September 2024

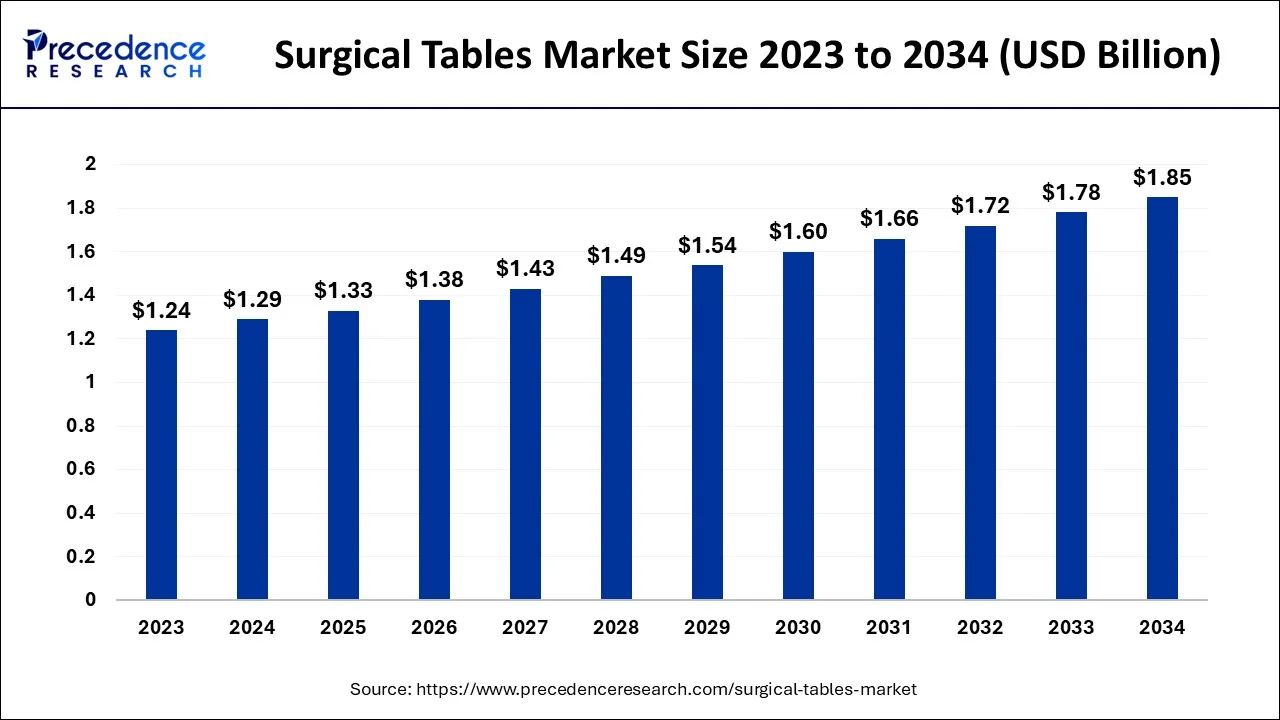

The global surgical tables market size accounted for USD 1.29 billion in 2024, grew to USD 1.33 billion in 2025 and is predicted to surpass around USD 1.85 billion by 2034, representing a healthy CAGR of 3.70% between 2024 and 2034. The North America surgical tables market size is calculated at USD 0.46 billion in 2024 and is expected to grow at a fastest CAGR of 3.82% during the forecast year.

The global surgical tables market size is estimated at USD 1.29 billion in 2024 and is anticipated to reach around USD 1.85 billion by 2034, expanding at a CAGR of 3.70% from 2024 to 2034.

An increasing number of surgeries due to an increase in trauma and injury cases around the world is expected to drive market growth. The increasing adoption of advanced surgical tables by hospitals and healthcare facilities for improved surgical experiences for patients and surgeons is expected to drive market growth. The COVID-19 pandemic has had an impact on all aspects of medical care, including surgical treatment.

