December 2024

Spinal Implants and Devices Market (By Product: Spinal Fusion Devices, Thoracic & Lumbar Fusion Devices, Cervical Fusion Devices, Spinal Biologics, Allografts, Xenografts, DBM, BMP, Synthetic Bone Grafts, Vertebral Compression Fracture Treatment Devices, Non-Fusion Devices, Spinal Bone Growth Stimulators; By Technology; By Surgery Type; By Procedure Type) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

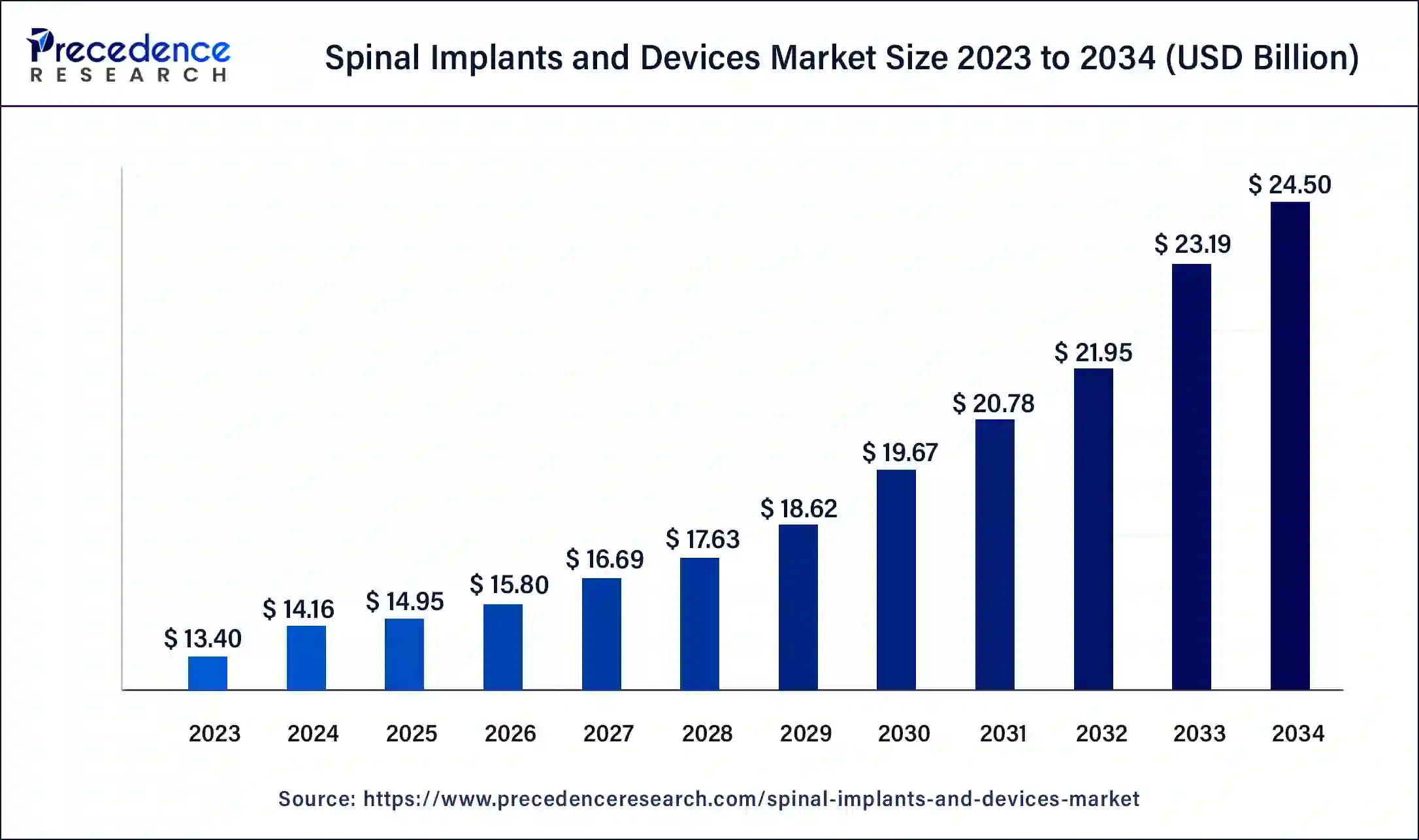

The global spinal implants and devices market size was USD 13.40 billion in 2023, calculated at USD 14.16 billion in 2024 and is expected to reach around USD 24.50 billion by 2034, expanding at a CAGR of 5.63% from 2024 to 2034. The North America spinal implants and devices market size reached USD 6.50 billion in 2023. Growing adoption rates due to the advantages of minimally invasive devices including less scarring, faster recovery, and less hospital stay duration, are key drivers of the spinal implants and devices market.

