January 2025

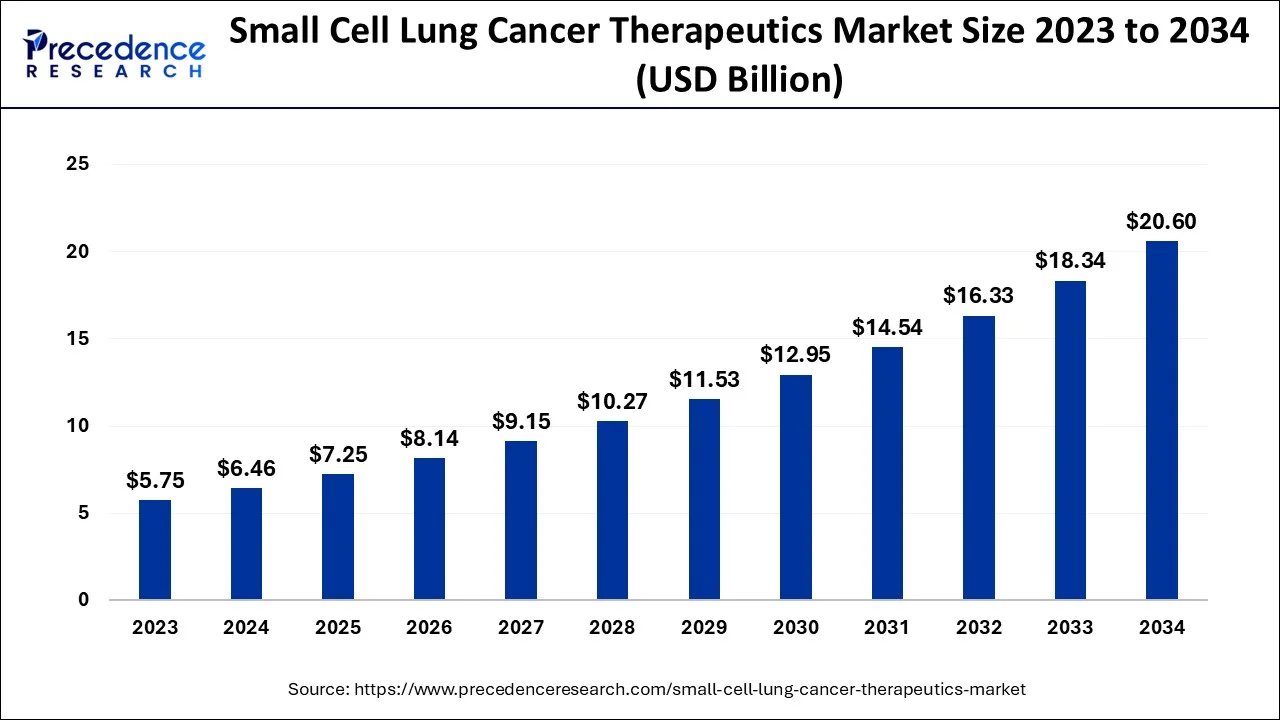

The global small cell lung cancer therapeutics market size is estimated at USD 6.46 billion in 2024, grew to USD 7.25 billion in 2025 and is predicted to surpass around USD 20.6 billion by 2034, expanding at a CAGR of 12.30% between 2024 and 2034.

The global small cell lung cancer therapeutics market size accounted for USD 6.46 billion in 2024 and is anticipated to reach around USD 20.6 billion by 2034, expanding at a CAGR of 12.30% between 2024 and 2034.

Lung cancer is the leading cause of death among men and women, accounting for approximately 15% of all lung cancer globally. Small cell lung cancer is an aggressive form of lung cancer that lies in the lung tissues which may affect other body parts with time. The primary risk factor for small cell lung cancer is smoking tobacco, which went around with a high mutation change. Even though the survival rate was low for lung cancer patients, the researchers hailed the satisfactory survival findings as a significant advancement for treating intractable cancer.

In February 2023, a scientific breakthrough by Professor Kevan Shokat of the University of California, USA, developed a mutated Ras protein, K-Ras (G12C), the first inhibitor. Shokat's discovery of the first drug for lung cancer was approved in the US in 2021. It has led to an improved lifestyle and a longer life by a month.

Lung cancer is the most prominent type of cancer worldwide and affects the lung tissues and creates difficulties in supplying oxygen to the blood. Cancer occurrence cases are rising worldwide due to overpopulation and variation in lifestyle, which is considered a significant factor stimulating the market's growth. Pharmaceutical and biotechnology industries are immensely investing in research and development to generate more effective and economical cancer immunotherapies, and the introduction of novel treatment techniques, such as cancer vaccines, chimeric antigen receptor T-cell therapy, and adoptive cell transfer therapy, is projected to drive the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.46 Billion |

| Market Size by 2034 | USD 20.6 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.3% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Therapy Type, By Drug Type, By Route of Administration, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for personalized medicine

Personalized medicine aims to minimize the use of therapies that may not be effective for a particular patient, reducing the risk of unnecessary side effects. By matching the right treatment to the right patient, personalized medicine has the potential to improve safety and efficacy outcomes in small-cell lung cancer treatment. This factor further drives the demand for personalized approaches and related therapeutics. Overall, the rising demand for personalized medicine in small cell lung cancer is driven by the potential to improve treatment outcomes, enhance patient safety, and cater to individual patient needs through targeted therapies and companion diagnostics.