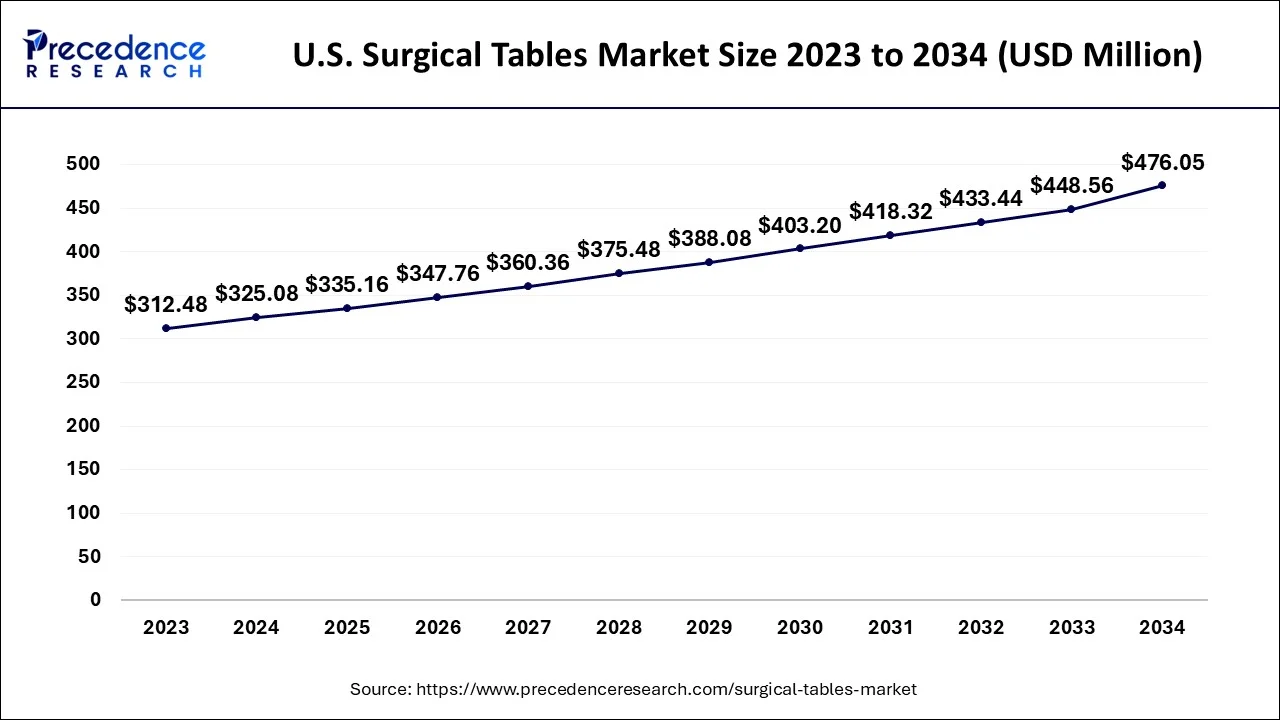

The U.S. surgical tables market size is evaluated at USD 325.08 million in 2024 and is predicted to be worth around USD 476.05 million by 2034, rising at a CAGR of 4.05% from 2024 to 2034.

