May 2025

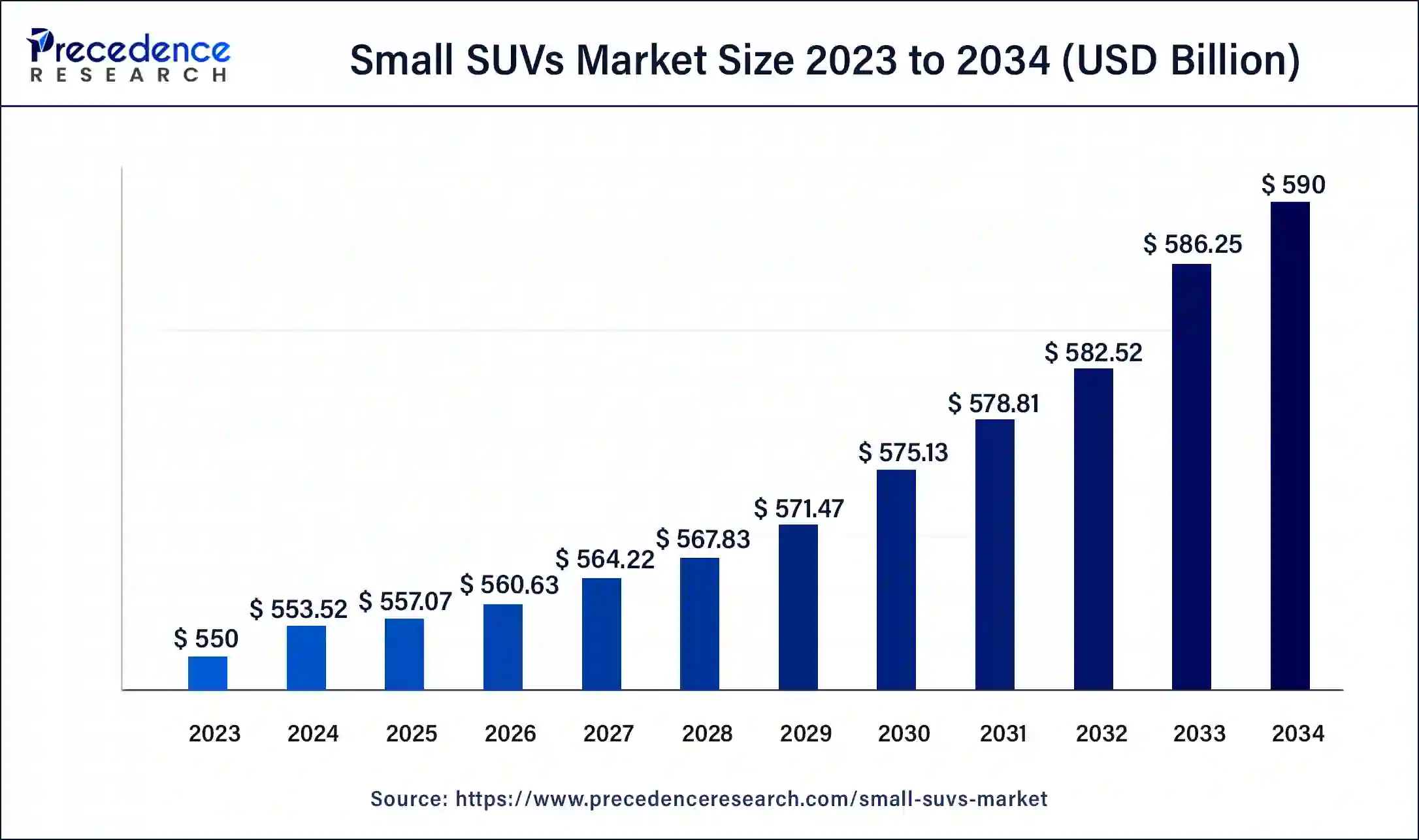

The global small SUVs market size was calculated at USD 553.52 billion in 2024 and is expected to reach around USD 590 billion by 2034, growing at a CAGR of 0.64% from 2025 to 2034. Customers are beginning to favor cars that have the functionality of an SUV but are smaller and easier to handle. Thus driving the growth of the small SUVs market.

