June 2024

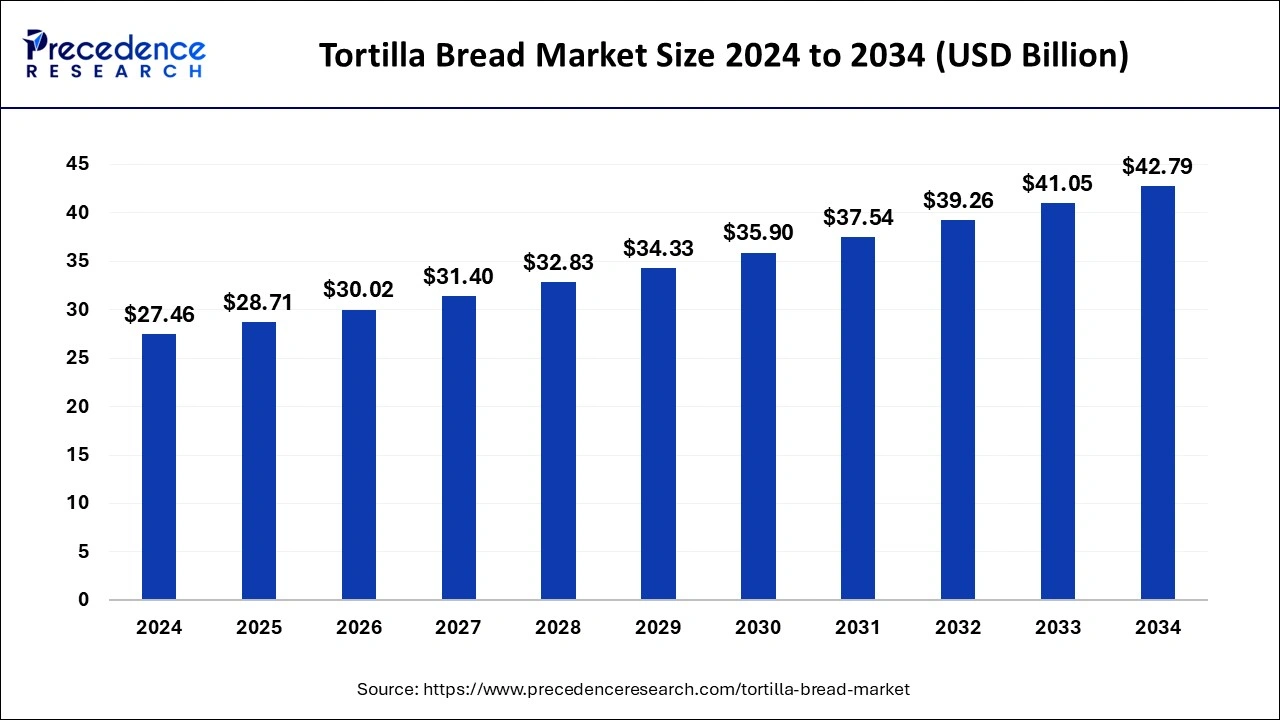

The global tortilla bread market size is calculated at USD 28.71 billion in 2025 and is forecasted to reach around USD 42.79 billion by 2034, accelerating at a CAGR of 4.54% from 2025 to 2034. The North America tortilla bread market size surpassed USD 11.53 billion in 2024 and is expanding at a CAGR of 4.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tortilla bread market size was estimated at USD 27.46 billion in 2024 and is predicted to increase from USD 28.71 billion in 2025 to approximately USD 42.79 billion by 2034, expanding at a CAGR of 4.54% from 2025 to 2034. In the fiercely competitive tortilla bread market, drivers are diverse, including shifting consumer preferences towards healthier options, increased demand for ethnic cuisines, and the growing popularity of wraps and burritos. Innovation in flavors, textures, and gluten-free varieties also fuels market growth, while sustainability and eco-conscious trends influence purchasing decisions.

