July 2024

The global supercapacitors market size was USD 2.50 billion in 2023 and is predicted to increase from USD 2.94 billion in 2024 to approximately USD 14.74 billion by 2034. It is projected to grow at a double digit CAGR of 17.50% from 2024 to 2034.

The global supercapacitors market size is projected to be worth around USD 14.74 billion by 2034 from USD 2.94 billion in 2024, registering a solid CAGR of 17.50% from 2024 to 2034.

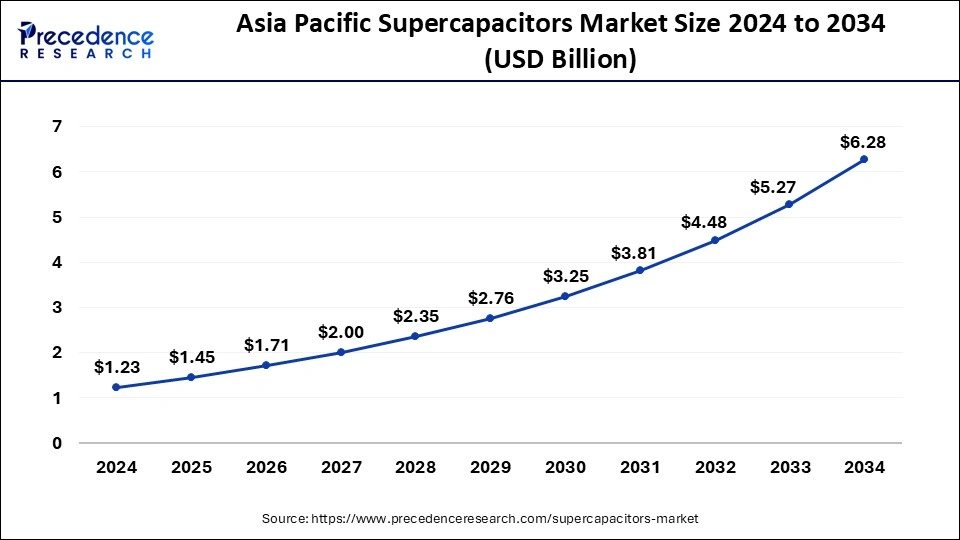

The Asia Pacific supercapacitors market size was estimated at USD 1.05 billion in 2023 and is anticipated to reach USD 6.28 billion by 2034, growing at a CAGR of 17.65% from 2024 to 2034.

Asia Pacific with technological advancements and growing consumer electronics sector, is observed to expand at a notable rate. The region is a global hub for the electronics and automotive industries, both of which are significant consumers of supercapacitors. The growth in electric vehicles (EVs), hybrid vehicles, and the increasing use of electronics in automobiles have significantly boosted demand. Many governments in the region have launched initiatives to promote renewable energy and energy-efficient technologies. For example, China’s focus on green energy and electric vehicles has driven the demand for supercapacitors as essential components in energy storage systems.

Advanced advances in storage technology with emerging market segments such as hybrid electric vehicles (HEV), smart grids and renewable energy systems and the capacity of supercapacitors to provide emergency shutdown power or backup to low-power equipment such as RAM, SRAM, microcontrollers and PC cards are the major driving factors for the global supercapacitors market. However, the factors expected to hamper market growth are high initial costs of materials and poor knowledge of supercapacitors. In addition, an increase in demand for newer solar and wind energy applications and an increase in demand for micro supercapacitors are expected to provide lucrative prospects for the future growth of the supercapacitor industry.

Supercapacitors Market Scope

| Report Highlights | Details |

| Growth Rate from 2024 to 2034 | CAGR of 17.50% |

| Market Size in 2024 | USD 2.94 Billion |

| Market Size by 2034 | USD 14.74 Billion |

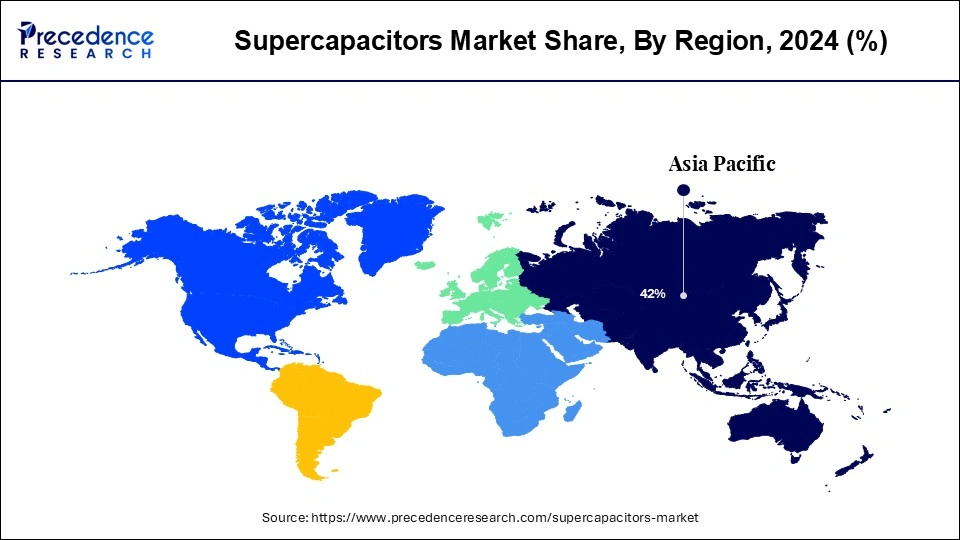

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Capacitance, Application, Voltage Range, Electrolyte Type, and Regions |

