March 2025

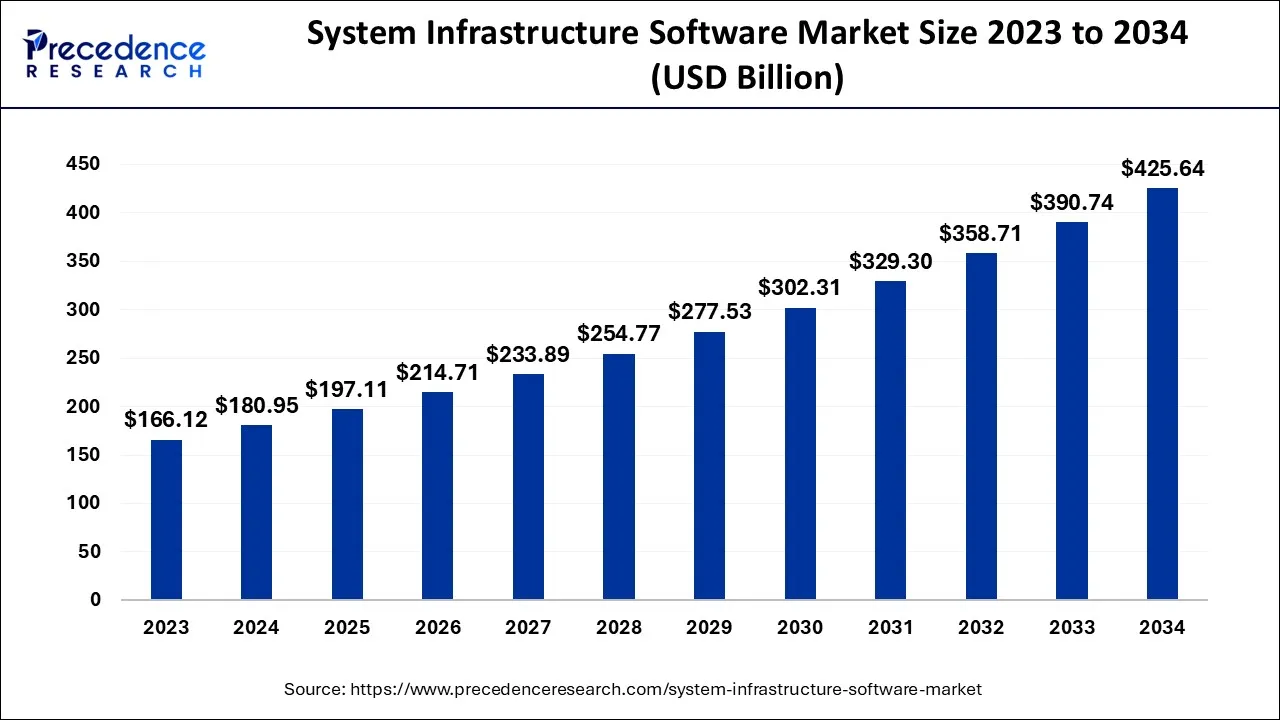

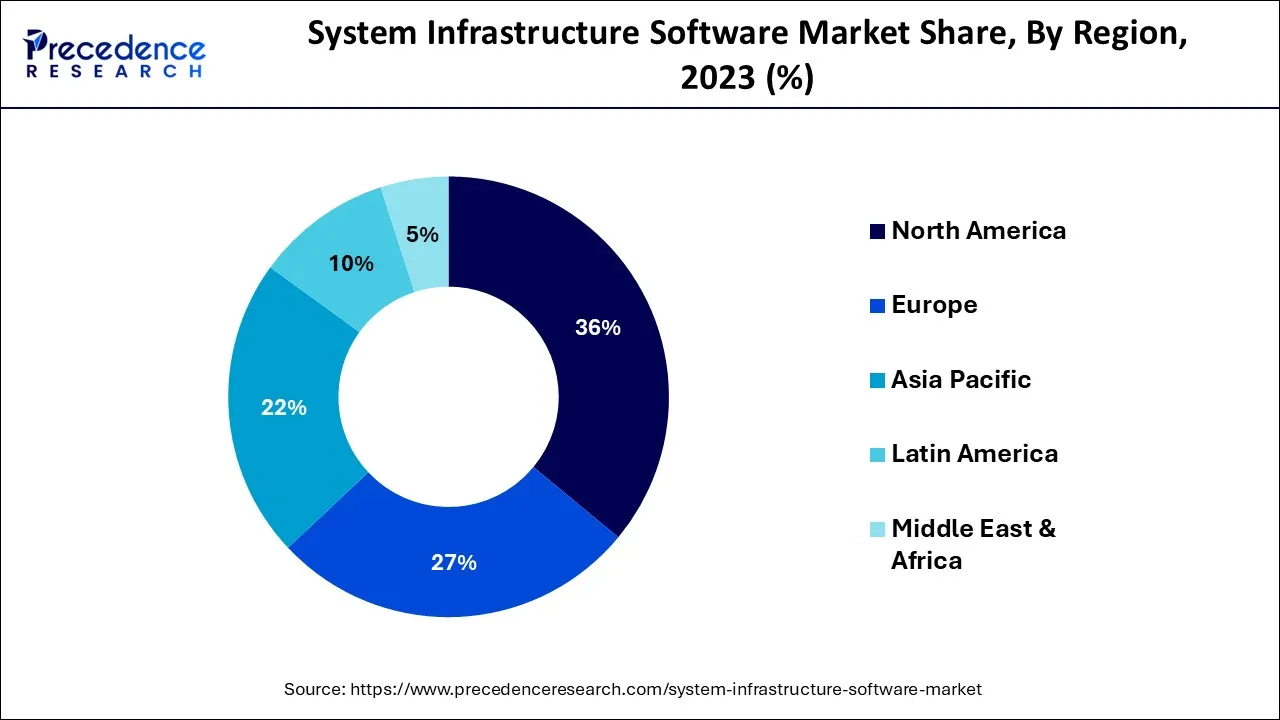

The global system infrastructure software market size is calculated at USD 197.11 billion in 2025 and is forecasted to reach around USD 425.64 billion by 2034, accelerating at a CAGR of 8.93% from 2025 to 2034. The North America system infrastructure software market size surpassed USD 65.14 billion in 2024 and is expanding at a CAGR of 9.08% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global system infrastructure software market size was estimated at USD 180.95 billion in 2024 and is predicted to increase from USD 197.11 billion in 2025 to approximately USD 425.64 billion by 2034, expanding at a CAGR of 8.93% from 2025 to 2034.

