April 2025

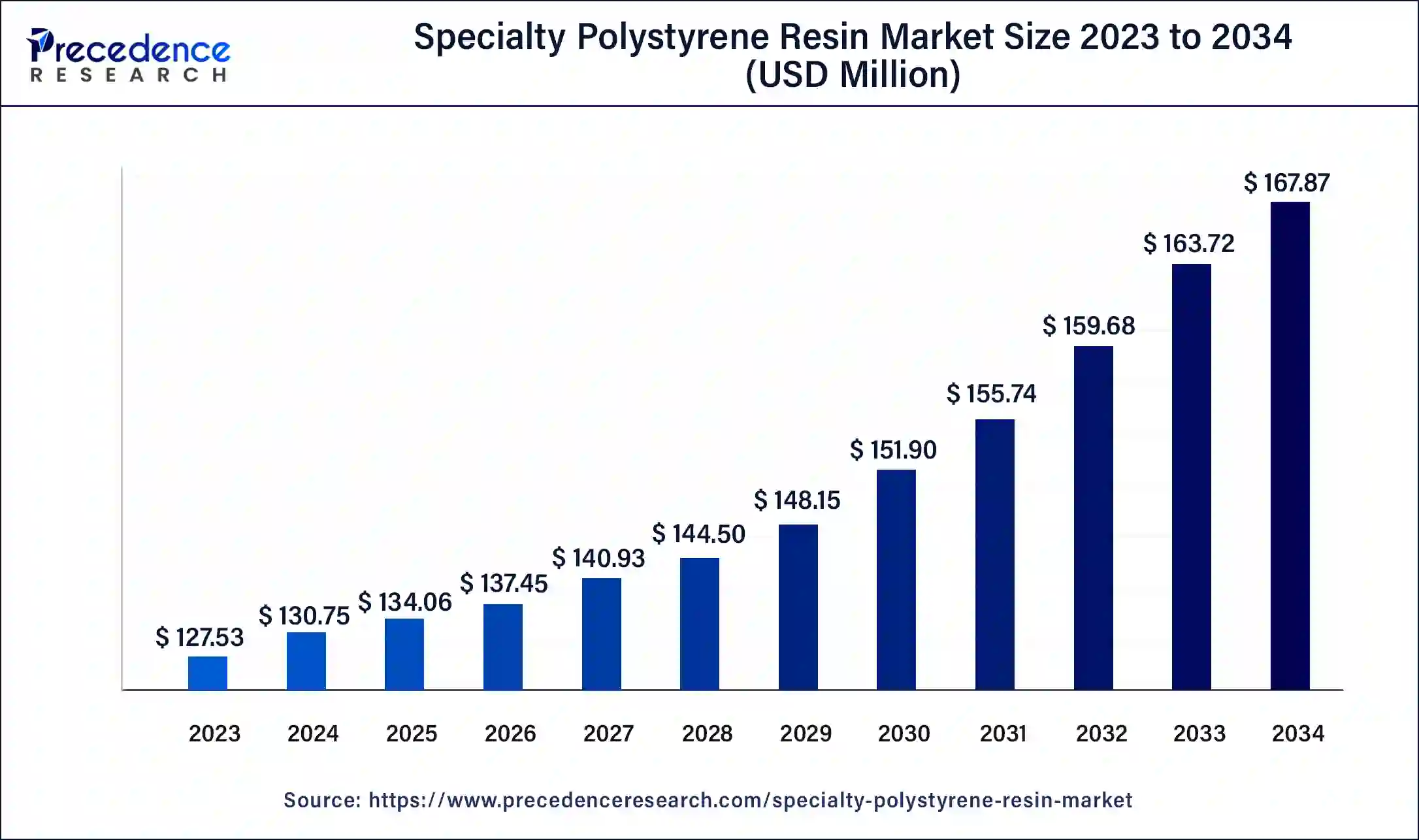

The global specialty polystyrene resin market size was USD 127.53 million in 2023, calculated at USD 130.75 million in 2024 and is expected to be worth around USD 167.87 million by 2034. The market is slated to expand at 2.53% CAGR from 2024 to 2034.

