January 2025

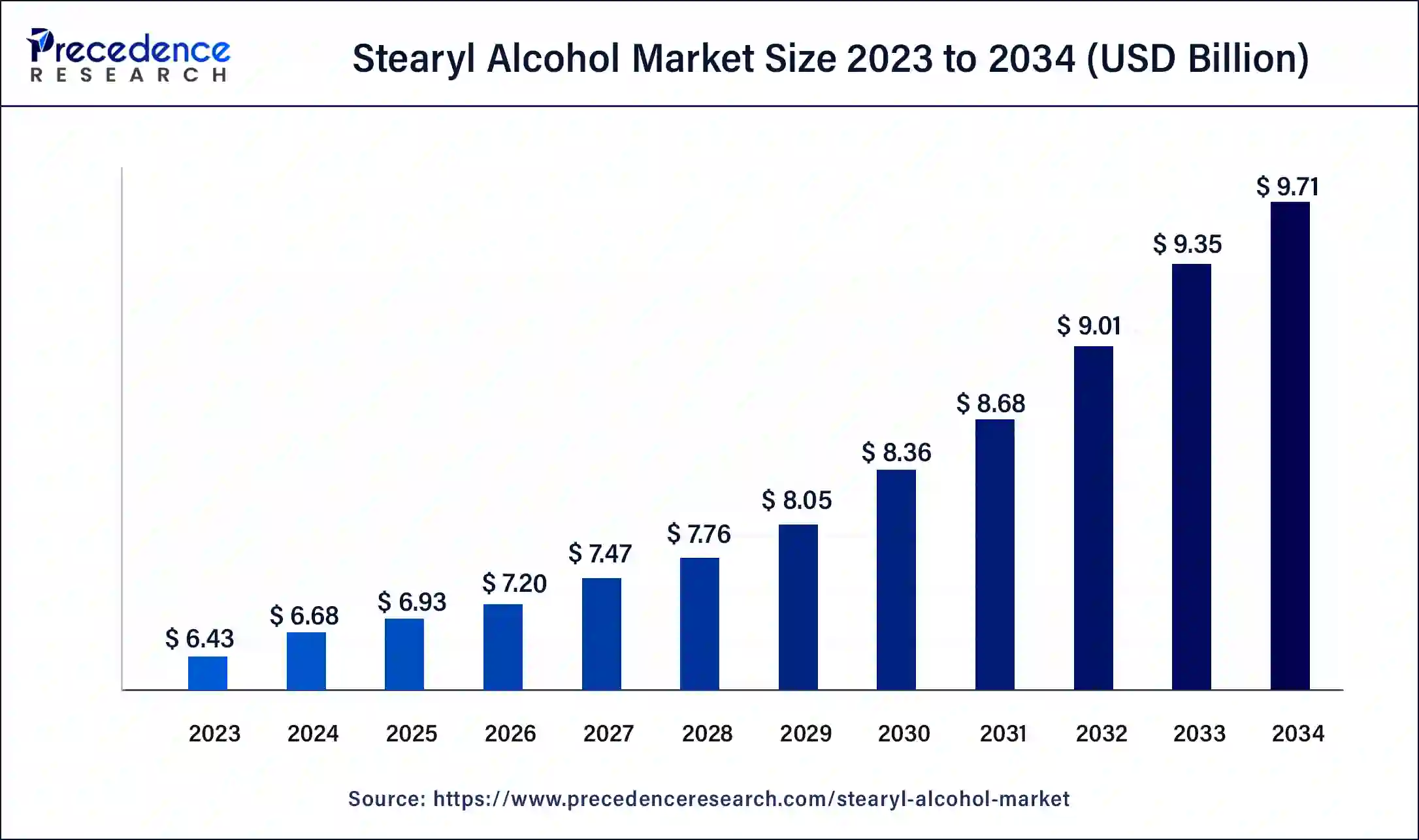

The global stearyl alcohol market size surpassed USD 6.43 billion in 2023 and is estimated to increase from USD 6.68 billion in 2024 to approximately USD 9.71 billion by 2034. It is projected to grow at a CAGR of 3.82% from 2024 to 2034.

