October 2024

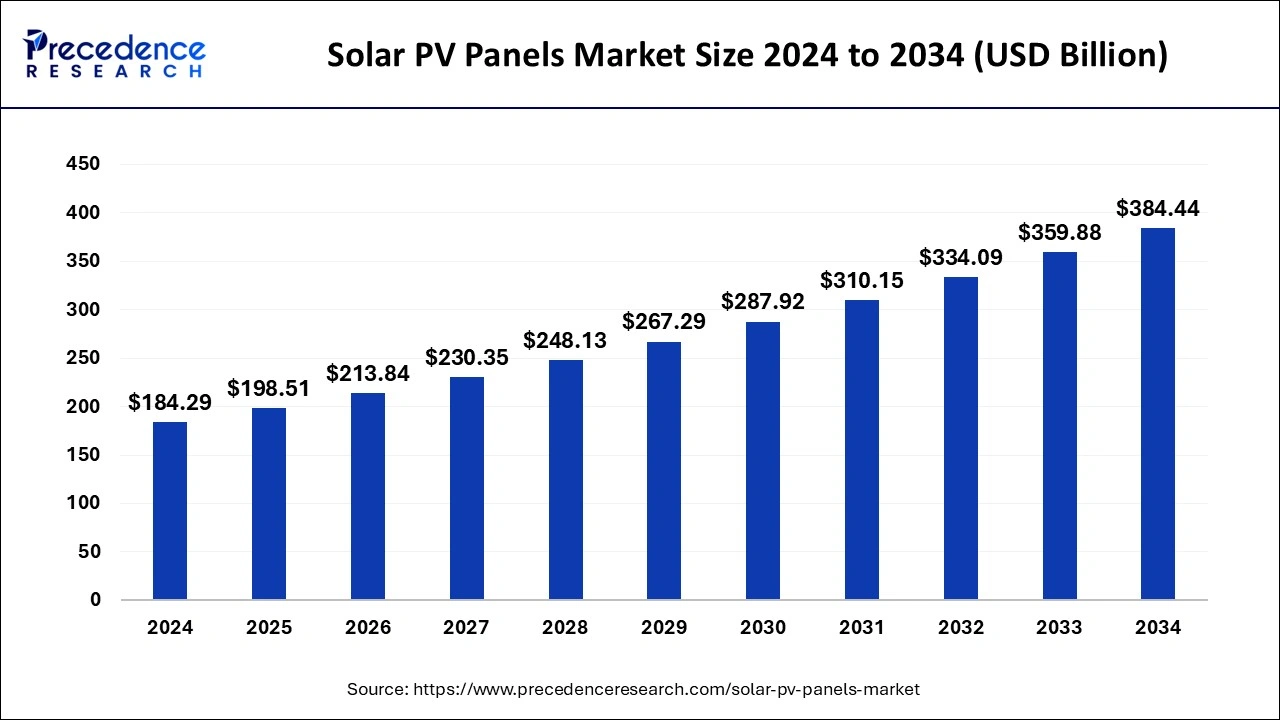

The global solar PV panels market size is calculated at USD 198.51 billion in 2025 and is forecasted to reach around USD 384.44 billion by 2034, accelerating at a CAGR of 7.62% from 2025 to 2034. The Asia Pacific solar PV panels market size surpassed USD 109.18 billion in 2025 and is expanding at a CAGR of 7.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solar PV panels market size was estimated at USD 184.29 billion in 2024 and is predicted to increase from USD 198.51 billion in 2025 to approximately USD 384.44 billion by 2034, expanding at a CAGR of 7.62% from 2025 to 2034. With improvements in photovoltaic technology, solar panels can now generate more electricity with the same quantity of sunshine because of their higher efficiency.

