October 2024

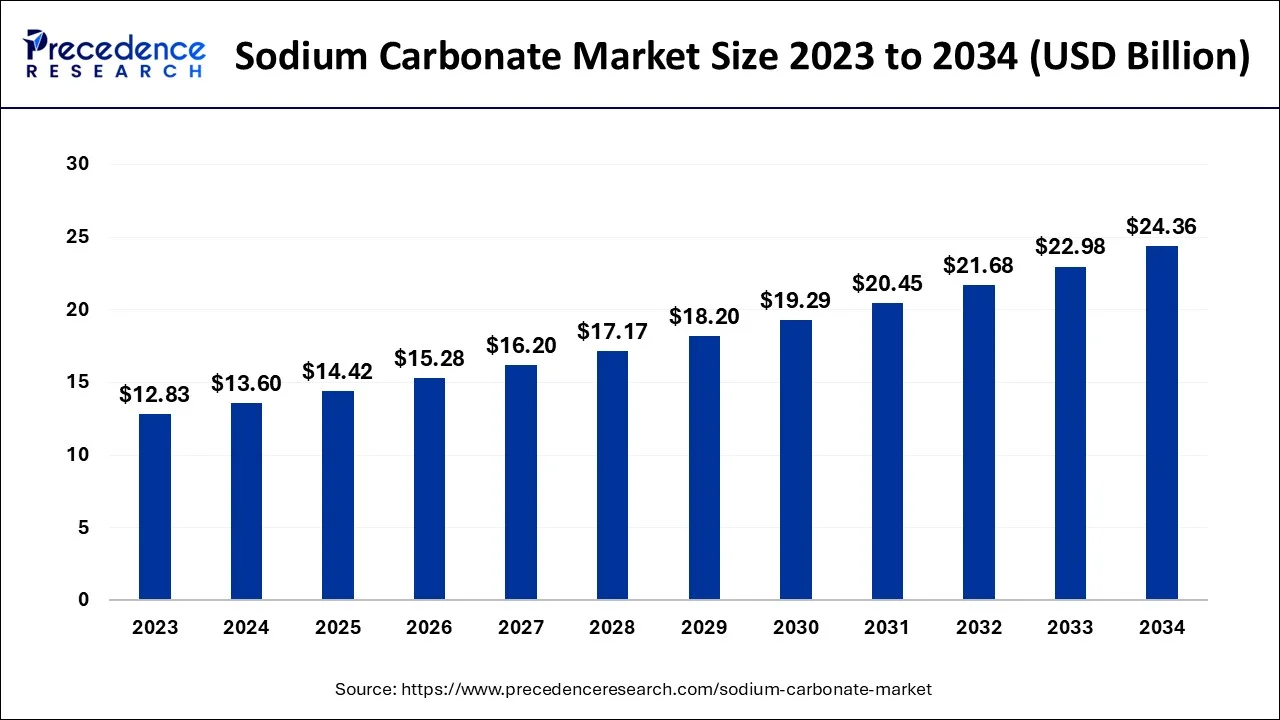

The global sodium carbonate market size accounted for USD 13.60 billion in 2024, grew to USD 14.42 billion in 2025 and is predicted to surpass around USD 24.36 billion by 2034, representing a healthy CAGR of 6% between 2024 and 2034.

The global sodium carbonate market size is estimated at USD 13.60 billion in 2024 and is anticipated to reach around USD 24.36 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034.

