What is the Stepper Motors Market Size?

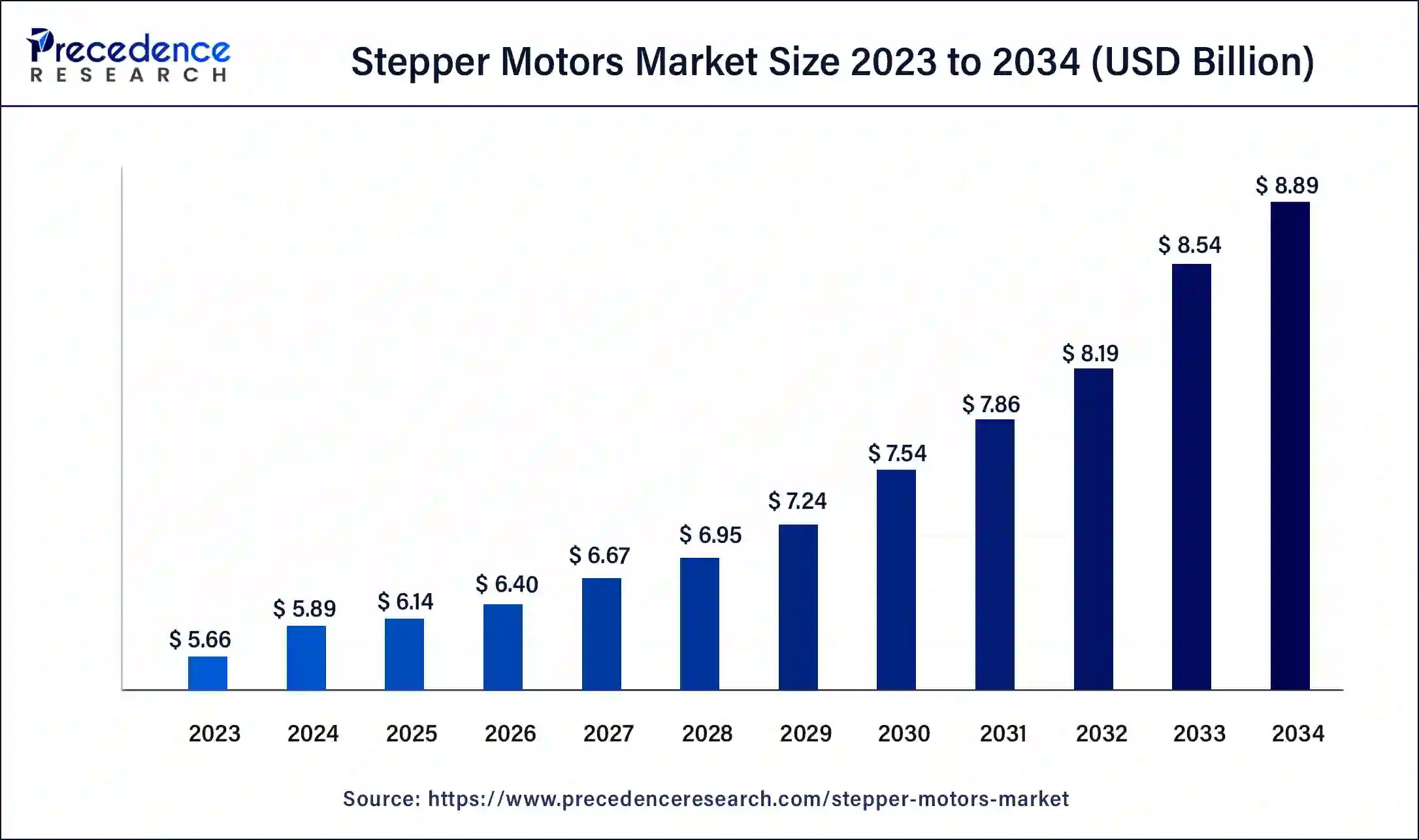

The global stepper motors market size is calculated at USD 6.14 billion in 2025 and is predicted to increase from USD 6.40 billion in 2026 to approximately USD 8.89 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034. The rising application of stepper motors in the semiconductor industry across the world is driving the growth of the stepper motors market.

Stepper Motors Market Key Takeaways

- The global stepper motors market was valued at USD 5.89 billion in 2024.

- It is projected to reach USD 8.89 billion by 2034.

- The stepper motors market is expected to grow at a CAGR of 4.20% from 2025 to 2034.

- Asia Pacific dominated the stepper motors market in 2024.

- North America is expected to attain the fastest rate of growth during the forecast period.