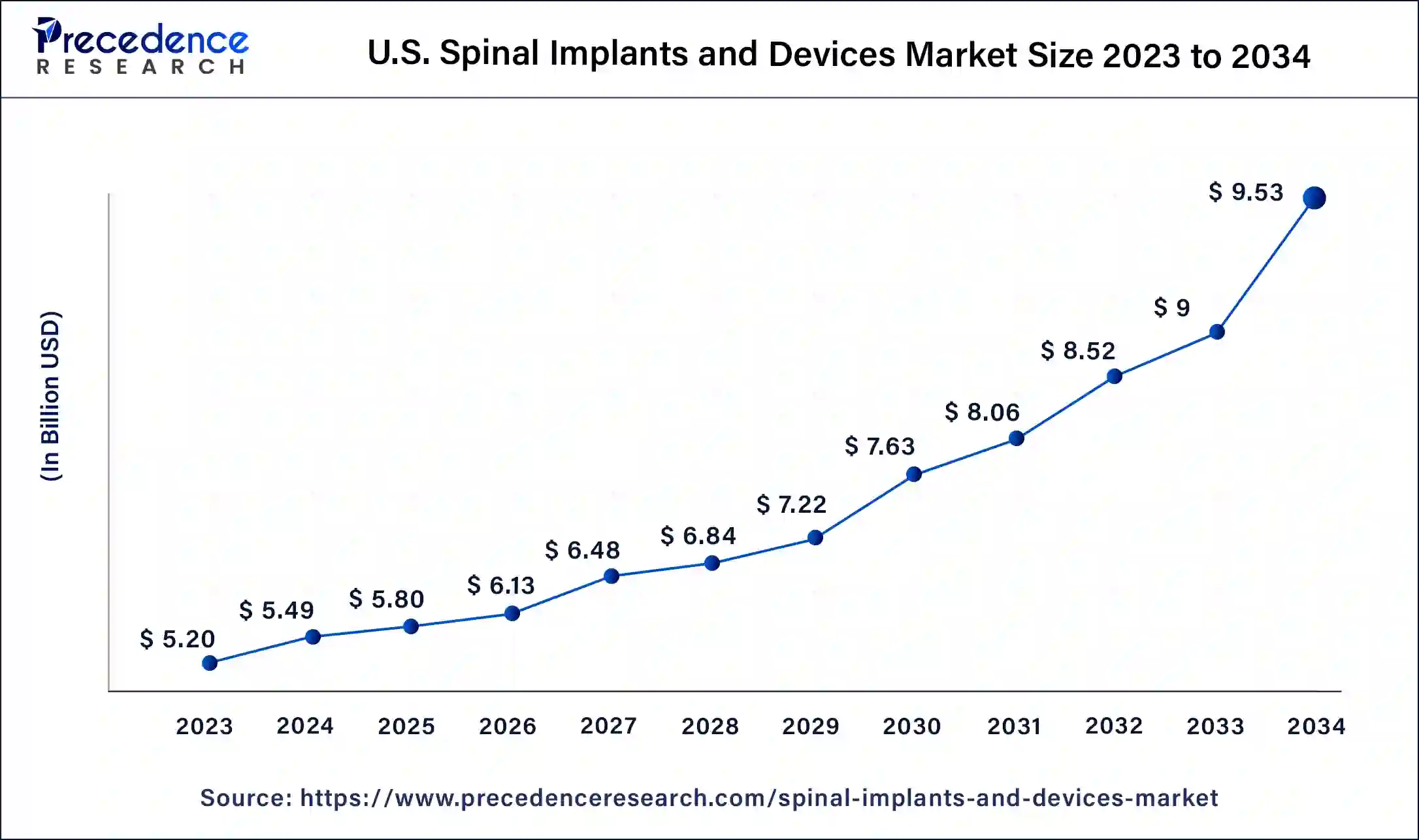

The U.S. spinal implants and devices market size was exhibited at USD 5.20 billion in 2023 and is projected to be worth around USD 9.53 billion by 2034, poised to grow at a CAGR of 5.66% from 2024 to 2034.

