January 2025

The global smart glass market size is calculated at USD 6.81 billion in 2025 and is forecasted to reach around USD 16.74 billion by 2034, accelerating at a CAGR of 10.51% from 2025 to 2034. The North America market size surpassed USD 2.71 billion in 2024 and is expanding at a CAGR of 10.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart glass market size was calculated at USD 6.16 billion in 2024 and is predicted to reach around USD 16.74 billion by 2034, expanding at a CAGR of 10.51% from 2025 to 2034. The demand for smart glass is increasing initiatives towards reducing energy consumption that regulates heat and light transmission.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is playing a transformative role in the smart glass market. The integration of AI is rising effectively with IoT devices to optimize functionality based on the conditions. AI algorithms are also increasing the adoption of smart glasses in various applications. Additionally, these systems require constant monitoring where AI plays a major role in predictive maintenance that reduces downtime. The crucial factor behind AI implementation also relies on the analysis of the future market trends which can help in optimizing particular businesses.

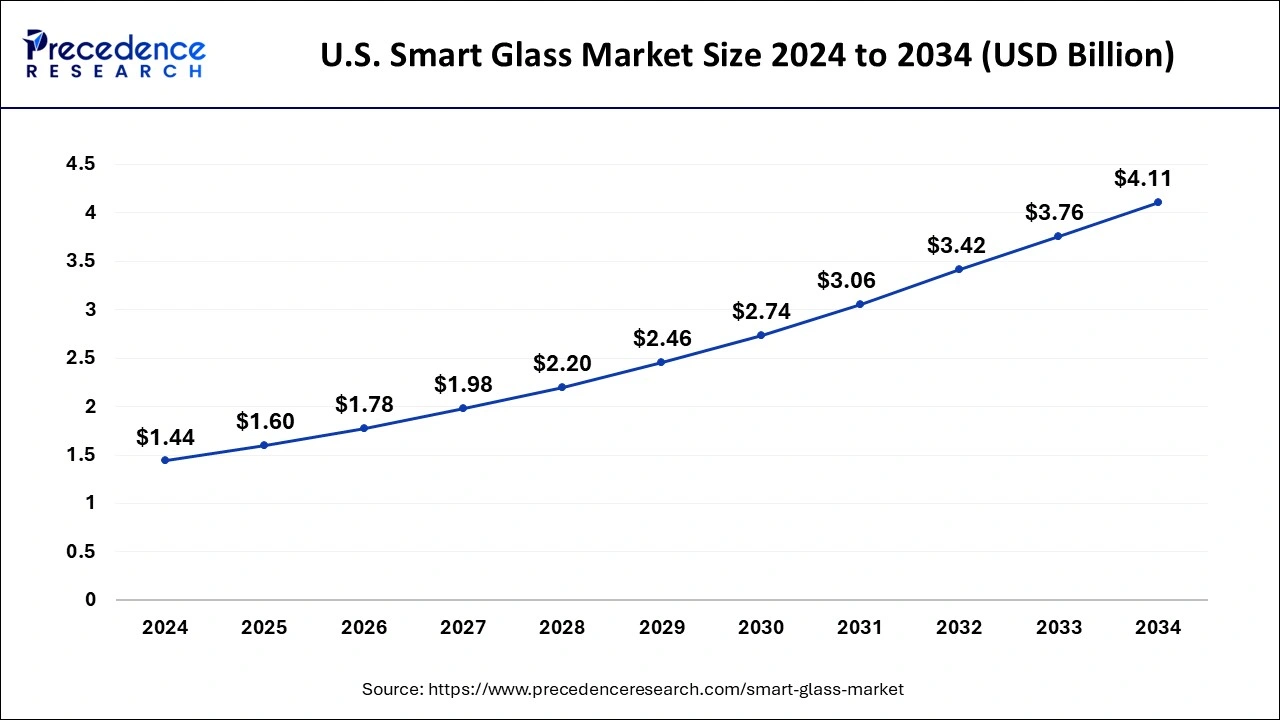

The U.S. smart glass market size was exhibited at USD 1.44 billion in 2024 and is projected to be worth around USD 4.11 billion by 2034, growing at a CAGR of 11.06% from 2025 to 2034.

