January 2025

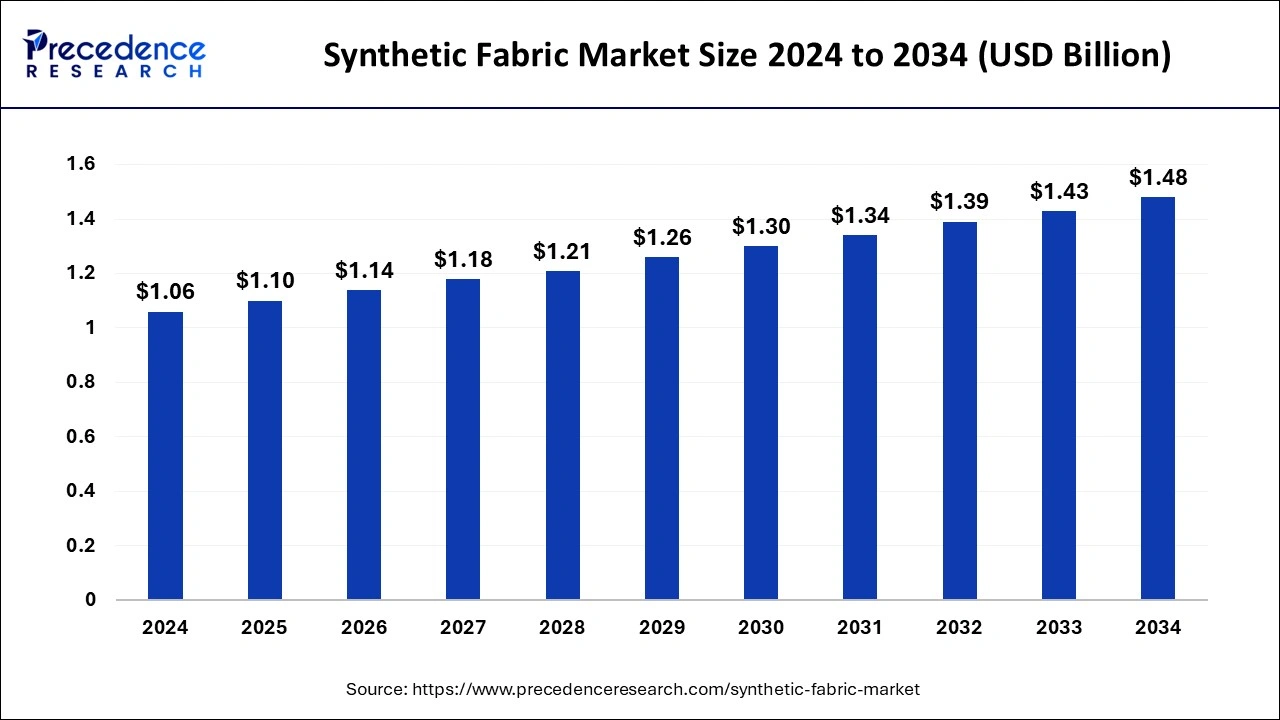

The global synthetic fabric market size is calculated at USD 1.10 billion in 2025 and is forecasted to reach around USD 1.48 billion by 2034, accelerating at a CAGR of 3.39% from 2025 to 2034. The Asia Pacific xxx market size surpassed USD xx billion in 2025 and is expanding at a CAGR of xx% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global synthetic fabric market size was estimated at USD 1.06 billion in 2024 and is predicted to increase from USD 1.10 billion in 2025 to approximately USD 1.48 billion by 2034, expanding at a CAGR of 3.39% from 2025 to 2034. The increased physical and chemical properties of synthetic fibers and cost-effective products are driving the market's growth.

