October 2024

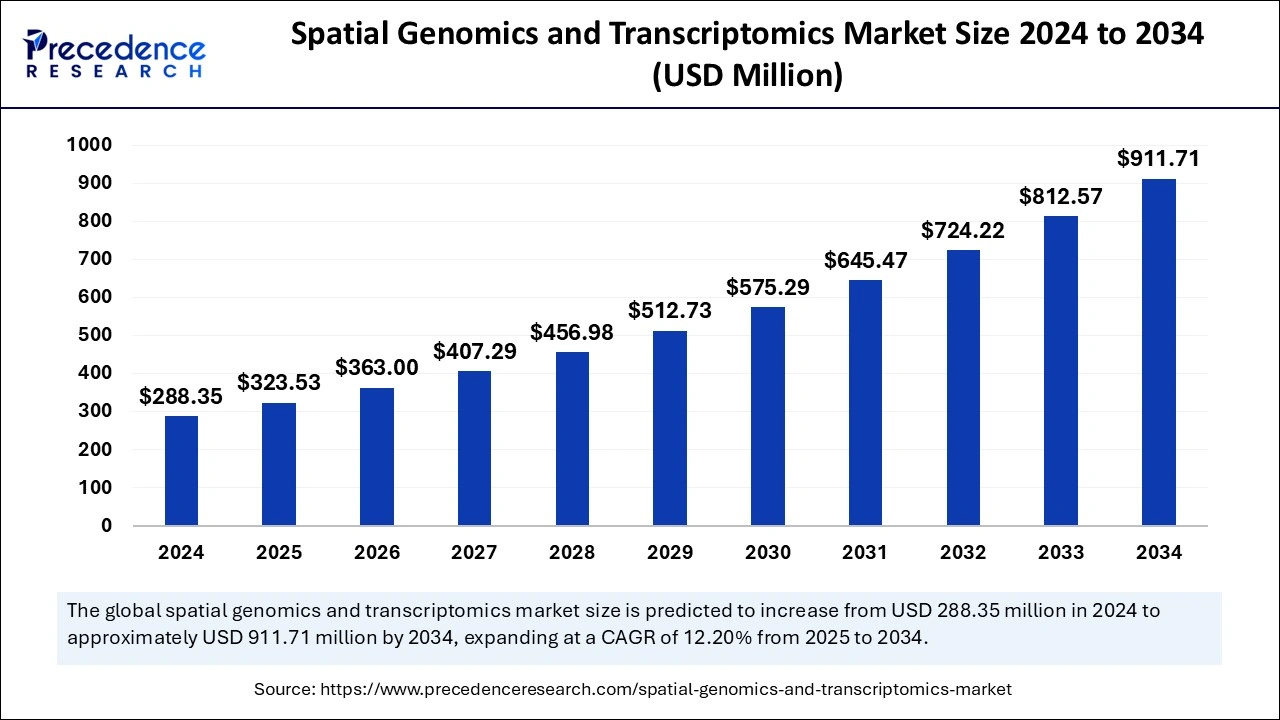

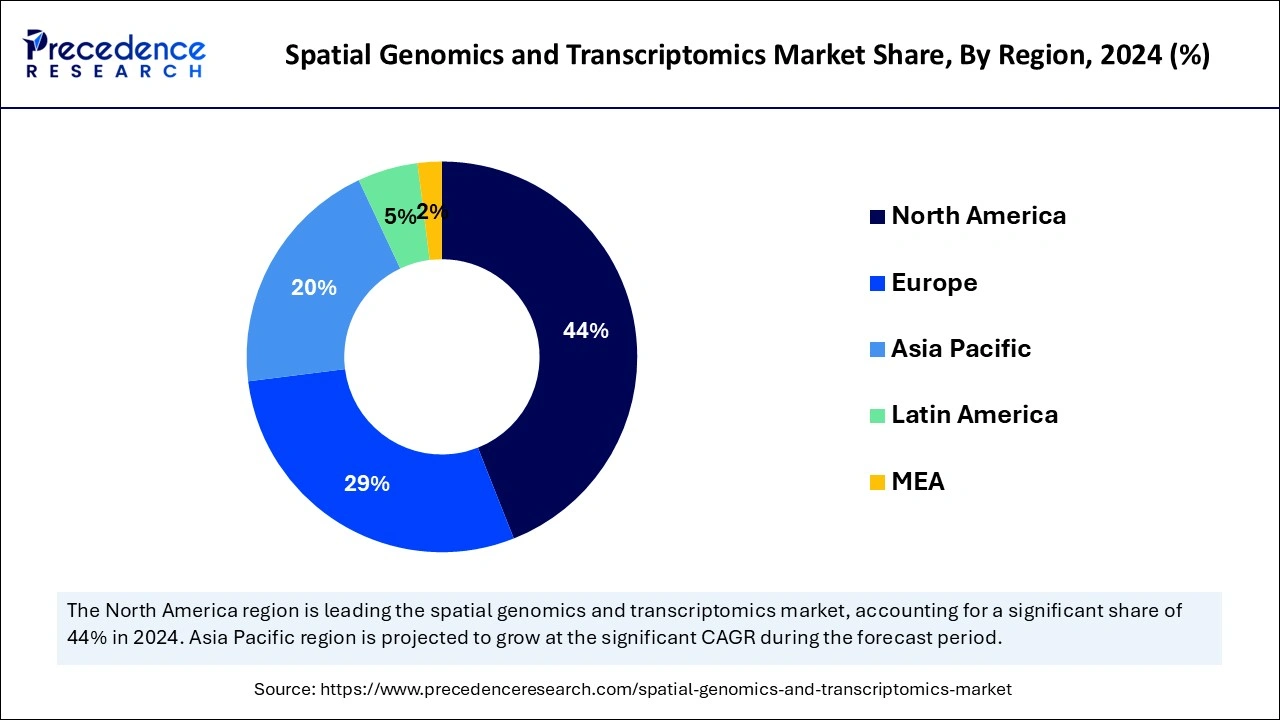

The global spatial genomics and transcriptomics market size is accounted at USD 323.53 million in 2025 and is forecasted to hit around USD 911.71 million by 2034, representing a CAGR of 12.20% from 2025 to 2034. The North America market size was estimated at USD 126.87 million in 2024 and is expanding at a CAGR of 12.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global spatial genomics and transcriptomics market size was calculated at USD 288.35 million in 2024 and is predicted to increase from USD 323.53 million in 2025 to approximately USD 911.71 million by 2034, expanding at a CAGR of 12.20% from 2025 to 2034. The demand for single-cell analysis has increased, which is responsible for driving the global spatial genomics and transcriptomic market. The introduction of spatial genomics and transcriptomics analysis is drawing a positive impact on market growth. Additionally, the rising government investments and funding for pharmaceutical R&D are making space for market growth.

The rising leverage of artificial intelligence with spatial genomics and transcriptomics and the human brain is projected to be a game-changing step in drug discovery and development. The proven role of AI in disease organic identification, potential candidate enrollment, target therapy developments, and diagnostic scales are significant reasons behind this integration. The capabilities of AI to provide more accurate data analytics, cell segmentations, and predictive optimizations are playing a favorable role in leveraging AI with technology.

The rising reliability of spatial genomics and transcriptomics technology on AI performance is expected to ease their adoption and utilization and lead to transforming the market situation. AI works with spatial genomics and transcriptomics technology as a helper to enhance the accuracy of complex spatial gene expression patterns, which enables researchers to understand disease mechanisms and drug discovery to comply with personalized medicine approaches. The rising collaborations between research and academic institutes are likely to draw a significant future for AI and spatial genomics and transcriptomics technology integration.

In April 2024, Nucleai announced the launch of artificial intelligence (AI)--based spatial biomarkers and improved histopathology workflows to revolutionize cancer treatment and diagnostics.