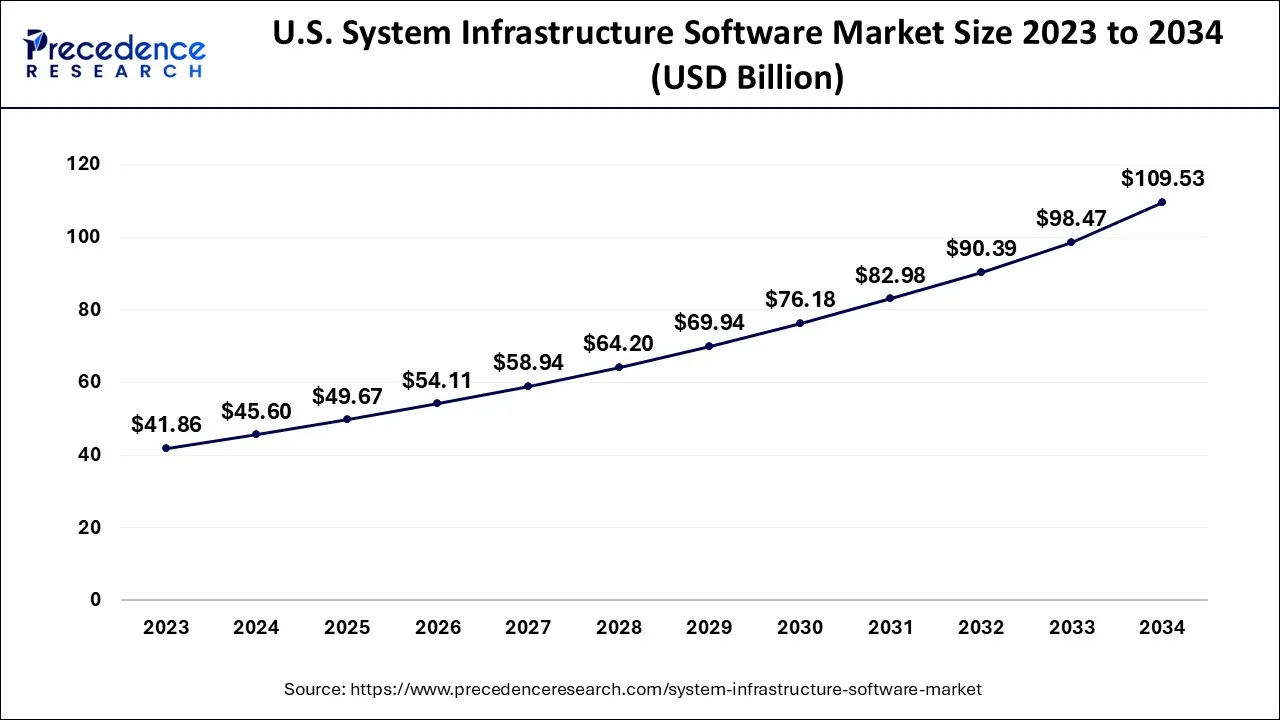

The U.S. system infrastructure software market size was exhibited at USD 45.60 billion in 2024 and is projected to be worth around USD 109.53 billion by 2034, growing at a CAGR of 9.16% from 2025 to 2034.

North America dominated the market with the largest market share in 2024. The growth of the market in the region is attributed due to the increasing adoption of advanced technologies in multiple organizations across the region that promotes the higher demand of system infrastructure software services. The increasing number of startups in the nation like the United States, Canada, etc. anticipates an increase in the growth of the market.

Asia-Pacific is expected to hold a significant market share in the forecast period. The growth is attributed to the increase in the infrastructure of the data center across the region expected to boost the demand of the system infrastructure software market. Rising investment in digitization and evolving startups across the region investment for the development of new products accelerate the demand of the market. The rapid adoption of the technology as well as innovations in storage management software along with the presence of potential key players offer significant opportunities for the region to grow during the forecast period.

The global system infrastructure software market offers software programs, specially developed for organizations in order to support their workforce, business transactions, and other internal procedures. System infrastructure software infrastructure is an essential part of modern business. Technology, when set up correctly and networked, may enhance back-office processes, boost efficiency, and facilitate communication. IT infrastructure, also known as information technology infrastructure, refers to the elements needed to run and maintain company IT infrastructures. IT infrastructure may be used for both the internal delivery of services and resources within an organization as well as outward delivery to clients of the company. Businesses may achieve their goals and even boost their profits with the aid of carefully built IT infrastructure.

Technology may be adjusted to boost production, increase efficiency, and improve communication when it is correctly networked. An organization can achieve its goals and gain a competitive edge in the market if its IT infrastructure is dependable, adaptable, and secure. However, if an IT infrastructure isn't deployed correctly, firms may experience connection, productivity, and security problems, such as downtime and attacks. Overall, the success of a firm might depend on how well its infrastructure is executed.

With the rapid adoption of technology, organizations are now heavily dependent on technological solutions for operations, services, and almost every procedure. Considering the rising dependency on technology, the system infrastructure software market will continue to sustain its growth during the forecast period.

Furthermore, the utilization of digital tools is fueling the market’s growth, the utilization of digital tools, systems, hardware, and software is expanding; cybersecurity concerns are growing; data governance is being improved to prevent data loss; and the need for hybrid computing is rising. With the integration of cutting-edge digital technologies, system infrastructure software helps businesses automate their business processes, fostering the expansion of their respective industries.

