January 2025

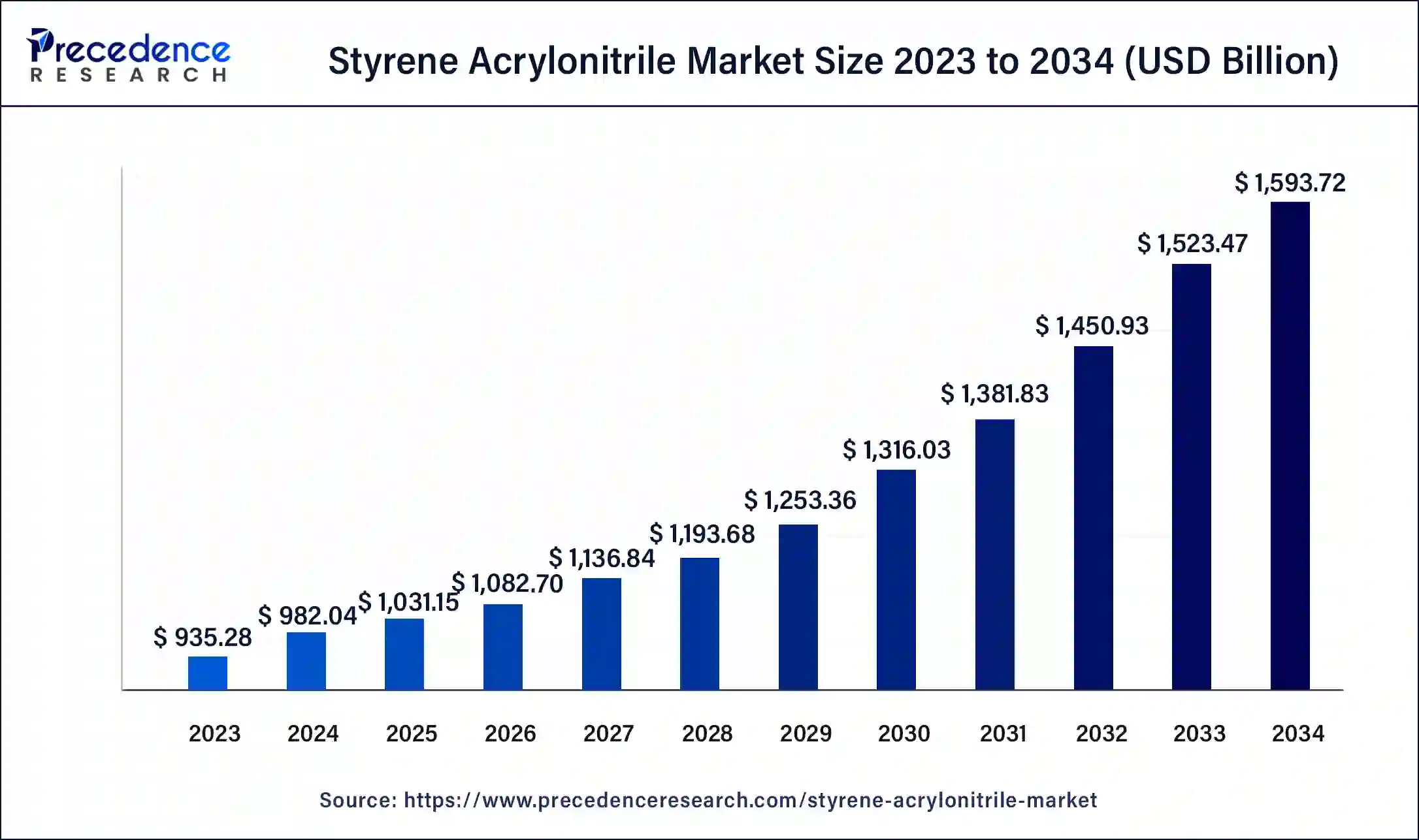

The global styrene acrylonitrile market size was USD 935.28 billion in 2023, estimated at USD 982.04 billion in 2024 and is anticipated to reach around USD 1593.72 billion by 2034, expanding at a CAGR of 4.96% from 2024 to 2034.

