November 2024

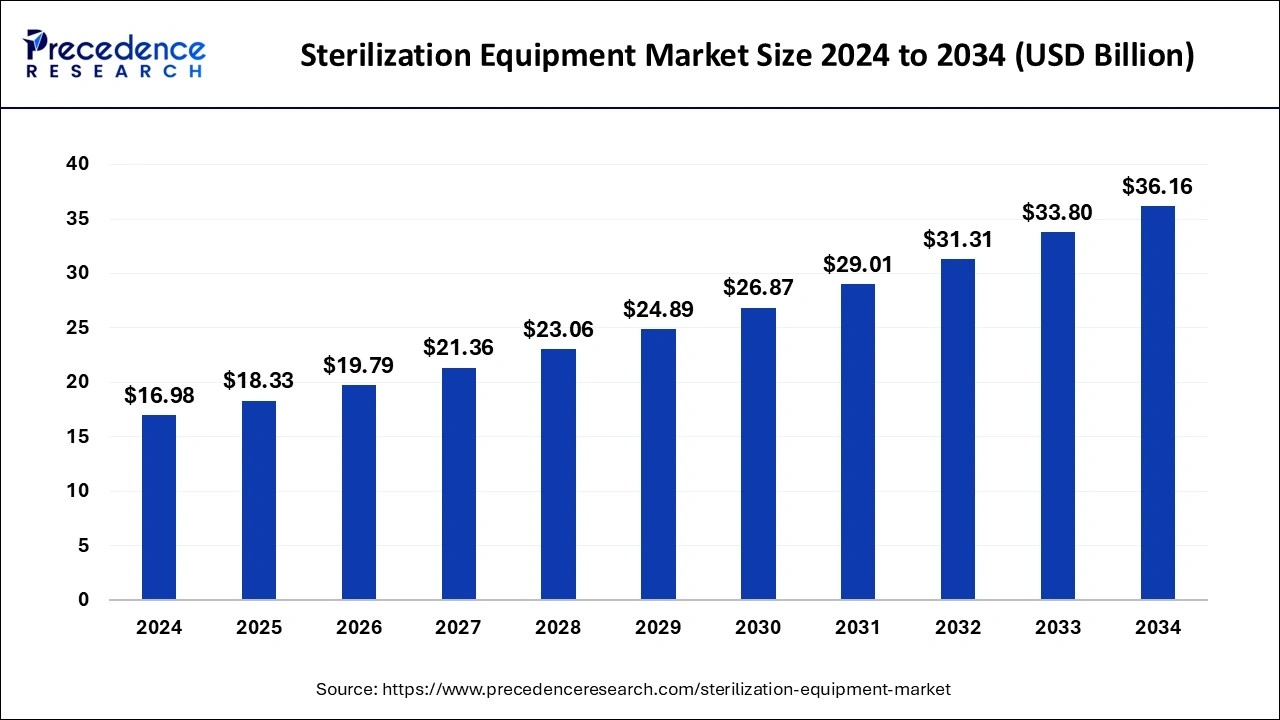

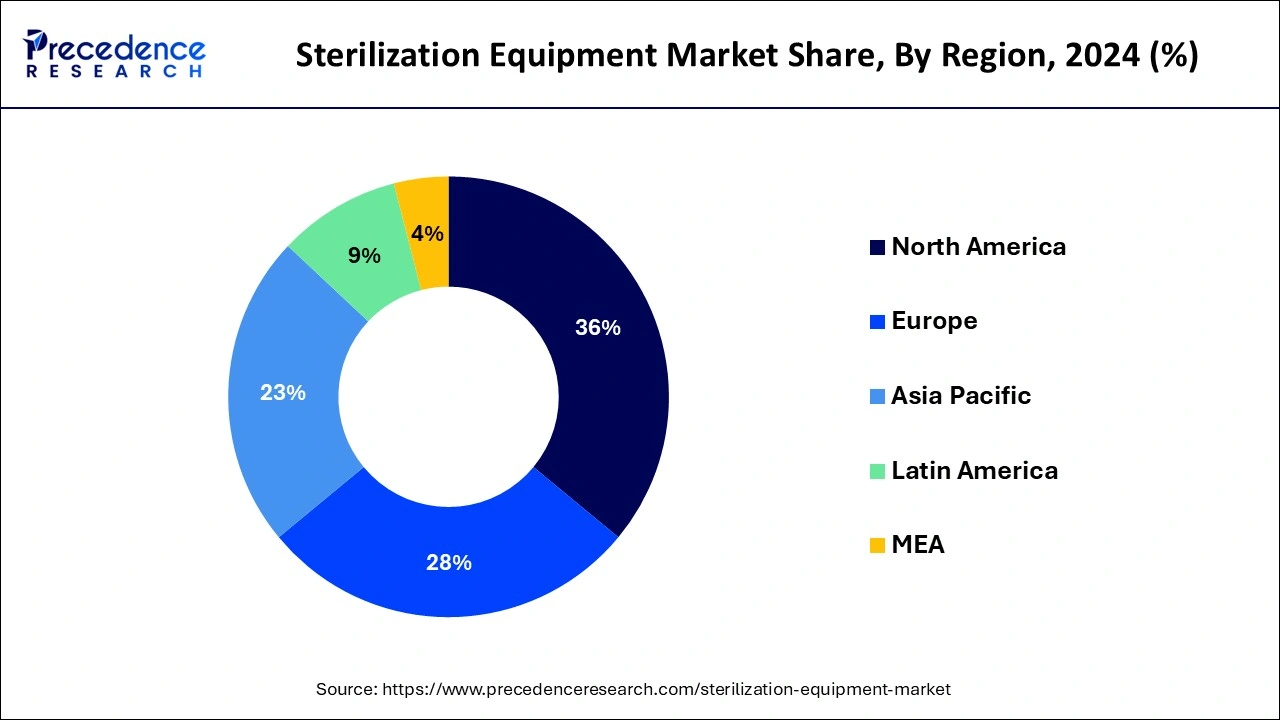

The global sterilization equipment market size is accounted at USD 18.33 billion in 2025 and is forecasted to hit around USD 36.16 billion by 2034, representing a CAGR of 7.85% from 2025 to 2034. The North America market size was estimated at USD 6.11 billion in 2024 and is expanding at a CAGR of 7.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sterilization equipment market size was calculated at USD 16.98 billion in 2024 and is predicted to increase from USD 18.33 billion in 2025 to approximately USD 36.16 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. Sterilization equipment helps sanitize, disinfect, and clean. It also helps remove the breeding ground for survival germs, prevent corrosion of delicate and expensive germs, etc.

