February 2024

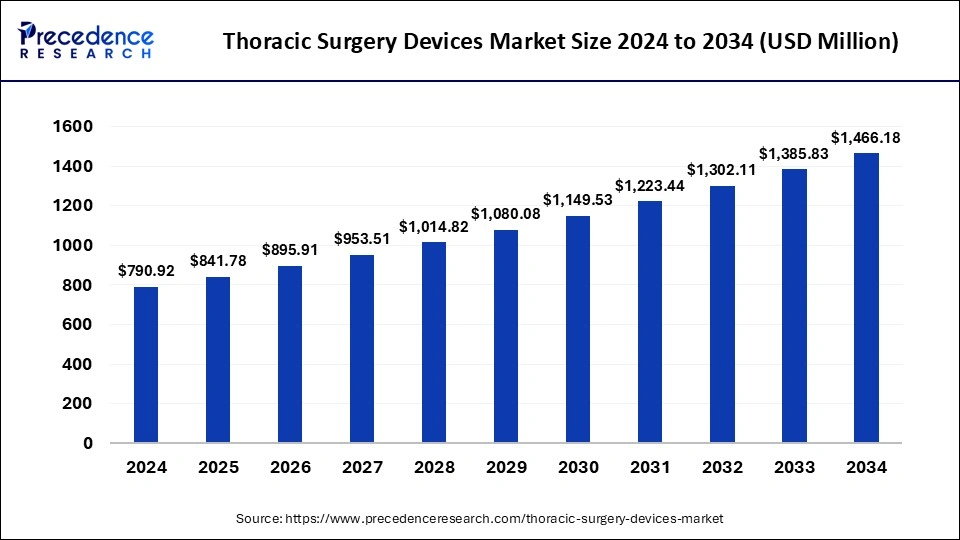

The global thoracic surgery devices market size is calculated at USD 841.78 million in 2025 and is forecasted to reach around USD 1,466.18 million by 2034, accelerating at a CAGR of 6.37% from 2025 to 2034. The North America thoracic surgery devices market size surpassed USD 316.37 million in 2024 and is expanding at a CAGR of 6.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thoracic surgery devices market size was estimated at USD 790.92 million in 2024 and is predicted to increase from USD 841.78 million in 2025 to approximately USD 1,466.18 million by 2034, expanding at a CAGR of 6.37% from 2025 to 2034. The thoracic surgery devices market growth is driven by factors such as the increasing prevalence of conditions like lung cancer, COPD, and heart diseases.

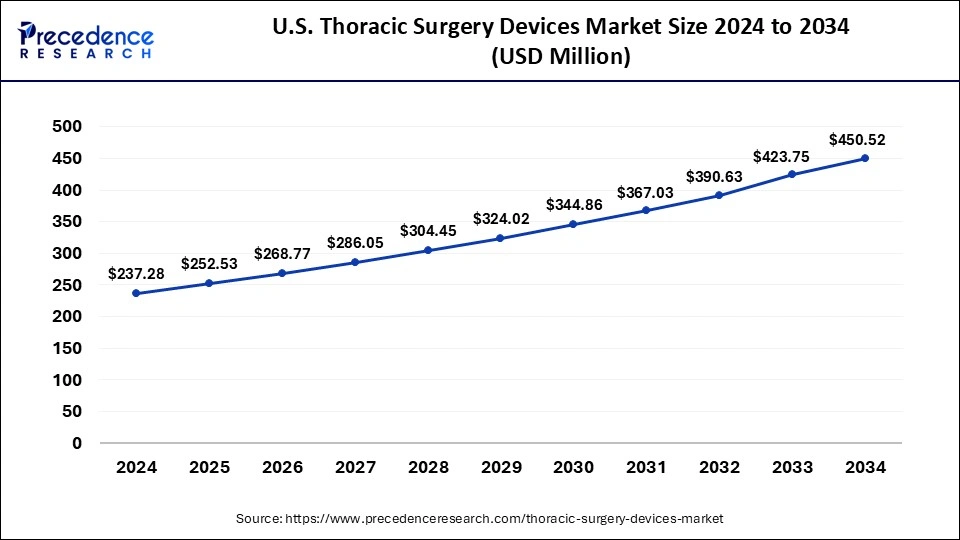

The U.S. thoracic surgery devices market size was valued at USD 237.28 million in 2024 and is estimated to be worth around USD 450.52 million by 2034, with a CAGR of 6.62% from 2025 to 2034.