The global styrene acrylonitrile market size accounted for USD 982.04 billion in 2024 and is predicted to reach around USD 1593.72 billion by 2034, growing at a CAGR of 4.96% from 2024 to 2034.

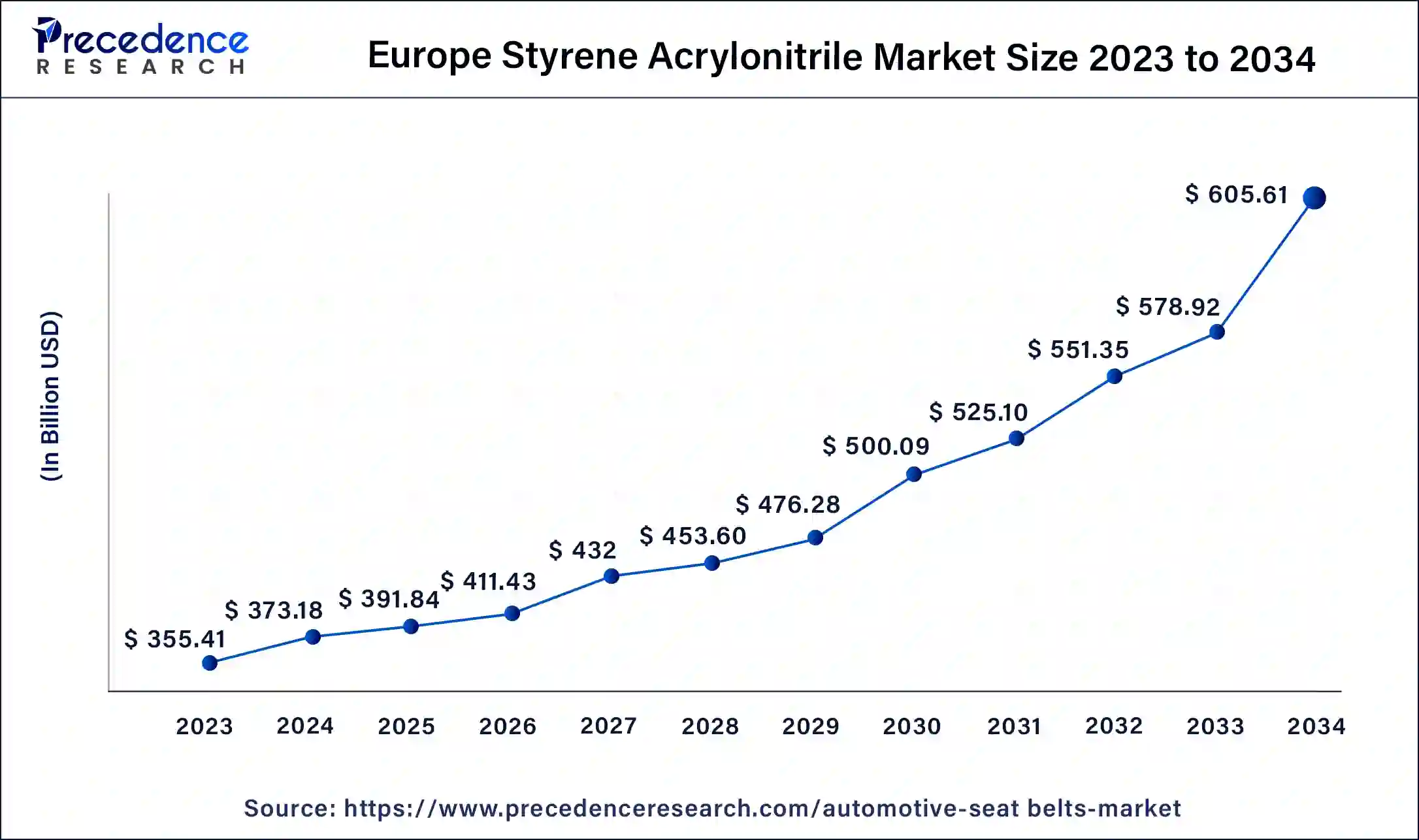

The Europe styrene acrylonitrile market size was valued at USD 355.41 billion in 2023 and is expected to reach USD 561.93 billion by 2034, growing at a CAGR of 5.20% from 2024 to 2034.