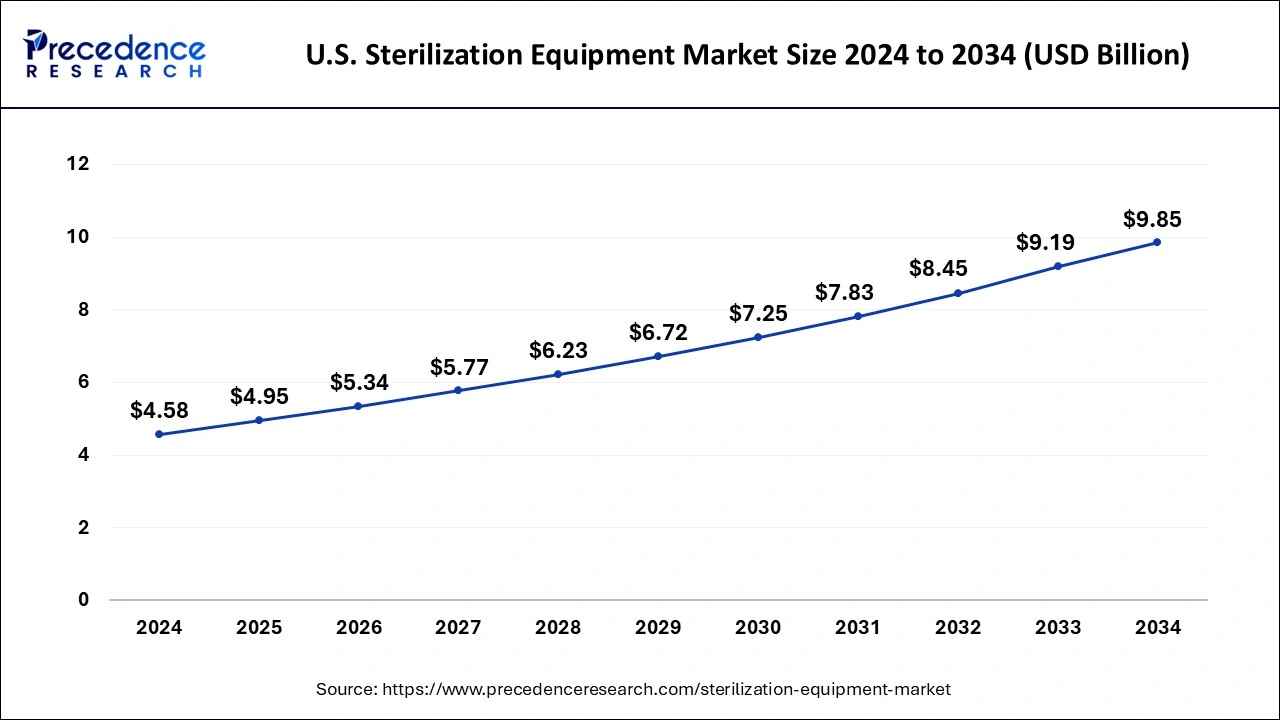

The U.S. sterilization equipment market size was exhibited at USD 4.58 billion in 2024 and is projected to be worth around USD 9.85 billion by 2034, growing at a CAGR of 7.96% from 2025 to 2034.

North America dominated the sterilization equipment market in 2024. Increased consumer awareness and government initiatives help to the growth of the market in the North American region. In the North American region, there are careful regulatory policies and well-developed healthcare infrastructure that aim to give high-quality health services. The Food and Drug Administration actively works with medical device manufacturers, government agencies, and other sterilization experts to improve the sterilization of medical devices or equipment, which contributes to the growth of the market. The United States Environmental Protection Agency provides ethylene oxide commercial sterilization facilities.

Asia Pacific is estimated to be the fastest-growing region during the forecast period of 2025-2034. The Asia Pacific Society of Infection Control (APSIC) guidelines for sterilization and disinfection of instruments in healthcare facilities for patient safety help the growth of the sterilization equipment market. The Asia Pacific region achieves a high standard in disinfection and sterilization. Increasing awareness about safety and hygiene in clinics and hospitals in the Asia Pacific region helps the growth of the market.

The sterilization equipment market refers to the industry that manufactures machinery and devices used to remove all kinds of microorganisms from surfaces and objects. Sterilization is the destruction or complete elimination of all microbial life forms, carried out by various methods using sterilization equipment. The sterilization equipment includes a micro incinerator or bacterial incinerator, which is used in microbiological laboratories; for hazardous waste destruction, incinerators are used; for dry heat sterilization, a hot air oven is used; and for moist heat sterilization, an autoclave is used. For heat-labile sterilization, filters are used, including membrane filters, sintered glass filters, disk filters, and diatomaceous earth filters.

The benefits of sterilization equipment in hospitals include preventing the wear of high-precision and expensive tools that have precise hinges and pivots. It helps to remove the biological load and many non-sterile bacteria living on the surface. Healthcare professionals use the same instrument for the next patient's surgery. In that case, sterilization equipment is used to remove dirt, foreign particles, blood, and pus.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.85% |

| Market Size in 2025 | USD 18.33 Billion |

| Market Size in 2024 | USD 16.98 Billion |

| Market Size by 2034 | USD 36.16 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology Type, and End-user Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased number of surgeries and healthcare-associated infections

In the number of surgeries and healthcare-associated infections, surgical equipment is highly used in the hospitals. Several instruments are used in hospitals for surgeries. Sterilization equipment is used to sterilize those instruments and prevent disease infections, including an autoclave for steam sterilization, dry heat sterilization, chemical sterilization, and plasma heat sterilization. It helps to improve patient care quality, facilitates smooth operations, helps to minimize surgical delays and contaminants, and helps to decrease the risk of surgical site infections. These factors help to the growth of the sterilization equipment market.

