January 2025

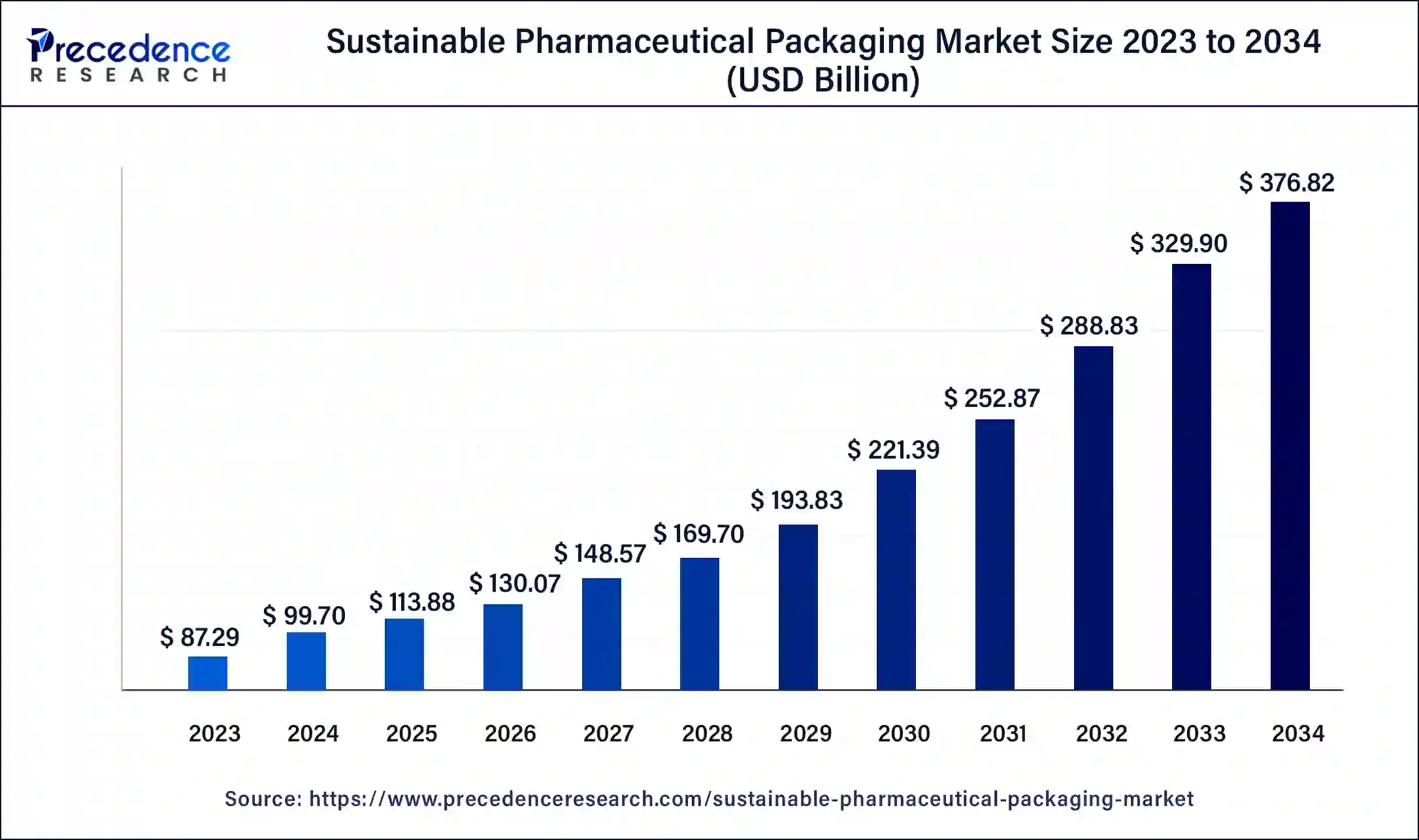

The global sustainable pharmaceutical packaging market size surpassed USD 87.29 billion in 2023 and is estimated to increase from USD 99.70 billion in 2024 to approximately USD 376.82 billion by 2034. It is projected to grow at a CAGR of 14.22% from 2024 to 2034.

The global sustainable pharmaceutical packaging market size is expected to be worth USD 99.70 billion in 2024 and is anticipated to reach around USD 376.82 billion by 2034, growing at a solid CAGR of 14.22% over the forecast period 2024 to 2034. Increasing awareness of environmental issues and regulatory pressures is the key factor driving the sustainable pharmaceutical packaging market growth.

