January 2025

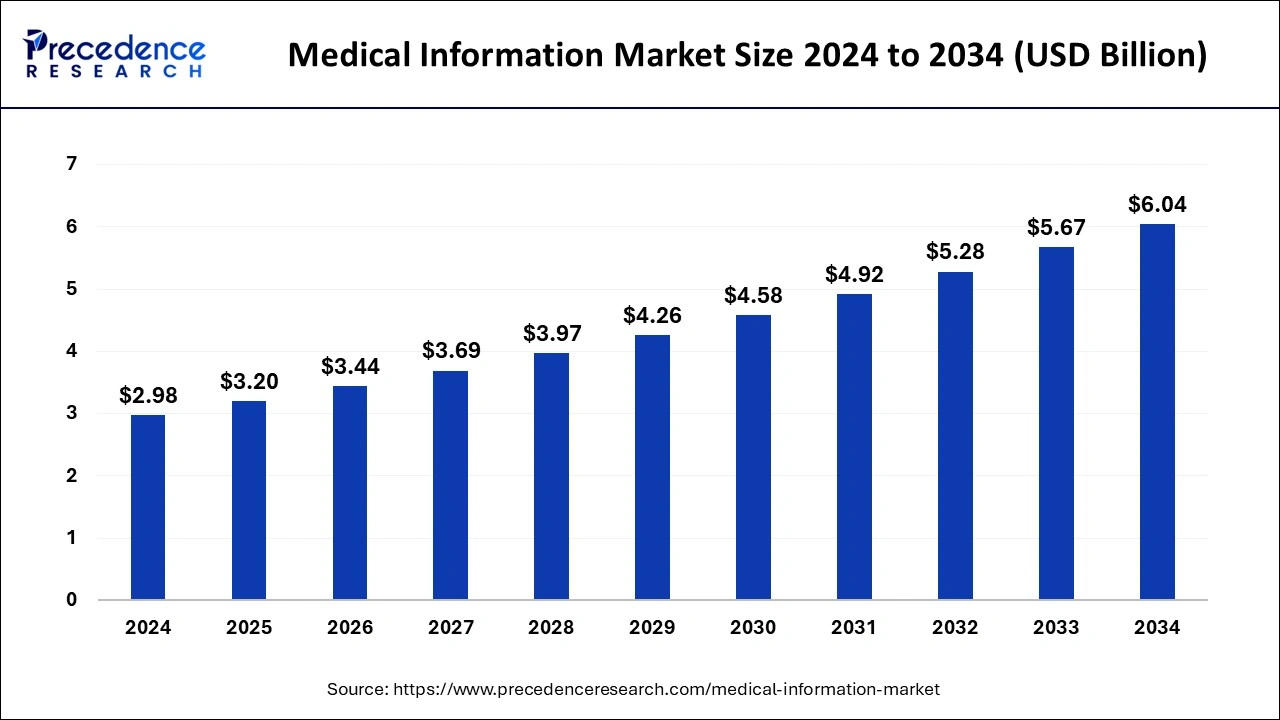

The global medical information market size is calculated at USD 3.20 billion in 2025 and is forecasted to reach around USD 6.04 billion by 2034, accelerating at a CAGR of 7.32% from 2025 to 2034. The North America medical information market size surpassed USD 1.16 billion in 2024 and is expanding at a CAGR of 7.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical information market size was estimated at USD 2.98 billion in 2024 and is predicted to increase from USD 3.20 billion in 2025 to approximately USD 6.04 billion by 2034, expanding at a CAGR of 7.32% from 2025 to 2034. The medical information market is driven by rising healthcare costs as well as increased spending on health IT infrastructure in an effort to save costs and promote efficiency.