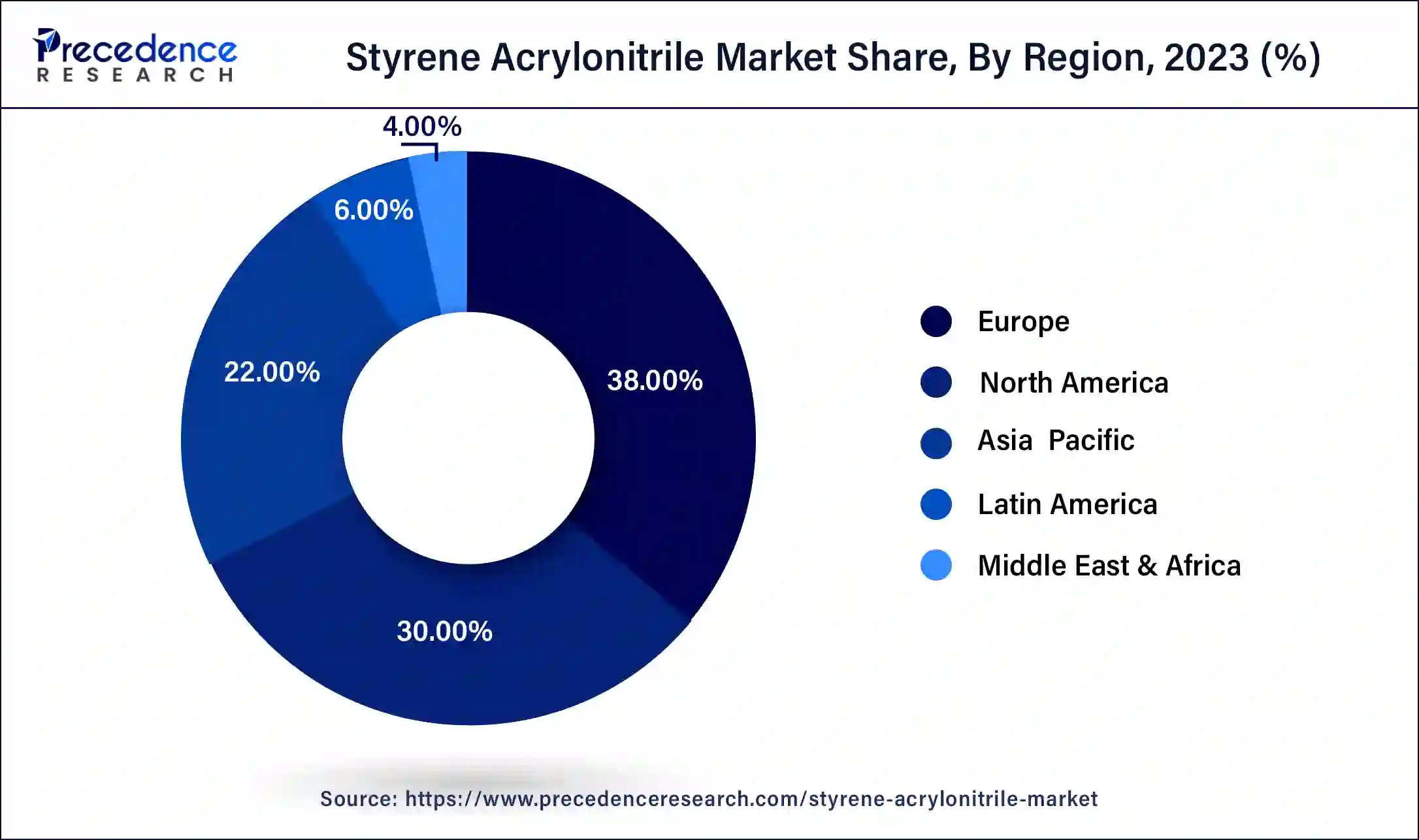

Europe has held the largest revenue share of 38% in 2023. Europe holds a major share in the styrene acrylonitrile (SAN) market due to robust demand across diverse industries. The region benefits from a well-established automotive sector utilizing SAN for interior components. Additionally, SAN finds widespread use in packaging, consumer goods, and construction applications, contributing to its dominance. Stringent quality and environmental standards further drive the preference for SAN in European markets. The region's commitment to innovation, coupled with a strong emphasis on sustainable practices, solidifies its position as a key player in the global SAN market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the styrene acrylonitrile (SAN) market due to its robust industrial infrastructure, technological advancements, and high consumer demand for SAN-based products. The region's well-established automotive, electronics, and packaging industries drive the substantial use of SAN in various applications. Additionally, stringent quality and safety standards propel the adoption of SAN, further solidifying North America's prominent position in the market. The presence of key market players and a focus on research and development activities contribute to the region's dominance in the styrene-acrylonitrile market.

Styrene acrylonitrile (SAN) is a specialized resin formed by blending styrene and acrylonitrile. This unique combination results in a material prized for its crystal-clear appearance, robust tensile strength, and resistance to chemicals. SAN stands out for its ability to maintain transparency akin to glass while offering improved heat resistance and stability compared to regular styrene-based polymers.

One notable characteristic of SAN is its transparent appearance, resembling glass, which makes it a preferred material for manufacturing consumer goods like kitchenware, optical lenses, and packaging materials. Additionally, SAN's mechanical properties, including rigidity and impact resistance, make it suitable for the production of durable and lightweight products. This copolymer resin finds wide usage in industries ranging from automotive to electronics, where its versatility and performance contribute to the creation of high-quality and visually appealing end products.

