September 2024

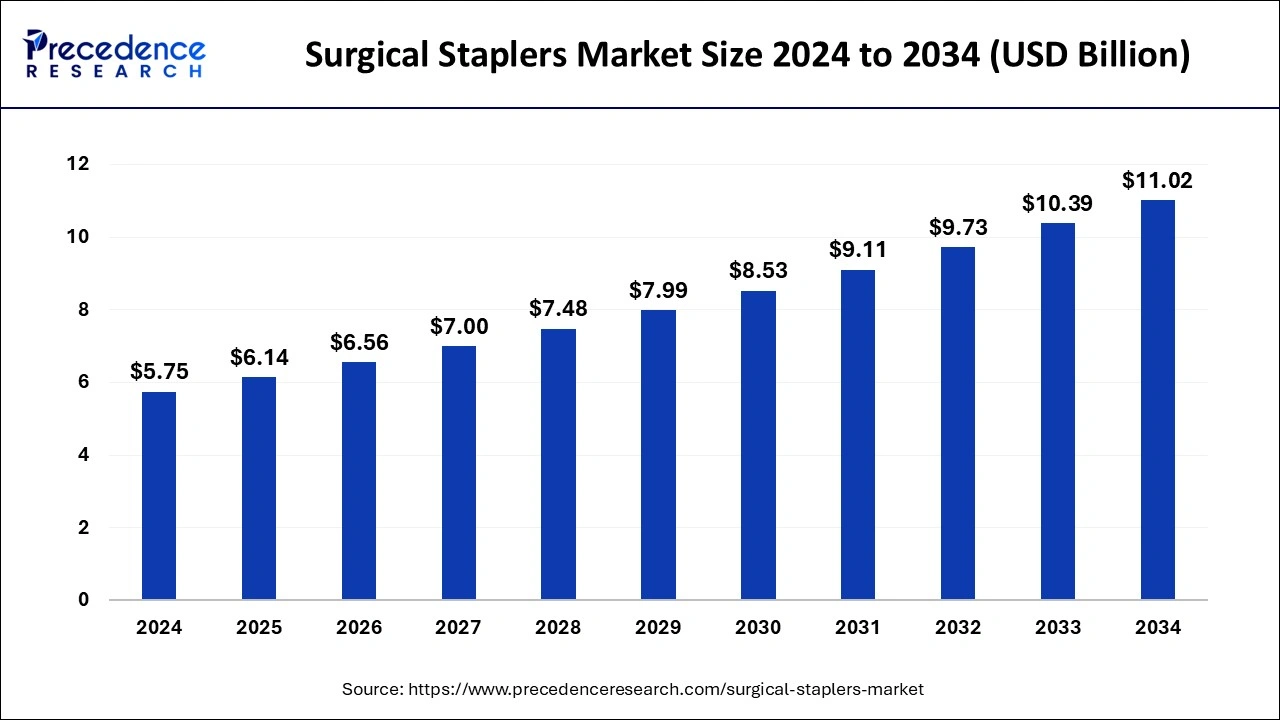

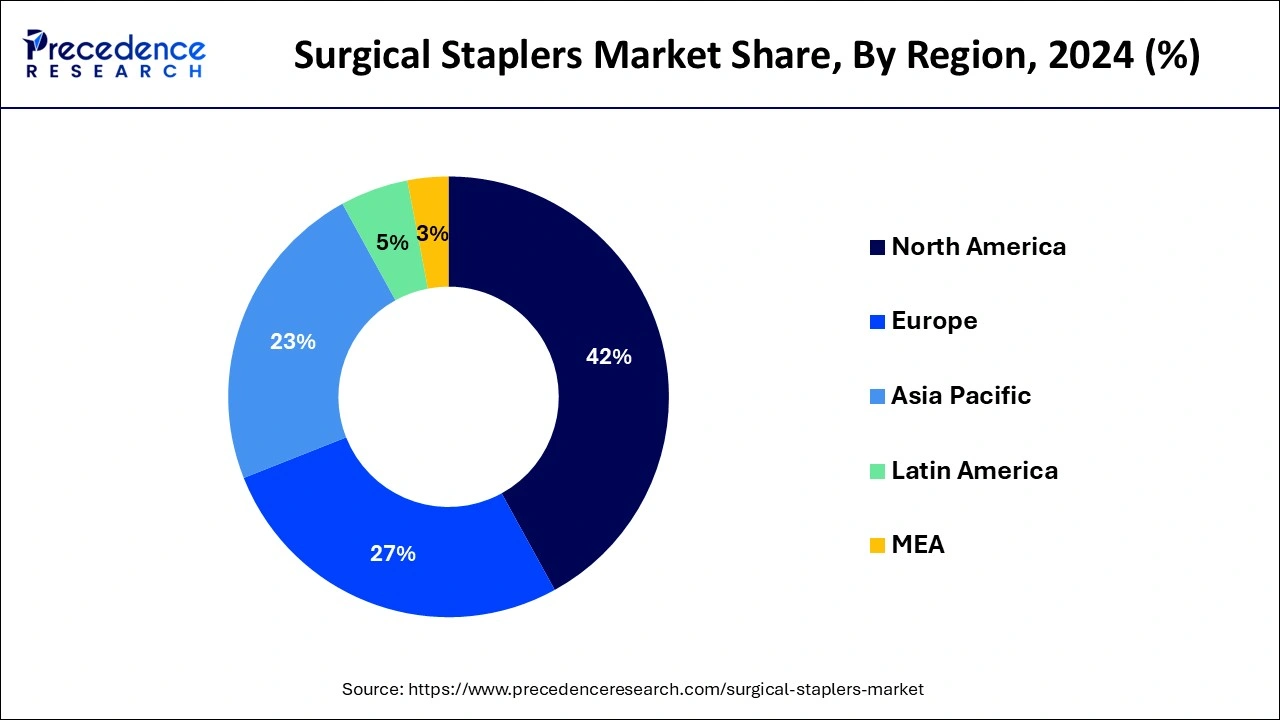

The global surgical staplers market size is calculated at USD 6.14 billion in 2025 and is forecasted to reach around USD 11.02 billion by 2034, accelerating at a CAGR of 6.72% from 2025 to 2034. The North America surgical staplers market size surpassed USD 2.42 billion in 2024 and is expanding at a CAGR of 6.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical staplers market size was accounted for USD 5.75 billion in 2024, and is expected to reach around USD 11.02 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034. The surgical staplers market growth is driven by the increasing number of surgical procedures and the rising demand for minimally invasive surgeries.

