September 2024

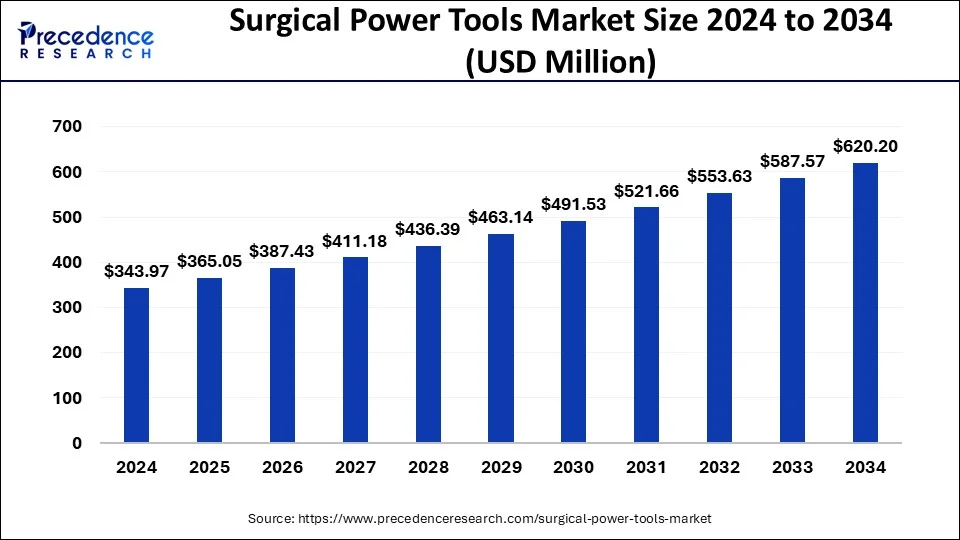

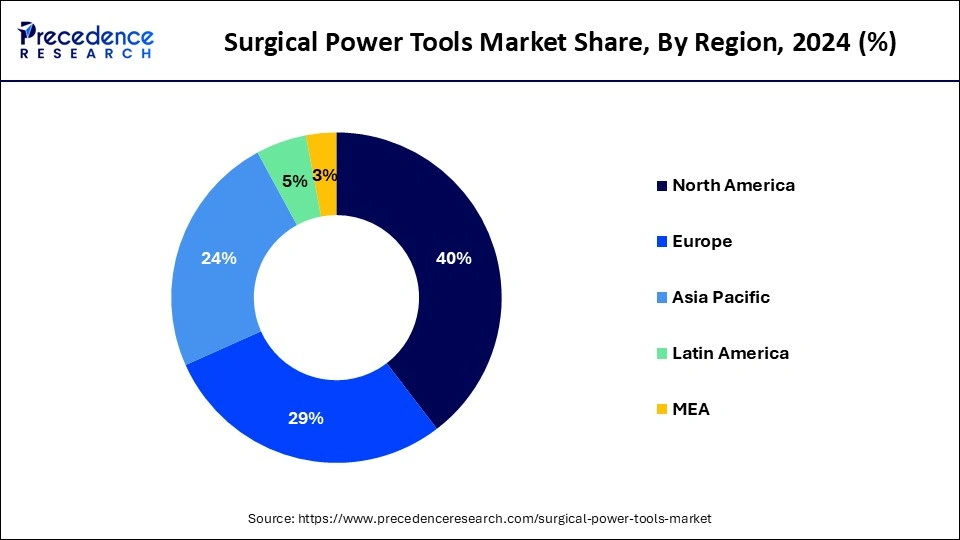

The global surgical power tools market size is calculated at USD 365.05 million in 2025 and is forecasted to reach around USD 620.20 million by 2034, accelerating at a CAGR of 6.07% from 2025 to 2034. The North America surgical power tools market size surpassed USD 137.59 million in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical power tools market size was estimated at USD 343.97 million in 2024 and is predicted to increase from USD 365.05 million in 2025 to approximately USD 620.20 million by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The rising incidence of chronic diseases, like neurological disorders, orthopaedic disorders, and cardiovascular conditions that require surgical treatments are major drivers of the surgical power tools market

