, including sleep trackers, smart mattresses, white noise machines, CPAP machines, and other innovations. The variety of products available online caters to different preferences and needs. Moreover, online shoppers can easily compare features, prices, and customer reviews across various sleep tech devices. This facilitates a more informed decision-making process and allows consumers to find products that best suit their requirements.

By Product

By Application

By Distribution Channel

`By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

December 2024

September 2024