January 2025

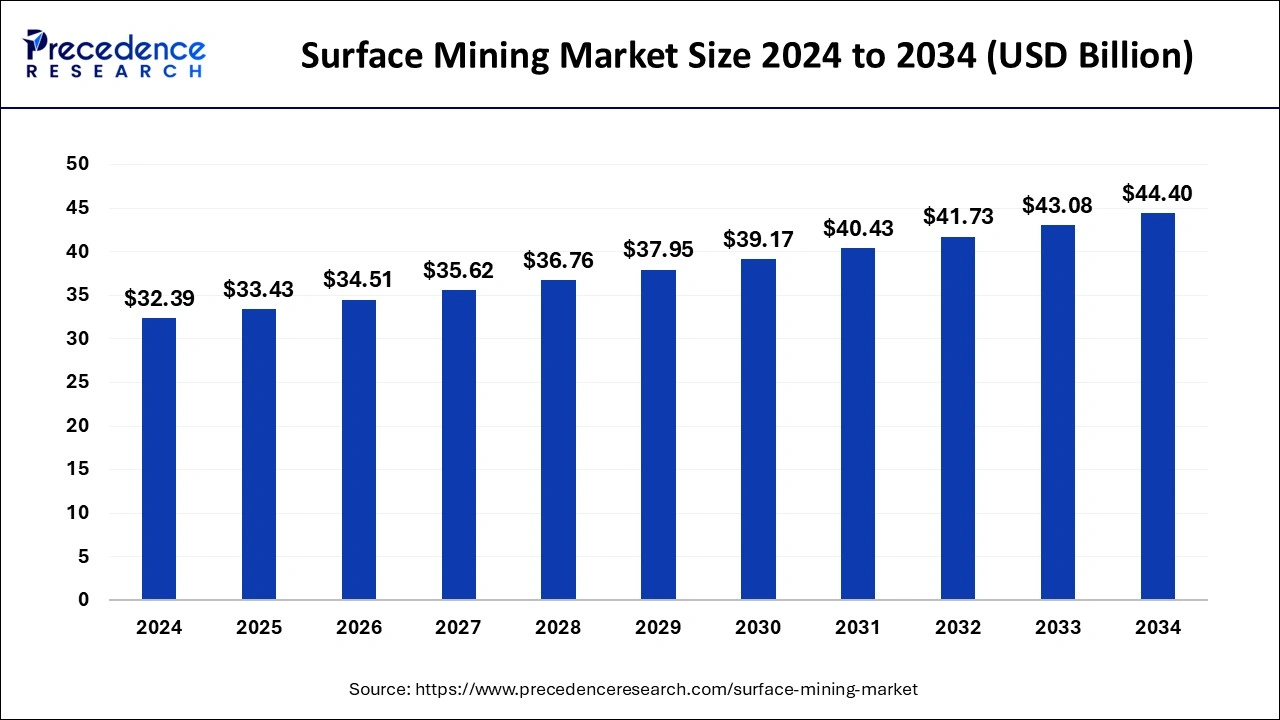

The global surface mining market size is calculated at USD 33.43 billion in 2025 and is forecasted to reach around USD 44.40 billion by 2034, accelerating at a CAGR of 3.20% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surface mining market size was estimated at USD 32.39 billion in 2024 and is predicted to increase from USD 33.43 billion in 2025 to approximately USD 44.40 billion by 2034, expanding at a CAGR of 3.20% from 2025 to 2034. The surface mining market is driven by growing demand for building supplies worldwide.

The industry that removes minerals and other geological elements from the earth's surface rather than underground is known as surface mining. This mining category encompasses a range of techniques, including mountaintop removal, quarrying, open-pit mining, and strip mining. These techniques are less expensive than underground mining because they can access deposits near the surface. Surface mining efficiently extracts substantial amounts of minerals, satisfying the world's demand for raw resources. Minerals such as coal, copper, iron ore, bauxite, and precious metals like gold and diamonds are extracted using this mining technique.

| Report Coverage | Details |

| Market Size in 2025 | USD 33.43 Billion |

| Market Size by 2034 | USD 44.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.20% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in the demand for metals and minerals in different industries

Rapid industrialization in developing nations is resulting in a rise in manufacturing and building activity. Extensive mining operations are required to supply the demands of automotive, aerospace, electronics, and equipment, which significantly depend on metals like iron, copper, aluminum, and nickel. The world's increasing urbanization needs many raw materials for infrastructure development. This includes buildings, roads, bridges, and other vital urban infrastructure projects, significantly increasing demand for minerals used in construction, such as limestone, sand, gravel, and metals. This drives the growth for the surface mining market.