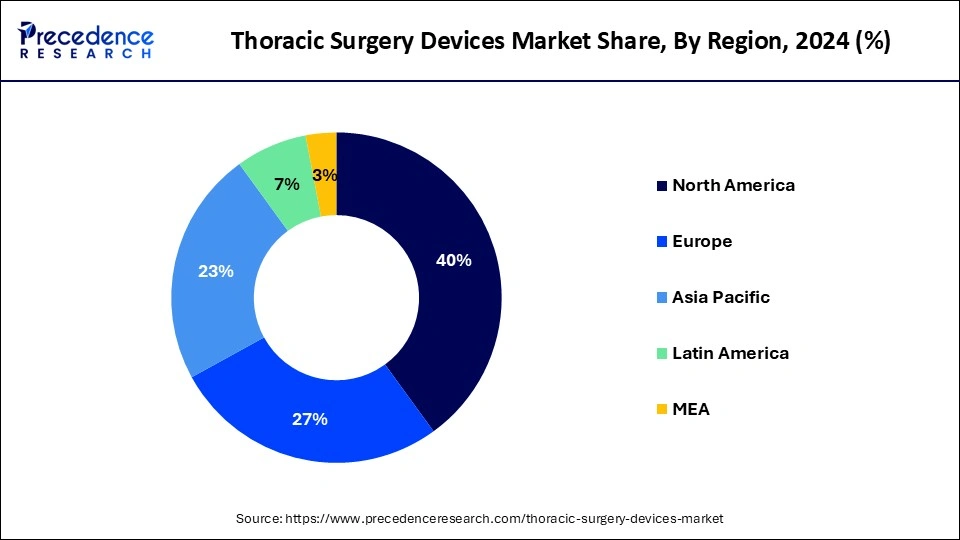

North America dominated the thoracic surgery devices market in 2024. Its growth is driven by the presence of major industry players, high healthcare expenditures, and the increasing use of advanced technological devices in hospitals. The region boasts state-of-the-art medical facilities, including hospitals, ambulatory surgical centers, and specialized thoracic surgery units, which fuel the demand for thoracic surgery devices. Moreover, the region has a high incidence of thoracic conditions like lung cancer, cardiovascular diseases, and esophageal disorders.

Asia Pacific is projected to host the fastest-growing thoracic surgery devices market over the forecast period. The market growth in this region is due to increased awareness about thoracic surgery, changing lifestyles, and a growing population. Rising disposable incomes and expanded healthcare coverage in several Asia Pacific countries have led to higher healthcare spending. As a result, patients have greater access to advanced diagnostic and treatment options, including thoracic surgeries, which contributes to the market's expansion.

Thoracic surgery devices include various equipment used in lung resections, biopsies, and other surgical procedures related to diagnosing and treating lung cancer. As the global healthcare community continues to see an increase in cases of lung cancer, the thoracic surgery devices market is expected to grow significantly.

Public health initiatives, advocacy campaigns, and educational efforts have collectively improved understanding among patients and healthcare professionals regarding the significance of timely diagnosis and treatment of thoracic diseases and conditions. This increased awareness has resulted in a rise in patient demand for thoracic surgeries, such as lung resections, esophageal procedures, and cardiac surgeries, among others.

| Report Coverage | Details |

| Market Size in 2025 | USD 841.78 Million |

| Market Size by 2034 | USD 1,466.18 Million |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Surgery Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising use of video-assisted surgical system

The growth of the thoracic surgery devices market is driven by the increasing use of video-assisted surgical systems, along with energy-based devices, and the establishment of numerous facilities for the easy implementation of cardiac rhythm management devices. Innovations and the adoption of advanced technologies in surgical methods and devices are also contributing to the market's growth. As more healthcare facilities provide thoracic surgical procedures, there is a corresponding rise in demand for devices that assist in diagnosis, treatment, and postoperative care, which is accelerating the thoracic surgery devices market expansion.

High development cost

Developing and introducing new thoracic surgery devices to the market can be expensive. The investment needed for research, development, and clinical trials, along with the risk of regulatory setbacks, can present financial difficulties for manufacturers. Creating prototypes, conducting feasibility studies, and performing tests to ensure the reliability, safety, and functionality of thoracic surgery devices are important but costly steps in the development process. High development costs pose a significant challenge in the market.

Integration of AI

The global thoracic surgery devices market presents several growth opportunities, including the development of cost-effective devices, increasing demand in developing countries, and a growing emphasis on research and development by market players. The integration of artificial intelligence and machine learning technologies into thoracic surgery devices is also anticipated to provide significant growth prospects. Key trends in the market include the adoption of robotic-assisted thoracic surgery devices and a growing focus on product innovation by industry participants.

