May 2025

Smart Healthcare Market Size, Share & Growth Analysis By Product (RFID Kanban Systems, RFID Smart Cabinets, Electronic Health Records (EHR), Telemedicine, mHealth, Smart Pills, Smart Syringes) - Global Industry Analysis, Trends, Segment Forecasts, Regional Outlook 2024 - 2033

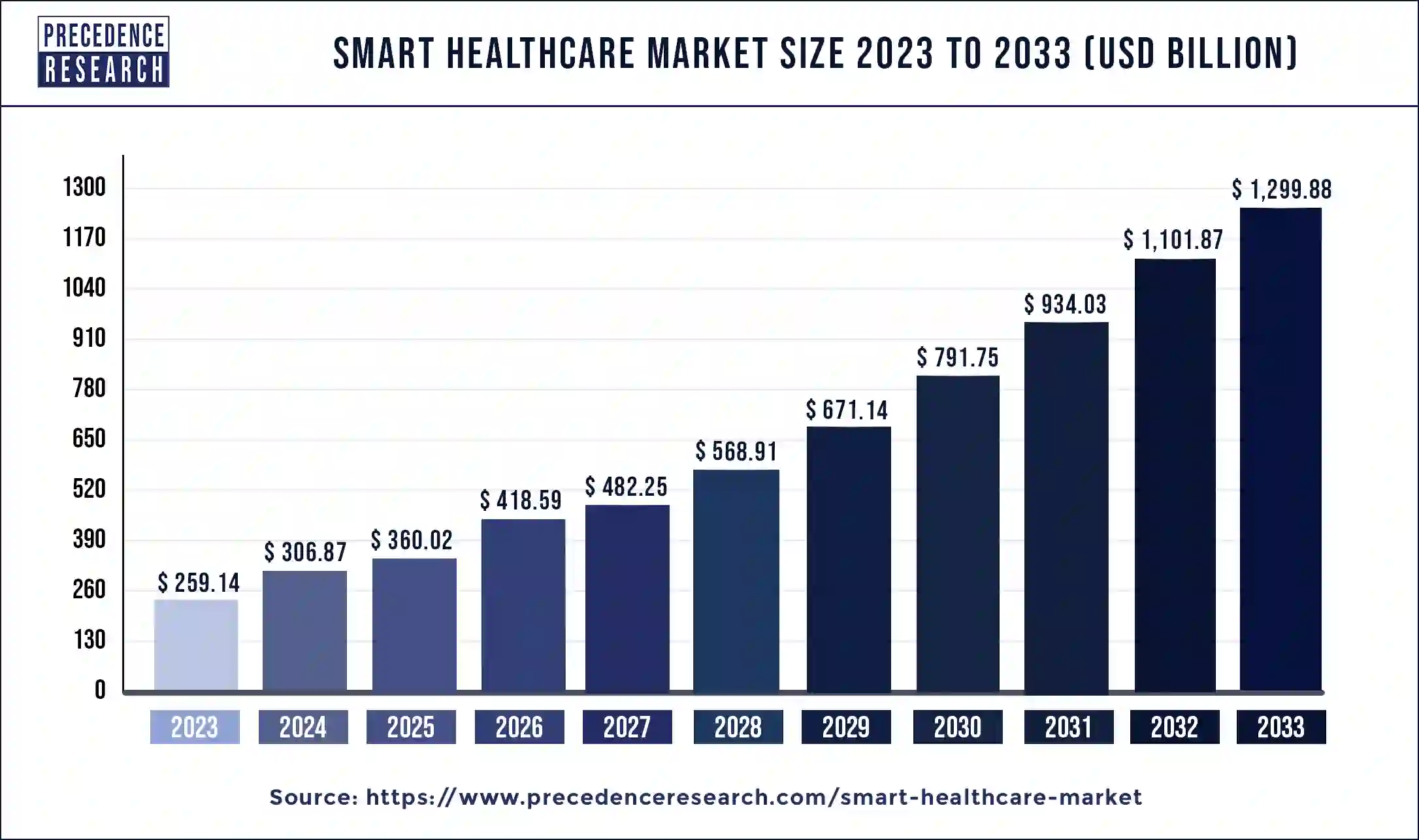

The global smart healthcare market was valued at USD 259.14 billion in 2023 and is projected to reach USD 1,299.88 billion by 2033, growing at a CAGR of 17.4% between 2024 and 2033.