- By type, the hybrid motors segment led the market in 2024.

- By type, the permanent magnet segment is expected to be the fastest-growing segment during the forecast period.

- By motion control, the open loop dominated the market in 2024.

- By motion control, the closed-loop segment is expected to be the fastest-growing segment during the forecast period.

- By application, the automotive segment will dominate the market in 2024.

- By application, the industrial machinery segment is estimated to grow with the highest CAGR during the forecast period.

Market Overview

The stepper motors market is one of the important industries in the advanced materials sector. This industry mainly deals in the manufacturing and distribution of stepper motors around the globe. This industry consists of various types of stepper motors that mainly include a permanent magnet, hybrid, variable reluctance, and some others. The demand for stepper motors has increased in recent times with the growing number of packaging companies across the world. There are two types of motion controls in stepper motors: open-loop and closed-loop. Stepper motors are mainly found in industrial machinery, packaging machinery, medical equipment, automotive, and other industries. This industry is expected to grow exponentially with the growth of automation and robotics.

- In February 2022, Heason Technology announced the addition of a new integrated stepper motor manufactured by Novanta IMS in their product portfolio to expand its motion system integration segment.

Stepper Motors Market Growth Factors

- The demand for automobiles has increased the demand for stepper motors.

- Government initiatives to strengthen the medical devices industry have increased the application of stepper motors.

- The rise in the number of robotic applications across the world.

- There are growing investments from public and private sector entities to develop the stepper motors market.

- The developments in the camera lens quality have helped the stepper motors industry to grow significantly.

- The use of stepper motors in computing applications accelerates industrial growth.

- The advancements in technologies for manufacturing stepper motors.

- The ongoing research and development activities related to hybrid motors.

- The application of stepper motors due to several features such as excellent speed control, repeatability of movement, and precise positioning boosts the stepper motors market growth.

Stepper Motors Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.89 Billion |

| Market Size in 2026 | USD 6.40 Billion |

| Market Size in 2025 | USD 6.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Motion Control, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for best camera smartphones across the world

The trend of smartphones has increased among people across the world in recent times. Nowadays, the trend of social media platforms such as Instagram, Facebook, Snapchat, Twitter, YouTube, and others has also gained significant popularity in every part of the globe. The demand for good cameras in smartphones has increased rapidly as content creators and amateur users like to upload high-quality videos and pictures on the above-mentioned social media platforms to gain popularity and monetize their content. Thus, with the growing demand for high-quality cameras in smartphones, the demand for stepper motors has increased as these motors help in the rotation of camera sensors. Hence, the increasing use of stepper motors in smartphone cameras to enhance picture and video quality is likely to drive the growth of stepper motors during the forecast.

- In January 2024, Oppo launched the X7 ultra. X7 ultra is a camera-centric smartphone that provides the world's first quad main camera with a superior 1-inch Sony LYT-900 sensor along with the world's first dual-periscope telephoto cameras with large sensors that provide a zooming ability ranging between 14mm-270mm.

Restraint

Availability of substitutes, along with excessive noise and vibration

The application of stepper motors is very prominent in several industries for numerous applications across the world. Although the application of stepper motors in various industries is worth it, there are several problems associated with it. Firstly, the availability of servo motors, which come with several added advantages over steeper motors, has been adopted in several industries. Secondly, the excessive noise and vibration associated with the use of stepper motors is a major problem. Thus, the growing use of servo motors, along with the problems associated with the use of stepper motors, is expected to restrain the growth of the stepper motors market during the forecast period.

Opportunity

Integration of modern technologies in stepper motors

The applications of stepper motors are gaining traction with the rising advancement in technologies such as IoT and WiFi. Recently, stepper motor companies have started integrating IoT and WiFi to generate commands for stepper motors, such as the motor's position, speed, and direction. Thus, the rising integration of modern technologies such as WiFi and IoT in controlling command of stepper motors is likely to create growth opportunities for the market players in the future.

- In January 2023, Kokoni launched Kokoni Sota. Kokoni Sota is a wifi-enabled 3D printer that comes with a high-speed stepper motor to enhance the printing speed.

Type Insights

The hybrid segment held the largest stepper motors market share in 2024 and is expected to continue its dominance during the forecast period. The rise in demand for hybrid stepper motors in aerospace sectors for several applications, such as satellite positioning systems, missile guidance systems, actuation mechanisms for landing gear, antenna positioning, and others, drives market growth. Also, the applications of stepper motors in security & surveillance systems for offering high resolution, torque, and speed in security cameras, in turn, boost the market growth. Moreover, the growing usage of stepper motors in medical and printing sectors due to numerous applications is likely to drive the growth of the stepper motors market.