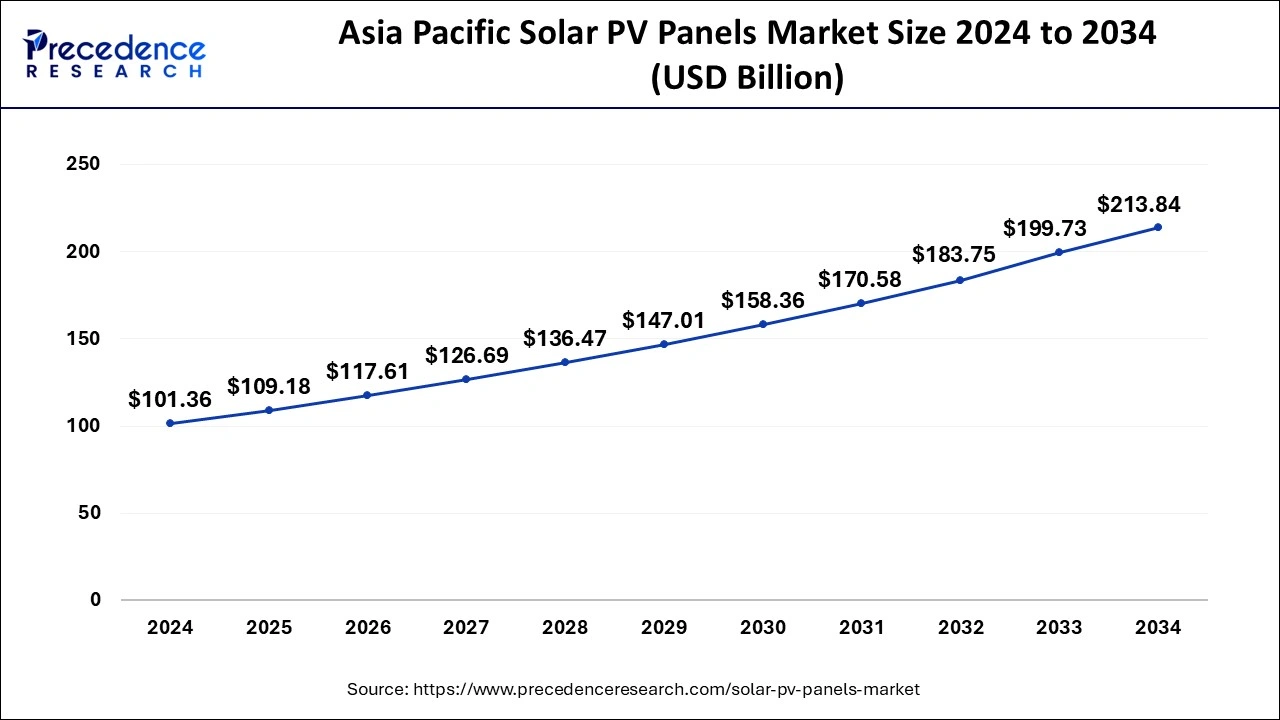

The asia pacific solar PV panels market size was valued at USD 101.36 billion in 2024 and is predicted to worth around USD 213.84 billion by 2034, expanding at a CAGR of 7.75% from 2025 to 2034.