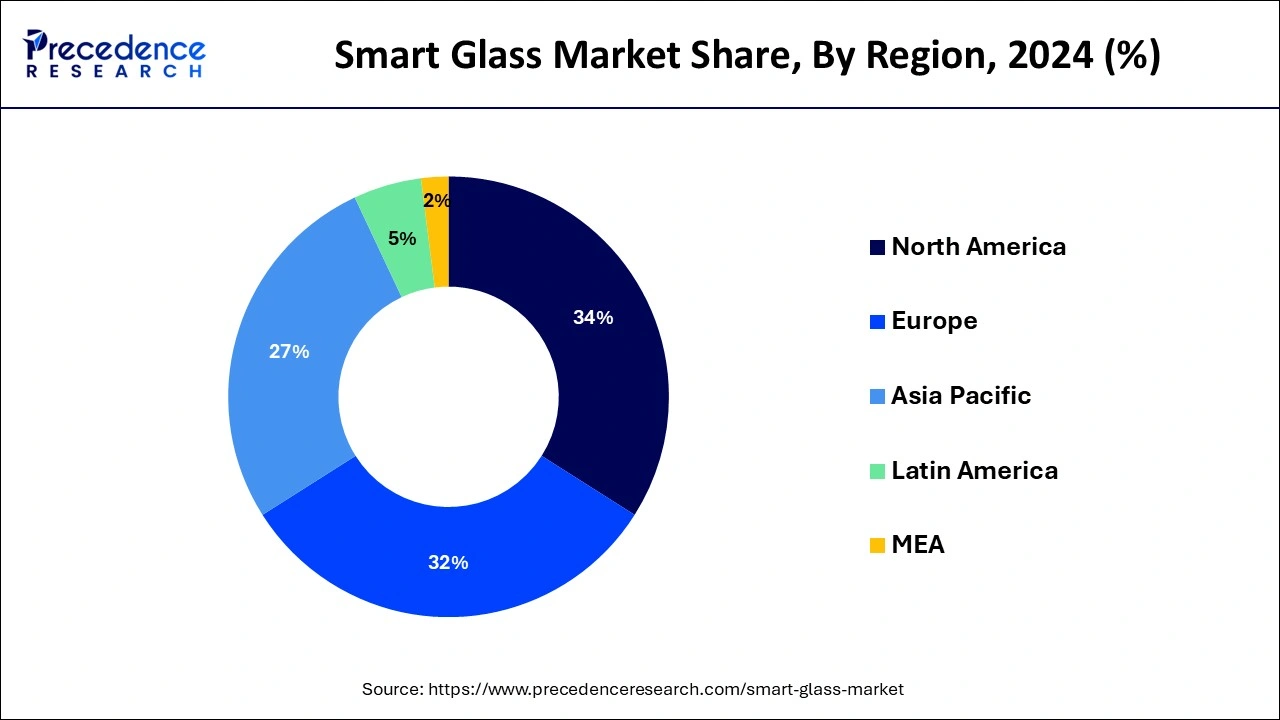

With a revenue share of more than 33.13%, North America dominated the global market for smart glass in 2024. This may be attributed to the availability of value-added goods like laminated glass as well as the implementation of energy-saving construction laws in the area. The area businesses are introducing items that meet customer demands.

The regional automotive industry is anticipated to see an increase in demand for smart glass due to the growing popularity of electric vehicles equipped with cutting-edge technology.

Through 2034, Asia Pacific is expected to have the greatest CAGR of more than 12.4%, thanks to the region's exceptional development prospects in the transportation industry. Growing demand for luxury cars and rising disposable income are encouraging regional market growth. Additionally, it is predicted that increasing energy conservation awareness in the area would encourage the use of energy-efficient air conditioners and windows.

