October 2024

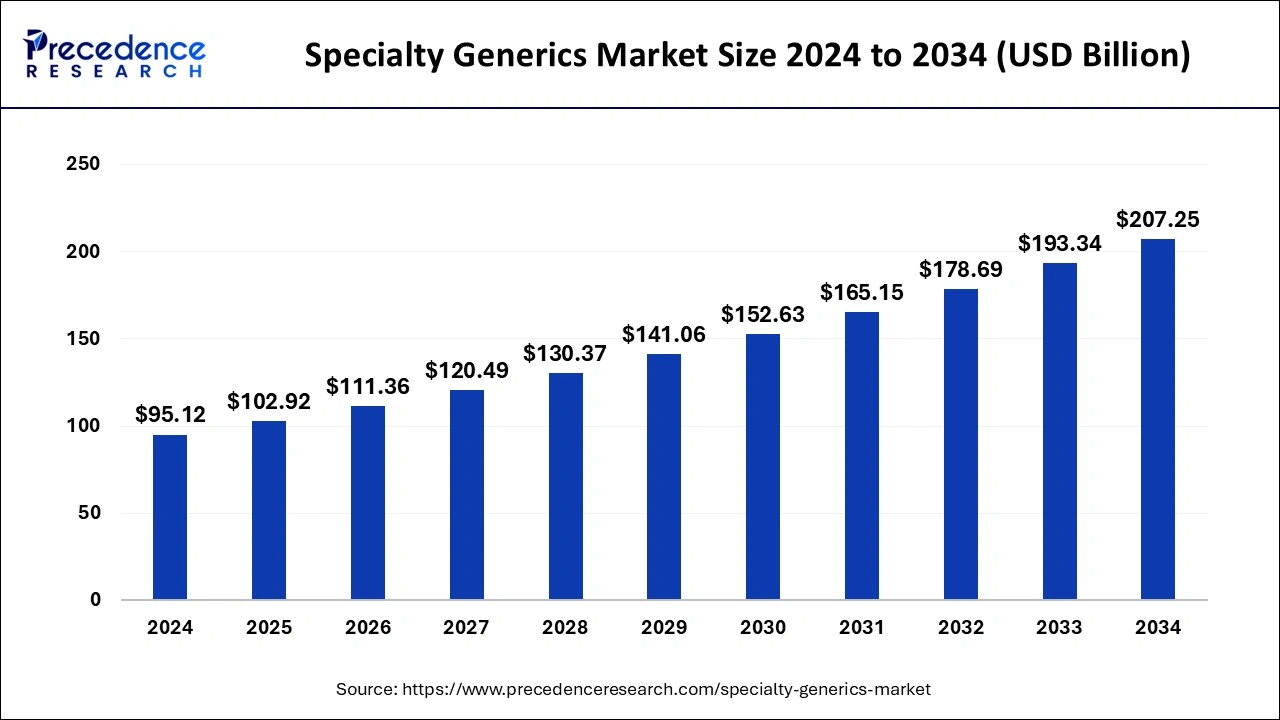

The global specialty generics market size is calculated at USD 102.92 billion in 2025 and is forecasted to reach around USD 207.25 billion by 2034, accelerating at a CAGR of 8.10% from 2025 to 2034. The North America market size surpassed USD 35.33 billion in 2024 and is expanding at a CAGR of 8.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global specialty generics market size accounted for USD 95.12 billion in 2024 and is expected to exceed USD 207.25 billion by 2034, growing at a CAGR of 8.10% from 2025 to 2034.

Once they lose their patent protection, specialty generics are generic equivalents of specialized medications. These medications are used to treat chronic or complicated medical disorders including rheumatoid arthritis, epilepsy, HIV, hepatitis, multiple sclerosis, cancer, autoimmune diseases, and epilepsy. Specialty generics are less expensive than their branded counterparts since they don't need to incur high research and marketing expenses.