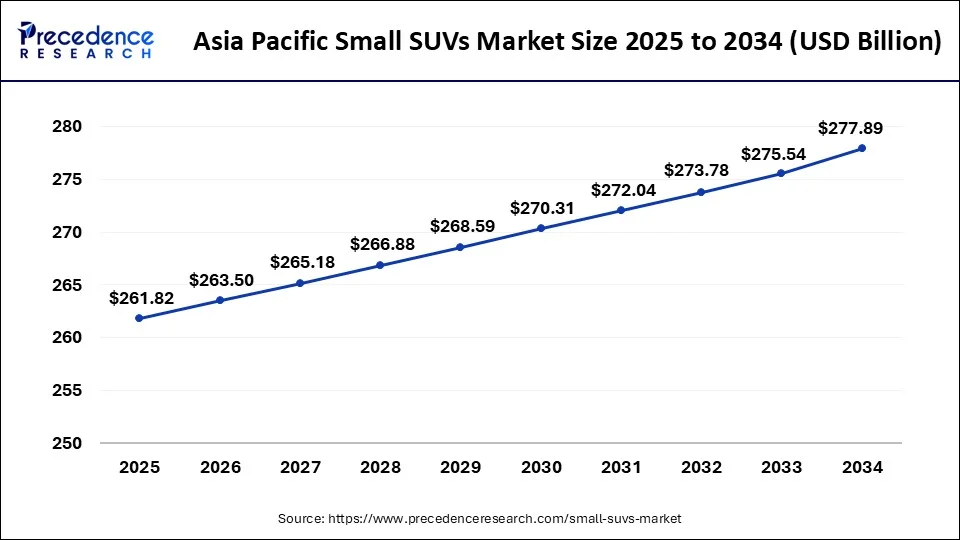

The Asia Pacific small SUVs market size was exhibited at USD 260.15 billion in 2024 and is projected to be worth around USD 277.89 billion by 2034, poised to grow at a CAGR of 0.66% from 2025 to 2034.

