September 2024

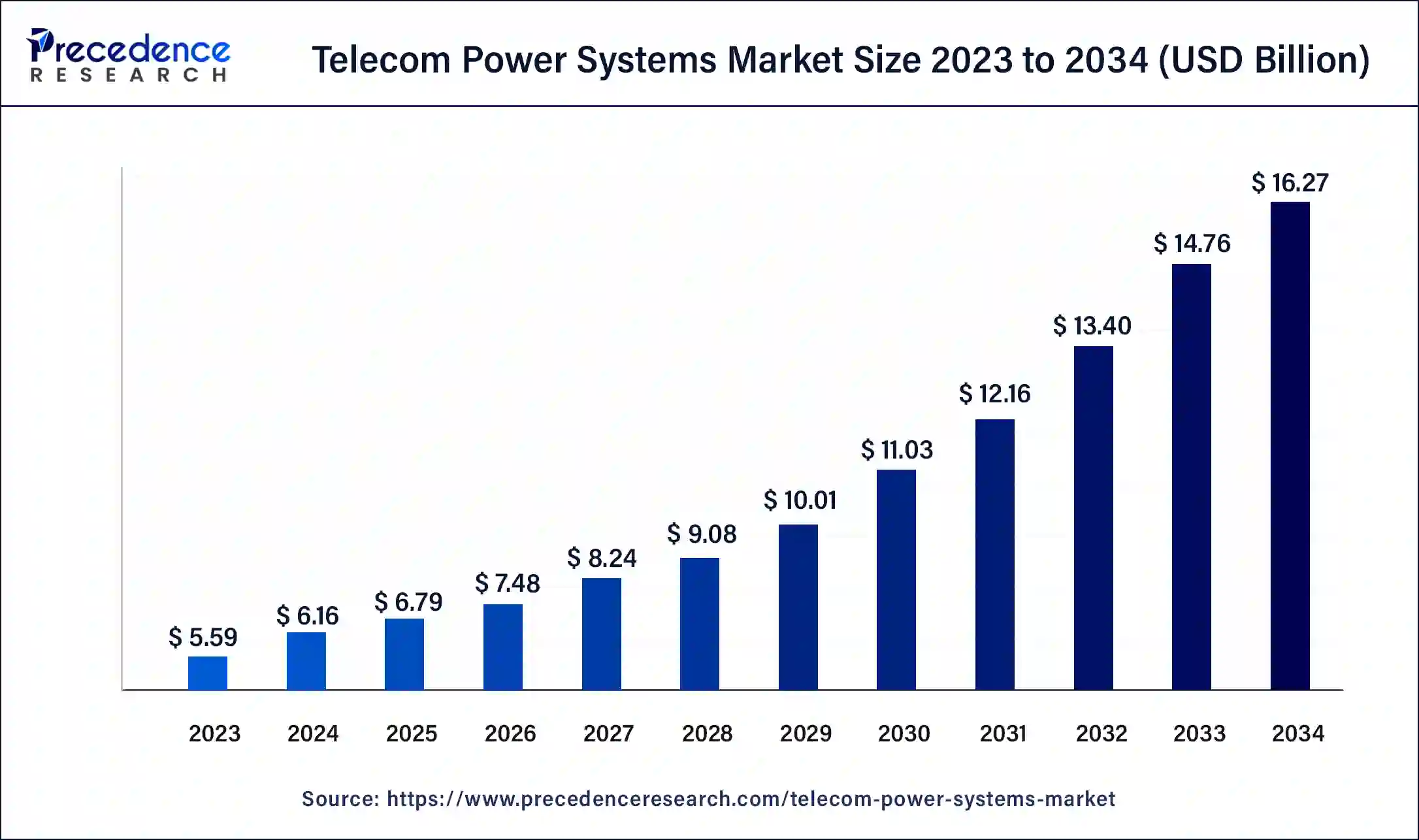

The global telecom power systems market size accounted for USD 6.16 billion in 2024, grew to USD 6.79 billion in 2025 and is projected to surpass around USD 16.27 billion by 2034, representing a healthy CAGR of 10.20% between 2024 and 2034.

