January 2025

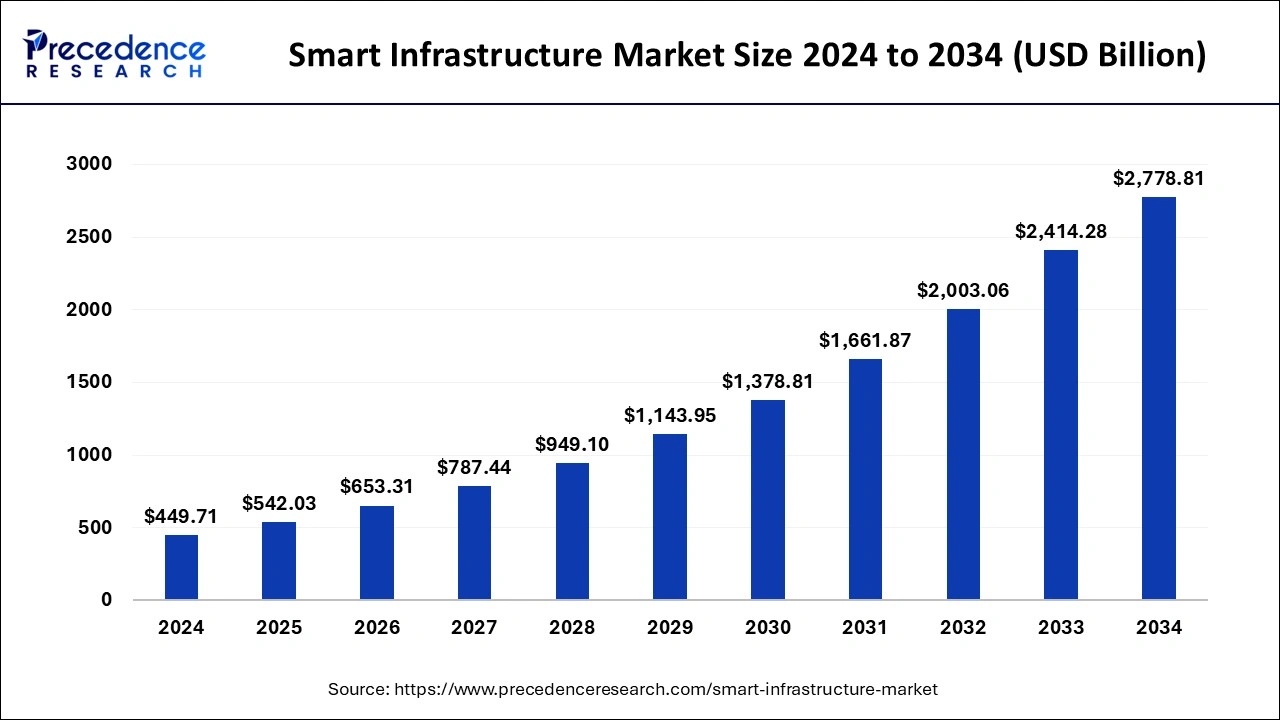

The global smart infrastructure market size is calculated at USD 542.03 billion in 2025 and is forecasted to reach around USD 2,778.81 billion by 2034, accelerating at a CAGR of 19.98% from 2025 to 2034. The North America smart infrastructure market size surpassed USD 143.91 billion in 2024 and is expanding at a CAGR of 20.16% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart infrastructure market size was estimated at USD 449.71 billion in 2024 and is predicted to increase from USD 542.03 billion in 2025 to approximately USD 2,778.81 billion by 2034, expanding at a CAGR of 19.98% from 2025 to 2034. The smart infrastructure market is growing significantly because more money is being invested in smart city projects by the government and private sector.