| Report Coverage | Details |

| Market Size in 2023 | USD 935.28 Billion |

| Market Size in 2024 | USD 982.04 Billion |

| Market Size by 2034 | USD 1593.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.96% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronics sector expansion and construction industry demand

The styrene acrylonitrile (SAN) market experiences a significant upswing in demand, courtesy of the expanding electronics sector and the robust requirements from the construction industry. In the realm of electronics, where devices like smartphones and gadgets are omnipresent, the need for materials with top-notch properties has heightened. SAN, distinguished by its excellent electrical insulation and transparency, emerges as the material of choice for crafting casings and components, meeting the stringent standards of electronic device manufacturing and thereby amplifying market growth.

Simultaneously, the construction industry's demand for transparent and durable materials in applications like windows, doors, and construction panels further propels the SAN market. As global urbanization and infrastructure development continue, SAN's versatility and mechanical strength make it a valuable material for architects and builders. The construction industry's reliance on SAN as a dependable solution for various applications underscores its role as a key driver in meeting the growing market demand for styrene acrylonitrile.

Raw material price volatility

The growth of the styrene acrylonitrile (SAN) market faces a notable hurdle due to the instability in raw material prices. The varying costs of essential raw materials like styrene and acrylonitrile present a challenge for SAN manufacturers. Sudden spikes in raw material prices can lead to higher production expenses, impacting profit margins and overall competitiveness in the market.

This volatility makes it difficult for businesses to plan and budget effectively, affecting long-term strategic decision-making. Additionally, the instability in raw material costs ripples through the entire supply chain, impacting suppliers, manufacturers, and consumers alike. In an industry where cost efficiency is paramount, the unpredictable nature of raw material prices introduces complexity, hindering the sustained and stable growth of the styrene acrylonitrile market.