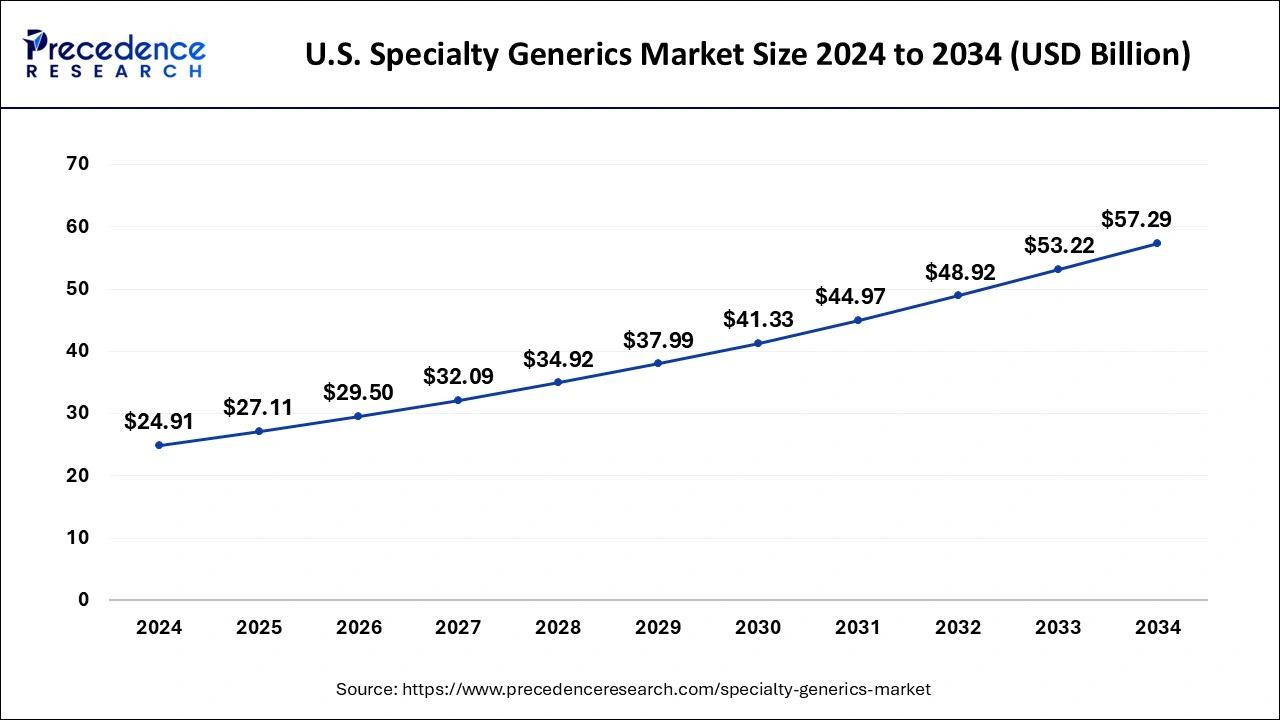

The U.S. specialty generics market size was exhibited at USD 24.91 billion in 2024 and is projected to be worth around USD 57.29 billion by 2034, growing at a CAGR of 8.69% from 2025 to 2034.