Increased use in industries

Sterilization equipment is used not only in the healthcare sector but also in other industries like cosmetics, food and beverages, biotechnology, and pharmaceuticals. Increased awareness of consumers about sterilization for product quality and safety has led to the adoption of sterilization equipment in various industries. Different sterilization techniques are used in industrial sterilization, including thermal sterilization, sterile filtration, chemical sterilization, and radiation sterilization techniques. The thermal sterilization method is highly used in the biotechnological and pharmaceutical industries. These factors help to the growth of the sterilization equipment market.

Risks of sterilization equipment

The sterilization equipment has some disadvantages, including effectiveness may decrease due to improper processing, fumes must be monitored, which causes potential health hazards, long decontamination and sterilization time, and it needs special handling due to toxicity and flammability, which may be a barrier to the growth of the market. Some of the devices need longer exposure, improper sterilization may lead to healthcare-associated infections or the potential to spread diseases, and the use of an incorrect sterilization process for a piece of equipment or a product may damage the item. Improper sterilization equipment carries risks for person-to-person barriers and also risks associated with breach of host barriers. These factors may restrict the growth of the sterilization equipment market.

Advanced technologies

Sterilization equipment is highly used in the healthcare sector and is a critical aspect, it ensures that the instruments are hazardous or harmful microorganisms. The use of advanced technologies in sterilization equipment helps to make healthcare safer and environmentally friendly. Investments in research and development to improve product quality and advanced technologies. Increasing integration of advanced technologies and adoption of digitalization. Identification of potential areas for development and market expansion and emerging advanced technologies will help the market grow in the future. These factors help to the growth of the sterilization equipment market.

The sterilization instruments product type segment dominated the market in 2024, and the segment is also expected to be the fastest growing during the forecast period. The sterilization instruments are the type of sterilization equipment that includes physical agents like radiation, chemical sterilants like formaldehyde or glutaraldehyde solutions, an oven for dry heat sterilization, and an autoclave for moist heat sterilization. These sterilization instruments are helpful for healthcare facilities to ensure infection control and patient safety. Sterilization instruments play an important role in the healthcare sector. Medical devices come in contact with sterile body fluids or tissues, which are critical items.

The items may be sterile when used due to some microbial contamination that can cause disease transmission. These items include surgical instruments, implanted devices, and biopsy forceps. These factors help to grow the sterilization instruments segment and contribute to the growth of the sterilization equipment market.

The heat/high-temperature sterilization segment dominated the market in 2024. In the heat/high-temperature sterilization technology, sterile air is used for the sterilization process with a temperature ranging from 260-320°C. The benefits of this heat/high-temperature sterilization equipment technology include its cost-effectiveness, ease of control, effectiveness, and simplicity of use, for example. In the autoclave, water and saturated steam are used at 121°C temperature for 30 minutes, which helps to kill the microorganisms.

In this way, heat/high-temperature sterilization helps kill microorganisms or improves the sterilization process. The autoclave or dry heat sterilization method is always preferred for sterilization over cold chemical sterilization, which is a less effective or significant level of sterilization. These factors help to the growth of the sterilization equipment market.

The hospitals and clinics segment dominated the sterilization equipment market in 2024. In hospitals and clinics, sterilization equipment or medical sterilization equipment are highly used due to their various benefits: help to remove breeding grounds for surviving germs, help to prevent corrosion of delicate and expensive tools, help to decrease the bioburden and many non-sterilized bacteria which living on a surface. It also helps to remove dirt, foreign particles, blood, and pus left behind, which can lead to dangerous health conditions for the next patient who requires surgery. Healthcare professionals use the same instrument. These factors help to grow the hospitals and clinics' end-user segment, which contributes to the growth of the market.

By Product Type

By Technology Type

By End-user Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

February 2025

February 2025