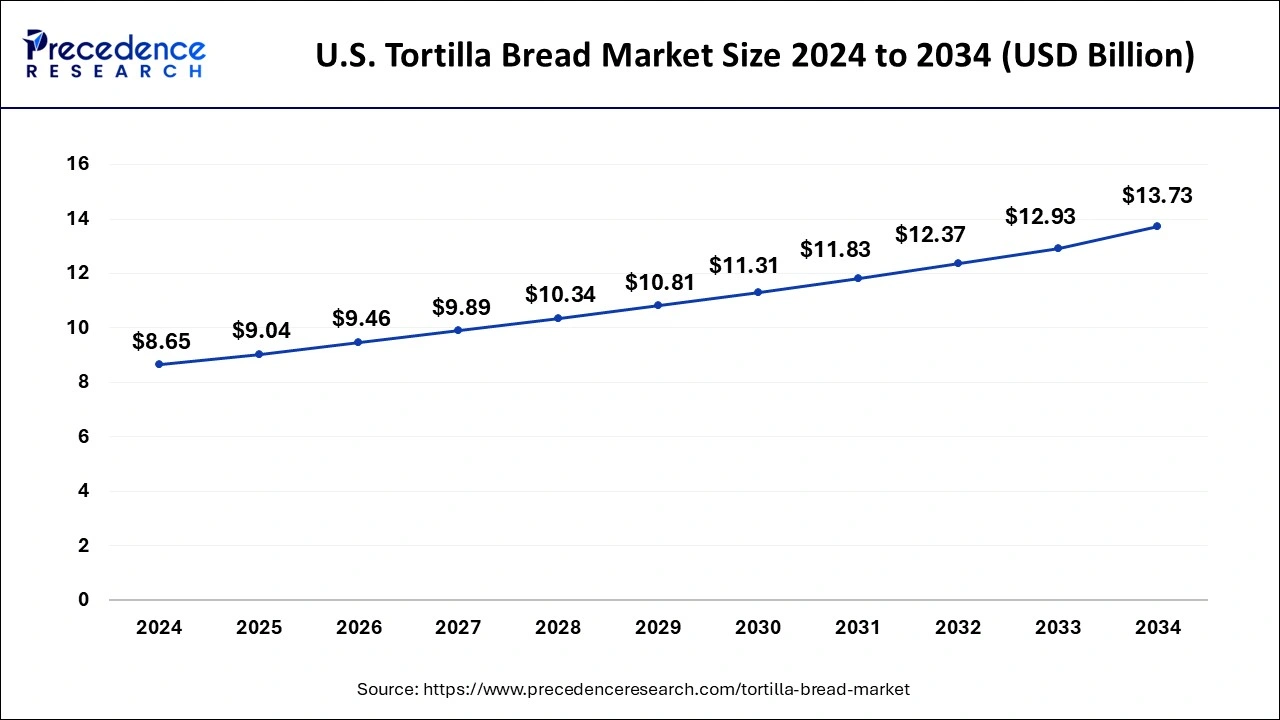

The U.S. tortilla bread market size reached USD 8.65 billion in 2024 and is predicted to surpass around USD 13.73 billion by 2034 at a CAGR of 4.73% from 2025 to 2034.