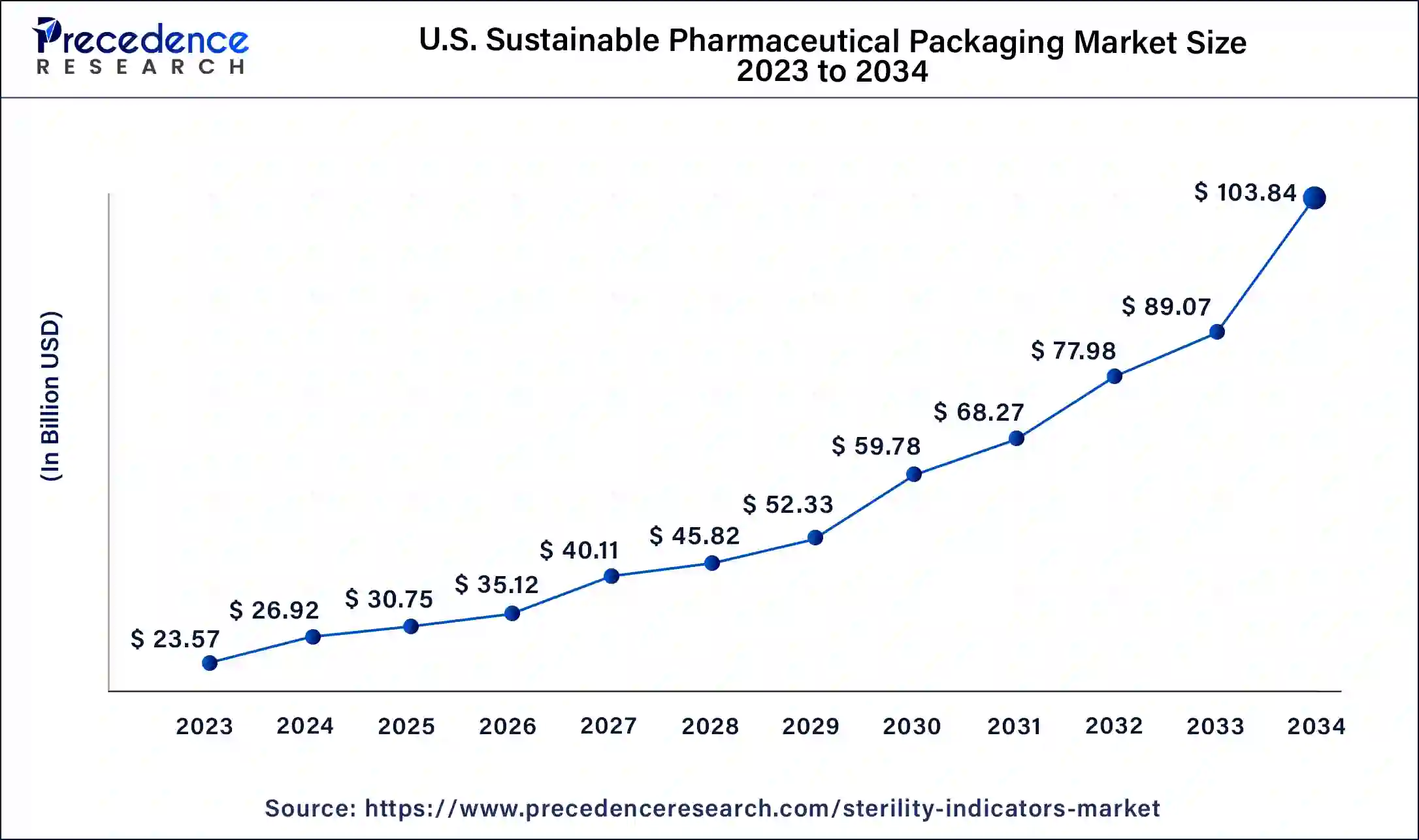

The U.S. sustainable pharmaceutical packaging market size was exhibited at USD 23.57 billion in 2023 and is projected to be worth around USD 103.84 billion by 2034, poised to grow at a CAGR of 14.43% from 2024 to 2034.