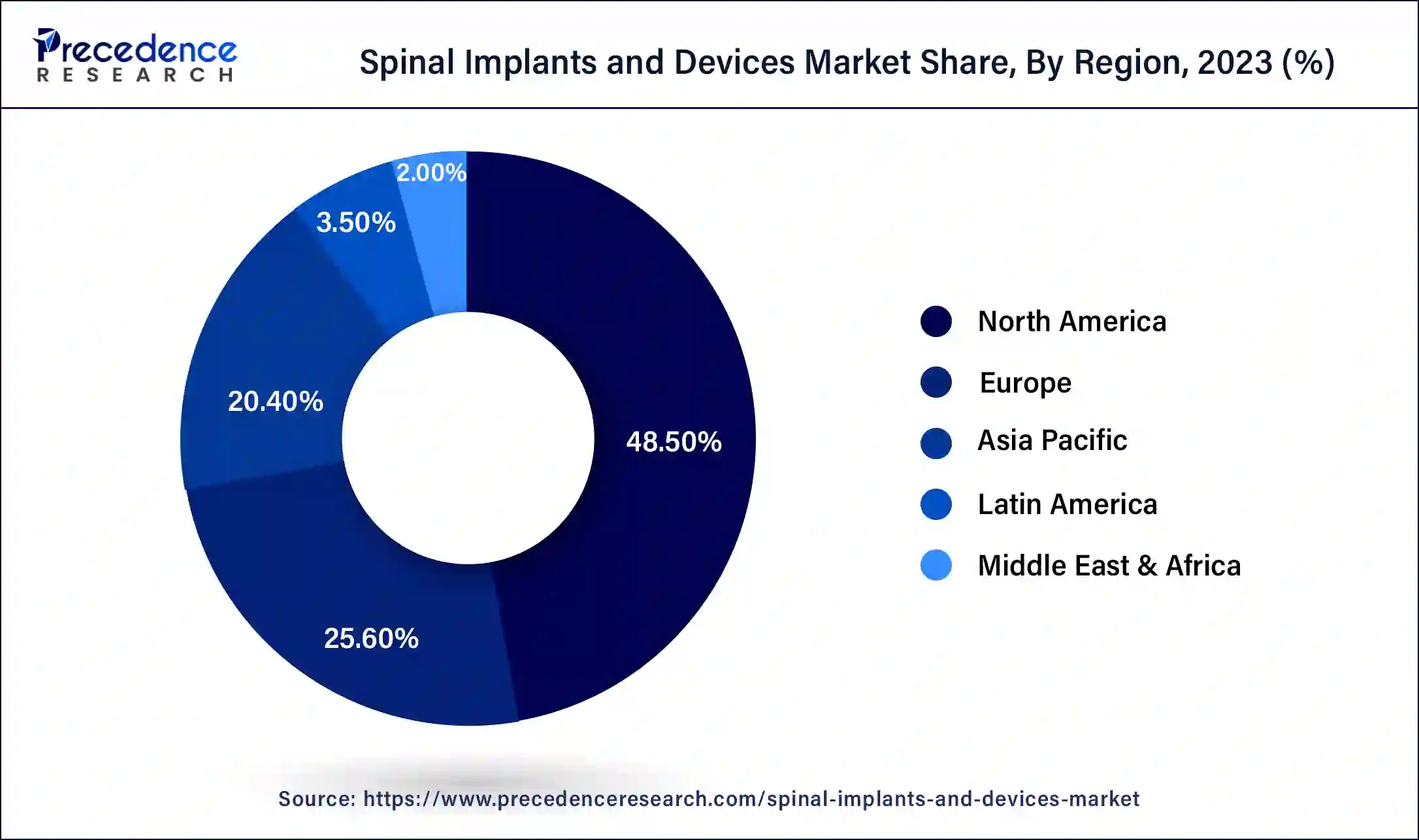

North America dominated the spinal implants and devices market in 2023. The regions growth is anticipated to be fueled by technological advancements, a rise in FDA approvals, an aging demographic, and the high incidence of spinal disorders. In the U.S., the spine market has seen rapid growth due to these technological innovations, which are also accelerating local market expansion. Also, healthcare reimbursement policies have significantly impacted the country's demand for spinal implants.

Asia Pacific is expected to witness the fastest growth in the spinal implants and devices market over the studied period. Several factors are driving the growth of the market, such as the rising prevalence of spinal disorders, the modernization of healthcare infrastructure, and an increasing elderly population. The region boasts a strong network of medical device firms, research institutions, and healthcare facilities, all of which play a key role in advancing spinal implant technologies. Also, the rise of local manufacturers can contribute to this progress.

The spinal implants and devices market in Japan is projected to expand at the fastest rate during the forecast period, driven by the aging population and a continuous demand for advanced medical technologies. Furthermore, government initiatives aimed at supporting the healthcare sector are expected to sustain this market growth.

Spinal implants are utilized to promote fusion, enhance spine stability, fortify the spinal column, and correct spinal deformities. These devices are employed in addressing conditions like scoliosis, spondylolisthesis, kyphosis, and fractures. The primary role of spinal implants is to aid in the fusion of two vertebrae and replace the natural disc material. The spinal implants and devices market aims to immobilize vertebrae