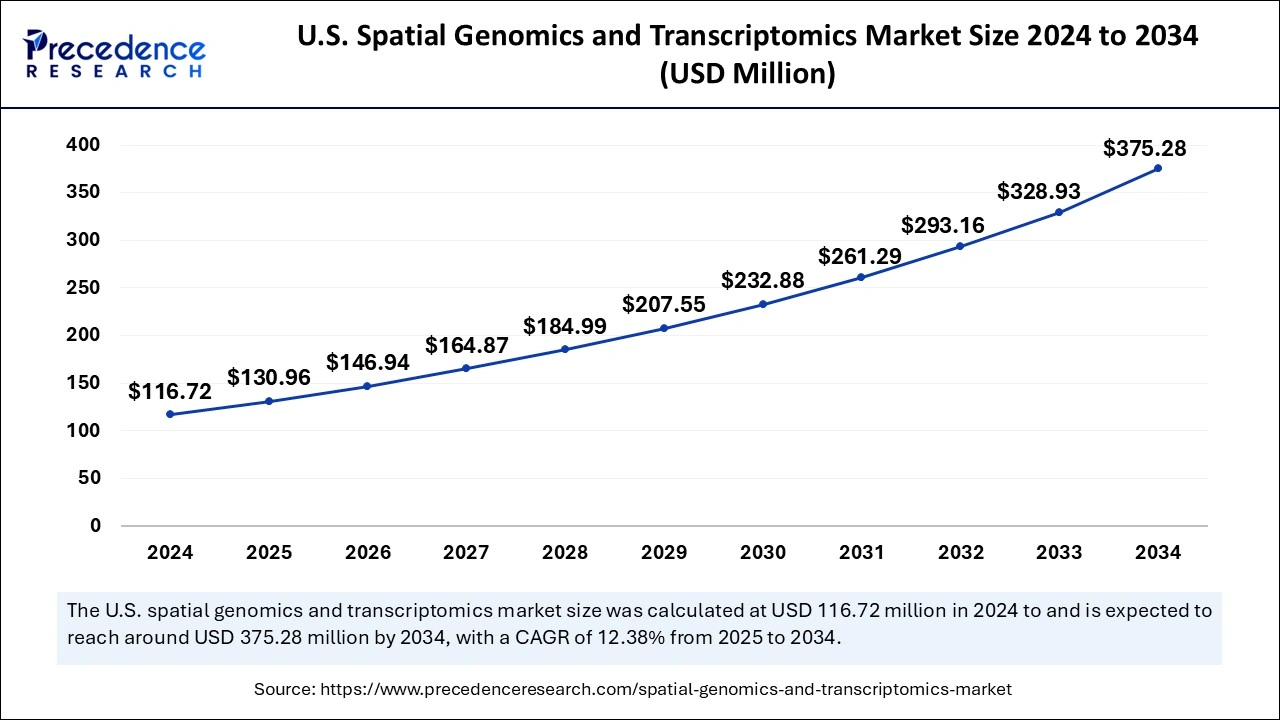

The U.S. spatial genomics and transcriptomics market size was exhibited at USD 116.72 million in 2024 and is projected to be worth around USD 375.28 million by 2034, growing at a CAGR of 12.38% from 2025 to 2034.

North America dominated the market with the largest share in 2024 due to well-established and advanced pharmaceutical and biotechnology companies and research institutes in the region. The demands for personalized medicines have increased; as a result, the surge for discovering new biomarkers and developing targeted therapies for complex diseases is driving the development of novel, innovative technologies and methods, including advanced spatial genomics and transcriptomics. Government investments and funding by agencies such as The National Institutes of Health (NIH) and the Defense Advanced Research Projects Agency (DARPA) are contributing to the regional market expansion.

The United States is leading the regional spatial genomics and transcriptomics market due to various factors, including government funding and grants, technology advancements, and ongoing strategic collaborations between government and non-government organizations, companies, research institutes, and academic institutions. Growing partnerships of research and development sectors with healthcare and academic institutes are emerging as a growth area for the U.S. spatial genomics and transcriptomics market.

Furthermore, the presence and support of government bodies, including the National Institutes of Health (NIH), the Food and Drug Administration (FDA), the Biomedical Advanced Research and Development Authority (BARDA), the Centers for Disease Prevention and Control (CDC), the Department of Defense (DoD), the Congressionally Directed Medical Research Programs (CDMRP), and the Walter Reed Army Institute of Research (WRAIR), is playing a favorable role in shaping the country's market.

Asia Pacific is anticipated to witness growth in the spatial genomics and transcriptomics market over the forecast period, as the region plays a crucial role in the adoption of advanced technology and the establishment of advanced pharmaceutical and biotechnology infrastructure. Growing government focus and investments in R&D, pharmaceutical and biotechnology companies, and healthcare institutes are creating market success in the region. Additionally, investments in academic institutes and collaborations with research sectors are expected to drive the development of novel and innovative technologies in Asian markets.