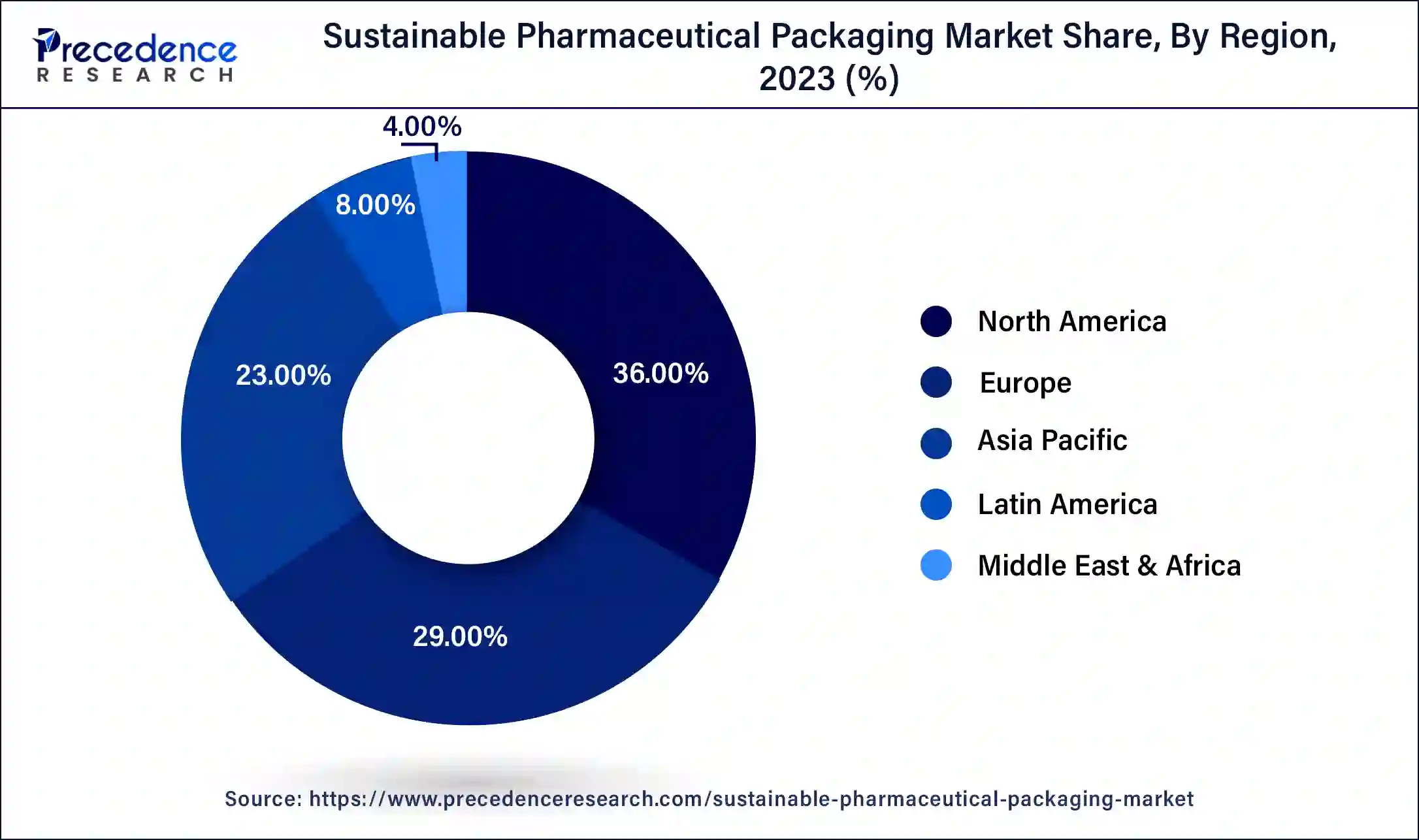

North America led the global sustainable pharmaceutical packaging market in 2023. The dominance of the region is due to the rising environmental policies and stringent regulations that enable pharmaceutical companies to adopt more sophisticated pharmaceutical packaging solutions. The U.S. sustainable pharmaceutical packaging market is fueled mainly by rising consumer awareness and the need for sustainable products.

Asia Pacific is expected to show the fastest growth in the sustainable pharmaceutical packaging market over the projected period. This is because of expanding industrialization and economic growth in economies such as China, India, and South Korea. Additionally, Governments in these nations are implementing stringent regulations on plastic utilization and waste management, which is encouraging pharmaceutical companies to adopt sustainable packaging alternatives.