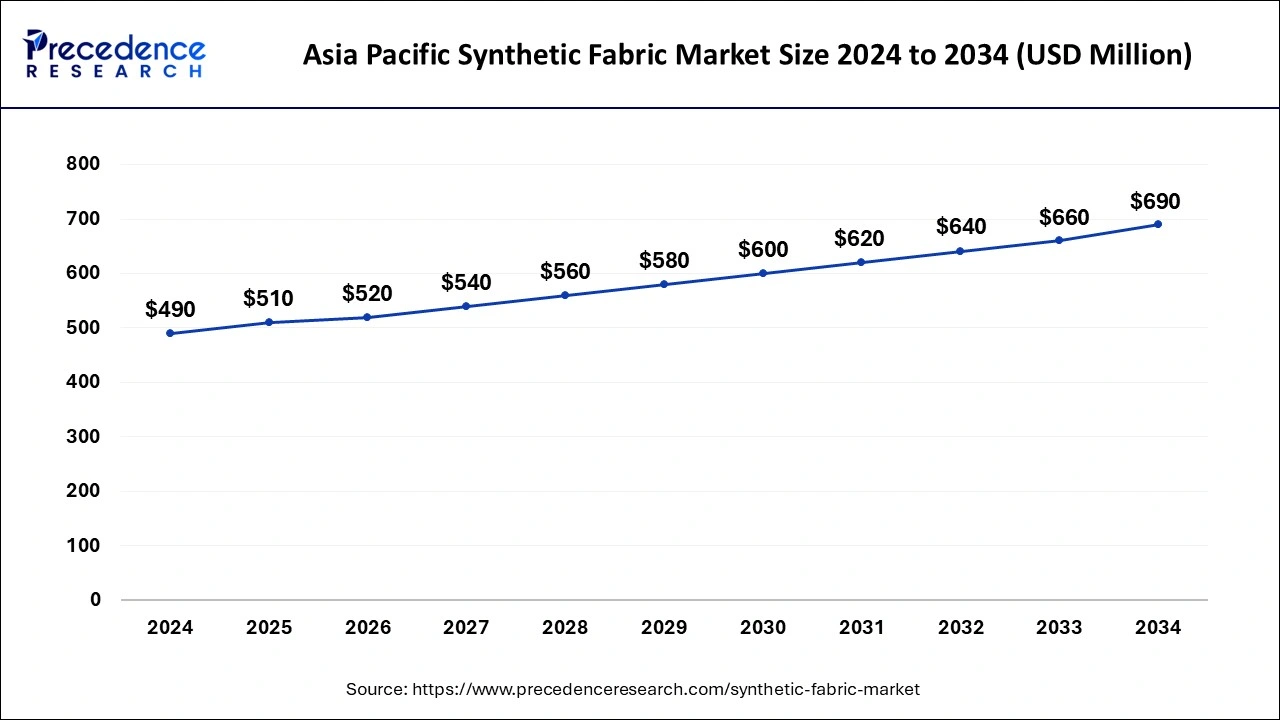

The Asia Pacific synthetic fabric market size was estimated at USD 490 million in 2024 and is predicted to be worth around USD 690 million by 2034, at a CAGR of 3.48% from 2025 to 2034.

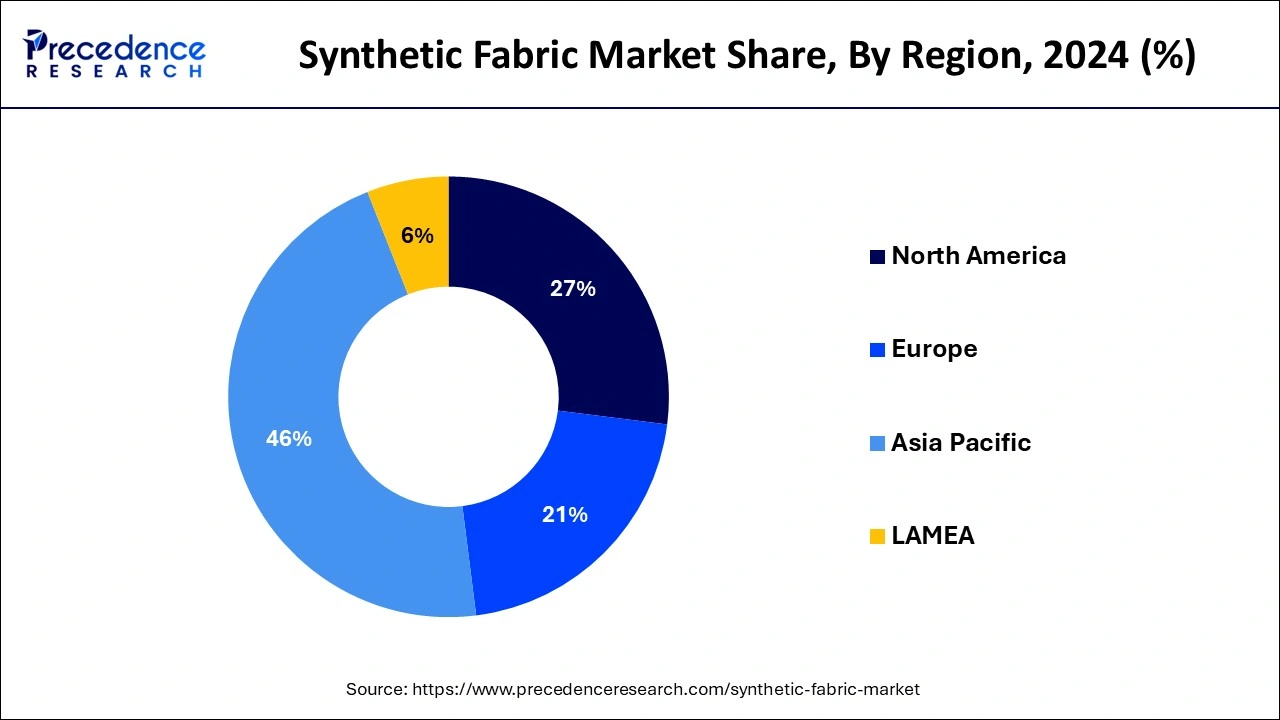

Asia Pacific dominated the synthetic fabric market with the largest market share in 2024. The growth of the market in the region is increasing due to the rising population, creating a higher demand for several industrial applications such as clothing, home furnishing, automobiles, and others, creating a higher demand for synthetic fabric. The rising revolutionary changes in the fashion and clothing industry and the ongoing investments in the development of the fashion industry in regional countries are expected to continue the growth of the market. The rising research and development activities related to the launch of products associated with synthetic fibers are further propelling the growth of the market.