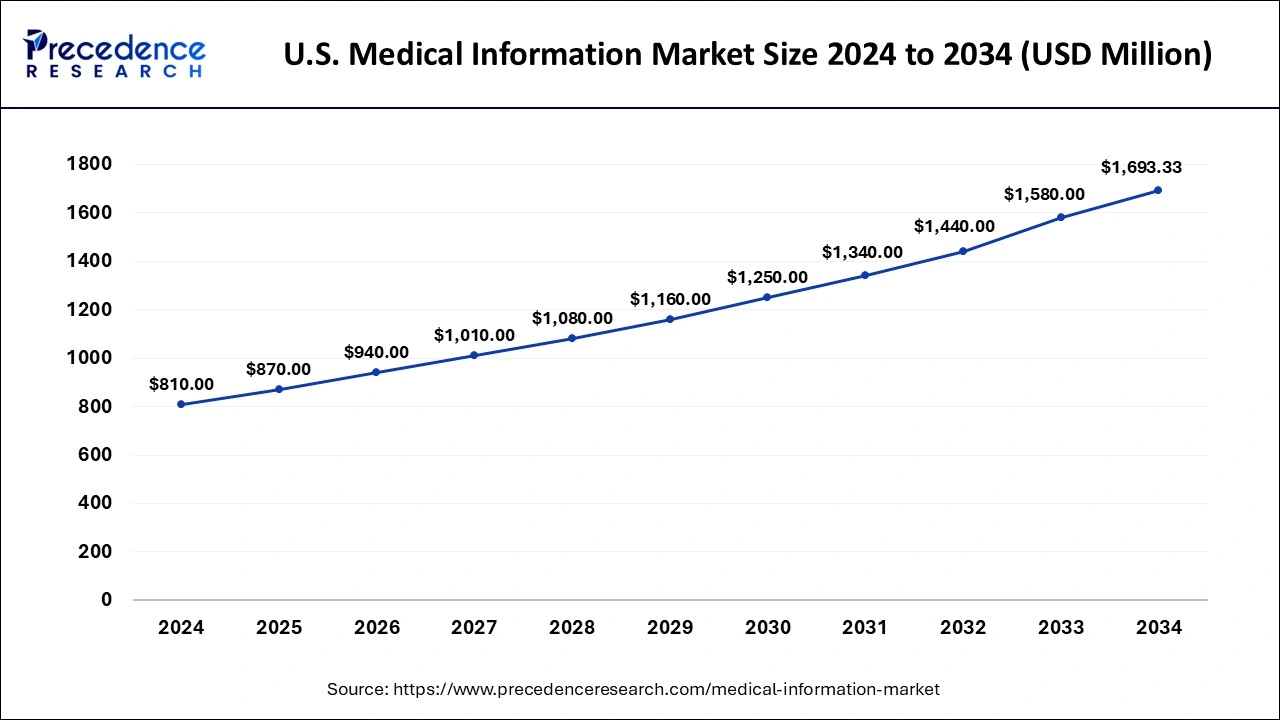

The U.S. medical information market size surpassed USD 810 million in 2024 and is projected to attain around USD 1,693.33 million by 2034, poised to grow at a CAGR of 7.65% from 2025 to 2034.