Challenges for clinical trials of the small cell lung cancer therapeutics

Considering the current situation, lung cancer is one of the leading causes of mortality. However, specifically, there are fewer cases of small-cell lung cancer across the globe. Limited patient numbers make it difficult for clinical trials. The lack of issues/patients has already limited the development of a proper and standardized trial program. With a lack of standardized trial programs, lung cancer gets complicated; it restricts players from developing new therapies. Small-cell lung cancer is notorious for developing resistance to medicines quickly. Identifying reliable biomarkers of treatment response and resistance is vital for evaluating treatment efficacy and patient stratification. Such challenges in the market also affect the identification of biomarkers that hinder the market’s growth.

Rising efforts by governments

Awareness among healthcare providers and patients about the prevalence of small-cell lung cancer is increasing. Patients and physicians are more occupied with learning new therapies for treating severe diseases, creating more opportunities. In addition, the government’s financial support for research and development is playing a crucial role in the advancements of diagnostic methods. Multiple governments across the globe are focused on improving healthcare infrastructure. All these elements that promote the advancements in diagnosis and screening methods are expected to offer multiple opportunities for the growth of the small cell lung cancer therapeutics market.

The chemotherapy segment is expected to increase rapidly during the forecast period. Chemotherapy enhances the patient's survival rate with a limited or extensive-stage disorder, and it can be curable to fewer patients with rare applications. Moreover, incorporating the latest chemotherapy regimens into the treatment program has increased the survival rate, with at least a fourfold to fivefold better median survival compared to no therapy.

The targeted therapy segment shows noticeable growth during the forecast period. The surge in clinical trials in immunotherapy and targeted therapies is expected to generate maximum opportunities in the market. The demand and supply of immunomodulators and immune checkpoint inhibitors have developed traction, describing the main therapeutic methods for small-cell lung cancer. Industries have developed comprehensive genomic profiles of small-cell lung cancer, projected to consolidate research and development in the various immune checkpoint inhibitors.

The Etoposide segment is the maximum contributor in the small-cell lung cancer therapeutics market. Etoposide has a prominent therapeutic activity in childhood leukemia, small cell lung cancer testicular tumors, and giant cell lymphomas. Combination therapies with cisplatin, or carboplatin, which are platinum compounds, where etoposide is denoted and used as a first defense therapy for small cell lung cancer, representing roughly 20% of all lung cancers.

Etoposide attains response rates ranging from 15% to 84%, depending on the population's treated characteristics and drug administration. The etoposide administration route is either intravenous or oral and hardly impacts the response rate, providing relevant dose adjustments for oral therapy.

The Atezolizumab segment is expected to show significant growth during the forecast period. As small-cell lung cancer shows a high mutation, these tumors become immunogenic and cannot respond to immune-checkpoint inhibitors; Atezolizumab helps restore tumor-specific T-cell immunity. Atezolizumab monotherapy had a safety profile with good durability of response in patients with refractory small-cell lung cancer and decent side-effect in a phase 1 trial.

The parental route of administration is the dominating segment with the highest revenue during the forecast period. Apart from the digestive tract, the parenteral administration route offers a supplement dosage form. In patients with cancer, drug delivery through the digestive tract sometimes becomes insufficient. Thus, the parenteral route of administration is mainly used. The advancements in the drug delivery platform will maintain the dominance of the parental segment throughout the forecast period.

The oral segment shows lucrative growth in the small cell lung cancer therapeutics market during the predicted period. As small-cell lung cancer is in the initial stage, the oral route of administration is generally preferred. As most target therapies are generally available in oral form, which is effective, as the demand for targeted therapies increases, the need for oral administration is recommended.

In addition, the rising emphasis on early diagnosis of cancer with proper screening and rapid diagnostic methods promotes the development of the segment.

The hospital pharmacies segment dominated the market in 2023, the segment is anticipated to hold a significant share of the market during the forecast period. The availability of advanced therapeutics with proper healthcare services at hospital pharmacies promotes the growth of the market. In addition, the presence of professionals that can assist patients with proper drug dosage plays a crucial role in the segment’s development.

On the other hand, the online pharmacies segment is observed to be the fastest-growing and most attractive segment of the market. The rising demand for door-step delivery for medicines along with the rising rate of homecare setting for cancer patients promotes the growth of online pharmacies segment. The outbreak of Covid-19 supplemented the development of online pharmacies, especially in urban areas.

North America is dominating the small cell lung cancer therapeutics market during the forecast period. The high occurrence of small-cell lung cancer in North America has stimulated research and development activities in the market, and the increase in demand for targeted therapies amongst the patient population will probably offer significant trade opportunities to small-cell lung cancer therapeutics firms.

Asia-Pacific is expected to be the fastest growing segment in the small cell lung cancer therapeutics market during the predicted period. The surge in small cell lung cancer prevalence is predicted to bolster market size, and increasing awareness about early disease diagnosis will drive the market in the region at a significant rate. China has a high occurrence of small-cell lung cancer, which is projected to present significant opportunities to most of the companies in the Asia Pacific. The overall improvements in pharmaceutical and biotechnology sectors in countries such as Japan, India, South Korea and China highlight the growth of the market.

The ongoing research and development activities for the innovation of novel therapeutics for multiple cancer forms is promoting the growth of the market in the Asia Pacific. Along with this, substantial support from several governments supplements the development of key players present in the region. For instance, in April 2023, headquartered in South Korea, Boryung received product approval from the Ministry of Food and Drug Safety for Zepzelca, a small-cell lung cancer drug licensed by PharmaMar, a Spanish-based pharmaceutical company. Under the approval, hospitals can use the medication in treating patients with metastatic small-cell lung cancer who have failed first-line platinum-based chemotherapy.

Segment Covered in the Report:

By Therapy Type

By Drug Type

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

October 2024

February 2025