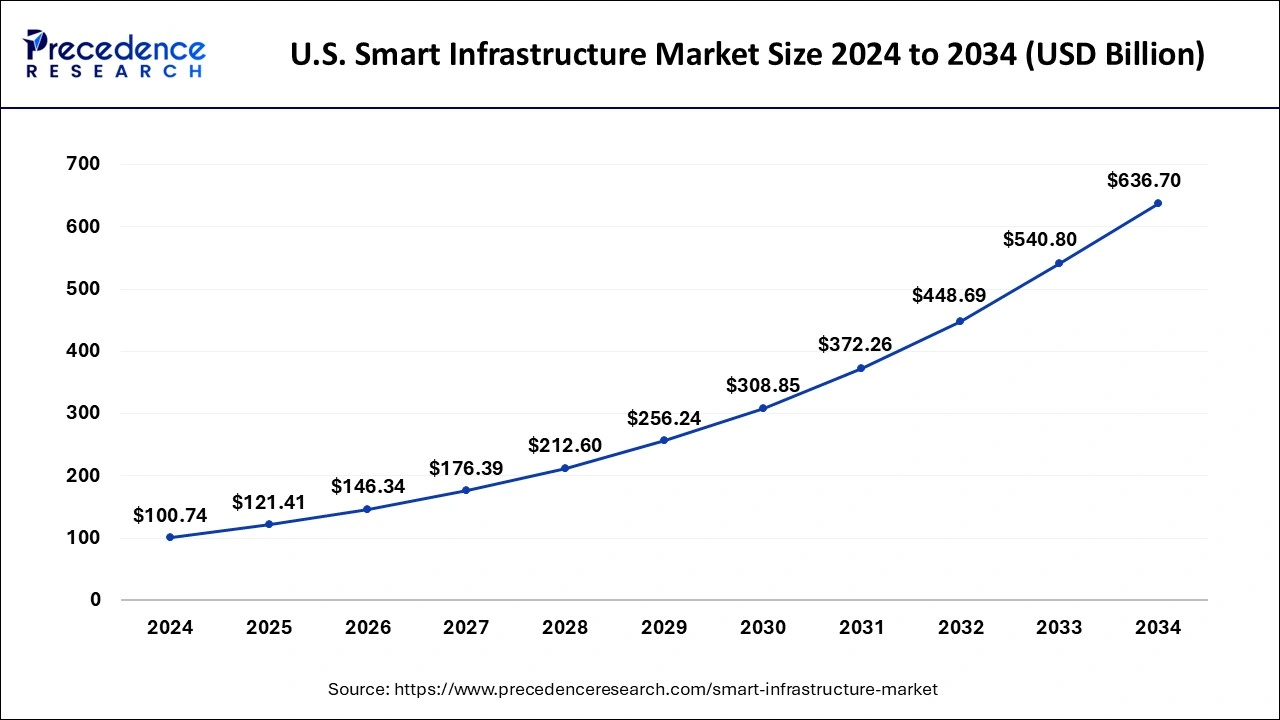

The U.S. smart infrastructure market size was valued at USD 100.74 billion in 2024 and is expected to be worth around USD 636.70 billion by 2034, growing at a CAGR of 20.25% from 2025 to 2034.

