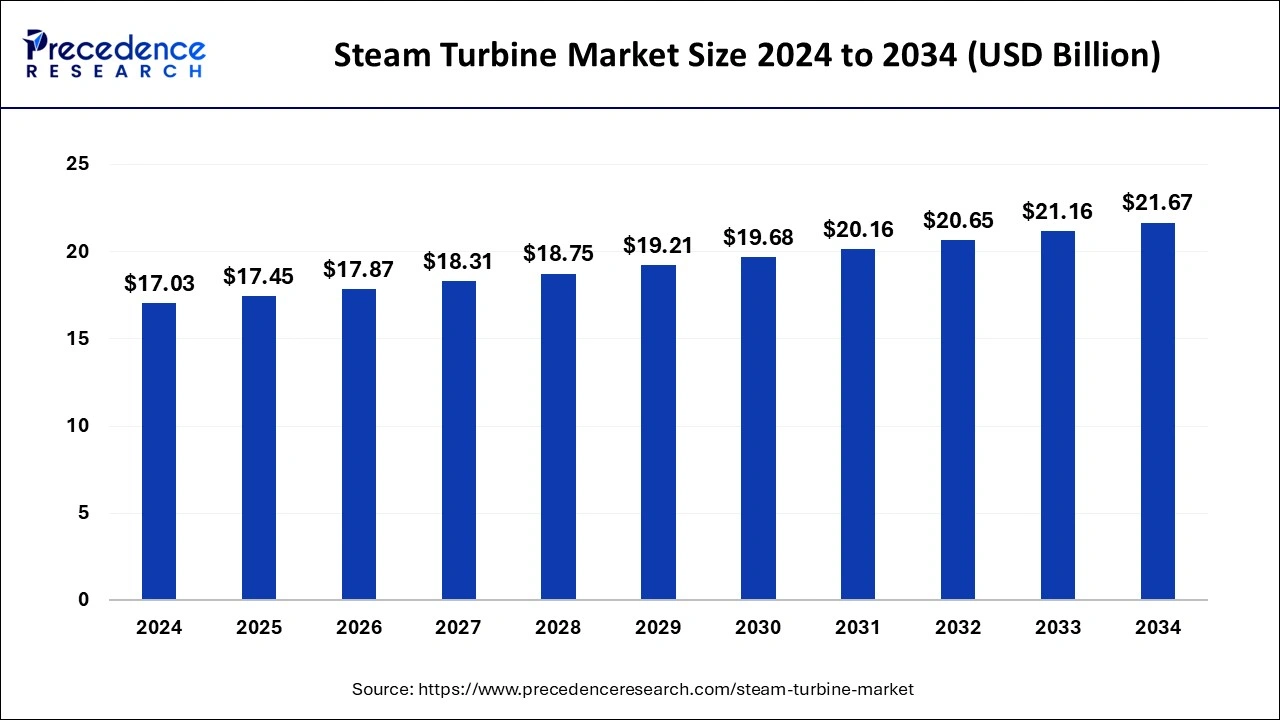

The global steam turbine market size is estimated at USD 17.45 billion in 2025 and is predicted to reach around USD 21.67 billion by 2034, accelerating at a CAGR of 2.44% from 2025 to 2034. The Asia Pacific steam turbine market size surpassed USD 12.39 billion in 2025 and is expanding at a CAGR of 2.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global steam turbine market size was estimated at USD 17.03 billion in 2024 and is anticipated to reach around USD 21.67 billion by 2034, expanding at a CAGR of 2.44% from 2025 to 2034.

Artificial intelligence (AI) based modeling and optimization analysis is conducted to improve the operation excellence of the industrial scale steam turbines that promote higher energy efficiency and contribute to the net-zero target from the energy sector. AI can help power plants to reduce their environmental impact by customizing fuel consumption processes and emission control systems. AI algorithms can analyze data from sensors and control systems to improve fuel-to-air ratios, enhance overall energy efficiency, and reduce emissions. These factors help the growth of the steam turbine market.