| Companies Mentioned | Tesla, CAP-XX, LS Mtron, AVX Corporation, Panasonic Corporation, SPEL Technologies Private Limited, Nippon Chemi-Con Corporation, Skeleton Technologies, Ioxus Inc., LS Mtron Ltd., Evans Capacitor Company, and KORCHIP Corporation |

Innovation of supercapacitors for electric vehicles

In September 2022, India's leading lithium-ion cell manufacturer GODI announced the development of India's first ever 3000F supercapacitor that could be used for electric vehicles. This high power supercapacitor is capable of storing and releasing electrochemical energy in order to improve battery life in electric vehicles. Additionally, this supercapacitor can be used in other renewable energy sources, smart grids and UPS applications. The development of supercapacitor for the application in electric vehicle is observed to grow in the upcoming period with the expansion of global electric vehicle market. Supercapacitors are being widely utilized in electric vehicles for fsst charging and high power density purpose. They can rapidly absorb and store energy, reducing charging times compared to traditional lithium-ion batteries. Thereby, as the demand for electric vehicles continues to grow, the development and implementation of supercapacitors in these vehicles are expected to drive the supercapacitor market.

High cost of production

The production process for supercapacitors can be more complex and require precise control to ensure the quality and performance of the final product. As compared to other energy storage technologies, supercapacitor technology is newer in the industry, which brings limited scale of production. This creates an obstacle for manufacturers as the per-unit manufacturing cost can be high. Thereby, the cost of production is observed to act as a major restraint for the supercapacitors market. However, the market holds the potential for cost reduction as development activities increase.

Expansion of renewable energy sector

The expansion of the renewable energy sector creates a favorable environment for supercapacitors. The growing interest in renewable energy technologies encourages research and development in energy storage solutions, including supercapacitors. This leads to advancements in supercapacitor technology and the creation of more efficient and cost-effective solutions. Supercapacitors are also being used in renewable energy sector to improve the reliability of energy supply. Supercapacitors can be integrated into renewable microgrids to store and supply power efficiently, especially in remote or off-grid areas.

The Electric Double-Layer Capacitors (EDLCs) segment holds significant potential in the supercapacitors market to grow. High energy density, wide application and rapid charging are few factors that promote the segment’s growth in the market. EDLCs are versatile and can be used across various industries, including automotive, renewable energy, consumer electronics, and industrial sectors. Their ability to deliver quick bursts of power makes them valuable in these sectors.

Continuous innovations in materials and manufacturing processes have improved the performance and reduced the cost of EDLCs, further boosting their adoption in the market.

The medium (10 to 100 Farads) segment holds a notable share in the market. Medium-range supercapacitors are used in numerous applications, including backup power supplies, automotive applications (like regenerative braking and start-stop systems), and in renewable energy systems. Their flexibility to be integrated into these diverse applications drives demand.

Being the most prominent segment of the supercapacitors market, the automotive segment is observed to expand with the shift towards electric vehicles. Supercapacitors provide rapid energy bursts, enhancing the performance of EVs, especially during acceleration and peak loads. Supercapacitors offer a high-power density, which is crucial for applications like regenerative braking in electric and hybrid vehicles. They can quickly absorb and release energy, making them ideal for these systems.

The medium voltage (2.8 to 5 V) segment of voltage range offers good balance between energy density and power supply. Many electronic systems and components are designed to operate within this voltage range. This compatibility reduces the need for additional voltage conversion components, making supercapacitors in this range more cost-effective and easier to integrate.

The organic electrolytes segment carries wider voltage range and higher energy density. Supercapacitors using organic electrolytes can achieve higher energy densities because of the higher operating voltages. This makes them more suitable for applications needing compact energy storage with substantial energy output.

The global Supercapacitors market seeks intense competition among the market players owing to rapid changing consumer preference. Further, the industry participants are prominently adopting growth strategies that include partnership, collaboration, merger & acquisition, and many others to maintain their competitive edge in the global market. Apart from this, they invest prominently in the R&D activity for new product development & advancements.

Some of the prominent players in the Supercapacitors market include:

Segments Covered in the Report

By Type (Volume in Units)

By Capacitance (Volume in Units)

By Application (Volume in Units)

By Voltage Range (Volume in Units)

By Electrolyte Type (Volume in Units)

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024