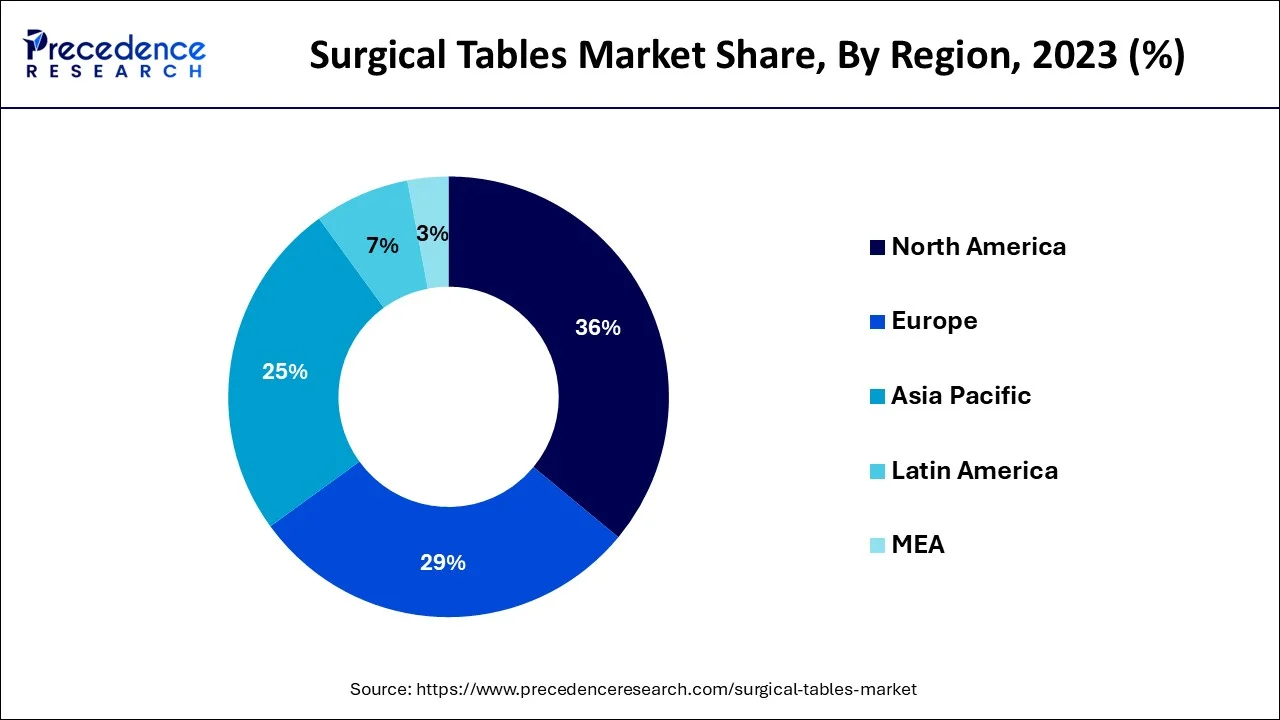

On the basis of geography, North America is anticipated to dominate the surgical tables market. The main drivers propelling the growth of the surgical tables market in North America are the favorable reimbursement environment in the U.S, the rising preference for minimally invasive procedures, and the staggering number of surgeries. Additionally, rising public awareness of the need for surgical procedures to address difficulties with chronic diseases and injuries is fueling market expansion. In recent years, there has been an increase in the number of knee and hip replacement operations, which has positively benefited the segment's growth in the surgical tables market. For instance, 15.6 million cosmetic treatments were carried out in the United States in 2020, according to a report from the American Society of Plastic Surgeons. Similarly, a total of 15.6 million cosmetic operations, including 13.2 million minimally invasive procedures and 2.3 million cosmetic surgical procedures, were carried out in the United States in 2020, according to a report from the American Society of Plastic Surgeons. Additionally, there are many important market participants present in this area, which is why significant growth rates are anticipated for the region. Collaborations between important market participants also contribute to market expansion. A new general surgery table will be introduced in the US in October 2021 thanks to a partnership between Stille AB and GE Healthcare.

As more complex procedures performed in the operating room necessitate the need for surgical tables to handle a variety of procedures/positions, a demand for surgical tables in hospitals is expected. During the forecast period, rising competition in the surgical instrument industry is expected to boost demand for technologically advanced surgical tables. The growing geriatric population base around the world is expected to drive up product demand during the forecast period. The Population Reference Bureau estimates that the number of Americans aged 65 and up will nearly double from 52 million in 2018 to 95 million by 2060.

| Report Coverage | Details |

| Market Size in 2024 |

USD 1.29 Billion |

| Market Size by 2034 |

USD 1.85 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, Material, End-Use, and Geography |

Growing prevalence of targeted diseases

Increasing demand during Covid-19

On the basis of product type, the general surgical table segment is expected to have the largest market share in 2023. An increase in surgeries, particularly in general, gynecologic, ENT, and cardiovascular operations. The prevalence of cardiovascular disorders (CVDs) is rising, which is also significantly driving up demand for operating tables. For instance, the CDC estimates that approximately 655,000 Americans pass away from heart diseases each year. Additionally, according to the WHO, 17.9 million people worldwide pass away each year.

In 2023, the specialty surgical table’s market category held a sizable market share. Neurosurgical, orthopedics, laparoscopic, and bariatric surgical tables make up the remainder of the specialty surgical tables market sector. Due to an increase in surgical treatments, such as orthopedics and bariatric surgeries, demand for specialist surgical tables is growing. In order for surgeons to execute specialty surgical procedures, they need to use a variety of surgical techniques and specialized patient postures. Additionally, it is predicted that during the forecast period, increased investments by various hospitals and organizations to improve surgical treatments and procedures, especially specialized operations, will encourage segment expansion.