Integrating AI technologies in surgical staplers reduces the chances of human errors and enhances precision. This leads to better wound closure. AI improves the design and functionality of staplers, reducing complications. AI-enabled staplers provide real-time feedback during surgical procedures, ensuring the stapling process is executed correctly. This data is then used to learn patterns with the help of machine learning, allowing the surgeon to choose an effective course of action for a particular case.

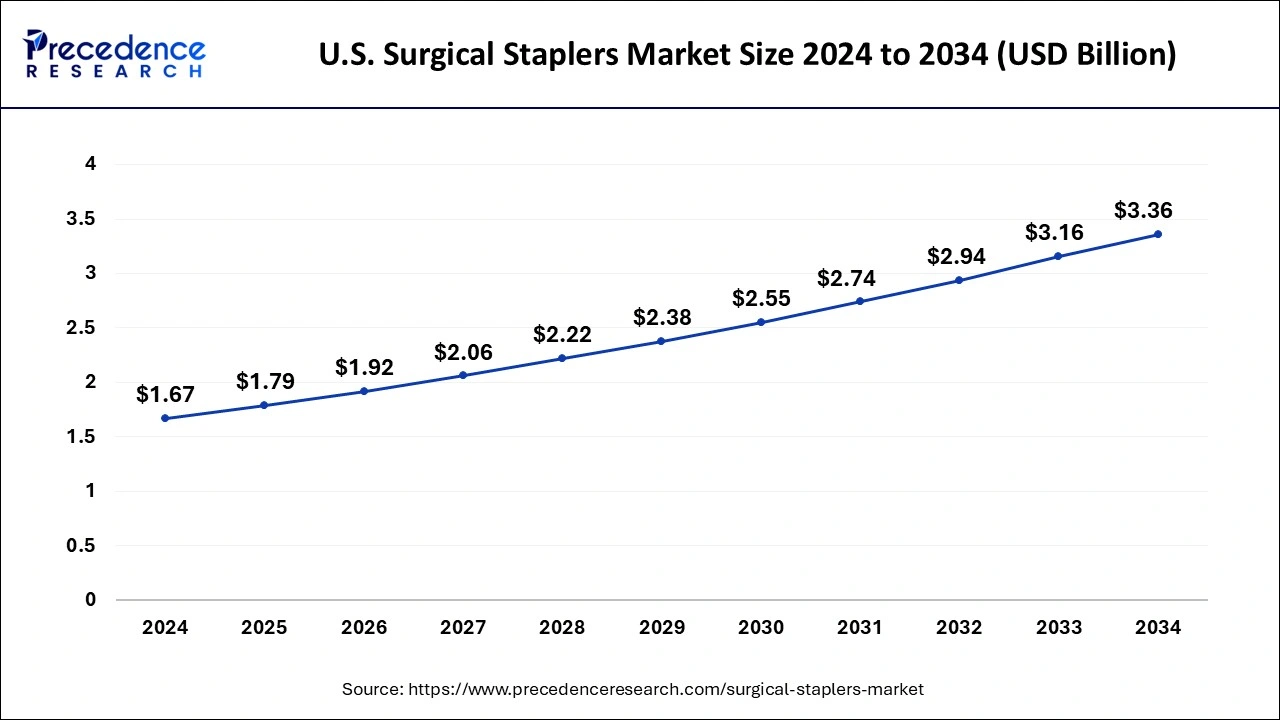

The U.S. surgical staplers market size was estimated at USD 1.67 billion in 2024 and is predicted to be worth around USD 3.36 billion by 2034, at a CAGR of 7.24% from 2025 to 2034.