North America is expected to witness a significant growth rate in the market during the forecast period. The growth of the market is expected to boost due to the rising demand for synthetic fibers in the automotive and clothing industry in the region. The higher availability of the major automobile players and the ongoing research on technological advancements with higher fuel efficiency in the automobile sector is accelerating the demand for synthetic fibers. Additionally, the rising fashion and clothing industry in the region is driving the expansion of the synthetic fabrics market.

Synthetic fabrics are manufactured by chemical processes from synthetic yarn, also known as synthetic fiber. Synthetic fabrics are completely man-made products that are made as an alternative to natural fibers like cotton and silk. It consists of the fibers like nylon, polyester, polyvinyl chloride (PVS), rayon, spandex, neoprene, acrylic, polyurethane, and polypropylene. These fabrics are easy to maintain and durable, have higher strength, wrinkle resistance, quick drying, versatility, and elasticity, and are low in cost compared to natural fabrics.

The increasing demand for alternatives to natural fiber products due to their higher cost, fast fashion, and the increasing popularity of synthetic fibers in different industrial applications due to their higher chemical and physical properties are driving the growth of the synthetic fabric market.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.10 Billion |

| Market Size by 2034 | USD 1.48 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.39% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand from several industrial applications

Due to their higher strength and durability, the increasing demand for synthetic fabrics in different industrial applications such as textile, sports equipment, packaging, home textiles, medical, and automotive applications is driving the growth of the synthetic fabrics market. The textile industry is one of the major consumers of synthetic fabrics due to their higher elasticity, strength, and other physical properties. Synthetic fabrics like nylon, spandex, and polyester are the most commonly used in clothing, linens, and upholstery due to their cost-effectiveness and ease of maintenance.

Synthetic fabrics like polyester are highly used in the manufacturing of sportswear and outdoor activities due to their elasticity and quick-drying properties. Synthetic fabrics are also used in the manufacturing of sports equipment like fishing lines, tennis rackets, and ski ropes due to their higher resistance and strength with excellent stretching capacity. It is also used in the medical industry in the production of medical textiles, like sutures, medical implants, and wound dressing. Synthetic fabrics are biodegradable substances and do not react with human skin or tissue, which makes them an ideal fabric to use in the manufacturing of medical textiles.

Insufficiency in raw material

The synthetic fabric market is facing significant challenges due to a combination of factors. Firstly, there is a fluctuation in the cost and availability of raw materials, which limits the expansion of synthetic fabrics in different applications. Secondly, the increasing cost of fiber processing is also a major issue, further restraining market growth. These limitations have resulted in a slowdown of the market's growth, with manufacturers struggling to keep up with demand and maintain profitability. Addressing these challenges will require cooperation between manufacturers and suppliers to ensure a stable supply of materials and find ways to reduce processing costs.

Expanding applications in the automotive industry

The rising demand for synthetic fabrics in the automotive industry to meet the rising demand for lightweight automobiles results in higher usage without compromising durability. Synthetic and conventional fibers are used in the manufacturing of automotive components like knitted, woven, nonwoven, and other composite structures. Synthetic fibers are also used in the different mechanical properties of the automobile, like sound insulation and abrasion resistance. Nylon is the most commonly used synthetic fabric in automobiles.

Polyester is used for proper upholstery and seat cushions. Carbon-woven fabrics are used in different car parts to make vehicles lightweight, especially electric vehicles. The rising demand for the automotive industry and the ongoing research and development on the innovations and launch of eco-friendly and fuel-efficiency vehicles are further driving the opportunity for the synthetic fabric market.

The acrylic fabric segment dominated the synthetic fabric market in 2024. Acrylic fabric is often more affordable compared to other synthetic fibers like nylon or polyester. This makes it an attractive option for manufacturers looking to produce cost-effective textiles without compromising too much on quality. Acrylic fibers can mimic the feel and appearance of natural wool, making them popular for use in clothing, blankets, and upholstery where a wool-like texture is desired. Acrylic is often used as a wool substitute due to its warmth, softness, and lightweight nature. Acrylic can be easily blended with other fibers such as wool, cotton, or polyester to enhance certain properties of the resulting fabric. This versatility allows manufacturers to tailor acrylic blends to meet specific performance requirements for different applications.

The apparel segment had the largest share of the synthetic fabric market in 2024. Synthetic fabric covers 60% of the overall clothing brands, including fabrics like nylon and polyester, all of which are made from petroleum-derived polymers. One of the biggest driving factors is fast fashion, which increases the demand for more clothes and ultimately increases the production of synthetic fabrics. Increased disposable income, especially in developed countries, is also driving the growth of the segment.

The rising demand for synthetic fabrics in the clothing and fashion industry is due to their recyclability, which creates a sustainable alternative to natural fabric, and recycling old garments with new yarn that helps minimize landfill waste and conversation resources. The increasing demand for sustainable, cost-effective, durable, and flexible yarn to meet the demands of the fashion industry and the manufacturing of different patterns of clothing are driving the demand for synthetic fabric in the clothing industry.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

November 2024