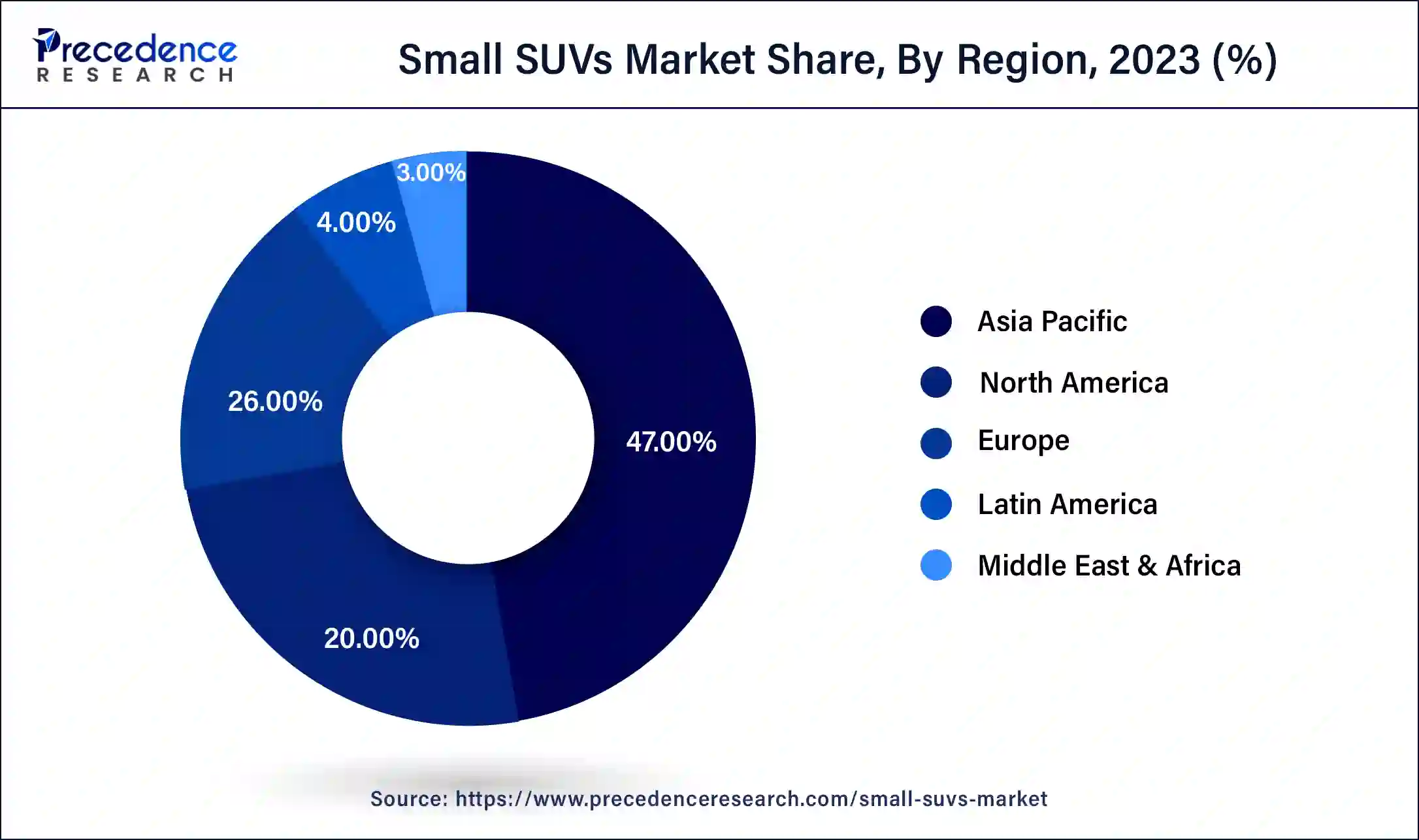

Asia Pacific held the largest share of the small SUVs market in 2024. With growing disposable incomes brought about by the region's expanding economy, more people are able to own automobiles, particularly compact SUVs, which are popular among families and considered a status symbol. Compact and adaptable cars are in high demand as cities become more urbanized. Compact SUVs are perfect for commuting in the city and the suburbs because they strike a balance between size, fuel economy, and storage capacity.

SUVs are becoming more and more preferred over sedans and hatchbacks because of their higher seating position, more visibility on the road, and increased safety features. These advantages are offered by small SUVs in a more cost-effective and fuel-efficient package. The growing middle class in Southeast Asian, Chinese, and Indian nations is driving up demand for personal vehicles, especially the compact small SUVs market.

Europe is expected to witness the fastest growth in the small SUVs market over the studied period. Rising demand for cars that strike a compromise between practicality and small size. Compact SUVs offer the utility of an SUV combined with easier city agility. Newer small SUV models with improved fuel efficiency appeal to buyers who care about the environment and want to cut their gasoline expenses. Small SUVs are now more appealing to consumers thanks to the incorporation of cutting-edge safety features, infotainment systems, and driver-assistance technologies.

An increase in small SUVs market models, such as electric or hybrid, is in line with Europe's strict pollution standards and the move toward more environmentally friendly transportation. Because they may be used for a variety of purposes and appeal to a wide range of customer groups, tiny SUVs combine comfortable city driving with off-road competence. Automakers from Europe and other countries are increasing the number of small SUVs they sell, giving buyers more options.

Customers are beginning to favor cars that are more compact and have the same level of adaptability as SUVs. In comparison to larger SUVs, small SUVs usually have higher seating positions and more cargo room than sedans. They also tend to use less gasoline. Small SUVs provide a decent compromise between size and utility as more people migrate into cities where parking and mobility are essential. Compared to larger SUVs, they are simpler to park and maneuver through city streets. Small SUVs are now available from manufacturers with cutting-edge features and technologies that were previously exclusive to larger cars. This makes them appealing to tech-savvy customers by offering connectivity features, infotainment options, and sophisticated safety systems.