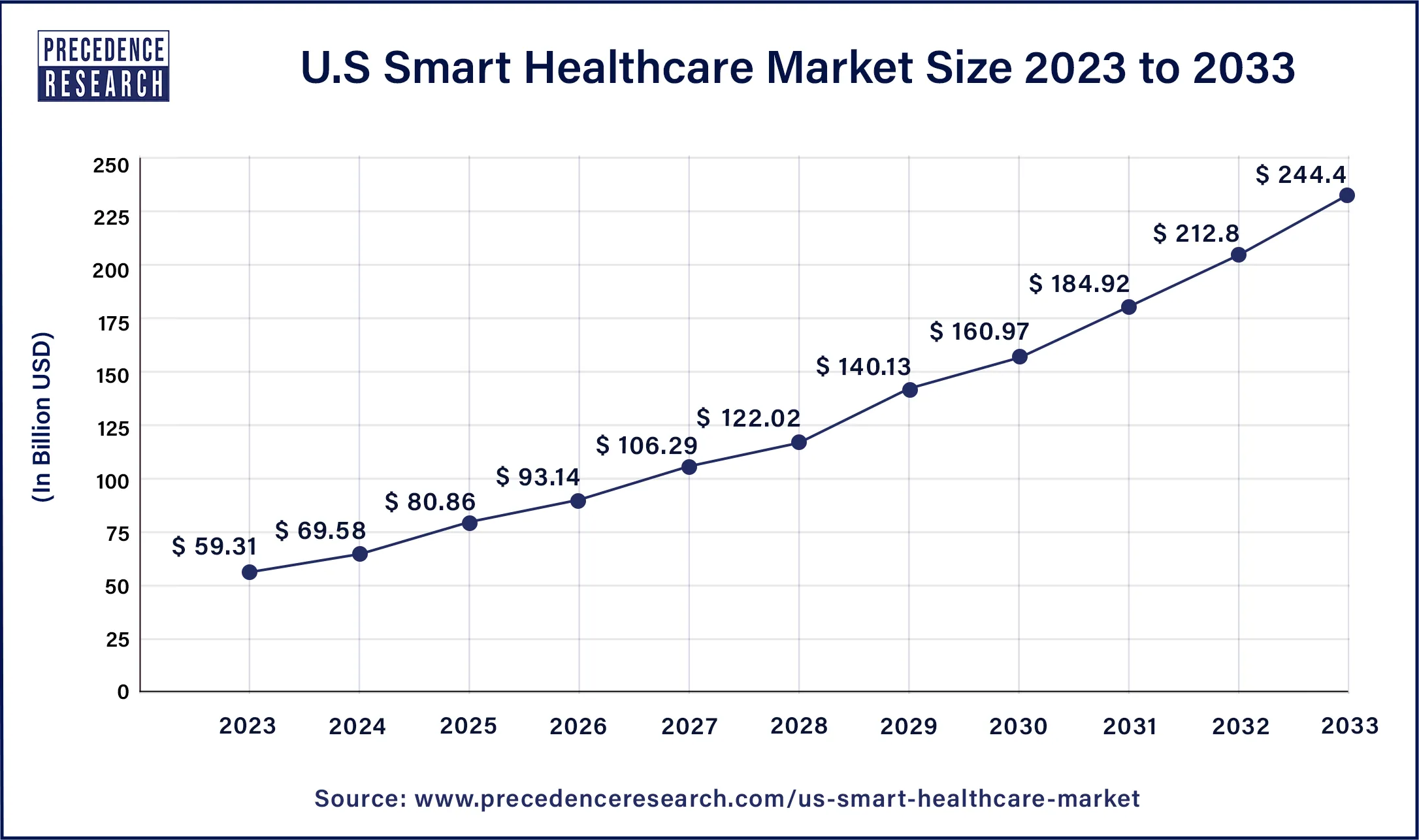

The U.S. smart healthcare market size was estimated at USD 59.31 billion in 2023 and is predicted to be worth around USD 244.4 billion by 2033, at a CAGR of 14.98% from 2024 to 2033.