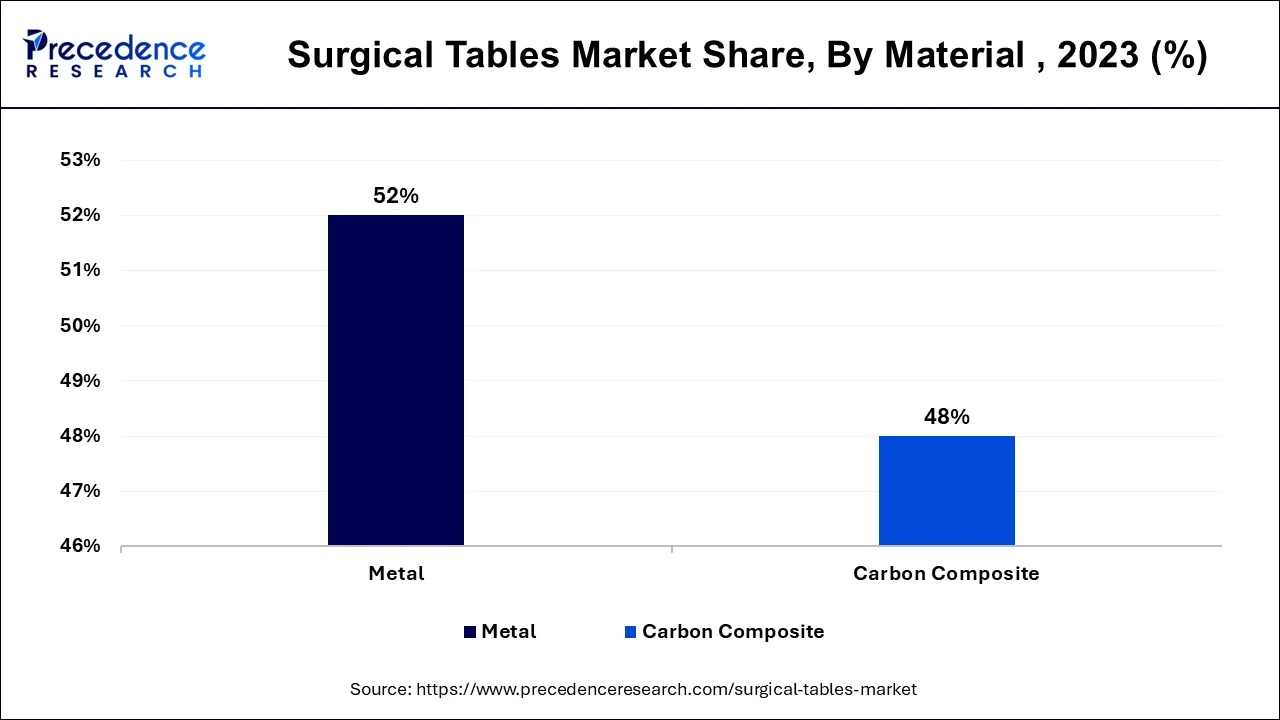

On the basis of the material, the metal segment is expected to have the largest market share in 2022. This segment's expansion is anticipated to be aided by increased adoption as well as rising demand for metal surgical tables due to their affordability and ease of availability. Due to their lower price compared to composite surgical tables, metal surgical tables are increasingly in demand among medical practitioners. One of the most used metals for making surgical tables is stainless steel.

The anti-microbial qualities of stainless steel make it ideal for use in operating rooms and medical equipment. Therefore, it is anticipated that widespread use of surgical tables made of stainless steel will fuel the segment's expansion. In 2023, the carbon composite market segment had a sizable market value. The surgical table's positioning surface, which is constructed of carbon fibre, may be moved both laterally and longitudinally. During surgical procedures, the surface and the patient are both moved by a motor to the desired position. It is anticipated that rising technological developments related to carbon composite surgical tables would forge a strong market position.

