May 2025

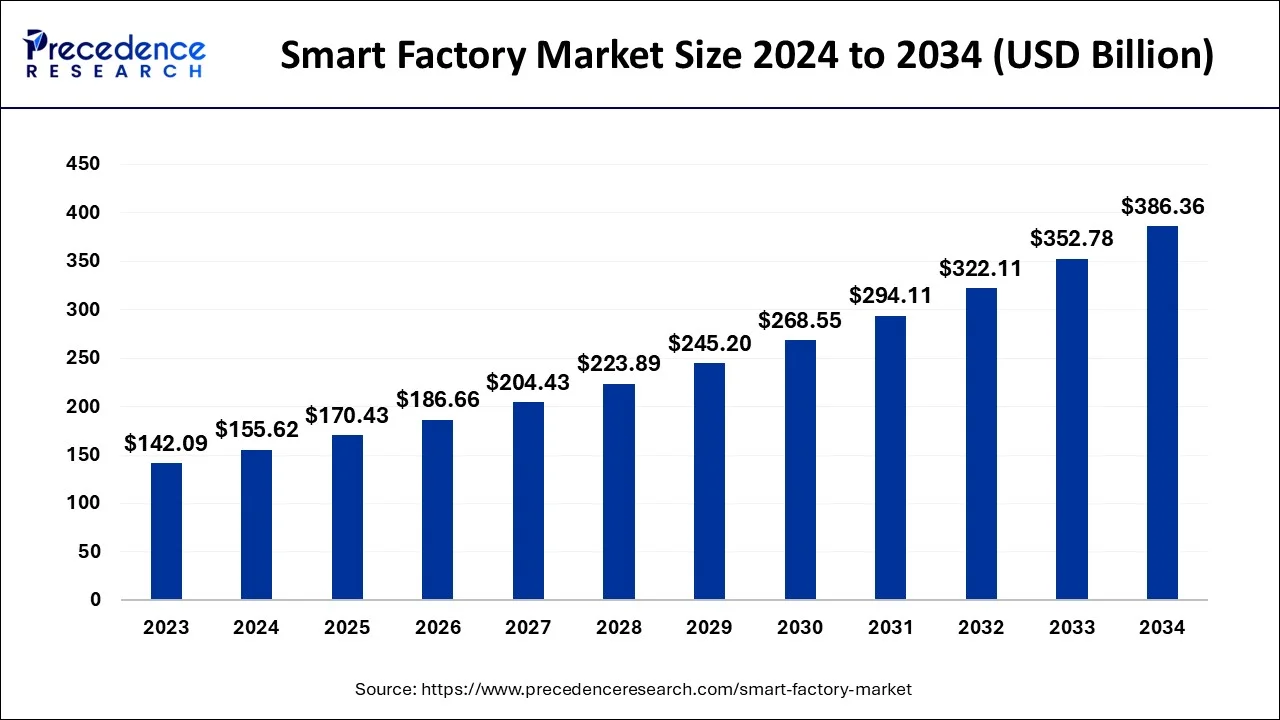

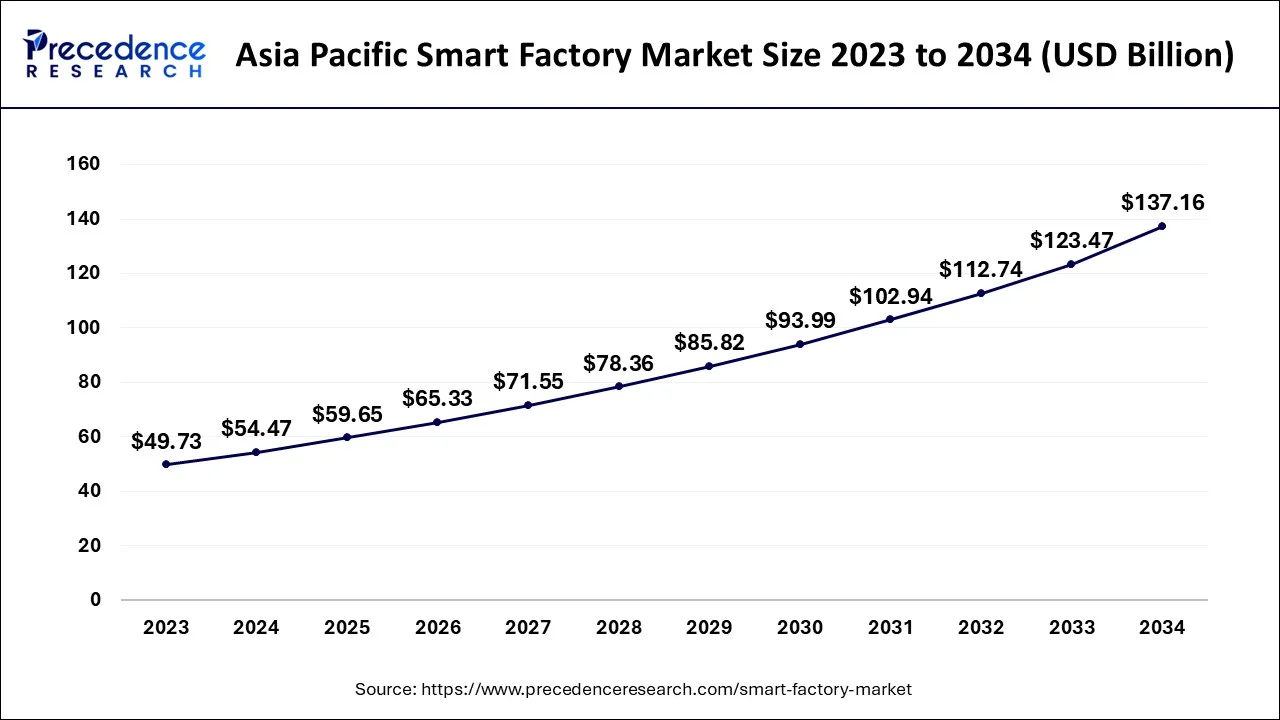

The global market size is calculated at USD 170.43 billion in 2025 and is forecasted to reach around USD 386.36 billion by 2034, accelerating at a CAGR of 9.52% from 2025 to 2034. The Asia Pacific market size accounted for USD 59.65 billion in 2024 and is expanding at a CAGR of 9.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ABC market size was estimated at USD 155.62 billion in 2024 and is predicted to increase from USD 170.43 billion in 2025 to approximately USD 386.36 billion by 2034, expanding at a CAGR of 9.52% from 2025 to 2034.

The Asia Pacific smart factory market size was valued at USD 54.47 billion in 2024 and is expected to be worth around USD 137.16 billion by 2034, rising at a CAGR of 9.67% from 2025 to 2034.