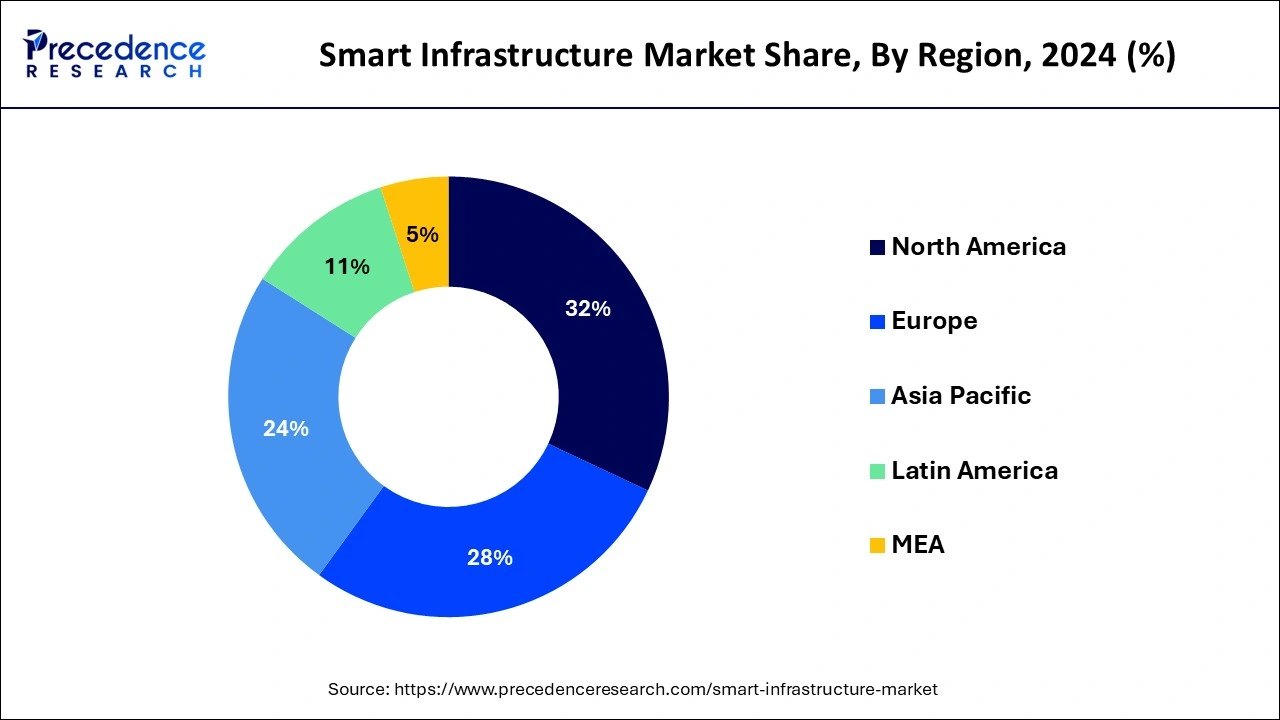

North America dominated the smart infrastructure market in 2024 with a 32% share. The region is undergoing substantial urbanization, intensifying pressure on existing infrastructure. This has resulted in a significant demand for smart solutions to tackle challenges associated with population growth, congestion, energy consumption, and sustainability.

Furthermore, North American federal, state, and local governments are actively endorsing smart infrastructure projects by providing funding and regulatory support, thereby contributing to robust market growth. Additionally, the region is a hub for technology leaders and research institutions, fostering advancements in areas like IoT, AI, and data analytics, consequently driving the demand for smart infrastructure.

Chicago has initiated a smart lighting program to install 270,000 LED lights within four years. In the project's first year, the city successfully installed 81,000 LED lights. Due to this initiative, Chicago anticipates annual savings of approximately USD 10 million in utility costs. The project incorporates a monitoring and control system, which promptly notifies the city of any outages and enables workers to optimize the performance of the streetlights.

The smart infrastructure market in Asia Pacific is expected to experience the fastest rate of growth. This is influenced by rapid urbanization, consumer interest in remote management services through IoT technology, and an increasing internet penetration rate. The growth in China's smart infrastructure market is propelled by supportive government initiatives for smart cities and growing concerns about energy consumption in buildings. Furthermore, the region's industries prioritize automation to enhance business operations and minimize overhead costs.

The smart infrastructure market offers services that incorporate advanced technologies and digital systems into physical structures like buildings, transportation networks, and energy grids. It utilizes the Internet of Things (IoT), artificial intelligence (AI), and data analytics to improve efficiency, sustainability, and connectivity. This includes applications like automated controls in buildings, intelligent transportation systems for better traffic flow, and renewable energy grids for monitoring and managing energy. Smart cities use data for improved urban planning. The growing consumer focus on the environment and energy efficiency drives the adoption of smart technologies to optimize energy use and decrease carbon emissions.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 19.98% |

| Market Size in 2025 | USD 542.03 Billion |

| Market Size by 2034 | USD 2,778.81 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Offering, By Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising urbanization and population growth

The smart infrastructure market is driven by rapid urbanization and population growth. As more people move to urban areas, efficient management of resources like water, energy, and transportation becomes crucial due to increased crowding. The market is also growing due to the widespread use of products to reduce traffic congestion, improve public transit, and lower energy consumption and greenhouse gas emissions. Furthermore, integrating advanced smart solutions for urban sustainability, reducing carbon footprints, and enhancing energy utilization and waste management creates lucrative growth opportunities for the market.