Because more procedures were conducted overall thanks to the adoption of cutting-edge technologies and non-invasive techniques, North America region held the highest market revenue share of 42% in 2024. The greatest obesity rate in the world, the localized presence of international companies, and Regulatory approval for minimally invasive surgeries are additional factors contributing to the significant market share. Special devices are created for laparoscopy and thoracoscopy procedures, which utilize surgical stapler devices, thanks to recent advancements in minimally invasive surgery. The prerequisite understanding of stapling instruments must now be acquired by surgeons.

Asia Pacific is predicted to have the greatest CAGR during the projection period since countries like China, India, and Japan have huge patient populations. Due to rising desire and use, surgery staplers were classified as "drugs" in 2011 and subject to regulation under the Cosmetics and Drugs Act in India. As a result of this act's application, surgical stapler production and distribution are now subject to tight controls. The market for stapling is predicted to expand profitably as surgical procedures are carried out more frequently, healthcare costs are on the rise, and public awareness of their use is growing. Important market companies are spending in this area to increase their footprint. The market in the region is expected to grow as a result of initiatives like those done by Johnson & Johnson Healthcare, India, to educate 8,000 doctors in sophisticated surgical devices, including non-invasive surgery staples.

One of the main key indicators driving the market's expansion is the increase in overall surgical procedures as well as the use of medical staplers in complicated chronic surgeries like heart surgery. The market is expanding due to the increasing use of surgical staplers, particularly in developed economies, as well as the accessibility of technologically enhanced product lines as a result of effective research and development initiatives by key industry players. The expansion of the market is also being aided by the rising incidence of cardiovascular illnesses and the global geriatric population.

Other aspects that contribute to the growth of such a market include the advancement of new technologies, prominent player health care infrastructures in industrialized nations, and increased demand for motorized surgical equipment in emerging markets. The market's expansion is constrained by the increasing demand for improved endovascular materials like glues and fibrinogen sealants, pricing rivalry within the sector, and the potential for allergy or unpleasant responses to elements like titanium or steel.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.14 Billion |

| Market Size by 2034 | USD 11.02 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Type, Product, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A rise in the acceptance of cosmetic procedures and medical travel in emerging markets

Due to rising demand for advanced technology, the power surgical stapler device sector is predicted to grow at a quick rate during the forecast period and hold the largest share in 2024. The growth of this market is being driven by the many advantages powered staplers have over manual staplers, including ease of use, low risk of problems like blood loss or spillages, shorter operating times, and lower hospital costs.

The powered section of the surgery staple market is driven by the several advantages that these staplers provide, such as precise wound closure, stability, fewer leaks, and lower compressive force. The expanded research and development efforts to enhance the functionality of motorized surgical staplers will create new opportunities for the development of the sector. Additionally, ease of usage and lower hospitalization costs compared to traditional staplers will boost market expansion.

Due to growing worries about communicable diseases, the disposable category is expected to experience impressive growth during the projection years. Biodegradable staplers are commonplace because they reduce surgical procedure-related infections, which ultimately improves technical quality. Disposing of surgical staplers also helps to prevent the spread of the infection from patient to medical staff. Additionally, the benefits of disposable staplers include a lower risk of infection and better product offers are anticipated to fuel demand for the sector.

Due to the growing use of detachable staplers in complex and chronic procedures, especially heart surgery, the disposable segment will generate more revenue in 2020. For minor injuries and post-operative wound closure, biodegradable staplers are generally regarded as the best option. All of these elements will raise product demand, raising the sector's value.

The stapling instruments are employed in a variety of surgical operations, but they are most frequently utilized on the skin to close wounds during procedures like bariatric and laparoscopic surgery, among others. Additionally, it is anticipated that an increase in the frequency of sports-related injuries and auto accidents will increase the supply for wound contraction, in turn driving up prices in the sector.

Due to the increased use of surgical instruments in hospitals, the healthcare segment is anticipated to dominate. Hospital beds are in short supply, especially in developing and undeveloped nations, which might be linked to the steady rise of the outpatient center market. The segment is also projected to be driven by trends including the expanding use of automation systems in surgery, which enhances the outcomes of minimally invasive procedures. Favorable bariatric surgery reimbursement regulations will also aid hospitals in maintaining their supremacy.

By Technology

By Type

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025