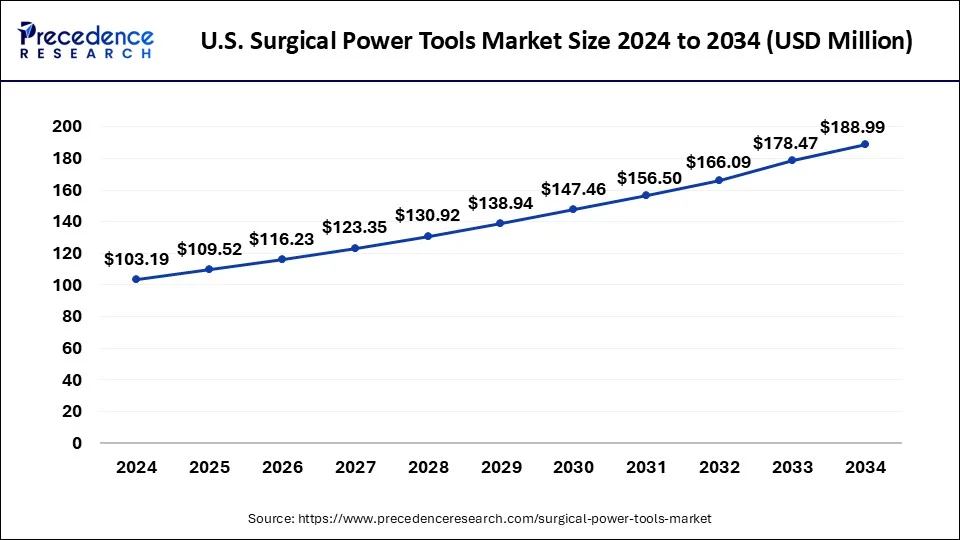

The U.S. surgical power tools market size reached USD 103.19 million in 2024 and is expected to be worth around USD 188.99 million by 2034 at a CAGR of 6.24% from 2025 to 2034.

North America has dominated the surgical power tools market in 2024. This region has dynamic and evolving industry that is driven by several technological advancements and higher demand for surgical power tools which aids in a complex surgery performed by medical professionals. The market for surgical power tools in North America is a dynamic and ever-evolving sector driven by technological advancements, growing consumer demand, rising awareness of surgical procedures for correcting facial deformities, and the availability of reputable healthcare facilities and services, among other factors that have contributed to the market's notable growth. With the use of these technologies, surgical precision and accuracy can be increased, thereby improving results and reducing problems.

In addition, market demand is driven by growing awareness of deformity correction in face as well as improved access and affordability of healthcare services. especially in developing countries where the middle class is expanding and access to healthcare is increasing.

Asia Pacific is expected to witness the fastest rate of growth during the forecast period in the surgical power tools market. Asia Pacific has witnessed an incremental development in the healthcare infrastructure in the past few years due to the increase in demand for preventive healthcare culture, technically advanced facilities provided by healthcare centres, and a rising geriatric population, which is more prone to diagnosis with age-related diseases, including chronic pain.

As per the National Library of Medicine, emergency departments in healthcare frequently deal with surgery due to traumatic brain injury-TBI. Over 1 million visits related to brain injuries are registered annually in the emergency department for different reasons. Here, surgical power tools play crucial roles in the recovery of patients after brain surgery, as it is the most complex one and could be fatal, many times if not appropriately treated even after surgery.

Additionally, many countries like India, Japan, China, and Singapore have invested in their healthcare infrastructure in huge amounts, including advanced facilities and highly skilled professionals. Due to this, the Asia Pacific region has become a medical tourism hub for the international population. Such facilities enable the healthcare system of Asia Pacific to deliver high-quality treatment to patients in a reasonable amount. Tourists travel to Thailand and Malaysia for surgical operations due to their affordable medical services and effective output and recovery rate.

The surgical power tools market revolves around the production, innovation and distribution of tools that are generally utilized in the surgical processes. The market has experienced significant growth in recent years, driven by advancements in surgical techniques, increasing demand for minimally invasive surgeries, and the rising prevalence of chronic diseases requiring surgical intervention. These tools are essential for precise and efficient procedures, reducing operative times and improving patient outcomes. Key factors fuelling the growth of the surgical power tools market include technological advancements such as the development of battery-operated tools, which offer greater mobility and flexibility in the operating room. Additionally, the increasing adoption of robotic-assisted surgeries drives demand for specialized power tools designed to work seamlessly with these systems.