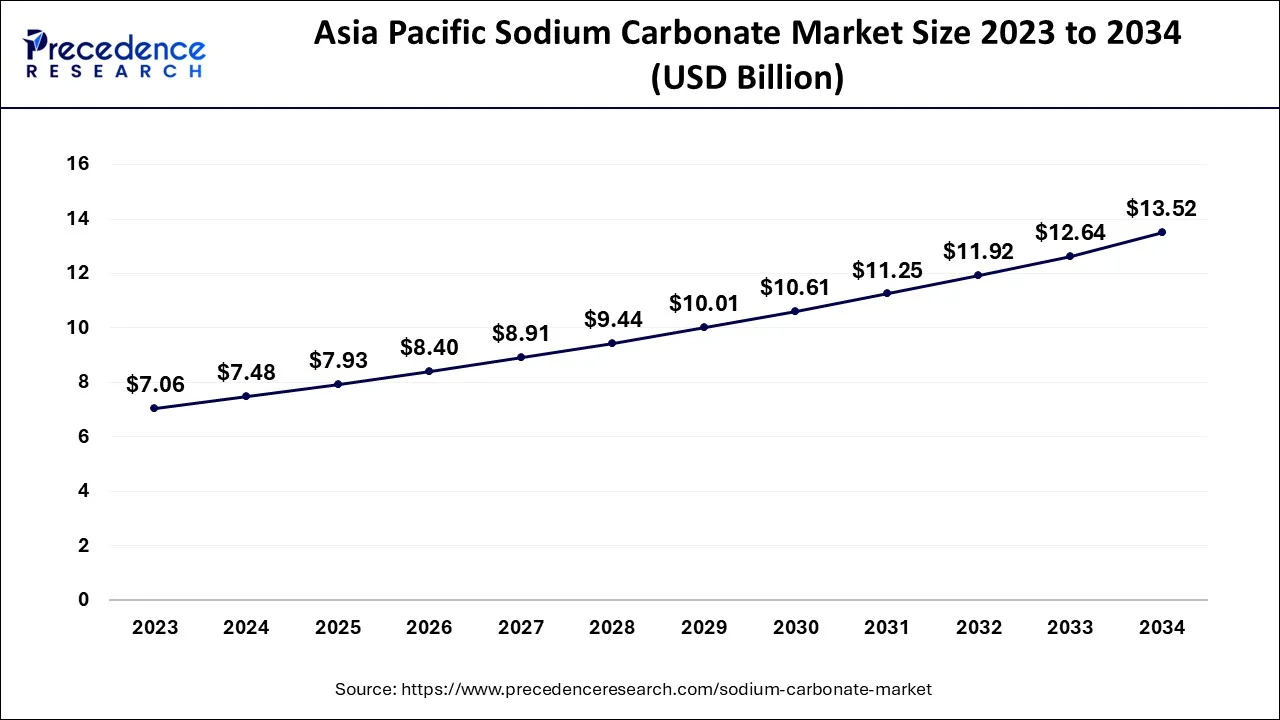

The Asia Pacific sodium carbonate market size is evaluated at USD 7.48 billion in 2024 and is predicted to be worth around USD 13.52 billion by 2034, rising at a CAGR of 6.08% from 2024 to 2034.