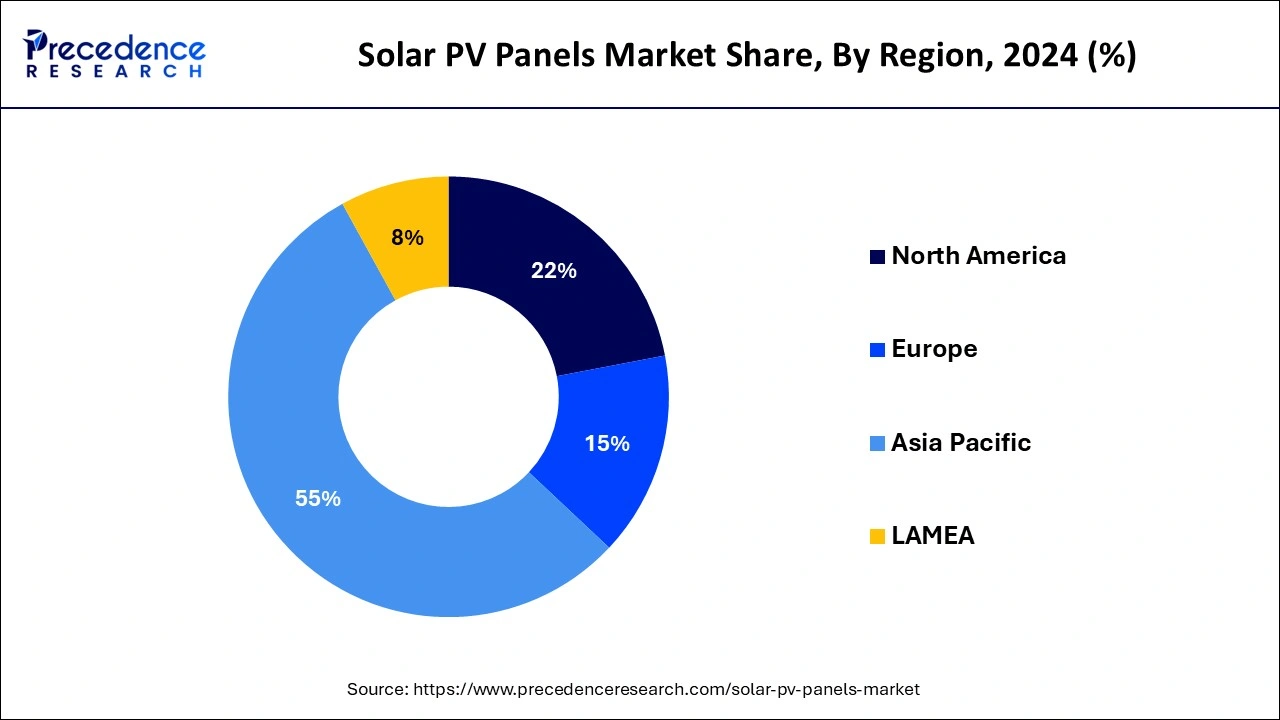

Asia Pacific holds the largest share of the solar PV panels market. The region's solar PV panels market is expanding quickly because of encouraging government regulations and rising demand for renewable energy sources. With large installations and official backing, China is the region's top market for solar photovoltaic systems. Two significant projects are the 600 MW Xingchuan Demonstration Photovoltaic Power Station in Sichuan and the 320 MW floating solar PV array in Shandong. With 44% of the market share, monocrystalline solar panels are preferred for their great performance and efficiency. These panels are a popular option in areas with limited space because of their reputation for a long lifespan and reliable performance.

North America is expected to host the fastest-growing solar PV panels market over the forecast period. The allure of solar PV systems is being increased by developments in energy storage and smart house integration, as well as increased solar panel longevity and efficiency. The original costs of solar systems are greatly decreased by federal and state incentives, such as tax credits, rebates, and net metering programs, which encourage wider adoption. Growing public understanding of solar energy's benefits to the environment and long-term financial advantages is increasing demand. A further important motivator is the ambition to achieve net-zero emissions and reduce greenhouse gas emissions. With the backing of progressive government policies, rising environmental consciousness among businesses and consumers, and technical breakthroughs, the North American solar PV market is expected to grow rapidly over the next ten years.

The growing need for renewable energy, technological improvements, and government regulations that are supportive of these trends are driving the rapid expansion and transformation of the global market for solar photovoltaic panels. Anticipated to increase dramatically because of their extended lifespan and efficiency. Trina Solar, Canadian Solar, and JinkoSolar are important providers. A sizable portion of the solar PV panels market is due to their easy grid connection and cheap operating expenses.

Driven by increased power requirements in industries such as data centers, hospitals, and corporate offices. Major players like JinkoSolar, Trina Solar, Canadian Solar, and LONGi Solar are leading the fiercely competitive market. To keep a competitive edge, these businesses concentrate on R&D, growing their production capabilities, and vertical integration.

The global solar PV panels market that produces, distributes, installs, and maintains solar photovoltaic panels is known as the solar PV (Photovoltaic) panels market. These solar panels use semiconductor materials to turn sunlight straight into power. There are several market segments that include solar panel types (monocrystalline, polycrystalline, and thin-film), applications (commercial, industrial, residential, and utility-scale), and geographic locations.

Businesses in solar PV panels market that manufacture and distribute solar panels as well as associated parts like mounting systems, inverters, and monitoring apparatus. Regulatory and legislative uncertainties, high initial installation costs, and technological constraints are some of the issues that could impede market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 359.88 Billion |

| Market Size in 2025 | USD 171.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.72% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Grid Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Energy storage integration

Right now, lithium-ion batteries are the most often used option because of their high energy density and decreasing cost. Other technologies are also being developed, such as enhanced lead-acid batteries, solid-state batteries, and flow batteries. The dropping costs of battery storage devices and solar panels have made integrated solutions more financially feasible.

Even with decreasing costs, some potential consumers may be turned off by a solar-plus-storage system's expensive initial investment. Advanced technology and knowledge are necessary to ensure storage integrates seamlessly with the grid and current PV systems. Businesses can use these systems to better control peak demand, lower energy expenses, and increase resilience to power outages.