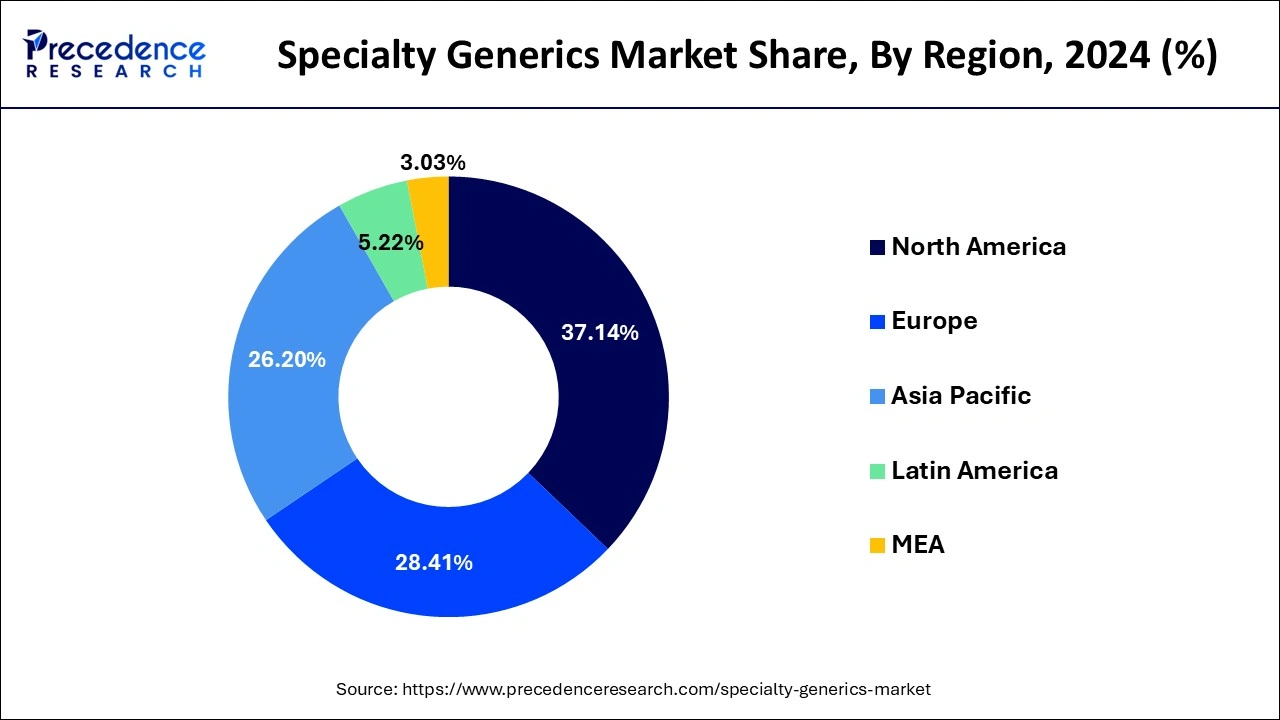

Due to favorable regulatory rules governing the approval of new drugs, North America dominated the specialty generics market and accounted for the greatest revenue share of 37.14% in 2024. The American FDA has launched a number of attempts to streamline the entire approval procedure. Thus, the Hatch-Waxman act's Generic Drug User Fee Amendments (GDUFA) were introduced by the U.S. FDA to hasten the distribution of affordable, safe, and effective generic medications to the general population.

As a result, the major producers are always working to commercialize specialty generic medications on the market. For instance, LYVISPAH (baclofen), a specialty drug authorized by the U.S. FDA for the treatment of multiple sclerosis and other spinal cord diseases, was introduced by Amneal Pharmaceuticals Inc. in June 2022.

The market for specialty generics is anticipated to expand quickly in Asia Pacific over the projected period. High unmet low-cost medical demands and the introduction of new generic medications in the region are the key drivers of the region's growth. A generic version of Midostaurin with the brand name MSTARIN was introduced by BDR Pharma in 2021 for the treatment of uncommon tumors such Acute Myeloid Leukemia (AML).

Specialty generics are affordable drugs used to treat chronic, complicated diseases like cancer, diabetes, HIV, multiple sclerosis, and rheumatoid arthritis. Additionally, some drugs require specialist handling and administration, often by injection or infusion. When the patent on a specialty medicine runs out, a generic version replaces it. Complex clinical disorders including cancer, HIV, hepatitis, and multiple sclerosis are treated using low-cost oral or injectable specialty generics. They are frequently thought of as biologics, which are injectable or infused substances made from live cells.

Generic pharmaceuticals cost between 80% and 85% less than brand-name drugs, according to the US food and drug administration, since they do not have high manufacturing and marketing expenses. This has increased the amount of prescription pharmaceuticals that are no longer protected by a patent, which is projected to fuel the specialty generic drugs industry's long-term expansion.