- In May 2024, MOONS Industries announced the inauguration of a manufacturing facility in Reading, Berkshire, UK. This manufacturing facility is open to the production of several products, such as DC motors and hybrid motors.

The permanent magnet segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing application of permanent magnet stepper motors in cameras and scanners for controlling positioning and movement drives the market growth. Moreover, the rising demand for permanent magnet stepper motors from the robotics industry for motion control, essential positioning, and some other applications boosts the market growth. Additionally, the upsurge in the use of permanent magnet stepper motors due to their compatibility and efficiency is likely to drive the growth of the stepper motors market during the forecast period.

- In July 2023, the researchers of Sona College in Tamil Nadu, India, developed a permanent magnetic stepper motor that was used in the LVM3-M4 for the Chandrayaan-3 mission.

Motion Control Insights

The open-loop segment held a dominant share in 2024. The rising demand for open-loop stepper motors due to less positioning error in several applications has driven the market growth. Moreover, open-loop stepper motors are capable of producing high torque at low speed and minimizing vibrations in certain applications, which in turn boosts market growth. Furthermore, open-loop stepper motors are more affordable than closed-loop ones, which is expected to foster the growth of the stepper motors market during the forecast period. Some of the widely used open-loop stepper motors include YKD2608MH, Nema17, Nema 23, RS485, and Leadshine CM Open Loop stepper motors.

The closed-loop segment is expected to attain the fastest CAGR during the forecast period. The rising demand for closed-loop stepper motors due to superior velocity smoothness and efficient power consumption capabilities has driven the market growth. Moreover, the ability of closed-loop stepper motors due to high-speed response along with increased torque is also boosting the market growth.

Additionally, the capacity of closed-loop stepper motors to replace servo motors coupled with less heat and vibration generation in several applications is likely to foster the growth of the stepper motors market during the forecast period. Furthermore, the growing use of closed-loop stepper motors in modern 3D printers is driving the market growth.

- In June 2023, Raise3D launched Pro3 HS. Pro3 HS is a fused filament fabrication (FFF) 3D printer that attains enhanced precision, speed, and accuracy due to the integration of closed-loop stepper motors it.

Application Insights

The automotive segment dominated the stepper motors market in 2024. The rise in the sales of modern vehicles across the world has increased the demand for stepper motors, thereby accelerating the market growth. According to Stocklytics.com, global car sales around the world are estimated to rise by 3.6% every year, and total vehicle sales are expected to be around 70.4 million units by 2024.

Moreover, the use of stepper motors inside the instrument clusters to provide accurate readings that alert drivers to check fuel levels, speed range, navigation, torque, rpm, and some others has boosted market growth. Furthermore, the applications of stepper motors for adjustment of car seats, beam control of headlights, wiper control, control of fuel injection, and controlling speed limits of cars are driving the growth of the stepper motors market during the forecast period.

- In July 2024, Novosense launched NSD8381-Q1. NSD8381-Q1 is an automotive-grade programmable stepper motor driver that provides superior performance and stability.

The industrial machinery segment is expected to grow with the highest CAGR during the forecast period. The growing demand for various types of stepper motors, such as bipolar stepper motors and hybrid stepper motors in the machinery of different industries, is driving the market growth. For instance, in November 2023, STMicroelectronics launched a high-current motor-drive series for industrial applications. The high-current motor-drive series includes STSPIN9 devices that are compatible with bipolar stepper motors and brushed DC motors. Moreover, the application of stepper motors in industrial machinery due to their low maintenance, high reliability, adaptability, and some others has boosted the market growth. Furthermore, the rising application of automation and robotics in industries is likely to drive the growth of the stepper motors market during the forecast period.

Regional Insights

Asia-Pacific held the largest share of the stepper motors market in 2024. The growth of the market in this region is mainly driven by the rising demand for stepper motors with the developments in the robotics industry with the presence of several robotic companies such as Kawasaki, Fanuc, Omron, and some others, thereby driving the market growth. Thegrowing development in the medical devices industry in countries such as China, India, South Korea, Japan, and some others has increased the demand for stepper motors for several applications such as medical scanners, actuators, samplers, fluid pumps, digital dental photography, respirators, and some other devices has boosted the market growth.

