January 2025

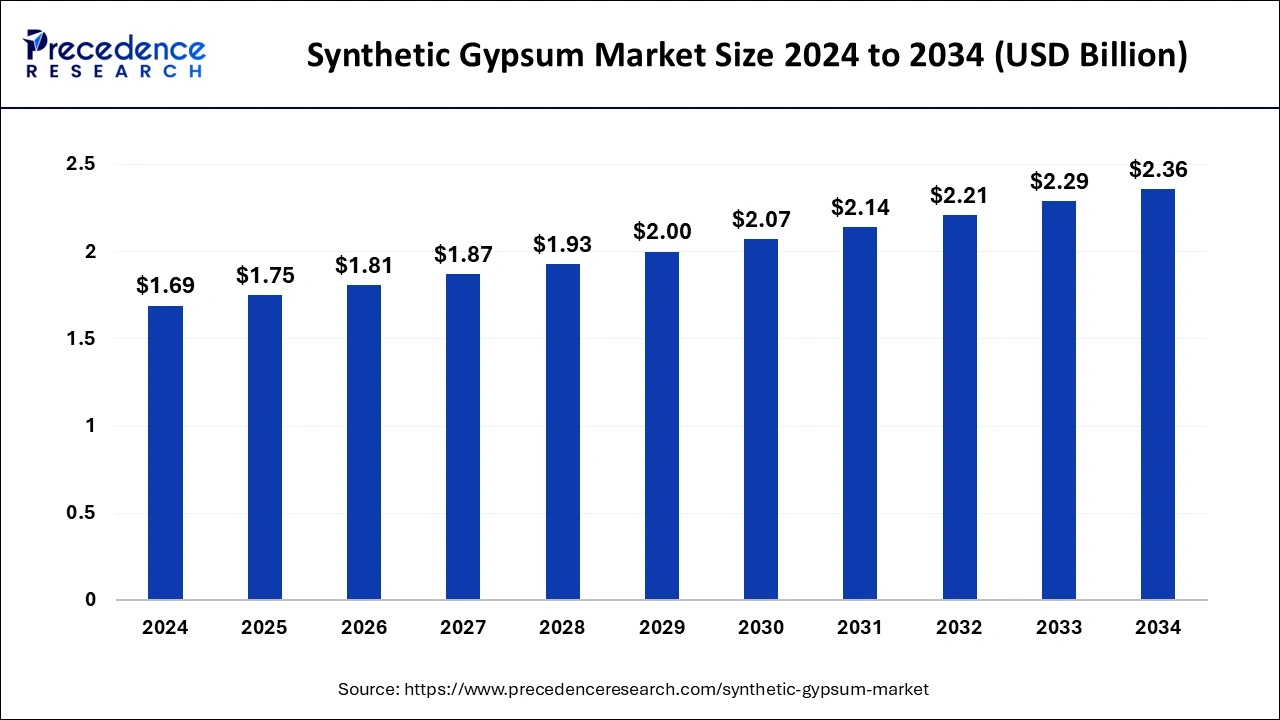

The global synthetic gypsum market size is calculated at USD 1.75 billion in 2025 and is forecasted to reach around USD 2.36 billion by 2034, accelerating at a CAGR of 3.40% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global synthetic gypsum market size was estimated at USD 1.69 billion in 2024 and is predicted to increase from USD 1.75 billion in 2025 to approximately USD 2.36 billion by 2034, expanding at a CAGR of 3.40% from 2025 to 2034. The use of FGD systems in power plants is encouraged by growing environmental requirements, and as a result, synthetic gypsum is widely available and can be reliably supplied for a variety of uses.

The synthetic gypsum market has grown significantly in recent years, mostly due to its expanding applications in a variety of industries. The use of synthetic gypsum, which comes from industrial processes like flue gas desulfurization (FGD) in power plants, is growing in popularity because of its affordability, advantages for the environment, and range of uses. Because synthetic gypsum is an environmentally benign substitute for traditional gypsum mining, it helps reduce greenhouse gas emissions.

The need for synthetic gypsum is increasing due to severe restrictions for waste management and emissions control, especially in areas where environmental standards are stringent. Synthetic gypsum is widely used in the building industry, mostly for the manufacture of cement and plasterboard. Construction, infrastructure development, and urbanization are the main factors influencing the synthetic gypsum market. However, the applications for synthetic gypsum can be found in the food and beverage, pharmaceutical, and ceramics sectors. It can be difficult to maintain consistent quality requirements for synthetic gypsum, which can limit its applicability in some situations.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 3.40% |

| Market Size in 2025 | USD 1.75 Billion |

| Market Size by 2034 | USD 2.36 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Waste reduction

In the synthetic gypsum market, the recycling and repurposing of synthetic gypsum should be promoted for use as a soil amendment in agriculture, cement manufacturing, and construction materials. This eliminates waste production and lessens the need for virgin resources. To guarantee that the synthetic gypsum produced satisfies industry norms and specifications, strict quality control methods must be implemented. This reduces the amount of off-spec material that could be wasted. Reduce the amount of waste produced during the manufacturing of synthetic gypsum and its impact on the environment by implementing waste reduction procedures such as the segregation, separation, and treatment of process effluents. To determine opportunities for improvement and to examine the environmental effects of producing synthetic gypsum, conduct life cycle assessments.