Favorable government initiatives and policies

Governments worldwide actively promote and invest in smart infrastructure projects to boost economic development, enhance sustainability, and improve overall quality of life. Additionally, various funding options, incentives, and regulatory backing for initiatives like smart cities, transportation upgrades, and renewable energy integration are creating lucrative opportunities. The growing global concerns about the environment, sustainability, and greenhouse gas emissions further drive the adoption of smart technologies. This trend is attracting private sector investments and fostering innovation in the smart infrastructure market. Furthermore, the COVID-19 pandemic has underscored the importance of smart infrastructure in ensuring public safety and resilience, positively influencing market growth.

Cyber threat issues

Potential cyber threats act as restraints for the smart infrastructure market, as concerns about cybersecurity, privacy, and security risks have been raised due to extensive data exchange and system integration in these projects. Moreover, the lack of policies and common standards has resulted in cities struggling to integrate privacy and cyber threat issues. Addressing these concerns is essential to prevent potential hindrances to market growth.

Technological advancements

Fostering a positive outlook for the smart infrastructure market expansion is the widespread implementation of smart grid systems, advanced metering infrastructure (AMI), and energy management. These technologies enable real-time monitoring, demand response, and efficient energy distribution. Moreover, there is a growing demand for intelligent transportation systems (ITS), such as smart traffic management and connected vehicles. These technologies facilitate traffic monitoring, dynamic signaling, and real-time traveler information, resulting in optimized traffic flow, reduced congestion, and enhanced road safety. The increasing adoption of smart city projects utilizing data analytics, IoT, and connected infrastructure is also creating lucrative opportunities for smart infrastructure market’s expansion.

The partnership between VMware and IBM was announced in November 2023 to integrate IBM Watson's data and artificial intelligence (AI) on the Red Hat OpenShift and VMware Private AI platform. This collaboration aims to improve the operational efficiency of AI-powered infrastructure and cloud platforms for their clients.

Rising adoption of AI and IoT

The global rise of smart cities and platforms is fueled by the widespread adoption of the Internet and the Internet of Things (IoT). The expanding use of IoT spans industrial applications, emergency services, public transportation, safety measures, city lighting, and overall smart city initiatives. Municipalities favor wireless IoT communications due to their cost-effectiveness, enhanced efficiency, and resource optimization.

Cisco predicts that machine-to-machine (M2M) connections supporting IoT applications will comprise over half of the world's 28.5 billion connected devices by 2022, with the connected home vertical accounting for a significant portion of total M2M connections.