China is leading the regional spatial genomics and transcriptomics market due to the increased prevalence of chronic disease and the vast population in the country. Countries' focus on pharmaceutical infrastructure has increased dramatically. Additionally, with government support, the country is well supported in the adoption of new and advanced technologies. Chinese government agencies, including the National Medical Products Administration (NMPA) and the National Health Commission (NHC), are highly investing in clinical research and drug discovery, making ways for market success.

On the other hand, along with Japan and Indonesia, India is playing a significant role in the regional spatial genomics and transcriptomics market due to increased government support and investments in the country's R&D sector and pharmaceutical and biotechnology expenditure. Furthermore, the increased prevalence of cancers and various rare diseases has led the region to focus on technology advancements in pharmaceuticals and healthcare expenditures.

Spatial genomics and transcriptomics are technologies that help to understand gene expression in a spatial location or context. Ongoing research and developments are allowing spatial transcriptome achievement by next-generation sequencing. The information about each cell and its specific location within tissues helps to understand the developments and pathways of the disease. The increased demand for single-cell analysis in research and development is driving the utilization of the spatial genomics and transcriptomics market technologies.

The growing prevalence of rare diseases has surged the researcher's shift in gene therapies and next-generation RNA and DNA sequencing. Ongoing developments in gene therapies and increased demand for personalized medicines require the adoption of cutting-edge technologies to comply with the demands, including spatial genomics and transcriptomics technology. The growing need for advanced technologies in drug discovery and development is highlighting the importance of spatial genomics and transcriptomics.

Oncology plays a significant role in the spatial genomics and transcriptomics market expansion. The growing prevalence of cancers is driving the adoption of spatial genomics for the detection of early cancer and the introduction of fourth-generation sequencing. Government and pharmaceutical and biotechnology companies’ investments in research are allowing the adoption of cutting-edge technologies. With a growing emphasis on R&D globally, the market is expected to witness favorable changes in the upcoming time. Furthermore, the market is being shaped due to increased companies' focus on introducing advanced instruments and consumables.

| Report Coverage | Details |

| Market Size by 2034 | USD 911.71 Million |

| Market Size by 2025 | USD 323.53 Million |

| Market Size in 2024 | USD 288.35 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.20% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drug discovery and developments

The increased prevalence of chronic diseases worldwide has led to demands for personalized medicines. The need for precision and targeted therapies has reached the top. Growing government and non-government organization support and investments in R&D factors are allowing the adoption of advanced technologies, enabling various research in the spatial genomics and transcriptomics market, including biomarker discovery, target identification, and validation, as well as drug resistance and susceptibility.

The adoption of innovative pathogenomics and transcriptomics technologies is helping to understand genetic mechanics to detect disease origin, progress, and diagnostic solutions. The ability of spatial genomics and transcriptomics technologies to allow information on potential disease-occurring properties in eels and tissues is driving their adoption for drug discovery and development. Furthermore, ongoing R&D activities enable researchers to map gene expression across a tissue sample with detailed spatial information.

High cost

The high cost of advanced technology and instruments required for spatial genomics and transcriptomics are the major restraints of market growth. The required specialized equipment, including sequencers, imaging systems, and microscopes, is very expensive. Additionally, cost-related reagents and consumables and training & expertise hinder the adoption of the spatial genomics and transcriptomics market. However, the adoption of low-cost sequencing technologies, government funding, and partnerships among institutes and companies can help to overcome this issue.

Strategic collaborations

The rising surge of strategic collaborations between academic industries, government, research institutes, and companies is holding great potential for the spatial genomics and transcriptomics market. The rising need for personalized medicines is driving demand for spatial genomics and transcriptomics technology. However, several challenges relevant to this technology, such as high cost, regulatory compliance & guidelines, limited portfolio, and lack of standardized approaches, are hindering their adoption in the R&D sector. Additionally, a lack of training and expertise hampers understanding and advanced technology approaches for researchers.

Rising collaborations among interdisciplinary researchers make it possible to overcome these restraints. Similarly, collaborations among government bodies are helping to enhance investments in R&D and pharmaceutical & biotechnology companies, which helps to make it easier for the adoption of novel and innovative technologies. These collaborations are projected to improve the accessibility of advanced technologies and the validation of research findings.