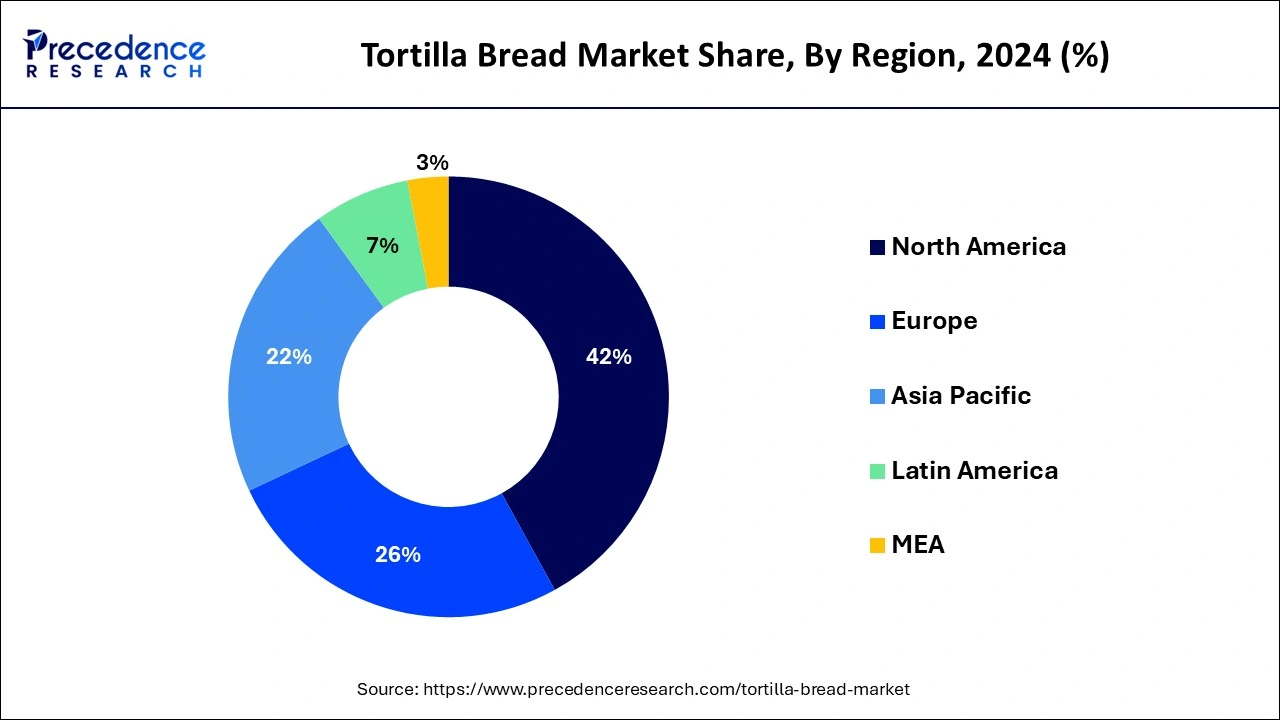

North America is the most dominant region of the tortilla bread market for several reasons. Firstly, tortilla bread has deep cultural roots in the region, particularly in Mexico and the southwestern United States, where it has been a dietary staple for centuries. This cultural heritage has led to a strong consumer preference for tortilla bread products, which are widely consumed as part of traditional dishes like tacos, burritos, and enchiladas. Additionally, the influence of Mexican cuisine has extended beyond ethnic communities, with tortilla-based dishes becoming increasingly popular among mainstream consumers throughout North America.

The diverse and growing population in North America has contributed to the expansion of the tortilla bread market. As the region experiences demographic shifts and increased immigration from Latin American countries, the demand for authentic ethnic foods, including tortilla bread, has surged. Furthermore, changing dietary preferences, such as the rising popularity of healthier and more convenient meal options, have further fueled the demand for tortilla bread products. With its widespread availability in supermarkets, convenience stores, and restaurants across the continent, North America has established itself as the dominant market for tortilla bread, reflecting the region’s rich culinary heritage and evolving consumer preferences.

The tortilla bread market has experienced significant growth and diversification in recent years, driven by factors such as changing consumer preferences, globalization, and the rising popularity of Mexican cuisine worldwide. Tortilla bread, a traditional staple of Mexican cuisine, is a flatbread made from either wheat flour or corn masa dough. Its versatility and convenience have made it a staple in various culinary traditions beyond Mexican cuisine, including Tex-Mex, Mediterranean, and fusion cuisine.

In its traditional form, corn tortillas are a fundamental component of dishes like tacos, quesadillas, and enchiladas, while wheat tortillas are commonly used for burritos, wraps, and sandwiches. However, the market for tortilla bread has expanded beyond its traditional applications. It is now widely utilized in the foodservice industry to create innovative dishes such as pizza crusts, salad bowls, and dessert wraps. Additionally, tortilla chips, made from thinly sliced and fried tortillas, have gained popularity as a snack food globally.

The tortilla bread market is characterized by a diverse range of products catering to different dietary preferences and culinary trends. With the increasing demand for healthier and gluten-free options, manufacturers are innovating by introducing tortilla bread made from alternative ingredients such as whole grains, gluten-free flour, and vegetable-based blends. Furthermore, the convenience factor of tortilla bread, its long shelf life, and its adaptability to various cuisines and meal occasions continue to drive its consumption and market growth on a global scale.

| Report Coverage | Details |

| Growth Rate From 2025 to 2034 | CAGR of 4.54% |

| Market Size in 2025 | USD 28.71 Billion |

| Market Size by 2034 | USD 42.79 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Ingredients, By Processing Type, By Product Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing diversity in culinary preferences

One of the key drivers of the tortilla bread market is the increasing diversity in culinary preferences among consumers globally. As people become more adventurous with their food choices and seek out new and exotic flavors, the demand for ethnic cuisines, including Mexican cuisine, has surged. Tortilla bread, a staple of Mexican cuisine, has gained popularity not only in regions with a large Hispanic population but also in areas where ethnic foods are embraced and celebrated. This growing appreciation for diverse culinary experiences has fueled the demand for tortilla bread, driving market growth.