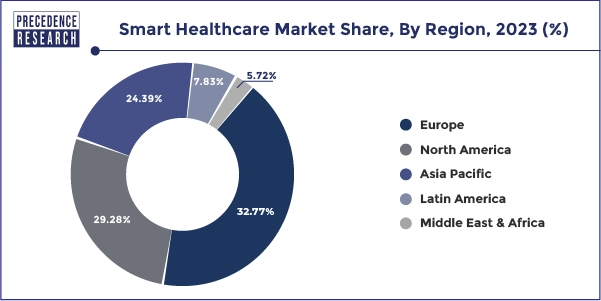

North America held a revenue share of 29.28% of the market, in 2023. This is due to supportive government policies for digital health deployment and accessibility of highly digital literacy resources. In addition, the involvement of key market players, rising knowledge of connected healthcare, high internet penetration, and smartphones, along with the use of health-related apps, are some of the key factors responsible for market growth. The American Hospital Association (AMA) announced on March 10, 2020, that, due to its affordability and high healthcare value, approximately 76 percent of hospitals in the U.S. use telehealth to communicate with consulting professionals and patients. In addition, the successful adoption of e-prescription systems and electronic health records (EHR) in different healthcare centers is driving regional market development.

Over the forecast era, Asia Pacific is expected to exhibit profitable growth. Due to their existing healthcare IT infrastructure and increasing investments in smart healthcare, countries such as Japan, Australia, and India exhibit significant potential. In developing nations such as China and India, the number of government digitalization initiatives is expected to accelerate the adoption of digital healthcare solutions such as health services. Companies are increasingly investing in telemedicine services with rising COVID-19 cases in the country. Huawei praised the provision of cellular networks, conferences, and smartphones across Thailand, Bangladesh, and Malaysia on April 14, 2020. This is intended to increase the acceptance of telemedicine practices in order to battle the region's COVID-19 pandemic.

The Asia Pacific smart healthcare market size was calculated at USD 52.22 billion in 2023 and is projected to expand to around USD 355.96 billion by 2033, poised to grow at a CAGR of 18.76% from 2024 to 2033.

| Year | Market Size (USD Billion) |

| 2023 | 63.21 |

| 2024 | 75.73 |

| 2025 | 89.88 |

| 2026 | 105.71 |

| 2027 | 123.16 |

| 2028 | 146.99 |

| 2029 | 175.43 |

| 2030 | 209.38 |

| 2031 | 249.9 |

| 2032 | 298.25 |

| 2033 | 355.96 |

Smart healthcare products are a tool that incorporates advanced technologies to provide patients with improved treatment and enhance the quality of life. Some of the most popular kinds of smart health care items are smart pills, smart syringes, electronic health care, etc. They have reliable patient-related data and assist physicians to properly handle their patients. The growth of this market is driven by rising chronic illnesses such as diabetes, cancer, heart disease, etc. The healthcare sector has been changed by digitalization. In recent years, the adoption of mHealth has increased significantly, primarily due to increasing smartphone use and digitization. Rising adoption of mHealth, government initiatives to digitize healthcare, and the prevalence of chronic disorders are likely to accentuate the demand for smart healthcare systems. For example, in March 2020, the Government of Quebec, in collaboration with the Canadian Medical Association (CMA), agreed to expand access to telehealth facilities in various provinces of Canada, such as Alberta, New Brunswick, British Columbia, Manitoba, Ontario, Newfoundland and others in collaboration with the Canadian Medical Association (CMA). These attempts are expected to place digital patient-oriented healthcare systems at the forefront globally.

| Report Highlights | Details |

| Market Size in 2023 | USD 259.14 Billion |

| Market Size by 2033 | USD 1,299.88 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 17.4% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