Moreover, the presence of several local market players in stepper motors, such as Moons Industries, Changzhou Fulling Motors Co., Ltd, and Shinano ABV Technologies Pvt. Ltd and some others are continuously engaged in developing stepper motors for several end-user industries and adopting several strategies such as partnerships, collaborations, and business expansions, which in turn drive the growth of the stepper motors market in this region.

- In November 2023, Fanuc announced a collaboration with Denso. This collaboration is done to introduce robots for midsize and small enterprises at 60% lower prices to boost productivity across Japan.

- In February 2023, Faulhaber launched all-new L series linear actuators. These linear actuators are equipped with stepper motors and perform several medical applications.

- In April 2024, Moons Industries launched the LE Series of linear stepper motors. These motors are launched to enhance stabilization and performance in high-accuracy engineering applications.

North America is expected to be the fastest-growing region during the forecast period. The rising demand for cars among the people, with the presence of numerous automotive companies such as Ford, Chevrolet, Rivian, Tesla, and others, has increased the demand for different stepper motors, which in turn drives the market growth. Moreover, the presence of several aerospace companies such as Boeing, SpaceX, Lockheed Martin, Northrop Grumman, and L3Harris has increased the demand for stepper motors for several applications such as controlling target & navigation servos, utility actuation, cabin pressure, valve, and trim controls which in turn is driving the market growth.

Additionally, the presence of various local companies of stepper motors, such as Nippon Pulse America, Inc, Ametek, Kollmorgen, ORIENTAL MOTORS USA CORP, and some others are developing superior quality stepper motors to fulfill the demand from various industries across the North American region, that in turn is expected to drive the growth of the stepper motors market.

U.S. Stepper Motors Market: Industrial Automation Takes a Lead

The U.S dominates the North America stepper motors market due to a strong manufacturing base and presence of advanced industrial automation, driving demand for stepper motors in various industries. The increased industrial adoption of precision, including robotics, 3D printing, and medical devices, is fueling the need for innovation and development of advanced steppe motors in the country. The U.S. is the home for key market vendors and research institutions. Government and companies' investments in R&D are fostering innovation and the development of advanced stepper motor technologies in the country. Key Companies like Oriental Motor, Applied Motion products, and Moon's Industries are leading the manufacturing of stepper motor technology in the U.S.

- In January 2023, Chevrolet launched a new Chevrolet Camaro. This car comes in two variants, including coupe and convertible, along with a powerful 3.6L V-6, 6.2L LT1 V-8, and the supercharged 6.2L LT4 V-8 engine models.

- In January 2024, Northrop Grumman Corporation launched Cygnus cargo delivery spacecraft. This spacecraft was successfully launched by SpaceX's Falcon 9 rocket to the International Space Station.

- In September 2023, Kollmorgen launched the P80360 stepper drive motor. This motor uses step-less control technology to deliver smooth, quiet motion and optimal performance at the full speed range.

Stepper Motors Market Companies

- Nippon Pulse America, Inc

- AMETEK Inc

- ORIENTAL MOTORS USA CORP

- Nanotec Electronic GmbH & Co. KG

- MOONS

- Nidec Corporation

- Minebea Mitsumi Inc

- Shinano ABV Technologies Pvt. Ltd.

- Changzhou Fulling Motors Co., Ltd.

- Phytron GmbH

Oriental Motor's Efforts in Stepper Motors Innovations

- The Oriental Motor has gained a significant position in the innovation and development of stepper motors in 2025.

- In 2024, the company launched its novel CVD series drivers for multi-axis stepper motors, with expansion of AZ series stepper motors, and new linear actuator attachments.

- In 2025, the company announced its participation in Automate 2025, a major robotics and automation event, which will be held from May 12 to May 15, 2025, to bring a demonstration of various stepper motor applications and demos.

- Oriental Motor announced the demonstration of its virtual robot simulators, small robot assembly lines, and conveyor demos using BLS Series brushless motors and αSTEP AZ Series stepper motors, at Automate 2025.

Recent Developments

- In April 2025, Nippon Pulse America, Inc. introduced the PFL20 Linearstep, a new 20mm linear stepper motor, designed for high thrust and efficiency in a compact, RoHS-compliant package. This is a smaller linear stepper motor, yet.

- In March 2025, Nidec Instruments extended its existing S-FLAG AC servo motors, along with launching of new "S-FLAG DYNAMIC MOTION TM" MB series motors.

Segments Covered in the Report

By Type

- Permanent Magnet

- Hybrid

- Variable Reluctance

By Motion Control

- Closed Loop

- Open Loop

By Application

- Industrial Machinery

- Packaging Machinery

- Medical Equipment

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344