by eliminating or greatly reducing pain caused by abnormal vertebral movements. Treatment options for spinal issues are continuously advancing with the advent of modern spinal implants and devices. Additionally, these implants and devices are becoming extensively effective and are recommended choices for treating spinal misalignments or degenerative changes.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.50 Billion |

| Market Size in 2023 | USD 13.40 Billion |

| Market Size in 2024 | USD 14.16 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.63% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Technology, Surgery Type, Procedure Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing prevalence of spinal disorders in young and senior populations

The rising prevalence of spinal disorders, such as degenerative disc disease, scoliosis, and spondylolisthesis, among both younger and older individuals is a key driver for the growth of the spinal implants and devices market. As people age, the wear and tear on their bones, muscles, and joints can lead to conditions like osteoporosis, herniated discs, and spinal stenosis. However, these conditions often result in chronic pain, decreased mobility, and a diminished quality of life, which can prompt many to opt for surgical interventions, including spinal implant procedures. The demand for spinal implants is anticipated to persist, fueled by an aging population and advancements in medical technology.

Lack of skilled physicians

The spinal implants and devices market is projected to experience slow growth over the forecast period, primarily due to the increasing costs of treatment methods. Additionally, the market may encounter further obstacles shortly, which include a shortage of qualified doctors and a lack of awareness and education about these medical advancements.