The global telecom power systems market size is estimated at USD 6.16 billion in 2024 and is anticipated to reach around USD 16.27 billion by 2034, representing a healthy CAGR of 10.20% between 2024 and 2034.

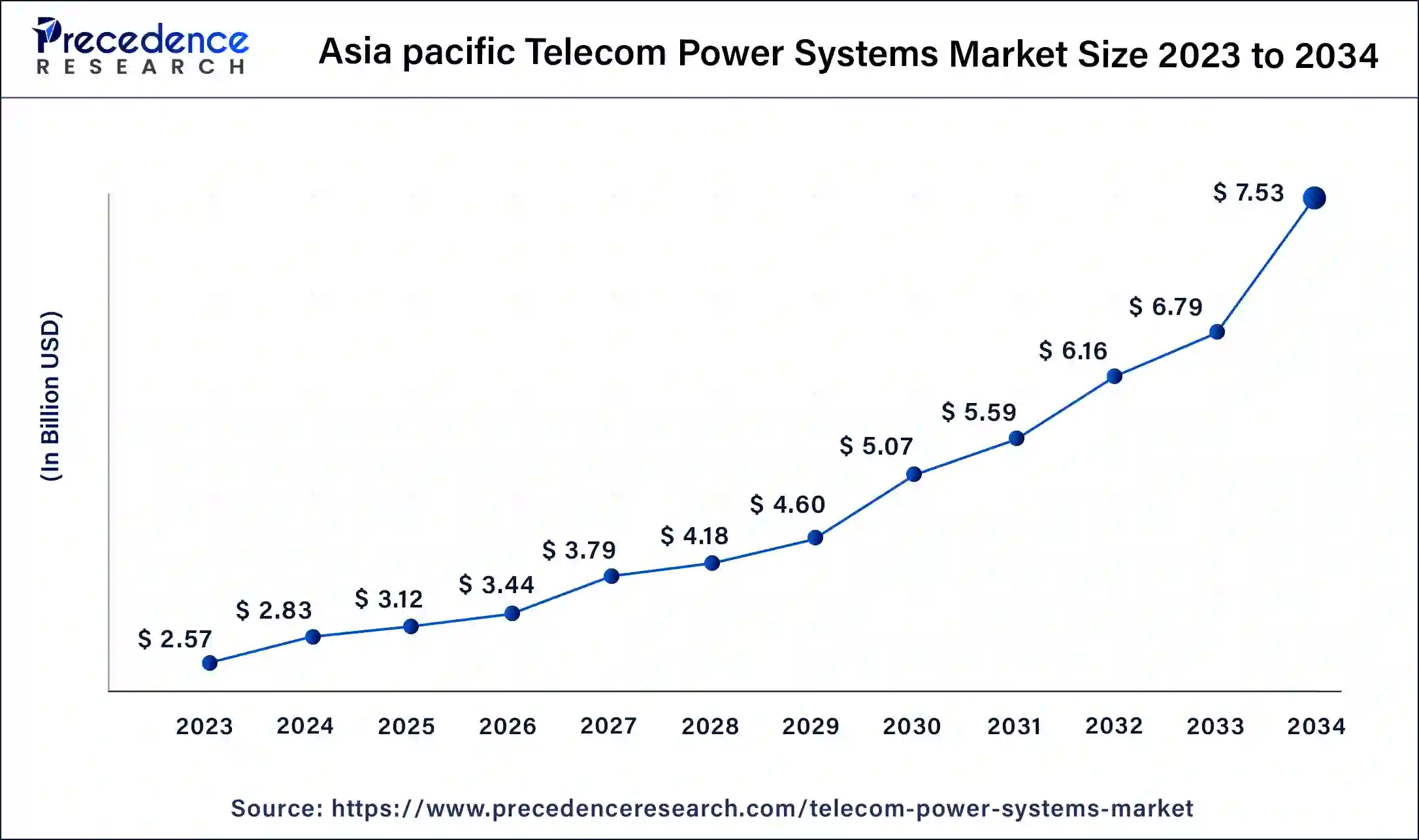

The Asia Pacific telecom power systems market size was valued at USD 2.57 billion in 2023 and is expected to surpass around USD 6.06 billion by 2032, growing at a CAGR of 10.27% from 2024 to 2034.