The global stearyl alcohol market size is projected to be worth around USD 9.71 billion by 2034 from USD 6.68 billion in 2024, at a CAGR of 3.82% from 2024 to 2034. The growing developments in the pharmaceutical industry around the world has driven the growth of stearyl alcohol market.

The stearyl alcohol market is one of the most important industries in the chemical domain. This industry deals in manufacturing and distributing stearyl alcohol across the world. The stearyl alcohols are also known as cetostearyl alcohol and octadecanol. This industry is driven by the growing demand for foam boosters in the pharmaceutical market. There are various forms of stearyl alcohol that mainly consist of flakes and granules. The applications of stearyl alcohol include emulsion stabilizer, fragrance ingredient, emulsifying agent, foam booster, viscosity modifier, and emollient. These alcohols are used in various end-user industries of cosmetics and personal care, pharmaceuticals, food & beverages, and some others.

According to data published by the National Bureau of Statistics and the China Alcoholic Drinks Association, in 2023, the total sales revenue of liquor enterprises above designated size nationwide reached 232.8 billion yuan, which is an increase of around 7.5% from the previous year.

What is the role of AI in the Stearyl Alcohol Market?

The advancement in AI technology is crucial for the development of numerous industries that exist currently. Most of the stearyl alcohol companies have started integrating AI in their laboratories and manufacturing plants to improve the quality of products along with enhancing the efficiency of workers. Also, the integration of AI in this industry can help in advanced research, molecular modeling, quality testing, demand forecasting, and others.

Top 10 Cosmetics Brands

| Report Coverage | Details |

| Market Size by 2034 | USD 9.71 Billion |

| Market Size in 2023 | USD 6.43 Billion |

| Market Size in 2024 | USD 6.68 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.82% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for automotive lubricants

The automotive trend is rapidly increasing around the world. With the rising development in the automotive industry, the demand for cars has increased due to several reasons, such as urbanization, status maintenance, rising disposable income, consumer preferences, long trips, and others. Due to the growing sales and production of vehicles around the world, the demand for automotive lubricants will also increase rapidly as lubricants are used in engine components for reducing friction, cooling, corrosion prevention, and others. These lubricants require stearyl alcohol as an important ingredient.

Regulatory concerns and volatility in raw material prices

The stearyl alcohol industry encounters various problems in everyday operations. There are several governmental regulations that forbid the use of stearyl alcohol in the cosmetics industry for manufacturing creams and lotions. Also, the fluctuations in the prices of raw materials of stearyl alcohol, such as palm oil and coconut oil, have created havoc among the market players. Thus, the strict government regulations, along with volatility in prices of raw materials, are expected to restrain the growth of the stearyl alcohol market during the forecast period.

Advancement in solvent injection technology

The stearyl alcohol industry has experienced several developments due to advancements in modern technologies. The rapid advancements in solvent injection techniques due to continuous research and development have gained traction in recent times. Solvent injection technology involves methanol or acetone as a solvent for dissolving lipid phases to derive high-quality stearyl alcohol. Thus, advancements in solvent injection techniques are expected to create ample growth opportunities for the stearyl alcohol market players in the years to come.

The granules segment held the dominant share of the stearyl alcohol market in 2023. The growing use of stearyl alcohol granules in manufacturing industrial lubricants has boosted market growth. Also, the rising application of octadecanol granules as a non-ionic surfactant in manufacturing plastics, candles, textiles, and other products has positively impacted market growth. Moreover, the demand for stearyl alcohol granules has increased as a chemical intermediate to increase the cleaning capacity of cleaners and detergents.

The flakes segment is expected to grow with the highest CAGR during the forecast period. The rising use of stearyl alcohol flakes in manufacturing perfumes has propelled the stearyl alcohol market growth. Also, the increasing application of flakes in the cosmetic industry to produce personal care products is driving the industry in a positive way. Moreover, the growing demand for flakes from the resin manufacturing industry due to its stability and miscibility has contributed significantly to industrial growth. Furthermore, the market growth is associated with the upsurge in demand for flakes in the shampoo manufacturing sector, along with its application in the food and beverage industry as an additive.