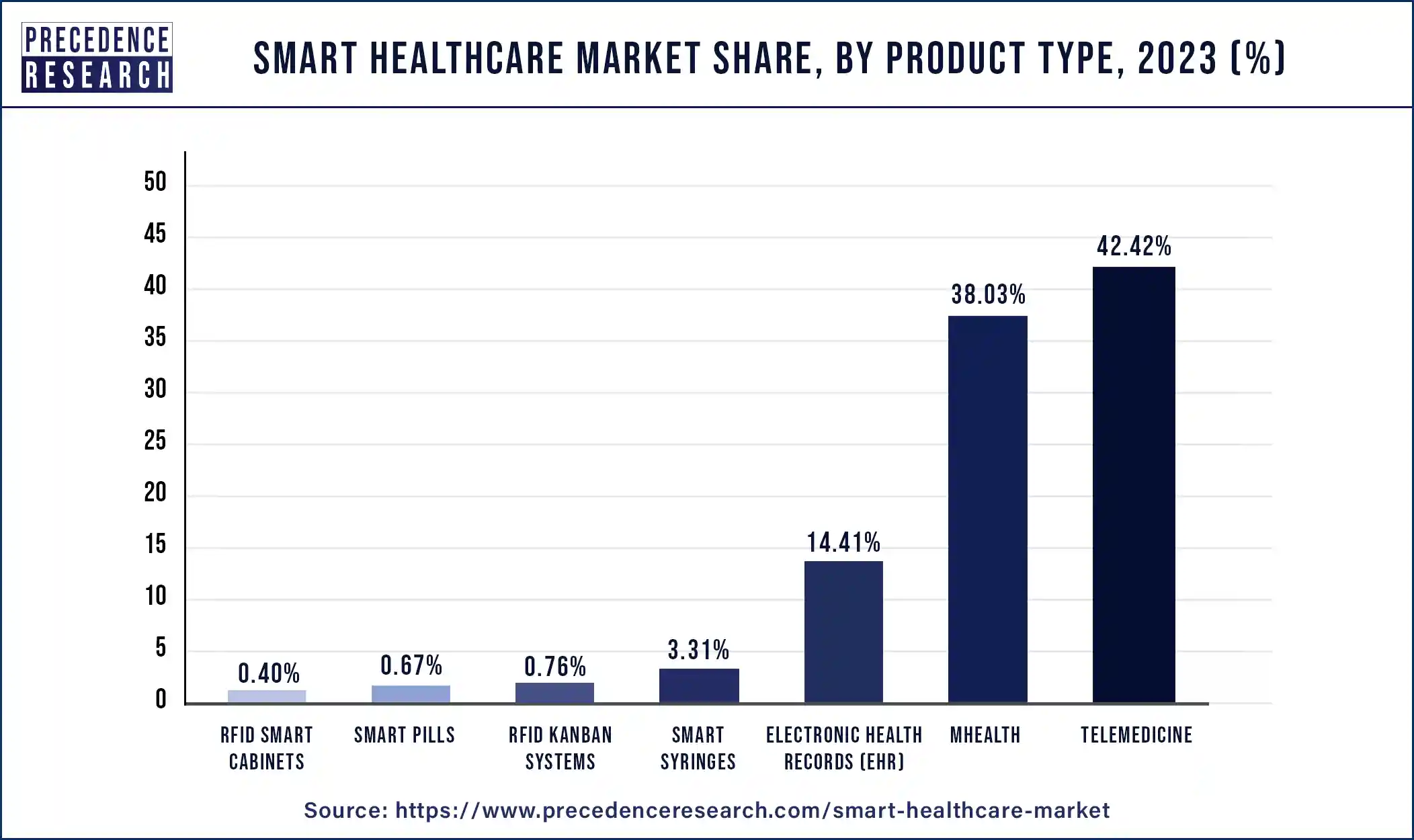

The telemedicine segment held the largest share of 42.42% in 2023. Telemedicine is often integrated into a broader health tech ecosystem, working alongside electronic health records (EHRs), data analytics, and other smart healthcare solutions. This integration enhances overall healthcare efficiency and data-driven decision-making. Telemedicine supports elderly care by enabling remote health monitoring in the comfort of patients' homes. This is particularly important for seniors who may face challenges in traveling to healthcare facilities regularly.

Telemedicine contributes to cost savings for both healthcare providers and patients. Reduced travel expenses, lower operational costs for healthcare facilities, and potential early intervention in medical conditions can lead to overall healthcare expenditure reduction.

On the other hand, the mHealth segment is observed to witness the fastest rate of growth during the forecast period. The widespread availability and use of smartphones and tablets provide a ready platform for mHealth solutions. These devices serve as powerful tools for accessing health-related information, monitoring, and managing one's health. mHealth enables remote monitoring of patients with chronic conditions or those recovering from surgeries. Wearable devices and sensors connected to mobile apps facilitate real-time monitoring, leading to better management of health conditions and reduced hospitalization.

Segments Covered in the Report

By Product Type

By Regional Outlook

North America

Europe

Asia Pacific

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

September 2024

January 2025

December 2024