Orthopaedic surgeries, in particular, contribute significantly to the demand for surgical power tools, as these procedures often require precision cutting and shaping of bones. Geographically, North America dominates the surgical power tools market, driven by a well-established healthcare infrastructure, high healthcare expenditure, and a growing geriatric population.

| Report Coverage | Details |

| Market Size in 2024 | USD 343.97 Million |

| Market Size in 2025 | USD 365.05 Million |

| Market Size by 2034 | USD 620.20 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Minimally invasive procedures

The increasing demand for minimally invasive surgeries is a significant driver in the surgical power tools market. Minimally invasive procedures offer several advantages over traditional open surgeries, including smaller incisions, reduced blood loss, faster recovery times, and shorter hospital stays. Surgical power tools facilitate these minimally invasive techniques by providing surgeons with precise and efficient instruments for accessing and manipulating tissues. Moreover, as patients increasingly seek less invasive treatment options, healthcare providers are expanding their surgical capabilities to meet this demand. This has led to a growing adoption of advanced surgical power tools specifically designed for minimally invasive procedures.

Furthermore, technological advancements, such as the development of smaller and lighter power tools, have made minimally invasive surgeries more feasible and accessible. These innovations enable surgeons to perform complex procedures with greater precision and control, driving the overall growth of the surgical power tools market. As the trend towards minimally invasive surgeries continues to grow, fuelled by patient preference and advancements in medical technology, the demand for surgical power tools is expected to rise steadily, positioning the market for further expansion and innovation.

High cost

One primary restraint of the surgical power tools market is the high cost of acquiring and maintaining advanced surgical equipment. The initial investment required for purchasing surgical power tools, especially those equipped with advanced technologies or designed for specialized procedures, can be substantial. Additionally, ongoing maintenance, servicing, and calibration expenses further add to the total cost of ownership. Moreover, healthcare facilities often face budget constraints and reimbursement challenges, particularly in regions with limited healthcare resources or where government healthcare spending is constrained. As a result, healthcare providers may be reluctant to invest in expensive surgical power tools, opting. Instead of more cost-effective alternatives or delaying equipment upgrades.

Opportunity

Integrating advanced technologies

Opportunity for the surgical power tools market lies in developing and adopting smart and connected surgical instruments. Recent launches in the market have showcased the potential of integrating advanced technologies such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) capabilities into surgical power tools, offering several benefits for both surgeons and patients.

Additionally, connectivity features enable these tools to seamlessly integrate with electronic medical records systems, enabling efficient data management and documentation. recent launches have also focused on enhancing the user experience with innovations such as lightweight and aesthetic designs, intuitive user interfaces, and wireless connectivity options. These advancements not only improve surgeon comfort and efficiency but also contribute to reducing the risk of fatigue and repetitive strain injuries that can be fatal to patients.