The consumables segment accounted for a significant share of the spatial genomics and transcriptomics market in 2024. The segment growth is attributed to the need for consumables, including specialized panels, essential reagents, kits, probes, and electrophoresis in spatial genomics and transcriptomics. The rising offering of advanced consumables by key companies is fueling the segment expansion. Additionally, the cost-effectiveness of consumables drives their priority in R&D.

The instruments segment is observed to grow significantly during the forecast period due to increased demand for specialized instruments for spatial genomics and transcriptomics. The rising adoption of next-generation sequencing, automation, high-throughput systems, imaging systems, and microscopy are driving the segment growth. The surge of key companies for the development and upgradation of existing instruments is playing a crucial role in this growth.

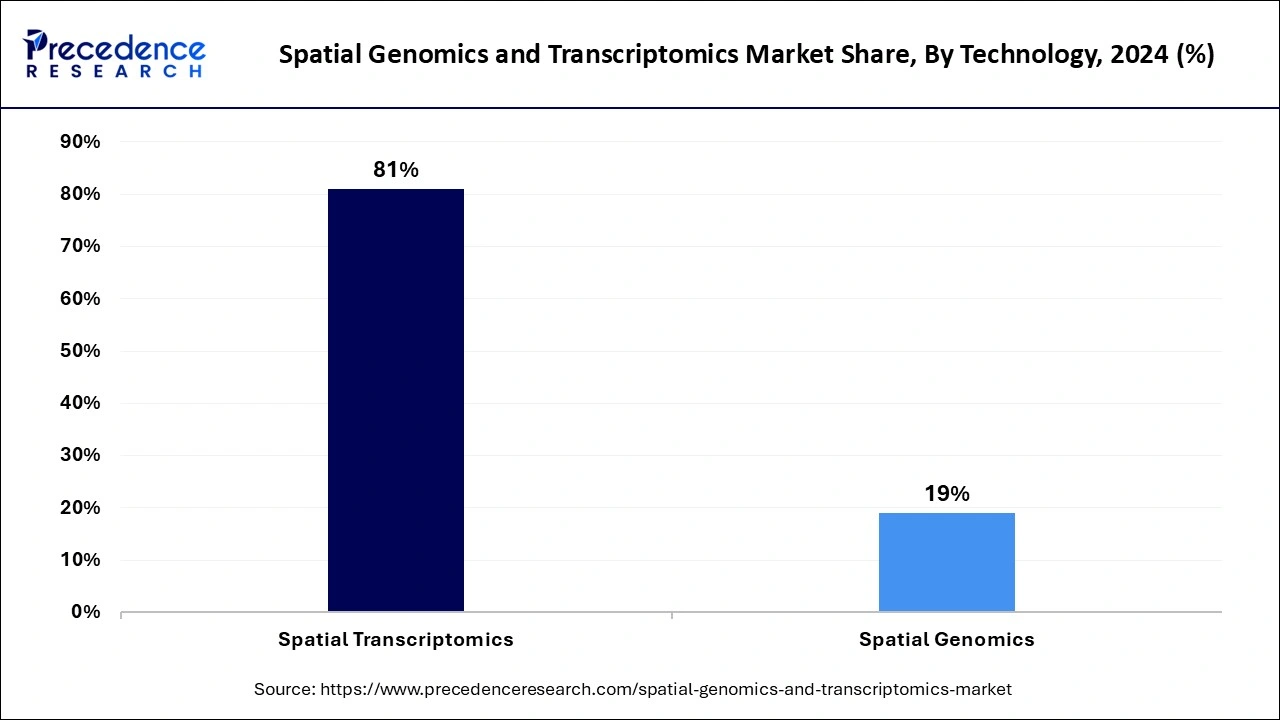

The spatial transcriptomics segment held the largest spatial genomics and transcriptomics market share in 2024 due to the increased adoption of spatial transcriptomics in single-cell studies. This technology helps to analyze gene expression in each cell within tissues and prevent their interactions. The rising demand for single-cell studies in drug discovery and development is making the technology popular. The need for cutting-edge spatial analysis tools and advanced consumables are the factors leveraging the growth of the segment.