Rise in demand for convenient and healthy food options

Another major driver of the tortilla bread market is the rise in demand for convenient and healthy food options. With busy lifestyles and an increased awareness of the importance of nutrition, consumers are seeking convenient meal solutions that are both tasty and nutritious. Tortilla bread, known for its versatility and ease of use, serves as an ideal base for a wide range of healthy and convenient meals, such as wraps, burritos, and quesadillas. Additionally, tortilla bread made from whole grains or alternative flour appeals to health-conscious consumers looking for gluten-free or low-carb options. The convenience and health benefits offered by tortilla bread have contributed to its widespread adoption and continued growth in the market.

Supply chain disruptions and ingredient shortages

One significant restraint facing the tortilla bread market is the vulnerability of the supply chain to disruptions and ingredient shortages. The production of tortilla bread relies heavily on key ingredients such as wheat flour or corn masa, along with other additives and flavorings. Any disruption in the supply of these ingredients, whether due to natural disasters, adverse weather conditions affecting crop yields, or logistical challenges, can significantly impact the availability and cost of tortilla bread production.

Moreover, fluctuations in commodity prices, trade policies, and geopolitical tensions can further exacerbate supply chain challenges, leading to price volatility and uncertainty for manufacturers and consumers alike. Ingredient shortages or quality issues may force producers to adjust their recipes or sourcing practices, potentially affecting the taste, texture, and overall quality of tortilla bread products.

To mitigate these restraints, stakeholders in the tortilla bread market must adopt strategies to diversify their supply chains, build resilience against disruptions, and collaborate closely with suppliers to ensure a stable and consistent flow of ingredients. Additionally, investing in research and development efforts to explore alternative ingredients or production methods could help alleviate dependency on vulnerable supply chains and enhance the market's resilience in the face of external challenges.

Expansion into new markets and applications

One significant opportunity for the tortilla bread market lies in expanding into new markets and applications beyond its traditional uses. While tortilla bread has long been associated with Mexican cuisine and dishes like tacos and burritos, there is a growing trend of incorporating it into various culinary traditions and meal occasions worldwide. Manufacturers can capitalize on this opportunity by promoting tortilla bread as a versatile and convenient option for a wide range of dishes, including sandwiches, wraps, pizzas, and even desserts. By tapping into new market segments and applications, the tortilla bread market can unlock additional growth opportunities and attract a broader consumer base.

Innovation in product development and healthier alternatives

Another key opportunity for the tortilla bread market is innovation in product development to cater to evolving consumer preferences for healthier and more nutritious options. With an increasing focus on health and wellness, consumers are seeking alternatives to traditional bread products that offer better nutritional profiles and dietary benefits. Tortilla bread manufacturers can capitalize on this trend by introducing innovative products made from whole grains, ancient grains, gluten-free flour, or vegetable-based blends.

By offering healthier alternatives with enhanced nutritional value and reduced calorie content, manufacturers can appeal to health-conscious consumers and differentiate their products in the market. Additionally, investing in research and development to explore new ingredients and formulations can lead to the creation of innovative tortilla bread products that meet the evolving demands of modern consumers.

The corn segment has dominated the market share in 2024 and is expected to maintain its position throughout the forecast period. Corn tortillas offer a distinct flavor and texture that appeals to consumers seeking authentic Mexican cuisine experiences. Moreover, corn tortillas are naturally gluten-free, making them suitable for individuals with gluten sensitivities or dietary restrictions. Additionally, some consumers perceive corn tortillas as a healthier alternative to wheat tortillas, as corn is a whole grain rich in fiber and nutrients. These factors, combined with the growing popularity of mexican cuisine globally, have propelled the dominance of the corn segment in the tortilla bread market.