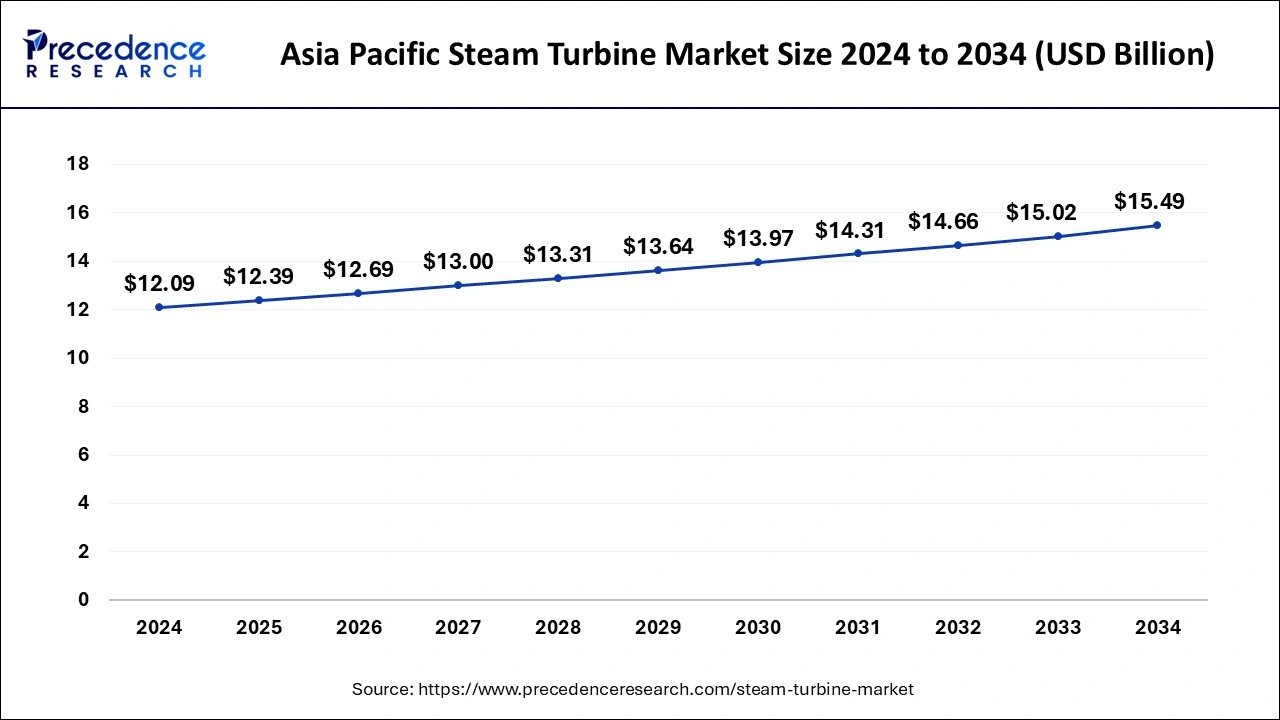

The Asia Pacific steam turbine market size was evaluated at USD 12.09 billion in 2024 and is predicted to be worth around USD 15.49 billion by 2034, rising at a CAGR of 2.50% from 2025 to 2034.

