January 2025

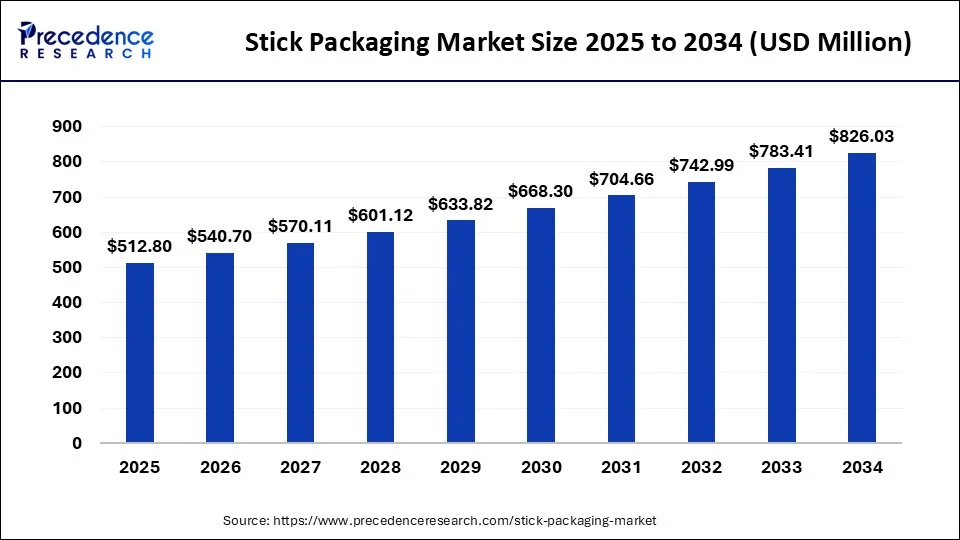

The global stick packaging market size accounted for USD 486.34 million in 2024, grew to USD 512.80 million in 2025 and is expected to be worth around USD 826.03 million by 2034, registering a CAGR of 5.44% between 2024 and 2034.

The global stick packaging market size is worth around USD 486.34 million in 2024 and is expected to hit around USD 826.03 million by 2034, growing at a CAGR of 5.44% from 2024 to 2034. The market growth is attributed to the increasing consumer demand for convenient, sustainable, and single-serve packaging solutions.

Artificial intelligence is impacting manufacturing processes and improving customization. Utilizing artificial intelligence, manufacturers are in a position to understand consumer buying habits and other trends and thus develop designs that will meet new requirements for packaging. Quality control issues are easily solved with the help of the latter, and such issues are resolved precisely, as machine learning algorithms minimize waste while maintaining a healthy level of quality. Moreover, AI applied to tools increases sustainability by reflecting on new material and design options with lower environmental impact.

The stick packaging market appears to be witnessing some tremendous growth, with the rising preference of customers for convenience and the environment around the world. The recent environmental issues include concerns such as the use of environmentally friendly trends such as reduced use of plastics. In the United States, departments and NGOs are working to change the unsustainable packaging systems. Issued on June 8, 2022, Secretary's Order 3407 (SO 3407) sets out to minimize the procurement, sale, and distribution of single-use plastic products and packaging. The ultimate aim is to eliminate all single-use plastic items from Department-managed lands by 2032. Additionally, the stick packaging area is fueled by the rising demand for portable products, mainly in food and beverage products, healthcare, and cosmetics. It is also evident that the aspect of materials is receiving the market’s attention as new companies look for biodegradable or recyclable materials.

| Report Coverage | Details |

| Market Size by 2034 | USD 826.03 Million |

| Market Size in 2024 | USD 486.34 Million |

| Market Size in 2025 | USD 512.80 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.44% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing Demand for Convenient Packaging Formats

Increasing consumer demand for convenient and portable packaging formats is anticipated to drive stick packaging market growth significantly. Consumer awareness and trends related to easy-to-handle food packaging formats demand stick packaging. The single-serve trend with the fast-moving life associated with urbanization as there is a ready inclination towards anything that comes easily. The factors related to being lightweight and the ability to provide portion control appeal to health-conscious individuals. They seek a convenient meal that is enjoyed with one hand without sacrificing portion size. Moreover, recent advancements in green materials, such as biopolymers that form bioplastics, are altering packaging approaches. Biodegradable stick packs are becoming more popular, as the shifting trend of banning single-use plastics in various parts of the world, including the EU and North America, thus fuelling the market of sustainable stick packaging.