On the other hand, the spatial genomics segment is anticipated to grow rapidly in the forecast period due to the increased adoption of next-generation sequencing technologies. Growing demand for personalized medicines and cancer research are driving the adoption of spatial genomics technology. The ability of spatial genomic technology to analyze genomic information in individual cells within tissue makes it a priority for cancer research.

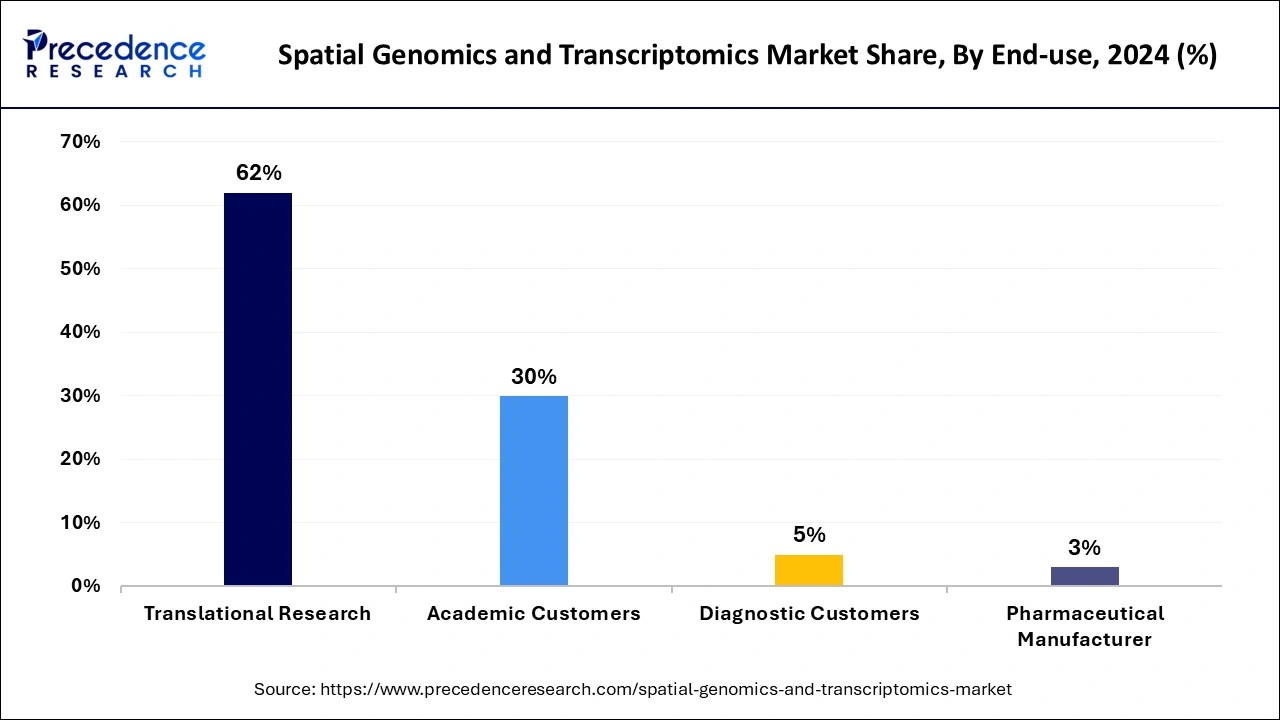

The translational research segment dominated the global spatial genomics and transcriptomics market in 2024. The rising demand for personalized medicines and the surge in cancer research are the major factors driving the growth of the segment. The adoption of spatial genomics and transcriptomics is high in translational research to enhance researchers' understanding of cell expressions and disease origin, progress, and potential diagnostic solutions. Government input in the R&D sector is allowing the adoption of cutting-edge technologies to advance drug discovery and development.

The academic customers segment is observed to grow notably during the forecast period. This segment growth is attributed to the increased adoption of spatial genomics and transcriptomics technology in university research institutes. The government funding that has been raised for research and development of advanced technologies is allowing academic research centers to adopt and utilize these technologies. Ongoing academic expertise to enhance gene expressions and drug development is leveraging the segment toward success. Furthermore, increased collaborations of government, research centers, and companies with academic institutes are contributing significantly to segment growth.

By Product

By Technology

By End-use

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

February 2025

December 2024