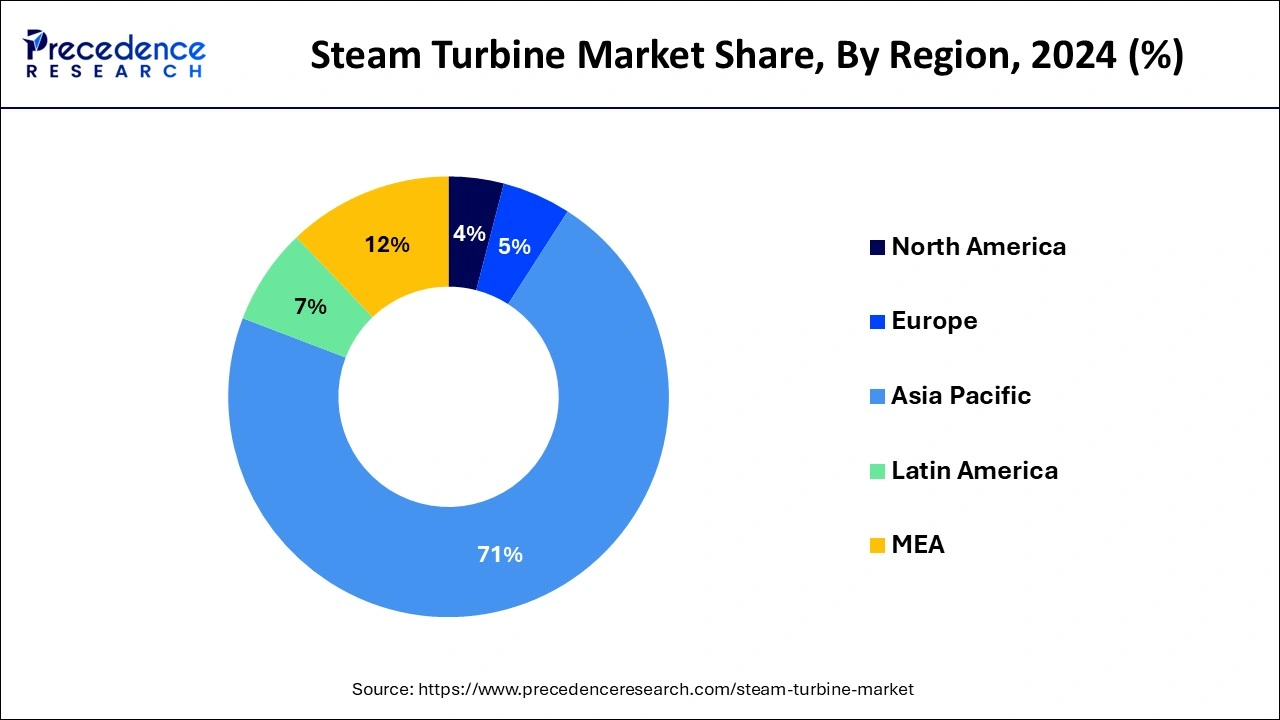

Asia Pacific led the global steam turbine market with the highest market share of 71% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to a shift in focus away from traditional energy sources and toward renewable energy sources.

North America is projected to expand at the fastest CAGR during the forecast period. Due to number of fossil fuel and biomass fired power plants, the Asia-Pacific is anticipated to maintain its market leadership in the market. The demand for steam turbines in China and India has been fueled by the rapid rate of industrial growth in both the nations.

Europe is expected to grow significantly in the steam turbine market during the forecast period. Various energy power plants in Europe are being replaced with new ones to enhance emissions as well as efficiency. At the same time, the old coal-fired power plants are also being replaced with biomass or gas plants to improve the generation of electricity. Furthermore, to support these developments, various policies as well as investments are also being provided by the government. Thus, all these factors enhance the market growth.

UK

The energy power plants in the UK are advancing with the development of new power plants. At the same time, some of the old power plants are also being replaced with new ones. These developments are enhancing the energy generation efficiency in the UK. Furthermore, with the use of polices laid by government these achievements are being conducted at a faster rate.

Germany

In Germany, to improve energy generation, as well as emissions, the old coal-fired power plants are being substituted with new ones. At the same time, to make the substitution faster as well as more effective, support from the government is also being provided.

| Report Coverage | Details |

| Market Size in 2025 | USD 23.48 Billion |

| Market Size by 2034 | USD 23.48 Billion |

| Growth Rate from 2025 to 2034 | 2.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Design, Exhaust, Fuel, End Use, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the design, the impulse segment dominated the global steam turbine market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The compact size, cheap operating and maintenance costs are only a few of the key elements that will boost product adoption.

On the other hand, the reaction segment is estimated to be the most opportunistic segment during the forecast period. The reaction steam turbine market share will be driven by its ability to offer high efficiency when compared to impulse turbines, as well as increased utility sector investments aimed at limiting electricity demand supply imbalances.

Based on the exhaust, the condensing segment dominated the global steam turbine market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The condensing steam turbine segment will be driven by ongoing investments in new generating capacity expansions to fulfill the ever-increasing power demand from industries. Other significant underlying drivers that will boost product demand include increasing penetration of cogeneration systems and rising industrialization throughout the developing regions.

On the other hand, the non-condensing segment is estimated to be the most opportunistic segment during the forecast period. The segment’s expansion will be fueled by factors such as ease of installation and its capacity to endure temperature variations. These systems provide steam at a predetermined pressure, making them ideal for the processing industry.

Based on the fuel, the biomass segment dominated the global steam turbine market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The segment’s future will be boosted by increased efforts to reduce carbon footprints, as well as a supportive regulatory environment. The captive power generation and combined heat and power systems are becoming more widely deployed, which will help market to grow at a rapid pace.

On the other hand, the geothermal segment is estimated to be the most opportunistic segment during the forecast period. Various measures have been launched by regulators to encourage the adoption of non-conventional energy resources, which will accelerate product development. Its potential to deliver dependable electricity with a low carbon footprint has encouraged even more investment in new geothermal capacity expansions.