Value for money and affordability are important factors influencing the small SUV industry. Budget-conscious buyers will find these cars appealing because they frequently have amenities and capabilities comparable to larger SUVs at a lower price range. As consumers become more mindful of environmental issues and want more fuel efficiency and lower emissions, several small SUV models now offer electric or hybrid drivetrain options. There is fierce competition among the several manufacturers offering a variety of models in the small SUV market. Throughout the segment, this competition spurs innovation and advancements in performance, efficiency, and design. Compact SUVs are becoming more and more popular, especially in emerging economies where they can adapt to different road conditions and tastes.

| Report Coverage | Details |

| Market Size by 2034 | USD 590 Billion |

| Market Size in 2025 | USD 557.07 Billion |

| Market Size in 2024 | USD 553.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 0.64% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Attractive financing options

Small SUV loans from financial institutions and automakers sometimes have low or no interest rates, which helps consumers afford them. Over the course of the loan period, these rates can considerably lower the total cost of the car. Giving customers flexible loan terms like longer repayment terms allows them to select a payment schedule that works with their budget. Because of their adaptability, tiny SUVs may be more affordable for a wider variety of consumers. Assistance with the down payment is provided by some financing agreements, either in the form of trade-in offers or cash incentives. As a result, purchasers will have a less difficult time affording a new small SUV at first. Cash-back offers are a common feature of financing packages from automakers and dealerships.

Market saturation

When the quantity of small SUVs on the market reaches a threshold where demand slows down or plateaus because of intense rivalry, wide product availability, and constrained customer base expansion, it is referred to as market saturation in the small SUV market. The market for compact SUVs may be saturated if there are many manufacturers and variants available. Price wars, more marketing initiatives, and a drive for product differentiation through innovation may result from this. The market may be approaching saturation if the small SUV category's year-over-year sales growth rate levels out or starts to fall. Consumer preferences for different car models or other modes of transportation may be shifting, which could indicate saturation for the small SUVs market.

Urbanization and compact design

Vehicles that can readily navigate crowded urban situations are in greater demand as cities get denser with population. Due to their smaller sizes, compact SUVs are ideal for driving in cities. Parking is scarce, and space is limited in urban areas. Compared to larger vehicles, small SUVs are easier to park in tight locations, making them a practical solution. There is a strong correlation between economic expansion and rapid urbanization, which raises disposable incomes.

People who live in cities, particularly young professionals, are searching for cars that can do several tasks and have the convenience of a small car combined with the capability of an SUV. Compact SUVs are made to be more maneuverable and nimbler, which is important while negotiating congested areas and small city streets.