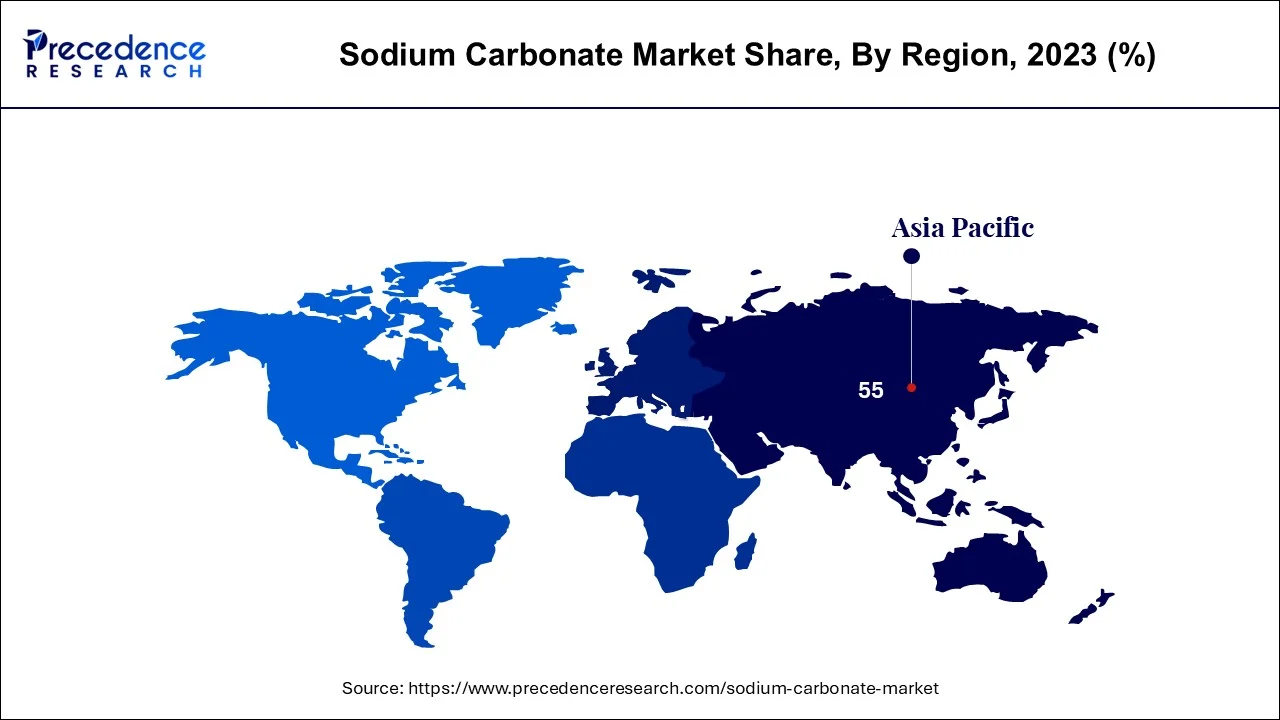

The sodium carbonate market is considered for various geographical regions such as North America, Europe, Asia Pacific and Rest of the World. The Asia Pacific is anticipated to dominate the sodium carbonate market in 2023 due to the rising rates of constructions. The factors such as evolution of road infrastructure, rise of prosperous middle-class population and increased economic growth are anticipated to contribute to the growth of sodium carbonate market. Augmented construction of non-residential & residential building to encounter the rising demand especially in China, India & the U.S., combined with substantial investment in new infrastructures has resulted in an accelerated pace of construction sector which is expected to increase the necessity for flat glass.

In the U.S. the demand for sodium carbonate produced with several flat glasses applications surpassed the worth of over USD 100 million in 2023 which represent the tremendous growth opportunities in area of construction industry. The growth of construction sector in emerging nation in Asia Pacific is especially major attributed to the increasing urbanization as well as considerable population base that has increased the demand for homes which use sodium carbonate-based products.

Sodium carbonate, also known as soda ash, is a whitish inorganic chemical with presence of alkaline properties which is used in multiple products such as detergents, glass, chemicals, feed & food sectors. The chemical formula of sodium carbonate if N2CO3 which is also referred as hygroscopic and amorphous substance that has increased solubility in almost each solvent including water. Sodium carbonate also helps in reduction of the furnace temperature that is essential to melt sand in the industry of glassmaking which needs to emphasize on reduction of the cost of production.

Also, sodium carbonate is extracted from ash of vegetations with high content of sodium. The chemical is also an industrial form limestones and sodium chloride using the process known as ‘Solvay Process.’ It is also chemically active which releases carbon dioxide after the treatment with acids. Although sodium carbonate has low level of toxicity, prolonged exposure to this chemical may cause eye or skin irritation. Additionally, the consumption of sodium carbonate may cause vomiting, nausea, diarrhoea and stomach ache.

Sodium carbonate is expected to witness a significant growth in usage to manufacturing products such as flat glass for (automotives and construction), soda-lime-silica glass, and glass containers (food and drinks) among other industries related to glass industry. Hence, the demand for flat glasses for the housing, automotives, and commercial building industries along with the container glass for consumer products has boosted the demand for the sodium carbonate industry.