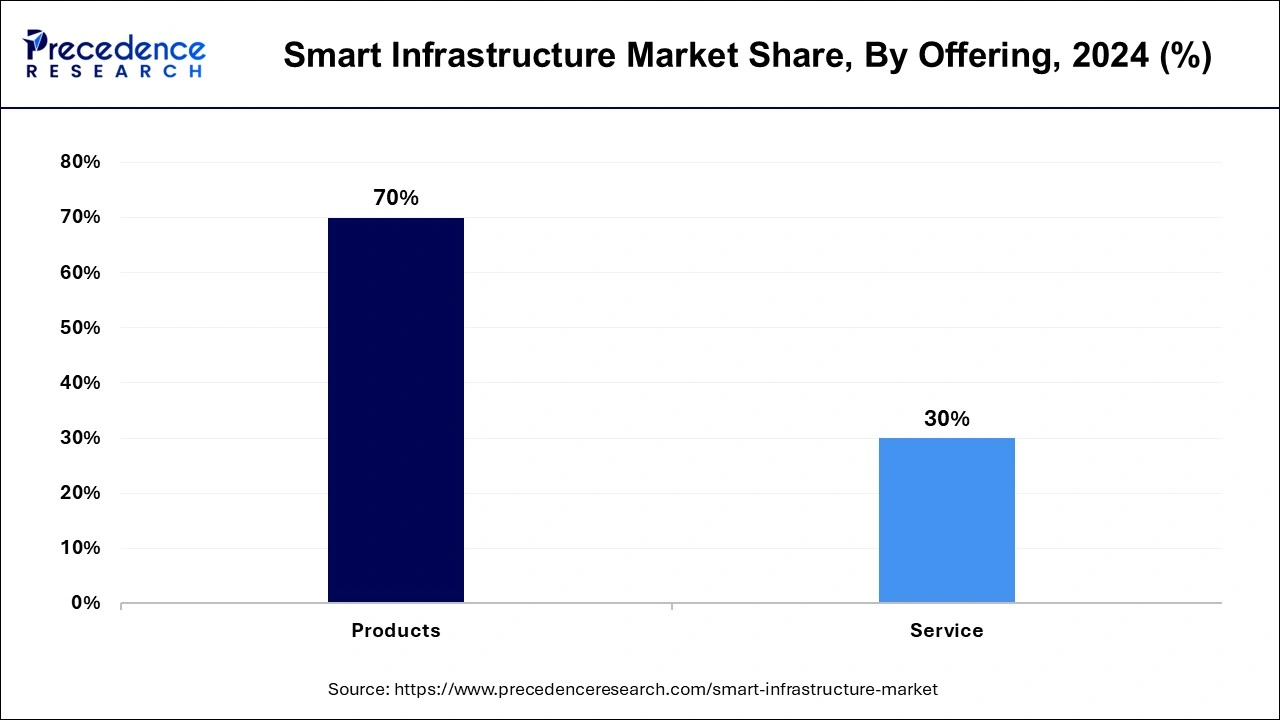

The products segment took the lead, holding the largest market share in 2024. This substantial market share results from the growing use of smart infrastructure hardware and software, including smart grid systems, building automation systems (BAS), and Internet of Things (IoT)-based environmental monitoring systems. These technologies are being adopted to enhance operational efficiency and minimize human errors. The product segment is expected to continue its dominance in the market until 2033, benefiting from ongoing technological advancements in developing smart infrastructure solutions.

In the smart infrastructure market, the service offering segment is to experience the highest compound annual growth rate. This significant growth is primarily due to organizations shifting their focus towards leveraging innovative infrastructure services to optimize their budgets.

The smart transportation system segment held the largest share of the smart infrastructure market in 2024 Recent progress in computing, communication sensors, and network speed has allowed for a significant overhaul of Traffic management, transportation infrastructure, and vehicular operations. Advances in sensing technologies and telecommunications have enhanced the capabilities of transportation systems to ensure safety and security. Moreover, favorable policies and regulations, heightened awareness of road safety, and rising vehicles present numerous potential opportunities in this segment during the forecast period.

During the forecast period, the smart waste management segment is observed to experience the fastest rate of expansion. This notable growth is due to the increasing adoption of smart bin technology, the integration of Blockchain technology for monitoring waste from its creation to disposal, and the advancement of automated sorting systems.

The non-residential end-users segment claimed the largest share of the smart infrastructure market in 2024. This dominance is mainly due to the growing acceptance of smart infrastructure solutions across commercial and industrial enterprises. These organizations are adopting these solutions to digitize their business operations and enhance consumer experience. Smart infrastructure solutions involve automation systems that streamline operations and optimize resource usage. Moreover, businesses integrate these solutions to bolster the digital security and safety of their sensitive data.

Over the forecast period, the residential segment is observed to grow at the fastest rate during the forecast period. Increasing demand for smart home technologies drives this growth, including HVAC management, lighting, smart meters, and security systems like smart door locks. These technologies are crucial in monitoring and managing a building's electrical and mechanical systems.

By Offering

By Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024