Limited market awareness

Potential participants may not be appropriately informed about the synthetic gypsum market. This may be the result of minimal coverage in trade journals or conferences or restricted marketing efforts by manufacturers of synthetic gypsum. There are still some businesses where natural gypsum is preferred over synthetic gypsum due to customs and traditions. This may cause people to be unaware of synthetic gypsum or to be reluctant to think of it as a good substitute. The benefits of adopting synthetic gypsum made from industrial byproducts may not be as well known in other areas due to a lack of understanding or emphasis on regulations pertaining to waste management and environmental sustainability. It's possible that awareness and adoption of synthetic gypsum are lower in areas with an abundance of natural gypsum resources.

Waste management solutions

Waste management solutions are essential to maintaining sustainability and environmental responsibility in the synthetic gypsum sector. A variety of industrial processes, including flue gas desulfurization (FGD) gypsum produced by coal-fired power plants and phosphogypsum produced by chemical manufacturing, result in synthetic gypsum as a byproduct. Recycled and reusable, synthetic gypsum finds numerous uses in the construction of wallboards, cement, agriculture, and soil amendments. Certain synthetic gypsum could include impurities that need to be cleaned up before being disposed of or used again. Contaminants can be rendered immobile by using stabilization and encapsulation procedures, which lessen their environmental impact and leachability.

The FGD gypsum segment held the largest share of the synthetic gypsum market in 2024 and is expected to maintain its position during the forecast period. In the construction business, FGD gypsum is frequently used in place of natural gypsum in plasterboard, cement manufacturing, and drywall. Because of its similar qualities to real gypsum, it's a great substitute. Agriculture also makes use of FGD gypsum as a soil supplement.

It enriches the soil with vital elements, such as sulfur and calcium, which enhance soil structure and encourage plant development. Reducing the environmental impact of industry, particularly power plants, can be achieved by using FGD gypsum. Transforming a waste product (SO2) into a useful resource (synthetic gypsum) lessens the demand for landfill space and encourages sustainability. FGD gypsum manufacturing offers an efficient way to lower SO2 emissions, which aids the industry in adhering to these standards.

The citrogypsum segment is expected to gain a significant market share during the forecast period. A byproduct of the manufacturing of citric acid, gypsum is usually obtained from citrus fruits. It has garnered interest in a number of areas recently, including construction. Because citrogypsum shares characteristics with natural gypsum, it can be used in wallboard production, soil conditioning, and cement manufacturing, among other applications.

An environmentally friendly substitute for conventional gypsum sources is citrogypsum. Its manufacturing lessens the dependency on naturally occurring gypsum, a limited resource, and also aids in the management of waste from the citrus processing sector. Using citrogypsum helps maintain environmental sustainability by keeping trash out of landfills and lowering greenhouse gas emissions from gypsum transportation and mining.

The drywall segment dominated the synthetic gypsum market in 2024. Within the drywall industry, synthetic gypsum presents many benefits. It is an appealing alternative for producers because it has qualities that are comparable to those of natural gypsum, frequently at a lesser cost. Furthermore, by utilizing synthetic gypsum, less natural gypsum needs to be mined, which can have negative environmental effects such as habitat destruction and soil erosion. The rise of the synthetic gypsum market has been mostly fueled by the building industry, particularly in areas with strict waste management and emissions restrictions. The drywall industry and other markets are anticipated to see a growing role for synthetic gypsum as demand for environmentally friendly construction materials rises.

The soil amendment segment is expected to hold the largest share during the forecast period. By lessening compaction and increasing water infiltration and retention, synthetic gypsum can aid in the improvement of soil structure. This helps to loosen the soil and encourage stronger root growth, which is especially helpful in hard clay soils. Rich in calcium and sulfur, synthetic gypsum is one of the two elements necessary for plant growth. Sulfur is required for the creation of proteins and enzymes, while calcium aids in the strengthening of cell walls and enhances general plant health. Synthetic gypsum can aid in lowering soil erosion by strengthening the soil's structure and encouraging root development. This is especially crucial in agricultural environments since erosion can result in topsoil loss and lower fertility.

Asia Pacific held the largest share of the synthetic gypsum market. As a byproduct of several industrial operations, including the manufacturing of phosphoric acid, power, and scrubbers used in coal-fired power plants to lower emissions, synthetic gypsum is created. The region's market is expanding in part due to the accessibility of raw materials needed to produce synthetic gypsum, such as sulfur dioxide, from industrial activities.

Asia Pacific’s governments and industry are becoming more and more conscious of the value of sustainable practices in the synthetic gypsum market. Governments in the area are making significant investments in infrastructure development, encompassing the building of homes, businesses, and industries.

Europe is expected to expand at a rapid pace in the upcoming years. This is due to a number of factors, such as the region's expanding construction industry, strict regulations governing emissions from coal-fired power plants, a major source of synthetic gypsum, and the growing demand for environmentally friendly building materials. Innovation and investment in technology for the effective manufacturing and use of synthetic gypsum were being observed in the European synthetic gypsum sector.

Furthermore, players and academic institutions involved in the synthetic gypsum market are collaborating to improve the quality of synthetic gypsum-based goods and create new uses. The European synthetic gypsum market was expanding due in part to consumer awareness of the advantages of employing recycled materials in building and regulatory backing for sustainable practices.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

November 2024