Early patent expirations are anticipated to hasten the increase of worldwide demand. Additionally, a rise in cancer patients is anticipated to promote total industry development. The introduction of affordable drugs for the treatment of a number of illnesses, including sclerosis, cancer, and other infectious diseases; an increase in the number of off-patent specialty drugs; and the early patent expirations of a number of branded specialty drugs are just a few of the factors expected to accelerate the growth of the specialty generics market over the course of the forecast period.

The FDA approved CGMP guidelines for handling specialty generics. Additionally, these specialty generic pharmaceuticals are less expensive than commercially available medications, which results in much-reduced profit margins for manufacturers. Additionally, the FDA is working harder to enforce GMP on suppliers to stop them from profiting from generic goods. This is seen to be the main obstacle preventing the growth of the global specialty generics market.

An aging population, an increase in the prevalence of numerous life-threatening diseases like cancer, multiple sclerosis, HIV, and others, cost-cutting initiatives taken by well-known healthcare providers, demand from emerging markets, and other factors are all driving the global specialty generics industry at the moment. Additionally, the FDA is pushing harder to have suppliers follow GMP in order to prevent them from making money off of generic products. This is considered to be the key barrier inhibiting the expansion of the worldwide market for specialty generics.

The global specialty generics market is currently being driven by an aging population, an increase in the prevalence of numerous life-threatening diseases like cancer, multiple sclerosis, HIV, and others, cost-saving measures taken by renowned healthcare providers, demand from emerging markets, and other factors.

| Report Coverage | Details |

| Market Size in 2025 | USD 102.92 Billion |

| Market Size in 2024 | USD 95.12 Billion |

| Market Size by 2034 | USD 207.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in chronic illness

The increase in chronic illnesses has driven market growth. Chronic diseases are persistent illnesses that frequently have no cure. It is, however, sometimes treatable and manageable. Chronic illnesses are caused by a changing lifestyle, poor eating habits, and failure to maintain a healthy weight; a few more protracted chronic infections increase the likelihood of developing cancer. The need for specialty generics to treat complicated chronic illnesses is growing as a result of increased exposure to these disorders.

For instance, a study report released by American Action Forum in September 2020 found that chronic illness incidence and costs are increasing and will continue to do so as the frequency of the condition among children and young adults’ increases. Chronic disease is a serious problem in healthcare since the rising overall cost of chronic disease in the United States now totals $3.7 trillion annually, or around 19.6 percent of the country's gross domestic product. As a result, the market for specialty generic drugs is expanding due to the rising frequency of chronic disorders.

Concentrated with fewer participants.

Due to their sophisticated production needs, greater capital expenditures, and generally lower quantities as a result of a smaller patient population, specialist generics have a more competitive market than regular generics. This leads to better profits than standard generics and a lesser price drop relative to branded medicine. Specialty generic drugs typically need prior authorization to be ordered, specific handling, administration, and monitoring.

The Injectables segment accounted for the biggest revenue share of 61% in 2023, dominating the market for specialty generics. The advantages of injectables, such as long-term effects and quick absorption, which increase patient compliance and acceptance, are to blame for the segment's domination. Furthermore, due to rising product approval and greater market penetration, the injectables category is anticipated to develop at the quickest rate throughout the projection period. This clearance makes it simple for cancer patients to obtain affordable specialty generic medications, boosting the number of prescriptions.

Due to the rising frequency of inflammatory illnesses including rheumatoid arthritis, the inflammatory conditions category led the market for specialty generics in 2023 and represented the biggest revenue share of 28%. Around 350 million individuals worldwide are estimated to suffer from arthritis, according to the Global RA Network. Additionally, the NHS reports that there are over 10 million people who have arthritis. Because of this, important companies have been able to increase their market share in this industry because of the growth in the occurrence of inflammatory disorders.

Due to an increase in the disease burden of cancer and the ANDA product approvals for generic Xtandi (Enzalutamide) for the treatment of castration-resistant prostate cancer in May 2021, the oncology segment is anticipated to have considerable growth throughout the assessment period. According to Globocan, the adoption of the western lifestyle, together with excessive consumption of alcohol, smoking, bad dietary choices, and physical inactivity, will lead to an increase in the number of new cancer cases of 47% from 2020, reaching 28.4 million during the next two decades. The need for specialty generics is anticipated to increase as cancer cases rise.