The emulsion stabilizer segment dominated the stearyl alcohol market in 2023. The rising application of emulsion stabilizers in the pharmaceutical and lubricant industry has boosted market growth. Also, the growing usage of emulsion stabilizers in cream and lotion manufacturing to improve appearance and texture has contributed significantly to market growth. Moreover, the increasing demand for emulsion stabilizers in the food and beverage industry as a preservative has accelerated the market growth. Furthermore, there is an upsurge in demand for emulsion stabilizers in the pharmaceutical sector to stabilize various formulated drugs.

The fragrance ingredient segment is expected to grow with the highest CAGR during the forecast period. The rising demand for long-lasting deodorants among people has increased the demand for stearyl alcohol. Also, the viscosity-controlling ability and chemical stability of stearyl alcohol are integral for manufacturing different varieties of fragrances. Moreover, stearyl alcohol is of a non-irritating and moderate nature that can be used in fragrances to suit sensitive skin, propelling the stearyl alcohol market growth. Furthermore, the market is growing due to the diffusion capabilities, along with aroma enhancement and longevity of stearyl alcohol.

The cosmetics and personal care segment held the dominant share of the stearyl alcohol market in 2023. The growing development in the personal care and cosmetics industry has driven the market growth. Also, the rising application of stearyl alcohol for manufacturing lotions and creams due to its emulsifying ability is likely to boost the industry in a positive way. Moreover, stearyl alcohol is used as an opacifier and moisturizing agent in the cosmetic industry, which is expected to foster industrial growth. Additionally, the growing usage of stearyl alcohol in hair treatment therapies due to its nourishing capabilities has increased its demand in the personal care industry.

The pharmaceutical segment is expected to grow at a notable rate during the forecast period. The rise in the number of pharmaceutical brands has increased the demand for stearyl alcohol, thereby driving the stearyl alcohol market growth. Also, the rising application of stearyl alcohol in manufacturing tablets, capsules, topical medicines and some others has propelled the market growth.

Moreover, the increasing demand for stearyl alcohol in the pharmaceutical industry due to its adaptability, stability, and inertness for enhancing the drug delivery systems along with maintaining medicinal dosages has contributed positively to industrial growth. Furthermore, the use of stearyl alcohol as a reference standard, along with the rising government initiatives to develop the pharmaceutical industry across the world, is beneficial.

Asia Pacific held the largest share of the stearyl alcohol market in 2023. The rising development in the pharmaceutical industry in countries such as India, Japan, Israel, China, South Korea, Taiwan, and others has increased the demand for stearyl alcohol. Also, the chemical industry in this region is supported by several government initiatives, which in turn boosts the market growth. Asia-Pacific region has a well-established cosmetics industry with several industrial giants such as Kao Corporation, AMOREPACIFIC, Kose, Lotus Herbals, Lakme, VLCC, Lifevision Cosmetics, Emami, Sugar Cosmetics, and some others that have increased the demand for stearyl alcohol to manufacture different variety of products. This region comprises several local companies of stearyl alcohol, such as Kao Corporation, Triveni Chemicals, VVF Ltd, KLK Oleo, and some others, which are constantly manufacturing high-grade stearyl alcohol for various end-users in the Asia Pacific region.

North America is anticipated to grow at a significant growth rate during the forecast period. This region consists of a well-established automotive industry with numerous companies such as Tesla, Ford, GM, Chevrolet, and others that have increased the demand for a variety of automotive lubricants, which in turn increases the demand for stearyl alcohol. The food and beverage industry in Canada and the U.S. is highly developed with the presence of various market players such as Tyson Foods, the Coca-Cola Company, General Mills, AB InBev, Diageo, Andrew Peller Ltd, Mark Anthony Group Inc, the Wine Group, Jackson Family Wines and some others has increased the applications of stearyl alcohol for various uses.

North America consists of various market players of stearyl Alcohol such as Acme Hardesty, Hallstar Beauty, Thomasnet, P&G Chemicals, and some others that are constantly engaged in manufacturing superior quality stearyl alcohol for numerous end-users. Also, these market giants are adopting several strategies such as partnerships, acquisitions, collaborations, launches and business expansions.

Segments Covered in the Report

By Form

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024