Growing sustainable practices

The increasing emphasis on sustainable practices is creating a notable opportunity for the styrene acrylonitrile (SAN) market. As businesses and consumers alike prioritize environmental considerations, SAN's potential for recyclability and eco-friendly applications positions it as a favorable choice. The demand for sustainable materials is driving manufacturers to explore alternatives with reduced environmental impact, and SAN's recyclability aligns well with these objectives.

Opportunities arise for SAN to become a preferred option in industries striving for greater sustainability, such as packaging and consumer goods manufacturing. The market can capitalize on this trend by promoting SAN as an environmentally conscious choice, meeting the growing demand for materials that balance performance with ecological responsibility. This shift toward sustainable practices not only aligns with market trends but also opens doors for SAN to establish itself as a key player in the evolving landscape of environmentally friendly materials.

In 2023, the continuous mass polymerization segment had the highest market share of 38% based on the type. Continuous mass polymerization in the styrene acrylonitrile (SAN) market involves a continuous process of synthesizing polymers without interruptions. This method ensures a consistent production flow, enhancing efficiency and product quality. Trends in this segment include increased adoption due to its cost-effectiveness and ability to produce high-quality SAN resins with desirable properties. Continuous mass polymerization aligns with the industry's focus on streamlined processes, meeting the demand for SAN with improved characteristics in applications such as packaging, electronics, and consumer goods.

The suspension segment is anticipated to expand at a significant CAGR of 6.4% during the projected period. The suspension segment in the styrene acrylonitrile (SAN) market refers to a production method where SAN is polymerized in a solvent, forming suspended particles. This process allows for the creation of SAN with distinct properties, including excellent transparency and impact resistance. Recent trends indicate a growing preference for Suspension SAN in applications requiring high clarity, such as optical lenses and transparent packaging. Its versatility and ability to meet stringent quality standards make Suspension SAN a key player in industries where transparency and performance are paramount.

According to the application, the kitchenware segment has held 30% revenue share in 2023. The kitchenware segment in the styrene acrylonitrile (SAN) market refers to the production of various kitchen utensils, containers, and accessories using SAN. Characterized by SAN's clarity, impact resistance, and suitability for molding intricate designs, kitchenware manufacturers are increasingly incorporating SAN into their product lines. The trend involves a growing preference for SAN-based kitchenware due to its durable and aesthetically pleasing qualities, meeting consumer demands for visually appealing and functional kitchen products with enhanced resilience and longevity.

The electronics covers segment is anticipated to expand fastest over the projected period. In the styrene acrylonitrile (SAN) market, the electronics covers segment encompasses the production of casings and protective components for electronic devices. The demand for SAN in this application is driven by its excellent electrical insulation properties, impact resistance, and transparency.

A notable trend in this segment is the increasing integration of SAN in the manufacturing of sleek and durable electronic covers, meeting the evolving consumer preferences for aesthetically pleasing and resilient electronic devices. SAN's unique combination of properties makes it a sought-after material for enhancing the performance and visual appeal of electronic covers.

According to the end user, the electrical & electronics segment has held 32% revenue share in 2023. In the styrene acrylonitrile (SAN) market, the electrical and electronics segment encompasses the use of SAN in manufacturing components such as casings, enclosures, and parts for electronic devices. SAN's excellent electrical insulation properties make it a preferred choice for ensuring the safety and functionality of electronic products. A trend in this segment involves the continual innovation in electronic devices, driving the demand for SAN as manufacturers seek materials that offer both electrical insulation and the transparency required for sleek and modern designs.

The medical segment is anticipated to expand fastest over the projected period. In the styrene acrylonitrile (SAN) market, the medical segment refers to the use of SAN in manufacturing various medical devices and equipment. SAN's biocompatibility, transparency, and durability make it a preferred choice for applications such as medical casings, diagnostic equipment, and components in the healthcare industry. A growing trend in the medical segment involves the continuous exploration of SAN's properties to enhance its suitability for medical applications. This includes efforts to improve SAN's biocompatibility and develop innovative solutions for medical device manufacturing, contributing to advancements in healthcare technology.

Segments Covered in the Report

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

October 2024

September 2024