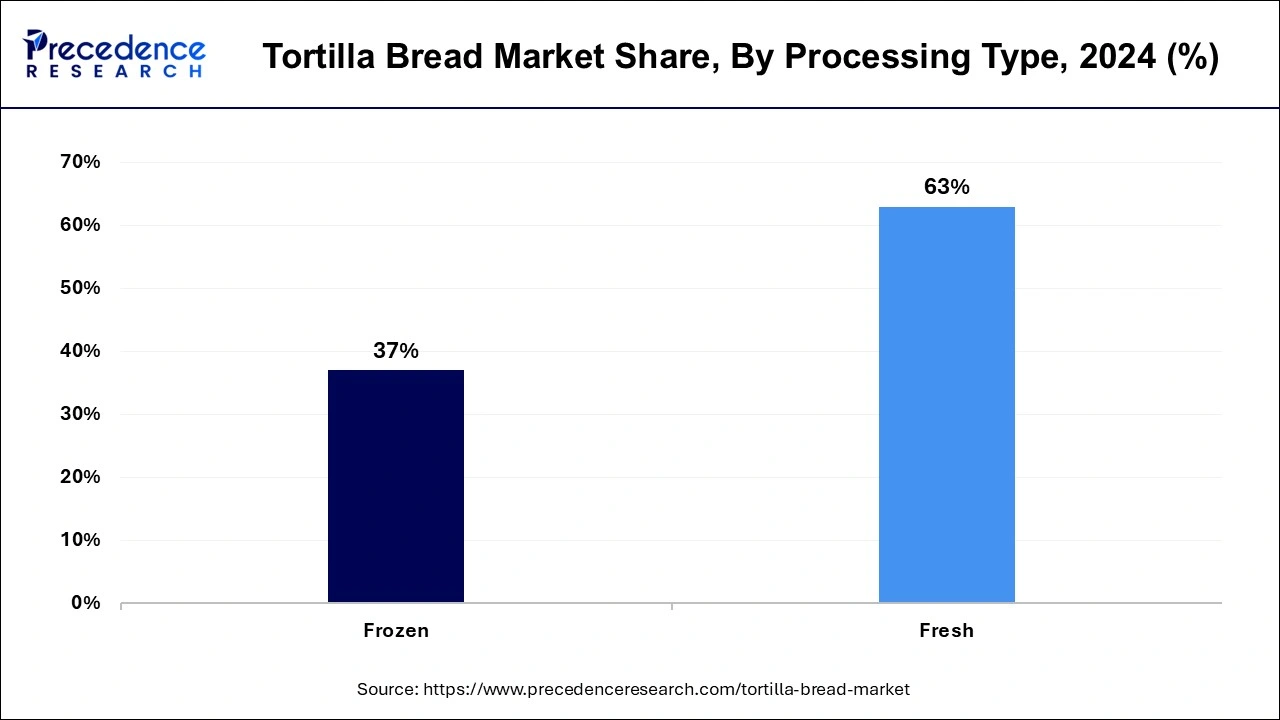

The fresh processing type segment held the largest market share of 63% in 2024. Fresh tortillas are prized for their superior taste, texture, and aroma compared to their counterparts that are frozen or shelf-stable. Consumers often prefer the convenience and authenticity of freshly made tortillas, especially in regions with a strong culinary tradition of using freshly prepared ingredients.

Additionally, fresh tortillas are perceived as a healthier option since they typically contain fewer preservatives and additives. This preference for freshness and quality has propelled the dominance of the fresh processing type segment in the tortilla bread market.

The tortilla chips segment dominated the tortilla bread market in 2024. This is due to its widespread popularity as a versatile and flavorful snack option. Tortilla chips are made from thinly sliced and fried tortillas, offering a crunchy texture and savory taste that appeal to consumers of all ages. They are commonly enjoyed as a standalone snack or paired with various dips, salsas, and toppings, making them suitable for social gatherings, parties, and everyday snacking occasions. Additionally, the increasing demand for healthier snack alternatives has driven the market for tortilla chips made from whole grains, multigrain, and natural ingredients, further solidifying its dominance in the market.

The hypermarket/supermarket distribution segment held the dominant share in 2024. This growth is attributed to several factors. Retail outlets offer a wide range of tortilla bread products, including various brands, flavors, and packaging sizes, providing consumers with ample choices and convenience. Additionally, hypermarkets and supermarkets have extensive shelf space and promotional opportunities, allowing tortilla bread manufacturers to showcase their products effectively and attract consumer attention. Moreover, consumers often prefer shopping for groceries in hypermarkets and supermarkets due to the convenience of one-stop shopping and the availability of other complementary products, further driving the dominance of this distribution segment in the tortilla bread market.

By Ingredients

By Processing Type

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024