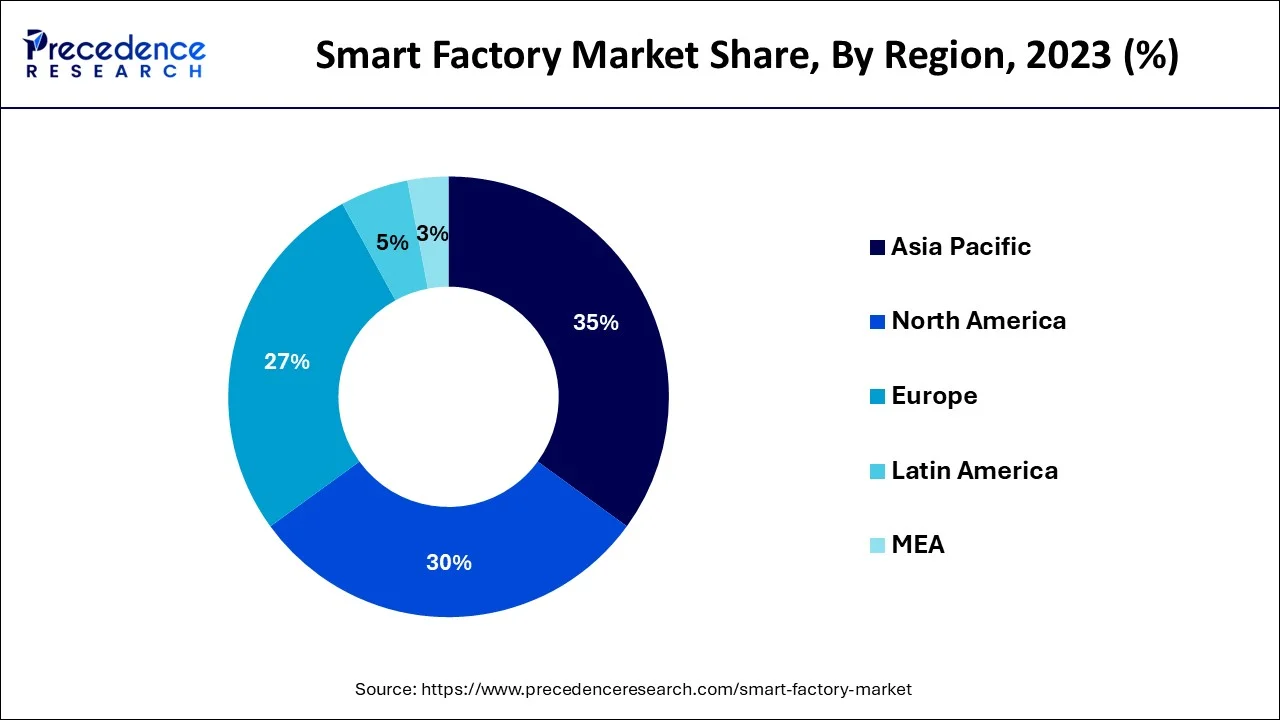

Asia Pacific held the largest share of the smart factory market in 2024. This is mainly due to its large manufacturing base. Countries like India and China are known for being major manufacturing hubs, leading to high adoption of smart factory technologies. Government emphasis on industrial automation has encouraged industries to adopt advanced manufacturing technologies, including industrial robotics and automation solutions. Moreover, rapid industrialization bolstered the market growth in Asia Pacific.

The market in North America is expected to expand at the fastest rate during the forecast period, owing to the presence of multinational firms sponsoring industrial technology research and development. The region is at the forefront of technological innovation. Thus, industries increasingly adopt advanced technologies, such as industrial Internet of Things (IoT) and cloud technologies, to boost production efficiency. Moreover, the rising government initiatives to expand the industrial base boost the market growth in the region.

A highly networked and digital production facility that relies on intelligent manufacturing is called a "smart factory." The idea of the "smart factory" is a crucial result of Industry 4.0 or the fourth industrial revolution. Most smart factories are being adopted by the manufacturing industry, which uses cutting-edge Technology like robotics, big data analytics, artificial intelligence, and the Internet of Things. These factories can self-correct and operate autonomously on a big scale.

An intelligent factory delivers connectivity, autonomy, and visibility. Although businesses have already used automation, smart factories go one step further and operate automatically. Smart factories are more adaptable than their predecessors because they embrace contemporary Technology, which allows them to learn and change in real-time.

The "smart factories" market will likely rise due to several key aspects, including an increased focus on energy absorption, production efficiency, and expanding use of developed industrial bases. Additionally, the industry's emphasis on the cyber world, where every link in the value chain would be connected to ensure informed manufacturing with no delays and zero defects, is another factor that is anticipated to favorably impact the growth of the smart factory market in the expected time frame.

One of the main elements fostering an optimistic view for market growth is the rapid digitalization across industries and the rising demand for industrial automation. A further factor driving market expansion is the extensive use of manufacturing execution systems (MES) and sophisticated data models for process-specific operation.

Along these lines, the market is expanding due to the rising use of reconditioned industrial robots and radio frequency identification (RFID) systems. Other growth-promoting technology developments include the Internet of Things (IoT), artificial intelligence (AI), and the integration of linked devices with cloud computing. These cutting-edge techniques support automated material handling, electrical and mechanical assembly, and product testing.

Force sensors are also used in smart factories to collect data for statistical process control (SPC) systems, validate component insertion, maintain constant force during buffing, polishing, and deburring, and maintain power during these processes. Other factors, such as the introduction of the Industrial Internet of Things (IIoT) and the growing usage of smart factory solutions to produce complex medical and automotive components, are predicted to propel the market toward expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 155.62 Billion |

| Market Size in 2024 | USD 170.43 Billion |

| Market Size by 2034 | USD 386.36 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.52% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in industrial robot adoption

The factors propelling the growth of the industrial robot market include the following:

The deployment of industrial robots has expanded as the need for automation has grown across industries. The expansion of the electronics sector and the skyrocketing labor costs in manufacturing have contributed to industrial robots' market growth. During the study period, this will likely boost the demand for industrial robots and assist the market expansion for smart factories.

Businesses can grow their market and draw customers by delivering smart manufacturing that uses less energy and is more energy efficient, owing to the growing focus on green technology and energy efficiency. Over the forecast period, colossal growth is anticipated in investments in these green systems.

Sustainability and energy efficiency are the smart factory's top priorities. Statistics on how to use the equipment effectively are also provided by the digital solutions that minimize energy use through data analysis. For example, smart factory systems only activate equipment when necessary.