Maintenance and longevity

Solar photovoltaic systems are often regarded as long-term investments, with a typical lifespan of 25 to 30 years or longer. Reliability and longevity are strongly related to the return on investment (ROI) of solar installations, both residential and commercial. A specific degree of performance and product quality is guaranteed by warranties ranging from 20 to 25 years, which are offered by many respectable solar panel manufacturers. For these warranties to continue to be valid, maintaining maintenance compliance is frequently required.

By putting monitoring systems in place, performance can be tracked in real time, which makes it easier to spot problems or underperforming panels that could need maintenance. In order to maximize the lifespan of solar PV systems, proper installation by qualified professionals is essential. Inadequate installation techniques may cause the panels to fail and deteriorate too soon.

Emerging markets and rural electrification

In emerging markets, dependable power grids are sometimes inaccessible to rural communities. A decentralized approach made possible by solar PV panels allows communities to produce their own electricity. Over time, solar photovoltaic technology has gotten more and more economical, making it a desirable choice for emerging market rural electrification projects.

Long-term electricity bill reductions might outweigh the initial cost of solar panels, particularly in places where grid electricity is expensive or unavailable. As a clean and renewable energy source, solar energy supports international efforts to halt climate change. Emerging markets can lessen their dependency on fossil fuels, cut greenhouse gas emissions, and lessen their environmental effect by implementing solar PV panels for rural electricity.

The thin-film segment held the largest share of the solar PV panels market in 2024. Within the larger solar PV market, there is a niche dedicated to thin-film solar panels. Thin-film solar panels, as opposed to conventional crystalline silicon solar panels, use thin layers of semiconductor materials, such as amorphous silicon (a-Si), copper indium gallium selenide (CIGS), or cadmium telluride (CdTe), to convert sunlight into electricity.

In general, thin-film solar panels generate less electricity per unit area than crystalline silicon panels due to their lower conversion efficiencies. Thin-film technology has always had difficulty increasing production volume and becoming cost-competitive with crystalline silicon. This market has particular benefits and difficulties. The flexibility of thin-film technology is a key benefit since it enables its usage in a variety of applications, including building-integrated photovoltaics (BIPV), where more conventional rigid panels might not be appropriate.

The crystalline silicon segment is expected to witness the fastest growth in the solar PV panels market in the upcoming years. One important area of the market for solar PV panels is crystalline silicon. The efficiency, dependability, and long-term performance of crystalline silicon-based solar panels have made them the industry leader in the solar energy sector worldwide. Compared to polycrystalline panels, monocrystalline panels often produce more electricity and function better in low light. They are frequently chosen for installations in homes and businesses where efficiency is valued above all else and space is at a premium. Both varieties of crystalline silicon panels are important players in the solar photovoltaic (PV) industry, providing customers with a variety of choices to meet their individual requirements, be it cost-effectiveness or energy production.