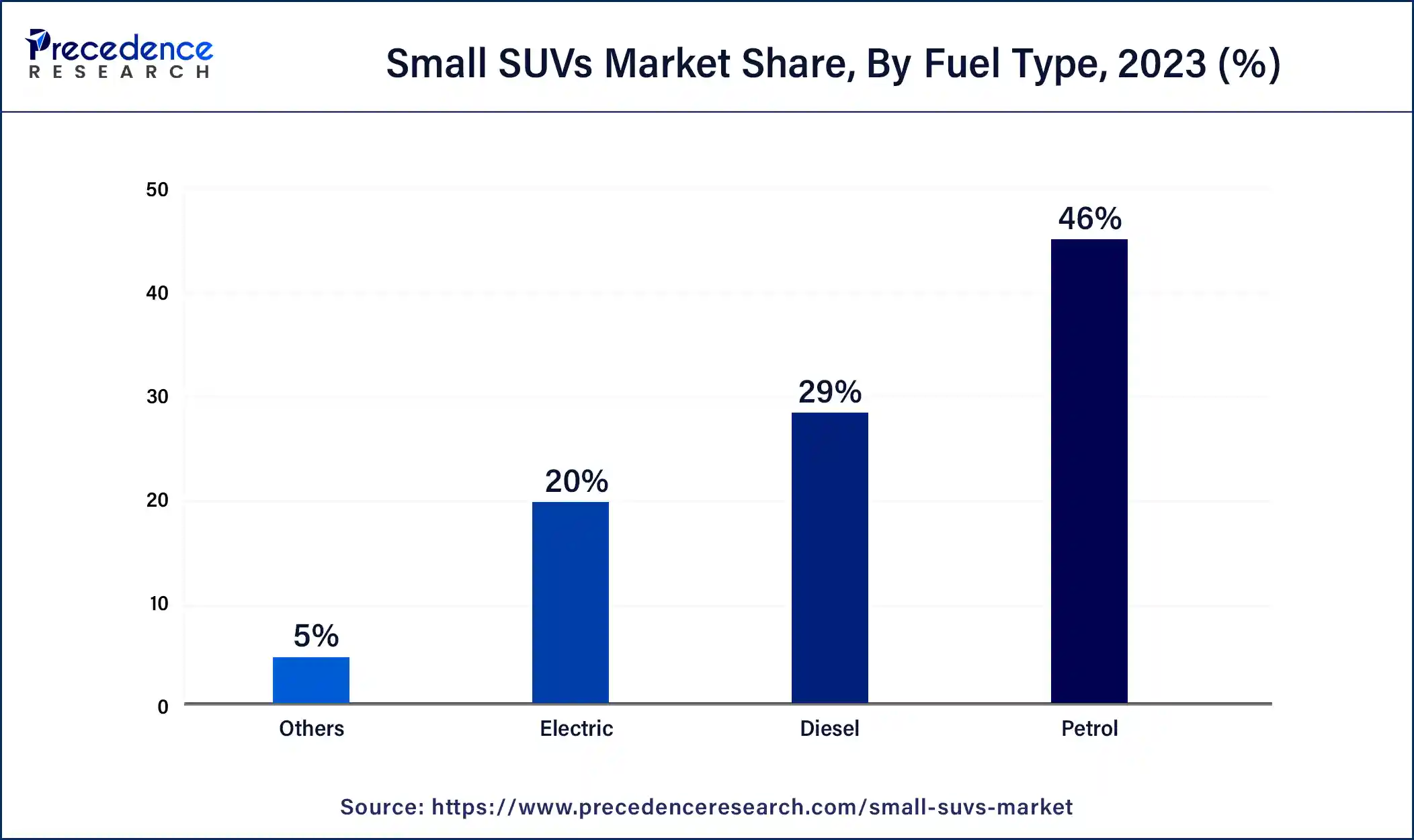

The petrol segment held the largest share of the small SUVs market in 2024. Petrol is still easily accessible, and there is a vast global network of refueling stations. Because of their continued ease, buyers continue to favor small SUVs with gasoline engines. Drivers who value power and acceleration will find that petrol engines perform well, providing decent acceleration. The fact that many customers are more accustomed to gasoline engines also plays a role in their enduring choice.

Models of the small SUVs market that are powered by gasoline frequently cost less to buy new than their diesel and hybrid/electric rivals. They are, therefore, a desirable choice for customers on a tight budget. Fuel-efficient engines are ideal for driving in cities, where compact SUVs are becoming more and more common because of their portability and small size. They are perfect for city driving due to their rapid start-up times and improved performance in stop-and-go traffic situations.

The electric segment is anticipated to grow at the fastest rate in the small SUVs market over the forecast period. Environmental concerns and the need for reduced emissions have made electric cars (EVs) a top priority for both manufacturers and consumers. Due to their popularity, small SUVs are experiencing an increase in the number of electric variants released to satisfy consumer demand. Numerous countries provide financial aid, tax breaks, and lowered registration costs as inducements to buy electric cars.

In the small SUVs market, customers find electric compact SUVs more appealing because of these advantages. Advancements in battery technology have improved the electric vehicles performance, charging speed, and range. Because of this, electrified compact SUVs are now more useful for everyday use. The convenience of owning an electric car is increased by the growth of EV charging networks, which also lessens range anxiety and promotes the use of small electric SUVs.

By Fuel Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

July 2025