Positive market momentum is being generated by consumers' shifting preferences for cloud-based technologies and solutions as well as the growing demand for an effective digital framework to handle more complicated data. The industry is anticipated to grow as a result of developments in virtualization and cloud technologies. Additionally, it is projected that an increased need for automation and an integrated approach to company processes would boost the market.

| Report Coverage | Details |

| Market Size in 2024 | USD 180.95 Billion |

| Market Size in 2024 | USD 197.11 Billion |

| Market Size by 2034 | USD 425.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.93% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising deployment of cloud-based solutions by organizations

The increasing adoption of cloud services for better organizational workflow and the growing requirement for digital frameworks to handle data storage drive the growth of the system infrastructure software market. Increasing cloud technologies in the organizations such as automation, healthcare, telecom, BFSI, etc., positively impacted the market growth. Many organizations are diverting towards cloud solutions for operating their business efficiently, remote working management, and accessing their data from anywhere. Cloud solutions enable the internal data flow of business. Additionally, cloud technologies are affordable in terms of installation cost and are used for business scalability. All these advantages are driving the demand for cloud-based solutions, which apparently fuels the growth of the system infrastructure software market.

Data storage, purchase, and management limitations

There are many benefits involved in the process of system infrastructure software but still, there are some of the major limitations in the growth of the market. In this technologically advanced world data acquisition and collection of data is much easier but managing that large amount of data is one of the main challenges in the market. Due to insufficient storage, the loss of data has been seen in several organizations. The loss of data can be extremely costly for businesses. Scalability is another impacting factor in the growth of the system infrastructure software market.

Smart building and data centers become the future opportunities for the market

The rising infrastructure of smart buildings and data centers would drive the demand of the market in the predicted time period. The increasing infrastructure in the urban area positively impacted the market. Rising smart buildings create a higher demand for IoT devices and optimize data flow with strong internet connectivity and security. Additionally, the combination of machine learning, artificial intelligence, and robotics process automation increases the effectiveness of the system infrastructure software process in the business. The advancement in technology in several businesses results in future opportunities in the system infrastructure software market.

The network and system management segment held the largest market share in 2024. The growth of the segment is attributed to the increasing end-user for automating their business minimizing the cost of the workforce and increasing the productivity of the business. A network management system that gathers real-time information from network devices and provides administrators with a centralized point of control from which they may manage network security procedures, distribute network resources, and other tasks.

The security segment is expected to increase its market share during the forecast period. The growth of the segment is due to the increasing concern about data security, internet usage, and transfer to digital infrastructure. Businesses must sustain operations reliant on their technological assets, therefore safeguarding the infrastructure involves safeguarding the company as a whole. Many businesses rely heavily on proprietary data and intellectual property (IP) to provide them with a competitive edge in the marketplace, and any loss or disruption of access to this data can have severe adverse effects on a business's profitability.

The data center infrastructure dominated the market with the highest market share in 2024. The segment is predicted to show a significant increase during the forecast period due to the rising infrastructure of smart buildings in the urban areas of the world. The increasing requirement for infrastructure software tends to the growth in the demand of the market. This data center approach hosts all of the IT infrastructure and data on-premises. Many businesses decide to have their own on-site data centers because they believe they have more control over information security and can more easily abide by laws like the U.S. Health Insurance Portability and Accountability Act (HIPAA) or the General Data Protection Regulation (GDPR) of the European Union.

Cloud integration is expected to dominate the market with the largest market size in the forecast period. The growth of the segment is attributed to the increasing use of cloud integration in various end-user organizations to smooth workflow and data storage requirements. Integrated resources are desired by certain enterprises to provide real-time applications and services, while improved automation capabilities are desired by others for back-office and customer-facing platforms. Along with faster deployment and scaling choices, integrated clouds also offer improved support for mobile apps.

The IT and telecom segment dominated the market with the largest revenue share of the market in 2024. The growth of the segment is attributed to the increasing telecom sector across the world and the increase in the adoption of Information Technology over the business results in higher demand for the segment. System infrastructure software is a component of the business models used by IT firms to automate their core operations, manage their workforces, and make the most use of both physical and virtual resources. Organizations may save expenses, become more effective, and have greater flexibility by expanding infrastructure automation.

The BFSI segment registered significant growth in the market in 2024. The increasing use of technologies in the banking sector, rising fintech companies' startups, and increasing consumer preferences toward digital banking expected growth in the market in the predicted time period. As consumer demands change, a number of BFSI companies are increasingly using digital infrastructure models.

By Type

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

May 2025

February 2025

October 2024