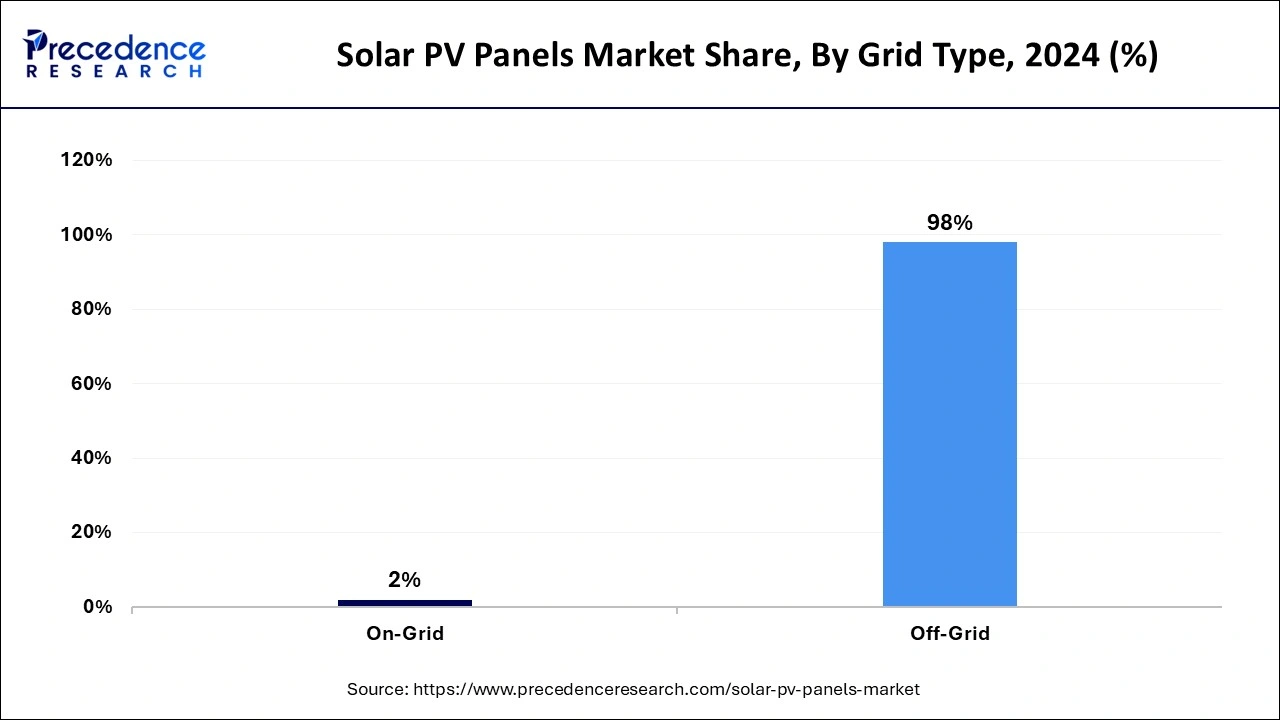

The on-grid segment held the largest share of the solar PV panels market in 2024. In the solar photovoltaic systems market, the category of solar photovoltaic systems that are linked to the utility grid is known as the "on-grid segment." When sunshine is available during the day, solar panels in an on-grid or grid-tied system provide power. Any electricity generated in excess of what a home or company uses right away is put back into the system. Net metering regulations, in which the surplus electricity produced by the solar panels is exported to the grid and the customer is credited for this exported electricity, are frequently used with on-grid installations. Because they don't need pricey battery storage solutions, on-grid systems are frequently more affordable than off-grid ones. Net metering regulations may also offer solar system owners financial advantages.

The off-grid segment is expected to grow rapidly in the solar PV panels market during the forecast period. Solar photovoltaic panels are used in systems that are not connected to the conventional electrical grid, which is referred to as the off-grid segment in the solar PV panels market. Usually running on their own, these systems use solar panels to produce electricity that can be used right away or stored in batteries for later use. Off-grid solar PV systems are frequently utilized in rural communities, cottages, RVs, yachts, and emergency backup power systems, as well as other isolated locations with little or no grid connectivity. By enabling users to produce their own electricity and lessen the need for centralized power sources, off-grid technologies provide energy independence. Off-grid systems are now more widely available and reasonably priced because of developments in solar PV technology, which have also resulted in cost savings and increased efficiency.

The industrial segment dominated the global solar PV panels market in 2024. Solar photovoltaic panels are commonly used in industrial markets, referred to as the industrial segment for solar PV panels. This involves powering manufacturing buildings, warehouses, factories, and other industrial processes with solar energy. Solar PV panels are being used by industries more and more to lower their electricity costs. Industrial facilities can realize long-term energy savings and reduce operating costs by producing their own electricity using solar power. Through on-site electricity generation, solar PV panels provide industrial facilities with a certain level of energy independence. This can be especially helpful in areas with expensive or unstable grid power or in isolated locations where it might be difficult or expensive to connect to the grid.

The commercial segment is expected to witness rapid expansion in the solar PV panels market in the upcoming years. Solar photovoltaic panels are used in commercial or non-residential environments, such as offices, factories, warehouses, and institutions, and are commonly referred to as the commercial segment in the solar PV panels market. This section covers a broad spectrum of uses, from small-scale installations on single commercial buildings to large-scale solar farms that feed the grid or several commercial buildings with electricity. The size and scope of commercial installations can vary greatly. Small rooftop arrays on specific businesses and massive ground-mounted installations spanning several acres are all possible. Environmental concerns are a major driving force behind a lot of commercial enterprises. Clean, renewable energy from solar PV panels can help companies lower their carbon footprint and show that they are committed to sustainability.

By Technology

By Application

By Grid Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024