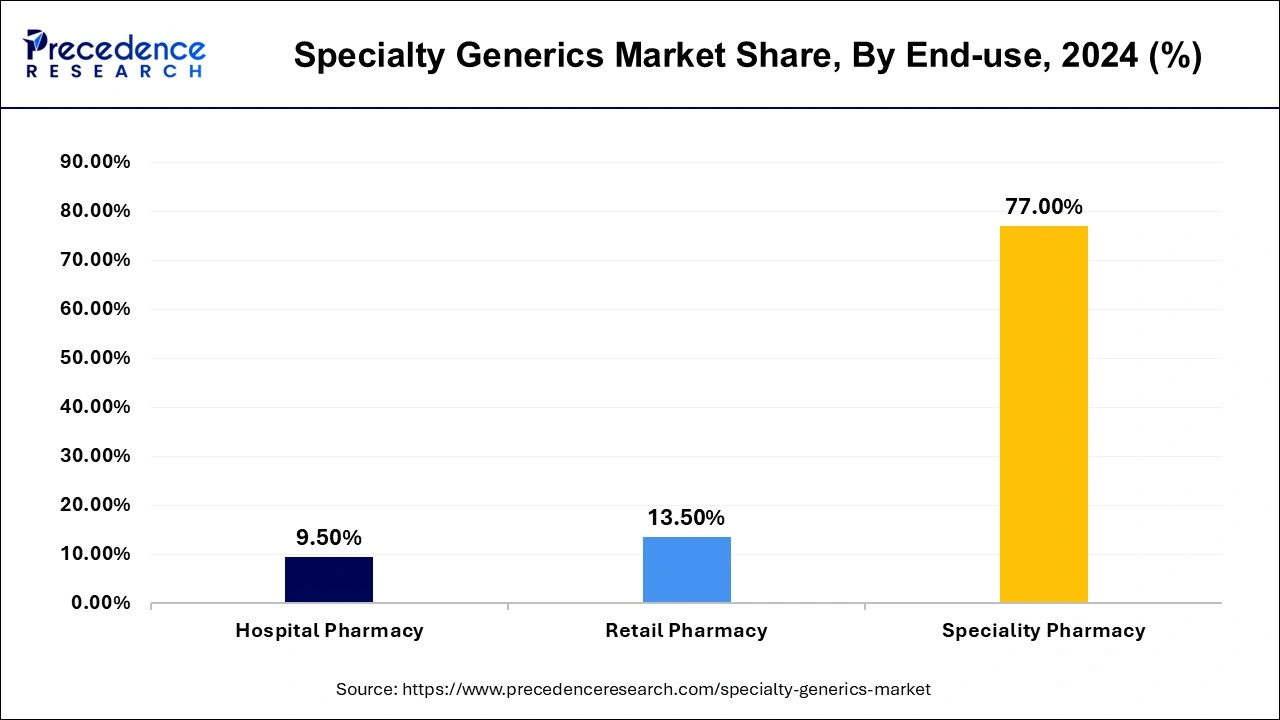

With a 77% revenue share in 2023, the specialty pharmacy category led the market for specialty generics. During the anticipated period, the market is anticipated to expand at a profitable rate. Due to low distribution costs and convenient access to medications, major specialty generic manufacturers and insurance companies select specialty pharmacies for the distribution of their goods. The top five specialty pharmacies in the world, according to the drug channels Institute's research from 2021, are CVS specialty, Accredo, Optum specialty pharmacy, Walgreens shops, and Humana specialty pharmacy.

In addition, compared to branded items, specialty generic medication inventory is less expensive and gives a high return on investment. Timely delivery, maximizing patient access, and efficient distribution management of specialty pharmacies all draw customers to them and help the market expand.

By Type

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

March 2024

May 2024

February 2024