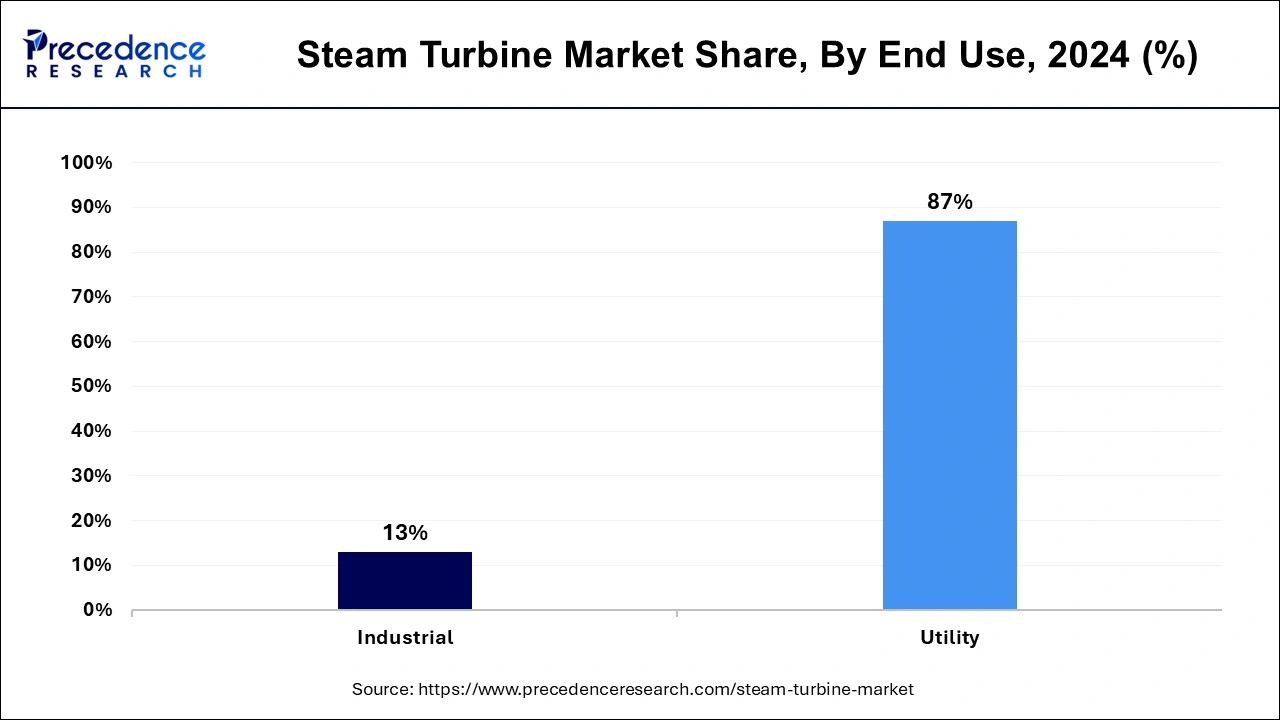

The utility segment has held the major market share of 87% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The segment will increase as combined cycle technology is deployed more widely and demand for onsite power generation equipment rises.

The industrial segment is projected to grow at a notable CAGR during the forecast period. The product adoption will be aided in the coming year by increased investment in the establishment of new industrial centers.

By technology, the steam cycle segment accounted for a considerable market share in 2024. The Rankine or steam cycle system is a standard choice for power generation. The technology is well-established, highly efficient, and versatile, taking up a dominant market share. With continued advancements in design and operation, steam cycle-based turbines offer high thermal efficiency, especially when used in tandem with combined cycle systems.

By technology, the combined cycle segment is predicted to witness significant growth in the market over the forecast period. Combined cycle gas turbines are becoming an eco-friendly alternative to standard steam turbines. As international mandates and growing pressure to tackle climate change grows, countries are switching over to cleaner energy sources with combined cycle steam turbines offering high efficiency, flexibility in load handling, and, crucially, significantly lower emissions of greenhouse gases such as carbon dioxide, sulfur dioxide, and various nitrogen oxides.

In June 2024, the contractual hanSumitomo Corporation (Sumitomo) officially announcedTauhara Geothermal Power Station in New Zealand to Contact Energy was officially announced by Sumitin June 2024. The Tauhara Geothermal Power Station is geothermal steam turbine generator.

By Design

By Exhaust

By Fuel

By End Use

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client