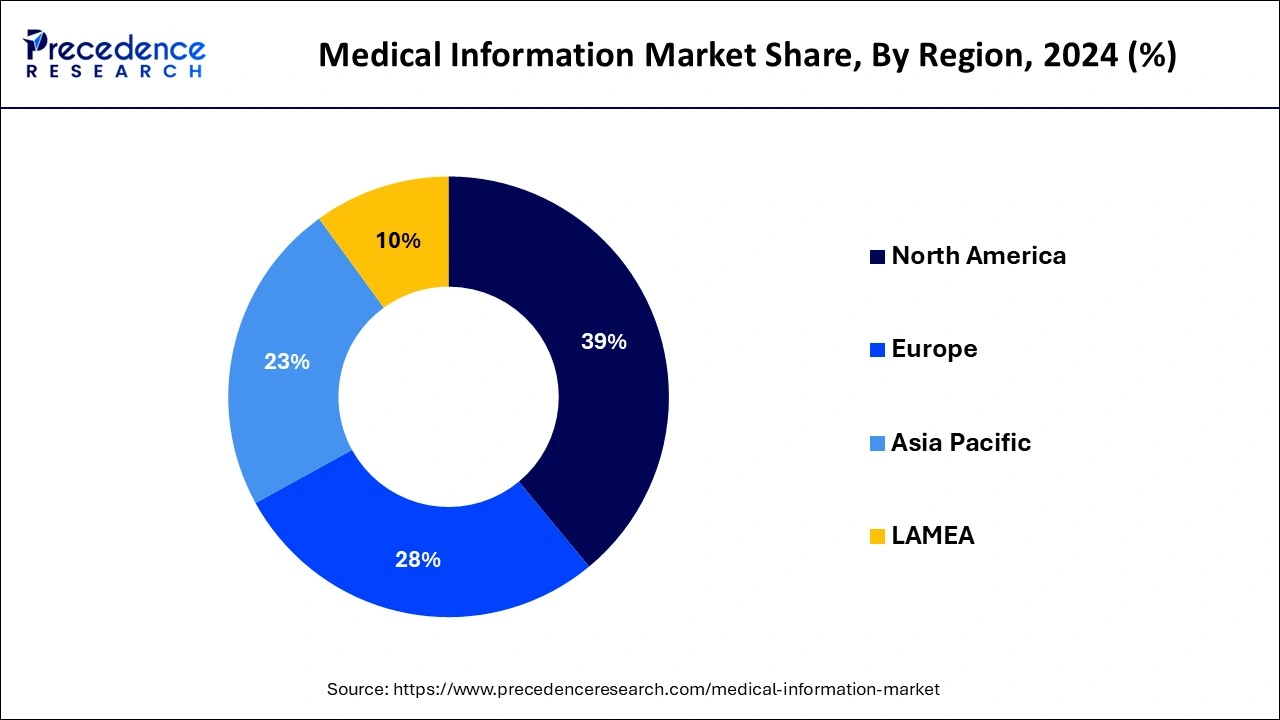

North America held the largest share of the global medical information market in 2024. Medical information systems offer medical professionals evidence-based data to support clinical judgment. These systems make it possible for various healthcare companies to share patient data securely. Providers are being forced by rising healthcare expenditures to implement more cost-effective information systems in order to simplify operations and cut costs. One major obstacle that still needs to be overcome is ensuring that various systems and platforms can exchange information and communicate with one another.

Asia Pacific is expected to host the fastest-growing medical information market during the forecast period. The Asia Pacific medical information market is expanding rapidly due to a number of important factors. This market includes a wide range of goods and services, such as post-marketing pharmacovigilance, medical equipment, and healthcare IT. The delivery of healthcare and patient monitoring are being greatly improved by the integration of telehealth systems, artificial intelligence, and digital health technologies. Leading nations that use these technologies, including remote healthcare services and sophisticated diagnostic equipment, are China and Japan. The need for medical gadgets and information systems is being driven by rising healthcare spending in nations like South Korea, China, and India. An increasing number of middle-class people who are more prepared to spend money on healthcare provide additional support for this.

An essential part of the larger healthcare sector is the medical information market, which includes the creation, administration, and sharing of health-related data and information. Electronic health records (EHRs), medical information systems, health information exchanges, telemedicine, and healthcare analytics are just a few of the elements that make up this umbrella.

By facilitating the exchange of health information between various healthcare organizations, HIEs improve patient care and interoperability. The COVID-19 epidemic has increased the adoption of remote healthcare services, which has led to exponential development in the telemedicine market. In order to raise efficiency, lower costs, and improve outcomes, this division focuses on health data analysis.

One of the main forces behind the deployment of EHRs and other health IT systems is government legislation and incentives. Key regulations have included those like the U.S. Health Information Technology for Economic and Clinical Health (HITECH) Act. The deployment of advanced information systems is being driven by the need to decrease costs and enhance efficiency in the healthcare industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.20 Billion |

| Market Size by 2034 | USD 6.04 Billion |

| Market Growth Rate From 2025 to 2034 | CAGR of 7.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Provider, Therapeutic Area, Product Life Cycle, Company Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased prevalence of chronic diseases

Accurate and easily understandable medical information is becoming more and more important in helping patients manage chronic conditions such as diabetes, heart disease, and arthritis. There is now a need for platforms that can provide trustworthy medical information remotely due to the growth of telemedicine. EHRs are essential for keeping track of patient histories and giving medical professionals access to relevant data.

The need for comprehensive medical information about chronic diseases is growing as a result of pharmaceutical companies' investments in research and development for these ailments' treatments. Comprehensive medical data is required in order to forecast trends in the prevalence and outcomes of chronic diseases using big data and health analytics.

Data privacy and security

Given how sensitive healthcare data is, data security and privacy in the medical information market are vital concerns. Large volumes of electronic health records (EHRs) and personal health information (PHI) are collected, stored, and analyzed in the market. Safeguarding the confidentiality and integrity of this information is crucial for upholding legal obligations, safeguarding people's rights, and preserving public confidence in healthcare institutions. Cybercriminals frequently target healthcare data, which makes it a prime target for ransomware attacks and data breaches. Weighing privacy concerns against the necessity of data sharing for research and better healthcare results.