The global specialty polystyrene resin market size is worth around USD 130.75 million in 2024 and is anticipated to reach around USD 167.87 million by 2034, growing at a CAGR of 2.53% over the forecast period 2024 to 2034. Rising usage of eco-friendly polystyrene by end-use industries to reduce greenhouse gas emissions is the key factor driving the growth of the specialty polystyrene resin market.

Specialty polystyrenes are the kind of polystyrenes that are designed for high-performance applications. These are fabricated with special additives and raw materials using innovative production techniques and improved properties. Specialty polystyrenes are a combination of less dense cells, and their cross-linked behavior gives them a better strength-to-weight ratio than polystyrene. The specialty polystyrene resin market products are utilized in different industries like automotive & transportation, building & construction, electrical & electronics, and others.

Role of AI in the specialty polystyrene resin market

AI particularly manages resin drying airflows and helps save energy in the specialty polystyrene resin market. AI-driven logic increases airflow through each active hopper plotted on changes in bulk flow and temperature. When the material at the bottom achieves the proper temperature, the Optimizer logic adjusts the airflow incrementally to match the actual processing rates along with the material drying requirements. Furthermore, AI-driven logic can dial back and rebalance the flows for unused hoppers, too.

| Report Coverage | Details |

| Market Size by 2034 | USD 167.87 Million |

| Market Size in 2024 | USD 130.75 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.53% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Function, Application, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing use of styrene polymers

The expansion of specialty polystyrene resin in the medical industry is mainly driven by the rising utilization of styrene polymers as PVC alternatives. Styrenic polymers are used primarily in the healthcare field to manufacture lightweight and high-performance medical devices. Additionally, the growing use of these polymers in the automotive industry is one of the key factors driving the growth of the market over the forecast period.

Strict quality requirements

Complying with strict quality needs raises the complexity and cost of the production process of the specialty polystyrene resin market application, particularly in the electronic and automotive sectors. Moreover, investments in quality control and technology are important to meet these criteria.

Development of sustainable and biodegradable materials

The focus on developing sustainable and environmentally friendly products generates a wide range of opportunities for the development of special biodegradable products in the specialty polystyrene resin market. These products can fulfill the increasing need for environmentally friendly options for several applications. Furthermore, major market players are investing in biodegradable alternatives such as polystyrene. This investment is meant to decrease the environmental impact of plastics.

The protection segment dominated the specialty polystyrene resin market in 2023. The dominance of the segment can be attributed to the increasing use of polystyrene to protect products or components from shock, handling, and damage during transportation. Protection can also be found in packaging materials, including corner doors, foam insulation, and fixtures. The protection can safeguard fragile items and valuables from loss during delivery and handling.

The durability segment is expected to grow at the fastest rate in the specialty polystyrene resin market over the forecast period. This is because the durability of the material stabilizes and minimizes the impact of changes in products to increase their shelf life which is necessary for the long-term suitability of products. Additionally, durability offers maximum impact resistance to products which can affect their quality positively.

The protective packaging segment led the specialty polystyrene resin market in 2023 and is expected to grow rapidly during the forecast period. The growth and dominance of this segment can be linked to the increasing demand for sustainable and efficient packaging solutions to meet consumer demand. Furthermore, increasing e-commerce coupled with the growing application of protective packaging solutions in various end-user industries is propelling segment growth further.

The packaging segment dominated the specialty polystyrene resin market in 2023 and is anticipated to grow further over the projected period. The dominance of the segment can be credited to the increasing trend toward sustainable and recyclable packaging. Furthermore, some companies are now manufacturing specialty polystyrene resins from post-consumer recycled polystyrene. These resins also have special properties that are similar to traditional resins, but they don't have hazardous environmental impacts.

Asia Pacific dominated the specialty polystyrene resin market in 2023. This growth can be attributed to the raised integration and connectivity in the region's developing nations. Furthermore, the ongoing emergence of new automotive, pharmaceutical, and packaging industries can strengthen this growth further. Also, the rising utilization of plastic packaging in several countries will contribute to the market.

North America is expected to show the fastest growth in the market over the studied period. This is because North America has a good consumer base for the specialty polystyrene resin market. This resin is popular due to its properties, such as flexibility and versatility. Moreover, there is a growth in online shopping, rising demand for effective protective products, and a desire for environmentally friendly and sustainable packaging solutions.

Segments Covered in the Report

By Function

By Application

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

January 2025

November 2024