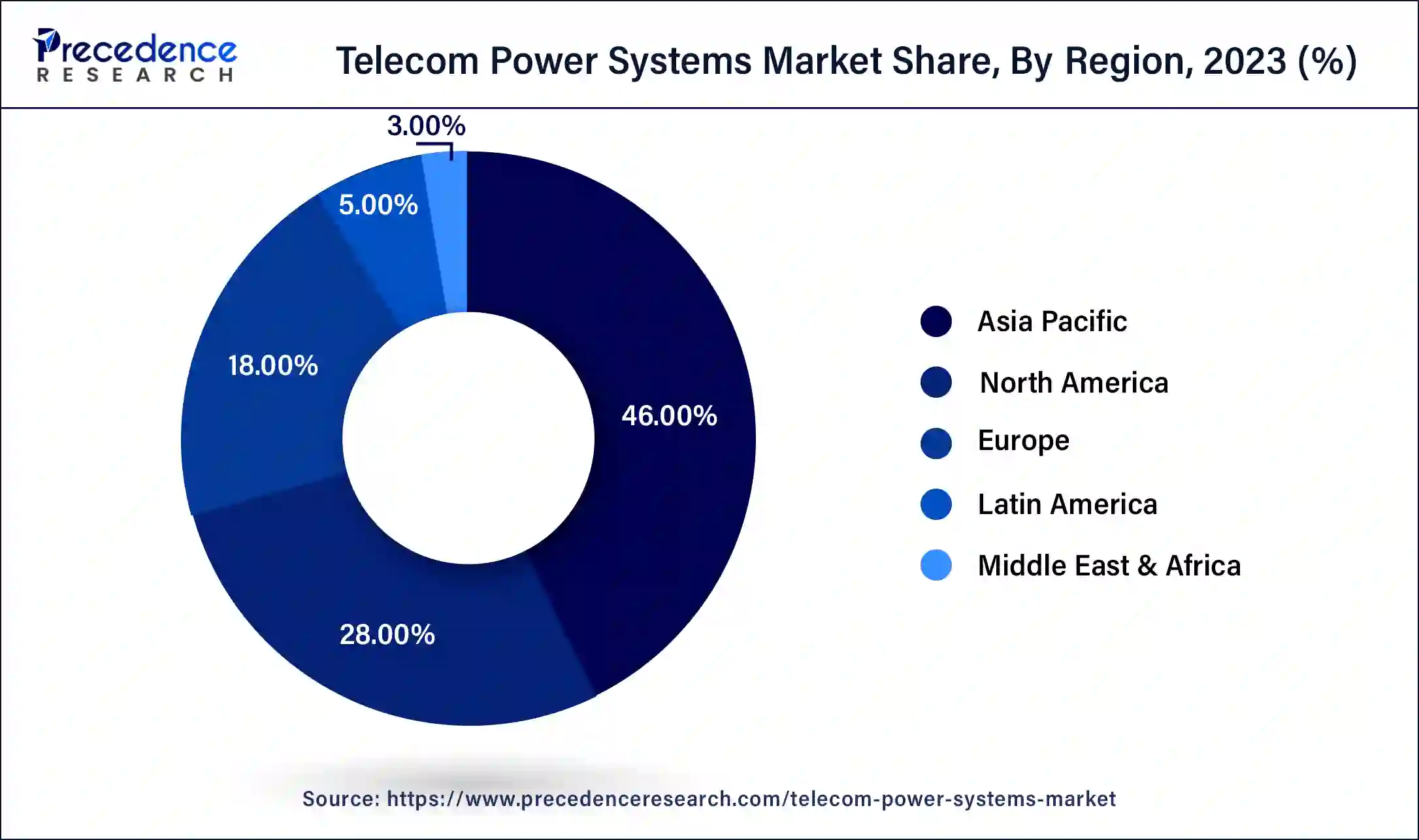

Asia Pacific has held the largest revenue share of 46% in 2023. In Asia Pacific, the telecom power systems market is witnessing robust growth driven by the rapid expansion of telecommunication infrastructure. Countries like China and India are investing significantly in 5G deployment and rural connectivity, fueling the demand for reliable power solutions. The region's focus on digital transformation and smart city initiatives further accentuates the need for advanced and scalable telecom power systems to support evolving networks.

Europe is estimated to observe the fastest expansion. Europe's telecom power systems market reflects a trend towards sustainable and energy-efficient solutions. With an emphasis on renewable energy integration and stringent environmental regulations, European countries are adopting advanced battery technologies and smart grid solutions. The region's commitment to reducing carbon footprints aligns with the growing demand for resilient and eco-friendly power systems in the telecommunications sector.

In North America, the telecom power systems market is characterized by a strong emphasis on innovation and reliability. The region adopts cutting-edge technologies, including advanced battery storage and smart grid solutions, to ensure seamless and sustainable telecom operations. With a focus on 5G deployment and smart city initiatives, North America showcases a dynamic landscape where telecom power systems play a crucial role in supporting the evolving needs of modern communication networks.

The telecom power systems market encompasses the global industry dedicated to providing reliable and efficient power solutions for telecommunication networks. These systems ensure uninterrupted power supply for critical telecom infrastructure, such as base stations, data centers, and communication hubs. The market is driven by the increasing demand for seamless communication services and the deployment of 5G networks. Key components include backup power systems, energy storage solutions, and power distribution units. Telecom power systems are crucial for maintaining network stability, minimizing downtime, and supporting the expanding infrastructure of telecommunications in our digitally connected world.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 10.20% |

| Market Size in 2024 | USD 6.16 Billion |

| Market Size by 2034 | USD 16.27 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Grid Type, Power Source, Power Rating, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

5G network expansion and smart grid technologies