Trade policies exhibit disparities across nations

Countries have very different surface mining regulation frameworks. Certain countries have strict safety and environmental laws that cost much money to comply. This raises operating expenses and may discourage funding for initiatives using surface mining. These consist of license requirements, quotas, and other regulatory limitations that may restrict the freedom of operation for mining businesses. For example, certain nations may set export limits on a specific mineral, which affects the dynamics of the worldwide market and supply.

Increasing investment in infrastructure projects

Surface mining may be made safer, more ecologically friendly, and more efficient with new technology and technologies. Improved drilling and blasting methods, real-time data analytics, and autonomous mining equipment are a few examples. Investments can result in adopting environmentally friendly mining methods, a decrease in the industry's adverse effects on the environment, and an increase in public and regulatory acceptance of the sector. This opens an opportunity for the surface mining market.

Adoption of AI and ML in mining industries

Geological data can be analyzed more rapidly and accurately than conventional techniques by AI and ML algorithms to discover possible mineral resources. Machine learning models may process large volumes of geological data and spot patterns and anomalies that human geologists might overlook. By estimating the quantity, quality, and location of mineral resources, predictive models can be created that will cut down on the time and expense of exploration.

Artificial intelligence (AI) systems can track real-time data from sensors positioned throughout the mining site to identify risks like gas leaks, broken equipment, or structural flaws. Due to machine learning models that can detect and prevent accidents by analyzing previous occurrence data, miners will work in a safer environment.

The strip-mining segment dominated in 2024 in the surface mining market. To reach the ore below, strip mining entails removing sizable overburden sections, or the earth and rock covering the mineral deposit. This method is typically less expensive because it involves fewer personnel and safety precautions than underground mining. Because strip mining is so efficient, it can extract vast amounts of minerals in a shorter time, lowering the cost per unit of mineral removed.

Technological developments in mining equipment, including trucks, shovels, and high-capacity draglines, have increased the productivity and size of strip mining. Overburden and ore may be removed more rapidly and efficiently by modern machinery. The open-pit mining segment shows a significant growth in the surface mining market during the forecast period.

In general, open-pit mining is less expensive than underground mining. Open-pit mining operations are appealing to mining corporations because of the economies of scale they may attain, which can result in cheaper costs per ton of extracted material. Large-scale machinery and equipment use lowers operating costs while increasing production. Open-pit mining operations have benefited from integrating automation and digital technology, such as remote-controlled equipment and autonomous haulage systems, by increasing production, decreasing labor costs, and improving safety. Real-time monitoring technologies and advanced data analytics have also improved the efficiency of decision-making processes and operations.

The coal mining segment dominated the surface mining market in 2024. With almost 36% of the world's electricity coming from coal, it is the most plentiful energy source. In the US, power plants that run on coal provide around 25% of the total electricity produced. Coal is a "homegrown" energy source in the United States. Most of the coal used to generate power in American homes comes from mines in the United States. Coal-fired power plants offer consistent, dependable, and reasonably priced power on demand to meet energy consumption needs. Coal continues to be crucial for reducing global energy poverty, even though much of the world lacks access to contemporary, clean energy.

The mineral mining segment is the fastest growing in the surface mining market during the forecast period. Green industrialization has enormous potential due to the clean energy transition's driving upsurge in the need for essential raw materials, particularly in poor nations. Because of their importance in clean energy technologies, crucial raw materials are in high demand, and forecasts suggest that there may be shortages in supply. These minerals are primarily found in developing nations, especially in Africa, accounting for 30% of the world's mineral reserves.

Asia Pacific carried dominated in 2024 and expected to sustain the position in surface mining market during the forecast period. The Asia-Pacific, which includes China, India has enormous reserves of essential minerals such as bauxite, gold, copper, iron ore, and coal. The region's mining potential is highlighted by the large nickel and bauxite reserves in Indonesia, the substantial rare earth elements in China, and the enormous amounts of coal and iron ore in India. The mining industry has seen significant investments from foreign and domestic businesses, improving production capacities. For example, China's Belt and Road Initiative (BRI) has made considerable investments in regional mining projects possible. Due to its advantageous mining policies and economic prospects, the region has drawn significant foreign direct investment.

North America shows a significant growth in the surface mining market during the forecast period. Base and precious metal mining activities have surged in response to the growing demand for these metals across various uses, particularly in the United States and Canada. Among the world's leading mining nations, Canada is number four. Canada is one of the world's top 10 producers of several metals and minerals, producing more than 60 different metals and minerals. In addition, Canada possesses abundant reserves of metals and minerals like platinum, nickel, copper, and cobalt, which are vital for developing renewable energy technology. Since minerals and metals are essential to low-carbon technology, demand for them will rise as EVs and batteries are created using them.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

August 2024

August 2024