Telemedicine and telehealth

The medical information market has seen a significant transformation in the delivery and accessibility of healthcare due to the rise of telemedicine and telehealth. The provision of therapeutic services to patients without an in-person visit is done through the use of software and electronic communications. This can involve digital medical information transmission, remote monitoring, and video consultations.

Gadgets and programs that track patients' vital signs (blood pressure, glucose levels, etc.) and send the information to medical professionals for continued supervision minimize the need for physical infrastructure and can cut back on hospital stays and travel expenses related to the provision of healthcare. This creates several opportunities for the players in the medical information market.

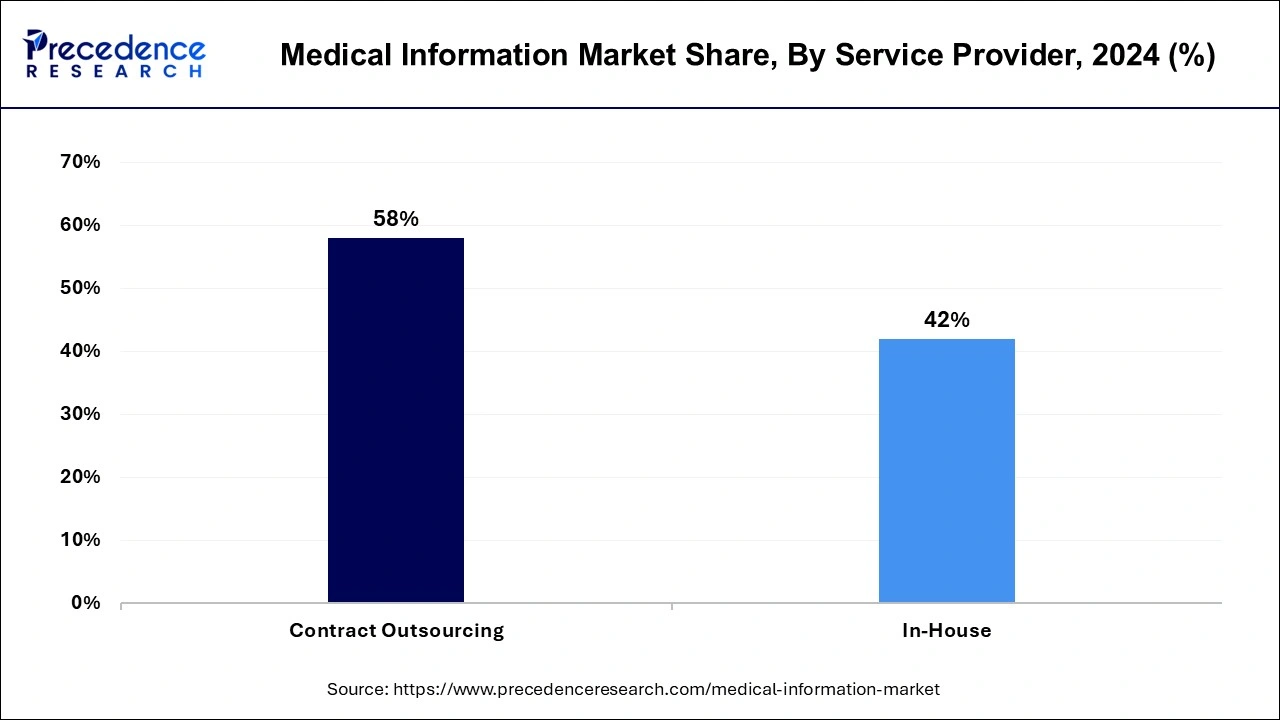

The outsourcing segment holds the largest share of the medical information market in 2024. Operating costs can be decreased by corporations through outsourcing. Businesses can save costs on salaries, training, and infrastructure related to sustaining in-house teams by utilizing the experience of outside providers. With outsourcing, businesses may adjust their operations to meet demand without having to worry about recruiting or firing employees. This adaptability is especially useful in the very dynamic healthcare sector. Healthcare businesses can concentrate more on their main objectives, such as patient care and clinical research, by outsourcing non-core services. This enhances general efficacy and efficiency. Overseeing regulatory filings, communicating with regulatory bodies, and guaranteeing adherence to rules.