IoT technologies resolve the manufacturing sector's workforce issue, particularly in industrialized nations like the United States. Because of this, the federal government and the corporate sector in the US are investing in Industry 4.0 IoT technologies to expand the American industrial base, which China and other nations with low labor costs have primarily replaced. IoT technology is the primary element driving the adoption of smart manufacturing systems globally.

Cybersecurity concerns with cyber-physical systems

The manufacturing industry is the most frequently targeted by cyberattacks; 47% of cyberattacks aim to steal trade secrets and competitive advantages from this industry. A cyber-physical system (CPS) is a cutting-edge technology that combines the virtual and real worlds to create automated manufacturing. Manufacturing procedures have been revolutionized by CPS technology.

Advanced Technology like robotics, automation, big data, virtual reality, artificial intelligence, sensors, augmented reality, and additive manufacturing is used in cyber-physical manufacturing facilities to give production processes unprecedented flexibility, accuracy, and efficiency. The market, however, might be constrained by the security risks related to using CPS. A CPS maintains vital plant data and facilitates connectivity among the facility's machinery; if the system is compromised, this data may be in danger.

5G technology's entry into the market for smart factories

Due to 5G technology, owners of a smart factory may use cellular technologies even more safely and adapt them for certain use cases. They can collect data from the production networks without connecting to the machines by installing sensors on equipment connected to 5G networks, enabling seamless real-time optimization. Several manufacturers utilize the 5G network for a consistent and powerful connection.

Wired communication is no longer necessary thanks to installing 5G networks in factories, which allows for high-speed manufacturing with high flexibility and minimal downtime. Industries must have a network that can support them in terms of speed, coverage, and dependability. A one-stop shop for factories and considerable prospects for smart manufacturing will result from the development of the 5G network.

Information technology and operational technology collaboration

The main obstacle to adopting a smart factory is the compatibility between informational Technology (IT) and operational Technology (OT). IT and OT employ various protocols and architectural styles, significantly increasing the complexity and costs involved. Today, siloed OT systems are the norm. A completely working digital ecosystem is necessary for a smart factory's smooth data sharing between machines and other physical equipment made by various vendors. Businesses with expertise in information and operational technology interoperability would have a competitive edge in manufacturing, reflected in the production yield.

The global market is divided by product into machine vision systems (processors, cameras, enclosures, software, integration services, frame grabbers, and lighting), industrial robotics (articulated robots, cylindrical robots, cartesian robots, parallel robots, scara robots, collaborative industry robots), control devices (servo motors and drives, switches & relays), communication technologies (wired and wireless), sensors, and other products. In fast-moving conveyor systems, proximity sensors are typically employed to count the number of products passing through a specific stage.

The proximity sensors are crucial for establishing the precise relative placement of the product when autonomous robots conduct an operation on the subject, such as welding in automobiles. In many different industries, they are also utilized to establish the relative placement of mold mates to guarantee the proper alignment of the complementary parts. Such essential uses for proximity sensors fuel market expansion for the projection period.

The global market includes different technology categories, including Product Lifecycle Management (PLM), Enterprise Resource and Planning (ERP), Human Machine Interface (HMI), Manufacturing Execution System (MES), Supervisory Controller and Data Acquisition (SCADA), Programmable Logic Controller (PLC), Distributed Control System (DCS), and other technologies. PLM has improved return on investment and redefined the utility of data in production (ROI). Manufacturing and industrial workers soon discovered that having all the information at their fingertips made them more effective.

PLMs allow businesses to expand their production capabilities to other geographical areas, which is another important benefit. To ensure product quality throughout their manufacturing facilities, several businesses have used the integration of PLM and ERP systems. PLMs allow businesses to expand their production capabilities to other geographical areas, which is another important benefit. Such benefits all promote segment expansion.

The automotive, oil and gas, semiconductors, pharmaceutical, chemical and petrochemical, aerospace and defense, food and beverage, mining, and other end-user sectors are the two divisions of the global market by end-user industry.

Oil and gas segment accounted an enormous share in the overall market growth owing to the various benefits associated with it such as reliability for large-scale production. Increasing penetration towards safety is also propelling the growth of the industry.

In other instances, firms in the oil and gas business are also seriously concerned about security. Governments in nations like Mexico, whose pipelines are frequently targets of robberies and insurgent attacks, are boosting their spending on process automation connected to pipeline security. One of the major security challenges the Latin American midstream industry has is the theft of oil from Mexican pipelines.

By Product

By Technology

By End-User Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

May 2025

May 2025