Smart Glass also known as switchable glass is an advanced technology-based glass that changes its light transmission properties. When voltage, light, or heat is introduced, smart glass undergoes a change in appearance and light transmission qualities. The expanding use in several applications, including architectural, automotive, aerospace, and marine, is fueling the expansion of the global market. The factors driving the market are technical breakthroughs in switchable glasses and architectural advances in the majority of buildings for the installation of smart windows. Switchable glass usage will also be aided by the government's rigorous regulations for retrofitting older buildings with eco-friendly and energy-efficient technology.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.81 Billion |

| Market Size by 2034 | USD 16.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.51% |

| Largest Market | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Control Mode, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing smart glass integration in automotive glass panels

The rising disposable incomes are leading the customers have insist on selecting premium amenities in their vehicles due to rising consumer buying power over the previous ten years. To differentiate their products from the competition, several multinational automakers are concentrating on incorporating contemporary ideas into their automobiles The use of switchable glass is one such design choice that has flourished in the car sector. In addition to windows, rear-view mirrors, windshields, sun visors, sunroofs, and panoramic view windows, they are used in glass panels for these items. These glass panels assist preserve temperature and privacy within the automobile in addition to controlling light transmission inside the vehicle chamber. These goods improve the comfort of the passengers and the energy economy of the vehicle thanks to these qualities.

Growing smart glass adoption in the construction industry

The use of smart glasses is increasing in buildings to develop smart facades, skylights, and smart windows, giving the structure a distinctive, dynamic aesthetic and allowing for control over the privacy within, particularly in office areas and hospital dividers. The need for intelligent construction materials is anticipated to rise as consumer expenditure rises in emerging nations, enabling customers to live elegantly. With the flip of a button, multifunctional rooms that are illuminated by smart glass respond to human demands and adapt to their surroundings. Additionally, it can insulate buildings from sound and heat, saving energy while offering architects and interior designers a 3D design option Additionally, this glass is used in various tourist attractions to design distinctive areas that draw visitors. For instance, the Eureka Tower in Melbourne includes a glass cubical space that extends 3 meters from the structure and is suspended 300 meters above the ground with people within. The glass stays opaque after it is inside the building's chamber.

Cost of smart glass is a barrier to the adoption

In 2024, the electrochromic glass market had a sizable share of more than 83.4%. This is partly attributable to the features of the device, including its high UV and IV ray blocking ratio, low operating voltage, and straightforward integration with big glass panels. Additionally, the electrochromic glass may be stained, colored, and made opaque to adjust how much light and heat it transmits depending on the environment. These glasses are widely used in medical facilities, educational facilities, business settings, and retail stores.

Due to the excellent stability of SPD against UV radiation, the Suspended Particle Device (SPD) smart glass category is anticipated to see the greatest CAGR of over 15.0% through 2030. These lenses can change from translucent to black in 1-3 seconds and provide fine and immediate light control. They also offer a remarkable optical quality that makes it easier to effectively manage sun glare.

Electronic gadgets frequently employ polymer dispersed liquid crystal (PDLC) glass, commonly referred to as switchable glass, magic glass, clever glass, or privacy glass. The technology is mostly utilised in businesses and residences to provide enough of light while maintaining privacy. It has applications in a number of fast-growing industries, including aviation, automobiles, ships, and architecture. The need for PDLC smart glass technology is being further fuelled by the rising predisposition toward "Green Energy" sources.

In 2024, the transportation application category held a sizable market share of around 49.6%. Aerial, vehicular, and maritime transportation are further subdivided into the transportation sector. The significant expansion in the automobile market can be attributed to luxury car manufacturers' increased use of smart glass. The market participants are being pushed by the increasing demand to broaden their product offerings in this niche in order to obtain a competitive advantage. For instance, the automotive giant BMW debuted its BMWi Vision Circular Show car in September 2021 at the IAA Auto Show. This vehicle was outfitted with a cutting-edge headlamp that was created utilizing the SPD LCG Technology created by Gauzy Ltd.

Commercial office buildings and corporate headquarters are where smart glass technology is most commonly used since it helps to significantly save expenses while increasing worker efficiency. In the approaching years, self-cleaning glasses, low-emissivity glasses, and solar control glasses are projected to emerge as popular options for the building industry. The expansion of the architectural sector is greatly influenced by the rising number of infrastructure projects, as well as restoration and renovation operations in residential and commercial areas.

By Technology

By Application

By Control Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2024

February 2025