The forceps segment dominated the thoracic surgery devices market by product in 2024. Forceps are essential surgical instruments that provide fine control for performing intricate procedures, while minimizing the risk of damage to surrounding structures. Thoracic surgeries often require precise and delicate tissue handling. Foreceps play a crucial role in grasping, holding, manipulating, and dissecting tissues, making them indispensable for thoracic surgeons.

The stapler segment is expected to see significant growth in the thoracic surgery devices market over the forecast period. The advantages of using surgical staplers and staples include quick placement, minimal tissue reaction, and decreased surgery time. Surgical staplers and staples are used externally to close large wounds or surgical incisions on a patient's skin or scalp. Moreover, they are less painful than traditional stitches and offer a simpler, stronger, and faster method for closing large, open wounds, particularly after major surgeries.

The lobectomy segment dominated the thoracic surgery devices market in 2024. The lobectomy segment has captured the largest revenue share in the market. Lobectomy is a key treatment option for lung cancer, especially when the disease is confined to a single lung lobe. This procedure can offer a high chance of cure or long-term disease control. For patients with early-stage lung cancer, lobectomy significantly improves survival rates compared to other treatments, offering the potential for a cure and extended life. Additionally, lobectomy allows for a detailed examination of the removed lobe, providing essential diagnostic information to guide further treatment decisions and staging.

The wedge resection segment is anticipated to experience considerable growth in the thoracic surgery devices market during the forecast period. The adoption of minimally invasive surgical techniques, such as video-assisted thoracoscopic surgery (VATS), has increased the use of wedge resection. These methods minimize patient trauma, shorten hospital stays, and provide faster recovery times by making them appealing choices for both patients and surgeons.

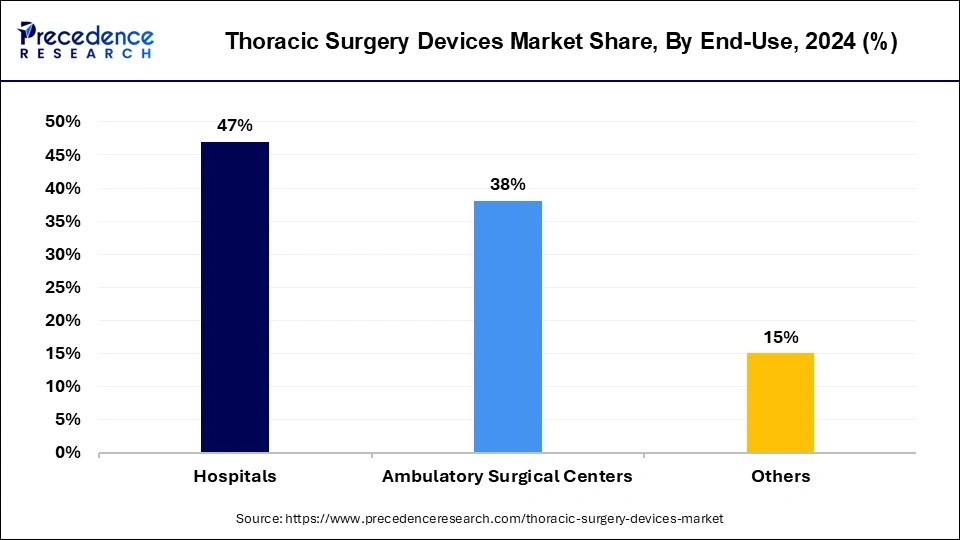

The hospital's end-use segment dominated the thoracic surgery devices market in 2024. The hospital segment dominated the market with the highest revenue share because hospitals serve as primary centers for patient care, diagnosis, and treatment. The increasing incidence of thoracic conditions, such as lung cancer, cardiovascular diseases, and esophageal disorders, requires advanced thoracic surgery devices to address patient needs effectively.

The ambulatory surgical centers (ASCs) segment is anticipated to experience the fastest growth in the thoracic surgery devices market during the forecast period. Ambulatory surgery centers (ASCs) are tailored for outpatient surgical procedures, and there is an increasing trend towards conducting thoracic surgeries in these facilities. Patients favor ASCs for same-day surgeries due to their convenience and shorter wait times. Additionally, innovative approaches are often implemented in ASCs, driving the demand for specialized thoracic surgery devices.

By Product

By Surgery Type

By End-use

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2024

January 2025

December 2024

December 2024