The multiple applications of sodium carbonate such as food, chemical manufacturing, personal care products, and swimming pool maintenance. The key factors such as growing demand for sodium carbonate is expected to propel the growth of sodium carbonate market, increasing environmental consciousness and expanding glass manufacturing industries is also contributing in the sodium carbonate market growth. However, different restraints are expected to hamper the market during projected period.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.60 Billion |

| Market Size by 2034 | USD 24.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Basis of Type, End-User, and Geography |

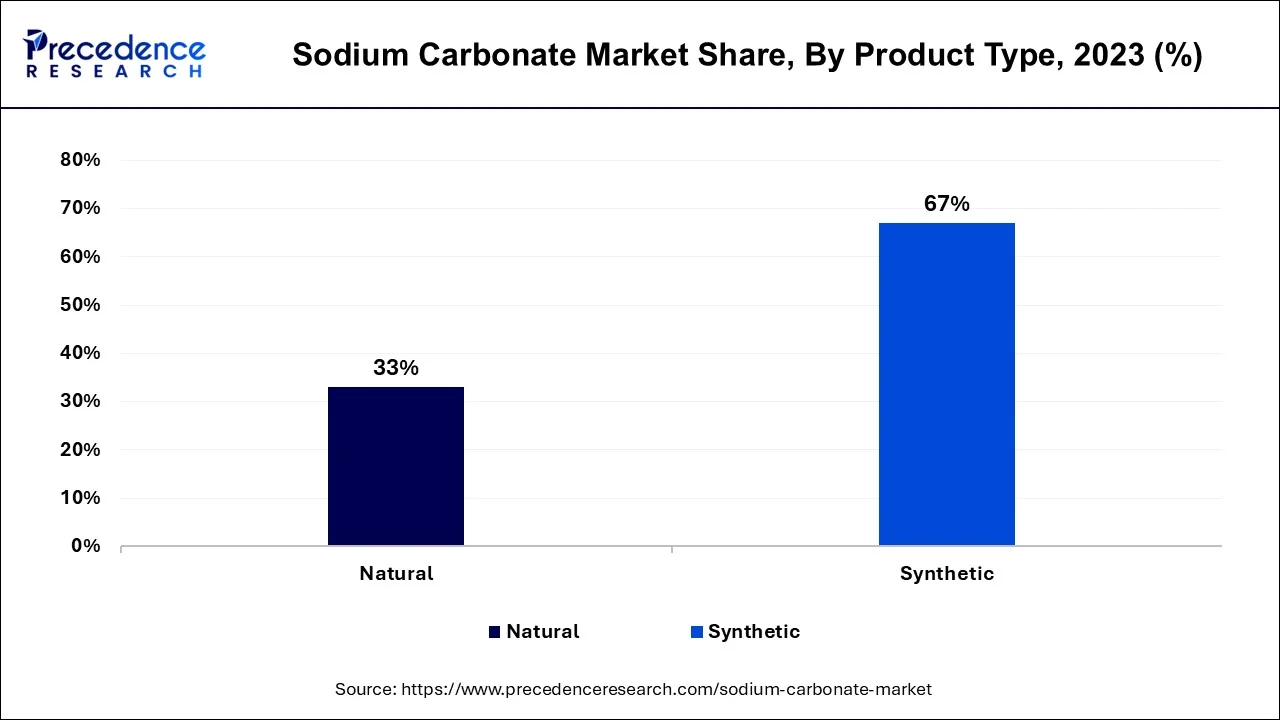

On the basis of product type, the segment is divided into natural and synthetic in the sodium carbonate market. The synthetic product segments are estimated to lead the market in 2023. The factors such as the easy manufacturing process are anticipated to contribute the growth of the synthetic segment.

The increased availability of raw materials such as brine, limestone, and coke is also expected to accelerate the growth of sodium carbonate market. Additionally, the growing use of sodium carbonate in multiple industries due to its wide applicability is anticipated to boost the growth of sodium carbonate market.

On the basis of end-user, segment is separated into chemical manufacturing, water treatment and softening, glass manufacturing, detergent and soaps industry, paper manufacturing, and mining industries. The glass manufacturing is further sub-segmented into container glass and flat glass. Also, chemicals manufacturing is sub-segmented on the basis of carbonate chemicals and sodium chemicals. Additionally, the glass manufacturing is also expected to lead the market in 2023 owing to the rising constructions of residential and non-residential constructions. The increased usage of flat glasses is also expected to propel the growth of sodium carbonate market.

By Product Type

By Basis of Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

February 2025

January 2025