Top biotechnology and pharmaceutical companies ranked by revenue in USD billion

| Company | Year 2023(Bn USD) |

| Johnson & Johnson | 85.16 |

| Sinopharm | 84.06 |

| Roche | 68.48 |

| Merck & Co. | 60.12 |

| Pfizer | 58.50 |

| AbbVie | 54.32 |

| Bayer | 51.72 |

| Sanofi | 46.84 |

| AstraZeneca | 45.81 |

Sustainable pharmaceutical packaging is the utilization of eco-friendly procedures and materials in the packaging of pharmaceutical products designed to lessen the environmental effects. Sustainable pharmaceutical packaging can also leverage a third-party logistics company for cross-docking, inventory management, and product packaging. The third-party logistics model also provides greater asset use and sharing alliances, which in turn raises demand and can have a positive impact on the sustainable pharmaceutical packaging market. The application of this can include primary and secondary packaging for medications that are made to ensure product integrity and safety.

Role of AI in the Sustainable Pharmaceutical Packaging Market

AI-based systems can be used to optimize production and management in the sustainable pharmaceutical packaging market. These systems can generate demand forecasts, analyze historical data, and assess storage conditions to predict the type and quantity of packaging needed. This can help reduce overproduction and waste, making packaging production more aligned with actual demand. Additionally, AI can be utilized to monitor and track products during the packaging process and identify any anomalies or defects.

| Report Coverage | Details |

| Market Size by 2034 | USD 376.82 Billion |

| Market Size in 2023 | USD 87.29 Billion |

| Market Size in 2024 | USD 99.70 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product, Process, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expansion of manufacturing facilities

The sustainable pharmaceutical packaging market is witnessing substantial growth due to increasing demand for various pharma products, especially in the context of drug delivery devices and chronic diseases. This trend is mainly propelled by emerging economies, demographic shifts, and healthcare facilities addressing the requirements of populations with financial hurdles. Furthermore, the vendors are growing their production abilities with investments in new factories such as Schott AG's facility in China, etc.

In June 2024, Evertis launched the Evercare brand for the healthcare packaging market, which was designed to provide superior performance and support regulatory compliance to the healthcare market. Evercare sits in a vertically integrated group that delivers a value proposition to healthcare customers in terms of innovation, sustainability, and supply chain security.

Limited availability of suitable materials

Sustainable, high-quality materials that fulfill the pharmaceutical demand and standards are not available readily. This scarcity can lengthen the adoption of sustainable packaging solutions. This is a major obstacle to the sustainable pharmaceutical packaging market. Moreover, sometimes businesses may struggle to get materials that give adequate protection and meet consumer criteria.

Growing adoption of QR codes for packaging

Quick response (QR) codes on packaging can offer better functionality for the sustainable pharmaceutical packaging market. These can reduce the requirement for physical leaflets or pamphlets that would have generally been needed for the pharmaceutical product. This practice is called e-labeling. Additionally, QR codes are becoming more adaptable to the packaging of medical and pharmaceutical devices.

The plastic segment dominated the sustainable pharmaceutical packaging market in 2023. The dominance of the segment can be attributed to the cost-effectiveness, versatility, and ability of plastic to meet strict regulations while providing eco-friendly alternatives. Additionally, the lightweight nature of plastic packaging can further contribute to its popularity in sustainable pharmaceutical packaging enabling it to dominate the market over the forecast period.

The paper & paperboard segment is expected to grow at the fastest rate in the sustainable pharmaceutical packaging market during the forecast period. The growth of the segment can be driven by the rising utilization of Paper-based pharmaceutical packaging such as labels, folding cartons, and inserts. Furthermore, these materials are easy to print with important information, offering a practical solution for branding and labeling while maintaining compliance with stringent regulatory standards.

The primary segment led the global sustainable pharmaceutical packaging market. This is due to its key role in ensuring pharmaceutical products' efficacy, safety, and integrity. The primary packaging is the materials that come directly in contact with the medication or drug product. which includes bottles, vials, blister packs, and sachets made from sustainable biodegradable materials.

The secondary segment is anticipated to grow at the fastest rate in the sustainable pharmaceutical packaging market over the projected period. The growth of the segment can be linked to the rising usage of recycled paperboard, which minimizes the utilization of inks and adhesives and includes designs that lessen material waste. Also, increasing focus on sustainable practices and innovations in outer packaging solutions can further enhance the adoption of Secondary packaging solutions.

The recyclable segment dominated the sustainable pharmaceutical packaging market in 2023 and is anticipated to grow at a rapid rate over the studied period. The dominance and growth of the segment can be credited to the increasing environmental concerns and a growing need for more sustainable and environmentally friendly packaging solutions. Moreover, recyclable packaging helps conserve resources and decrease waste by keeping materials in longer circulation, thus contributing to the segment's growth.

Segments Covered in the Report

By Material

By Product

By Process

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

March 2025

August 2024