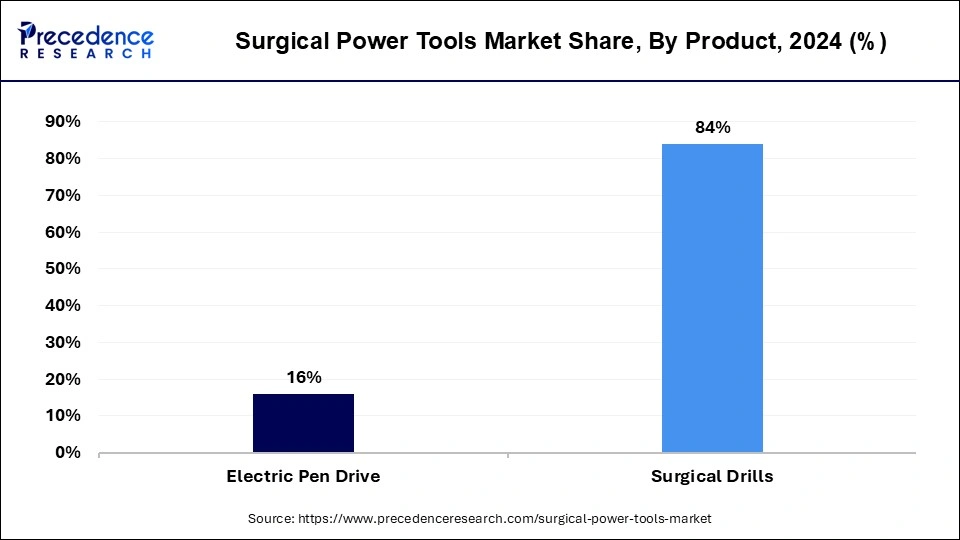

The surgical drill segment held the largest share of the surgical power tools market. Surgical drills are used in many different types of surgical operations and are an essential instrument in surgical surgeries. Neuro surgeries, orthognathic surgery, maxillofacial surgery, dental implant surgery, etc., are some of these operations. Surgeons may perform precise and accurate procedures with minimal tissue damage thanks to the use of surgical drills, which are used to cut and shape hard tissues such as bone. Technological developments have created more sophisticated and effective surgical drills, such as high-speed electric and pneumatic drills, raising the market's demand for these instruments.

The electric pen drive segment is predicted to have the fastest rate of growth in the surgical power tools market during the forecast period. Electric pen drives are the best option for sensitive treatments since they provide excellent control and precision in surgeries. Because of their fast-operating speed design, surgeons can execute precise and accurate cuts with little to no tissue damage. Patients heal more quickly as a result, and there is a lower chance of problems.

Additionally, they are quieter than conventional electric or pneumatic drills, which might lessen the worry and tension related to surgical operations. In addition, new technological advances have led to the creation of increasingly sophisticated and effective electric pen drives, including models with adjustable speed settings, oscillating tips, and longer battery life.

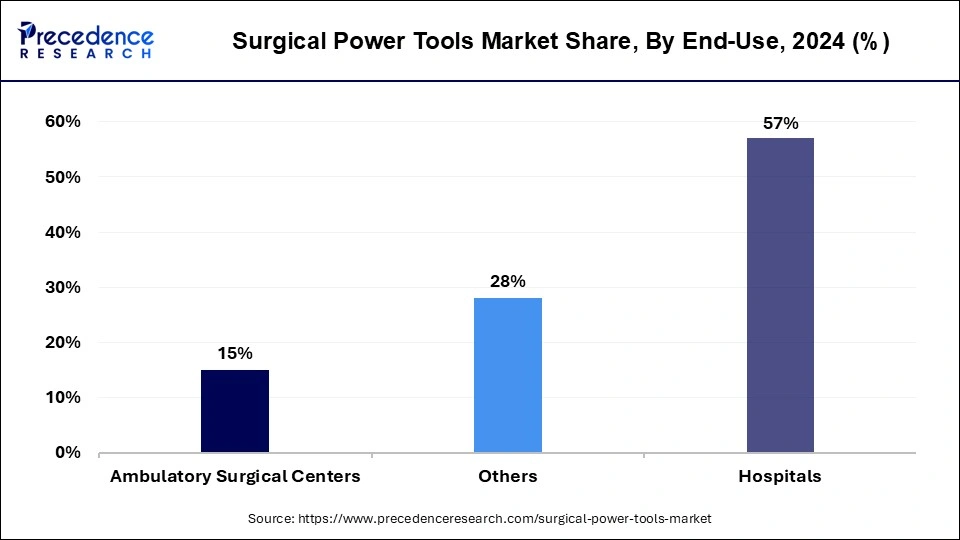

The hospitals segment held the largest shaer of the surgical power tools market in 2024, indicating its dominance in the market. Surgical procedures are primarily carried out at hospitals. They are, therefore, the primary users of power tools for these procedures. In order to perform complex surgical procedures, which requires specialized instruments like surgical power tools, hospitals have well-equipped operating rooms and trained personnel. Long-term partnerships between hospitals and manufacturers can lead to more affordable prices and improved customer service.

Hospitals also follow stringent procedures for sanitizing and maintaining surgical instruments, especially power tools. Specific requirements are frequently met for manufacturers to sell their goods to hospitals. In addition, hospitals must adhere to stringent guidelines and standards regarding the calibres and security of medical equipment.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025