The in-house segment is expected to witness the fastest growth in the medical information market during the forecast period. In the medical information (MI) sector, the term "in-house approach" refers to the practice of pharmaceutical and healthcare organizations handling their medical information operations in-house as opposed to contracting out these services to outside suppliers. Businesses now have more control over their MI procedures, which enables customization to match particular requirements and preserve brand and internal policy coherence. Keeping sensitive information inside the company allows for improved data security and confidentiality when managing MI internally. Over time, internal teams can develop extensive product knowledge and expertise, which can enhance the caliber of information given to patients and healthcare providers.

The oncology segment held the largest share of the medical information market in 2024. A crucial and quickly developing sector of the medical information market, oncology is driven by the increasing incidence of cancer, scientific breakthroughs, and the need for targeted and individualized treatment choices. The rising global incidence of cancer is driving significant growth in the oncology information industry. The introduction of novel medicines, increased awareness of cancer screening, and improvements in medical technology have all played a significant role in this expansion. With the increased usage of telemedicine services, cancer patients now have better access to follow-up consultations and specialized care.

The immunology segment is expected to grow rapidly in the medical information market during the forecast period. The market for medical information is a significant and quickly developing industry, especially in the field of immunology. The study of the immune system, its ailments, and the creation of therapies to control the immunological response are all included in the field of immunology. Numerous ailments, such as autoimmune disorders, allergies, infectious diseases, and cancer, are significantly impacted by this field. The growing prevalence of autoimmune diseases and our growing understanding of them have led to an expansion of the market for diagnostics and treatments related to these ailments. Growing allergy incidence and advancements in diagnostic technologies are driving growth in the market for allergy diagnostics and therapies.

The clinical phase segment led the medical information market in 2024. The clinical phase, also known as the clinical trial phase in the medical information market, is an essential stage in the development and approval of new medications and medical treatments. New drugs and treatments are tested extensively in laboratories and on animals before being tested on humans; if clinical trials show that the medication is safe and effective, the data is submitted to regulatory bodies (such as the FDA in the United States or the EMA in Europe) for review and approval. Continuous monitoring of the medication's performance in the general population is also done to find any long-term or uncommon side effects.

The post-market approval segment is expected to expand significantly in the medical information market during the forecast period. In the medical information industry, the term "post-market approval" (PMA) describes the actions and procedures carried out following regulatory permission for the commercialization of a pharmaceutical product or medical device. This stage is essential to guarantee the product's continued quality, safety, and efficacy after patients and healthcare professionals may access it. Periodic safety update reports, or PSURs, are required to be submitted by manufacturers to regulatory agencies in many locations. Application of tactics to reduce dangers that have been found, such as label modifications, more user training, or, if required, product recalls. Regulatory agencies' routine inspections to verify adherence to other laws and good manufacturing procedures (GMP).

The medium-sized segment held the largest share of the medical information market in 2024. Medium-sized businesses frequently concentrate on certain medical niches, spurring innovation through the creation of specialized medical information services and products. They might carry out epidemiological studies and clinical trials, contributing important information and knowledge to the larger medical information ecosystem. Unlike larger, less adaptable organizations, they may give patients, pharmaceutical companies, and healthcare professionals with tailored medical information solutions. Health informatics systems, such as electronic health records (EHRs), health information exchanges (HIEs), and telemedicine platforms, are developed and implemented in part by medium-sized businesses.

The small-sized segment is expected to grow at a considerable CAGR in the medical information market during the forecast period. Small businesses are frequently at the forefront of innovation because of their swift adaptation and adoption of novel concepts. Oftentimes, they concentrate on specialized markets or particular requirements for medical information that larger organizations could miss. Numerous small businesses cater to niche markets in the medical information industry, such as those for uncommon diseases, particular medical problems, or particular target audiences. Modern health IT solutions, such as electronic health records (EHR), telemedicine platforms, and mobile health apps, are often created and used by small businesses. Small businesses frequently collaborate with bigger biotech and pharmaceutical corporations, offering specialized knowledge and services to enhance the strengths of their bigger competitors.