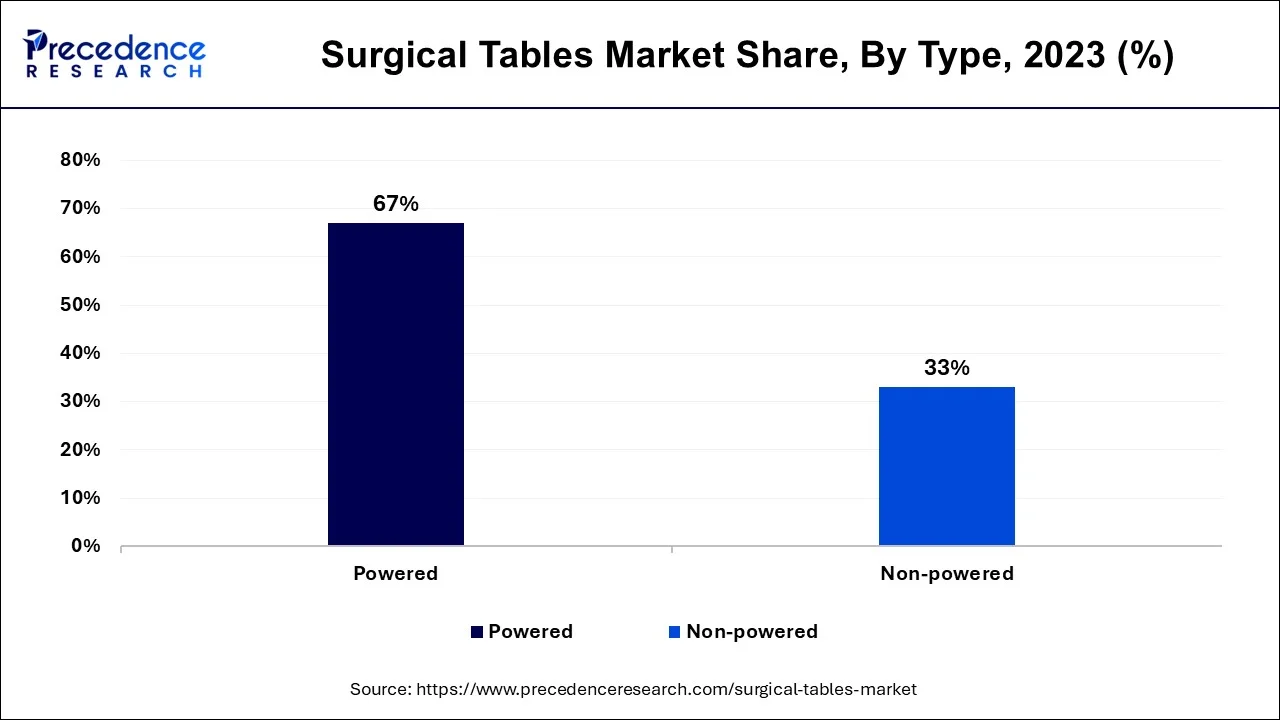

On the basis of type, the segment of powered maintained a dominating status in the market Battery power is frequently used in powered surgical tables, eliminating the need for electrical wires on the floor. Through a variety of motor-driven features, including tilt, back and leg support, height adjustment, an inclination of the tables, and return-to-level, these devices help the operating room team position the patient. Such advantages provided by powered surgical tables are anticipated to boost segment expansion.

In 2023, the non-powered sector also held a sizeable market share. Hydraulic and non-powered surgical tables are in greater demand in hospital settings worldwide due to advancements in the medical technology sector, an increase in patients, and surgeons emphasizing the importance of safety and comfort. Conversely, non-powered surgical tables lack auto-control features, which may interfere with a surgeon's or healthcare provider's ability to concentrate while performing surgery. In turn, it is projected that this will limit segment growth throughout the forecast period.

On the basis of end-use, the segment of hospital has emerged as a dominant market. Because hospitals are available for primary care in the majority of developing nations worldwide and have favorable payment policies, hospitals do more procedures than any other type of healthcare facility. Hospital investments in surgical equipment, such as operating tables, are gradually increasing, which is boosting the segment's growth.

During the projected period, it is predicted that the ASCs segment will increase at the fastest rate. The demand for surgical tables at ambulatory surgical centers is primarily driven by the increased preference for same-day surgery, significant cost savings, waiting time reductions, and an increase in the number of patients needing surgical procedures. Hospital investments in surgical equipment, such as operating tables, are gradually increasing, which is boosting the segment's growth.

During the projected period, it is predicted that the ASCs segment will increase at the fastest rate. The demand for surgical tables at ambulatory surgery centers is primarily driven by the increased preference for same-day surgery, significant cost savings, waiting time reductions, and an increase in the number of patients needing surgical procedures.

By Product

By Type

By Material

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025