The surge in 5G network expansion is a primary driver propelling the demand for T telecom power systems. The deployment of 5G brings unprecedented data speeds and connectivity, requiring robust and efficient power solutions. telecom power systems are crucial to supporting the increased infrastructure demands, ensuring reliable and uninterrupted power supply for the vast number of base stations and data centers integral to 5G networks. As the global adoption of 5G accelerates, the demand for advanced telecom power systems rises, driving innovation in energy-efficient and scalable solutions to meet the evolving needs of high-speed and low-latency communication.

The integration of smart grid technologies significantly contributes to the market demand for telecom power systems. Smart grids enhance the efficiency, reliability, and adaptability of power distribution in telecommunication networks.

By incorporating intelligent monitoring, control, and optimization features, smart grid technologies enable telecom power systems to operate seamlessly, responding dynamically to demand fluctuations. This integration not only enhances energy efficiency but also aligns with the broader trend of sustainable and resilient telecom infrastructure, positioning telecom power systems as vital components in the evolving landscape of smart and interconnected communication networks.

Interoperability challenges and limited access to remote areas

Interoperability challenges pose a significant restraint on the demand for telecom power systems. The diverse range of equipment and technologies used in telecommunication networks often lacks standardized interfaces, hindering seamless integration of power systems. This complexity complicates the management and coordination of diverse components, potentially leading to inefficiencies and compatibility issues. Overcoming interoperability challenges is crucial for ensuring a cohesive and integrated telecom power infrastructure that can adapt to the evolving needs of the industry.

Limited access to remote areas presents a notable constraint on the market demand for telecom power systems. Many remote and underserved regions lack adequate infrastructure, making it challenging to deploy and maintain power systems for telecom networks. The absence of reliable power sources in these areas hampers network expansion, hindering connectivity and communication services. Addressing these accessibility issues is vital for unlocking the full potential of the telecom power systems market and ensuring comprehensive coverage and connectivity, especially in remote and underserved regions.