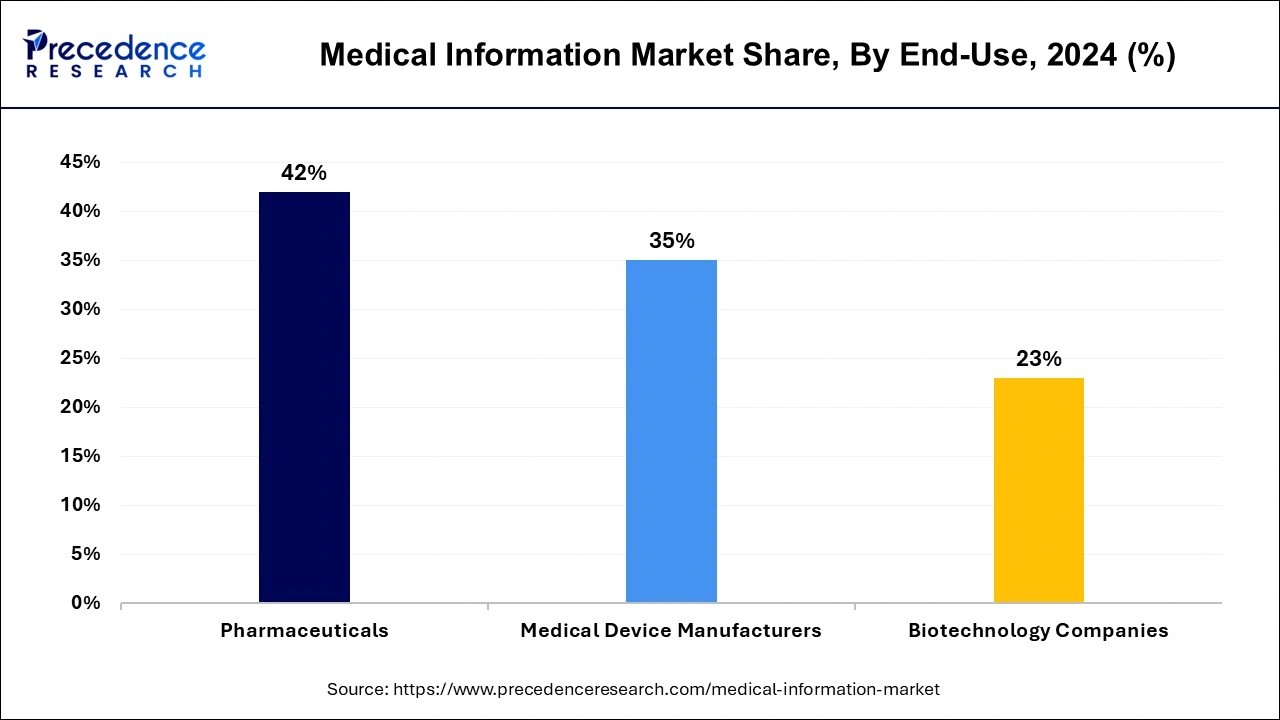

The pharmaceuticals segment dominated the medical information market in 2024. One of the main sources of information regarding drugs is the pharmaceutical industry. They create thorough records pertaining to the medications they generate, which include safety information, dosage guidelines, and prescribing information. In order to make well-informed decisions regarding patient treatment options, healthcare providers require access to this information. Pharmaceutical businesses frequently create educational resources for patients and healthcare providers. Brochures, websites, and instructional programs are a few examples of these tools that have the purpose of educating people about certain illnesses, available treatments, and optimal healthcare procedures. A growing number of pharmaceutical companies are investing in digital health solutions, like online platforms and mobile apps, to give patients and medical professionals information and support.

The innovators segment is expected to grow at the fastest rate in the medical information market during the forecast period. In terms of mobile medical reference apps, Epocrates is a pioneer. It offers clinical information to medical practitioners via smartphones and tablets, including information on drug safety and prescription, clinical practice guidelines, and tools for diagnosing illnesses. A professional networking site called Doximity was created with healthcare workers in mind. It helps doctors to collaborate, communicate, and share knowledge in a safe manner, keeping them informed and connected. Patients can use the web resource Zocdoc to locate and schedule appointments with local healthcare providers. In addition to giving patients access to reviews and ratings to aid in their decision-making, it expedites the appointment scheduling process.

By Service Provider

By Therapeutic Area

By Product Life Cycle

By Company Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025