Restrain Adoption Due to Environmental Concerns

Environmental concerns related to the disposal of single-use packaging are anticipated to restrain the stick packaging market’s growth. Although efforts to integrate biodegradable materials are underway, the environmental impact of non-recyclable options continues to deter eco-conscious consumers. Waste management infrastructure in various countries remains inadequate, exacerbating the problem of improper disposal. Furthermore, growing concern places pressure on manufacturers to prioritize sustainability, further hindering the conventional stick packaging industry.

High Demand for Sustainable Packaging Solutions

High demand for eco-friendly and biodegradable materials is anticipated to create significant opportunities for the stick packaging market. This increasing demand for environment-friendly packaging agents is expected to present great prospects for the future of stick packaging. Laws, including the EU’s Single-Use Plastics Directive, which was to eliminate avoidable plastic use by 2030, have created demand for products from sustainable sources such as bio-degradable and compostable packaging materials. Furthermore, the analysis done by the World Economic Forum shows that the global consciousness of plastic waste has resulted in higher demand for standardized packaging, with firms pledging their sustainable initiatives. That shows these trends create a great market for the shift to more sustainable stick packaging material solutions across industries, thus fuelling the market.

The biaxially oriented polypropylene (BOPP) segment dominated the stick packaging market in 2023 due to its better performance features, including tensile strength, clarity, and barrier properties. These features are important for material preservation, and moisture and aroma lock-in are crucial for food and beverage products. As reported by the European Bioplastics Association, BOPP was a significant component of FFP and was preferred, as its highly recyclable material also meets the rigid packaging standards in Europe and North America. Furthermore, the growing environmental consciousness further fuel the segment in the coming years.

The polyethylene (PE) segment is projected to grow at a significant rate in the stick packaging market in the future years, as it is flexible and more in line with international goals on sustainability. Authorized carrier bio-based PE solutions have begun to advance, and solutions have limited the dependence on fossil-based PE. In 2022, the DOE launched the Plastics Innovation Challenge to coordinate various initiatives aimed at plastic recycling and reducing environmental impact. These recommendations affected virtually every industry, including pharmaceuticals and personal products. Furthermore, the lightweight benefits and cost-effectiveness of this material make it appealing to various industries, thus boosting their demand.

The food & beverages segment held the largest revenue share of the stick packaging market during the forecasting period, as single and portable servings were in high demand. Convenience is the world’s megatrend, and stick packaging specifically targets this. It takes time to consider this, as most people today live in urban cities. Among food packaging, stick packaging has also gained popularity in instant coffee, powdered drinks, and condiments, where portion control contributes to increased product safety. Manufacturers also gradually use sustainable materials, including eco-friendly stick packaging, which further propels the market.

The pharmaceuticals segment is projected to grow rapidly in the stick packaging market in the coming years, owing to the growing percentages of accurate dosages and better patient compliance. Several benefits associated with stick packaging include easy opening and better sealing of the packets. This makes the product suitable for being used to pack powdered products, including coffee or sugar, as well as sachets containing oral rehydration solutions. According to the WHO in a 2024 publication, there was an increase in demand for better personal care packaging globally, especially in emerging markets. Moreover, new material technologies that support sterility and meet regulatory requirements, especially in the Asia-Pacific and Middle East markets, further boost the demand for stick packaging solutions.

Asia Pacific dominated the stick packaging market in 2023, owing to the growing middle-class population, especially in developing countries such as China, India, and South East Asia. USDA is also supported by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), which claims that the population in Asia and the Pacific is increasingly urbanized, and their consumption habits are also fast-changing. This leads to an increase in demand for packaging materials, most especially those which are used on the go. Additionally, the various companies in the packaging industry located in China and Japan will give further impetus to research and development as well as to manufacturing capacities. This is further supported by the push for sustainability; most Asia Pacific governments have encouraged the use of sustainable packaging.

North America is estimated to host the fastest-growing stick packaging market during the forecast period due to the rising demand for convenient, healthy, and friendly packaging and increased consideration for environmental concerns. According to the U.S. EPA, North American consumers are in a better position to compete for environmentally friendly and recyclable packaging. This shows the growing popularity of stick packaging, especially in food and beverages and the pharmaceutical industry. Additionally, the increasing consumer preference for health supplements, including the use of functional foods, further contributes to the increased demand for stick packaging formats.

By Material

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025