Rural electrification initiatives and advanced battery technologies

Rural electrification initiatives play a pivotal role in surging demand for the telecom power systems market by extending connectivity to remote areas. As governments and organizations strive to bridge the digital divide, the need for robust telecom infrastructure in rural locations rises. Telecom power systems have become essential for providing reliable energy solutions to support communication networks in these off-grid and underserved regions. The deployment of power-efficient solutions in tandem with rural electrification projects facilitates enhanced connectivity, empowering communities and promoting economic development.

The integration of advanced battery technologies significantly contributes to the growing demand for telecom power systems. As energy storage becomes a critical component in ensuring uninterrupted power supply, advanced batteries enhance the efficiency and reliability of these systems. Lithium-ion and other innovative battery technologies offer improved energy density, longer lifespan, and faster charging capabilities, addressing the evolving needs of telecom networks. This surge in advanced battery adoption aligns with the industry's pursuit of sustainable and resilient solutions, further propelling the demand for telecom power systems in the market.

The DC power segment has held a 62% revenue share in 2023. DC power in telecom power systems refers to the use of direct current for providing electrical power to telecommunication equipment. It involves converting alternating current (AC) to DC, minimizing energy loss and enhancing efficiency. This approach is integral in telecom infrastructure, offering a reliable and stable power supply for various applications, including base stations and data centers.

The digital electricity segment is anticipated to expand at a significant CAGR of 14.5% during the projected period. Digital electricity in telecom power systems refers to the incorporation of digital technologies for efficient power management. It involves smart grid technologies, IoT integration, and digital monitoring to optimize energy consumption and enhance overall system performance. This trend reflects the industry's shift towards intelligent and data-driven solutions, contributing to improved reliability and sustainability in telecom power systems.

The on-grid segment held the largest market share of 42% in 2023. On-grid telecom power systems are integrated with the main electrical grid, drawing power directly from the utility. This grid connectivity ensures a consistent and reliable energy supply for telecom infrastructure. The trend in on-grid solutions involves optimizing energy efficiency and exploring renewable energy integration to reduce dependence on traditional power sources, aligning with sustainability goals.

On the other hand, the off-grid segment is projected to grow at the fastest rate over the projected period. Off-grid telecom power systems operate independently of the main electrical grid, crucial for remote or underserved areas. Trends in off-grid solutions include advancements in energy storage technologies, leveraging advanced batteries and renewable sources like solar or wind, enhancing reliability and reducing environmental impact in off-grid telecom deployments.

The diesel-battery power segment had the highest market share of 47% in 2022. In telecom power systems, a diesel-battery power source combines traditional diesel generators with advanced battery technology. This hybrid system ensures continuous power supply, utilizing diesel generators for primary energy and integrating batteries for energy storage and load optimization. This approach reduces fuel consumption, minimizes environmental impact, and enhances overall system efficiency.

The diesel-solar power segment is anticipated to expand at the fastest rate over the projected period. A diesel-solar power source in telecom power systems integrates diesel generators with solar panels. This hybrid solution harnesses solar energy to supplement diesel power, reducing reliance on conventional fuel, cutting operational costs, and aligning with sustainable energy practices, making it a trend in the pursuit of eco-friendly and cost-effective telecom power solutions.

The 10-20 KW segment had the highest market share of 54% in 2022. Telecom power systems in the 10-20 KW range cater to smaller-scale installations, providing efficient and reliable power for medium-sized telecommunication infrastructure. These systems offer a balanced solution for sites with moderate power requirements, ensuring optimal performance and energy management.

The above 20 KW segment is anticipated to expand at the fastest rate over the projected period. Telecom power systems above 20 KW are designed for larger-scale deployments, addressing the increasing power demands of extensive telecommunication networks. These high-capacity systems incorporate advanced technologies to support the expanding infrastructure, promoting sustainability, and addressing the challenges of larger-scale energy requirements in the telecom industry.

Segments Covered in the Report

By Product

By Grid Type

By Power Source

By Power Rating

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

August 2024