3D-printed spinal implants

The spinal implants and devices market is being driven by an increasing focus on developing custom implants. Expertise is required for the anatomically complex 3D printing of spinal implants. Advancements in medical imaging and instrumentation have elevated the 3D approach to a globally recognized method for spine defect repair. These advanced techniques, often used alone or alongside conventional methods, yield better results. Furthermore, Additive manufacturing technology, commonly known as 3D printing, is gaining prominence and popularity in the medical devices industry. Hence, the rising demand for 3D printing technology in manufacturing is expected to propel market growth during the forecast period.

The spinal fusion devices segment dominated the spinal implants and devices market in 2023. Spinal fusion surgeries are frequently conducted to address various spinal conditions, including degenerative disc disease, spondylolisthesis, and fractures. These procedures utilize spinal fusion devices designed to stabilize and align the spine by encouraging bone growth and recovery. Recent technological advancements have led to the creation of advanced fusion devices, such as those that preserve motion and those used in minimally invasive techniques. These innovations have contributed to a higher adoption rate among orthopedic surgeons.

The vertebral compression fracture treatment devices segment is expected to grow at a faster rate in the spinal implants and devices market over the forecast period. This can be attributed to the rise in spine disorders and the growing preference for minimally invasive surgeries among patients is driving demand. Additionally, numerous major companies are expected to drive segment growth by pursuing regulatory approvals, conducting clinical trials, and launching new products to broaden their geographical reach. This implant comes with a sterile, single-use surgical kit intended to ensure precise placement and minimize infection risks.

The laminotomy segment led the spinal implants and devices market in 2023. Laminotomy is often carried out alongside other spinal procedures like discectomy or spinal fusion. The prevalence of these decompressive surgeries is attributed to the high occurrence of conditions such as spinal stenosis, which frequently requires surgical intervention to relieve symptoms and enhance patients' quality of life. The primary driving force behind laminotomy procedures in spinal implants is the need to treat specific issues like spinal stenosis or the narrowing of the spinal canal.

The foraminotomy segment is expected to show the fastest growth in the spinal implants and devices market during the forecast period. The segment is expected to be propelled by the growing acceptance of minimally invasive surgeries (MIS) among patients. This technique is primarily used to treat conditions such as foraminal stenosis and pinched nerves. Most patients experience successful outcomes with this procedure, and complications from foraminotomy are rare.

The spinal fusion & fixation technologies segment dominated the global spinal implants and devices market. The significant market share of this segment can be attributed to the rapid adoption of fusion and fixation techniques, driven by increased awareness of spinal health and improved diagnostic capabilities that support early detection of spinal problems. Furthermore, Manufacturers of spinal implants are introducing cutting-edge technological innovations in biomaterials by focusing on biocompatibility, durability, and flexibility. This drives the development of next-generation spinal fusion and fixation devices, meeting the evolving needs of the global healthcare market. These advancements are expected to boost the segment's growth further.

The motion preservation technologies segment is anticipated to grow at the fastest rate in the spinal implants and devices market over the forecast period. This technology provides a superior alternative for spinal fusion to individuals suffering from lumbar spinal stenosis, degenerative disc disease, and facet pain. It is categorized into total disc replacement (TDR), posterior dynamic devices, prosthetic nuclei, and facet replacement.

The open surgery segment led the spinal implants and devices market in 2023. Open surgery comes with several drawbacks, including extended operating times and high invasiveness. Hence, many of these procedures result in significant blood loss, raising the risk of damage or infection to healthy tissues. This is linked to an increase in open spine surgeries and a preference for them among healthcare professionals. Another key factor driving the segment's growth is the necessity of open surgery for certain spine treatments, such as the placement of spinal implants.

The minimally invasive surgery segment is anticipated to grow at the fastest rate in the spinal implants and devices market over the forecast period. This trend is associated with the increasing prevalence of spinal disorders and an aging global population. Moreover, Collaborative international medical research and development efforts are driving a push towards advanced minimally invasive spinal implant technologies, which established the industry as a global leader in surgical innovation.

Segment Covered in the Report

By Product

By Technology

By Surgery Type

By Procedure Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

December 2024

August 2024