January 2025

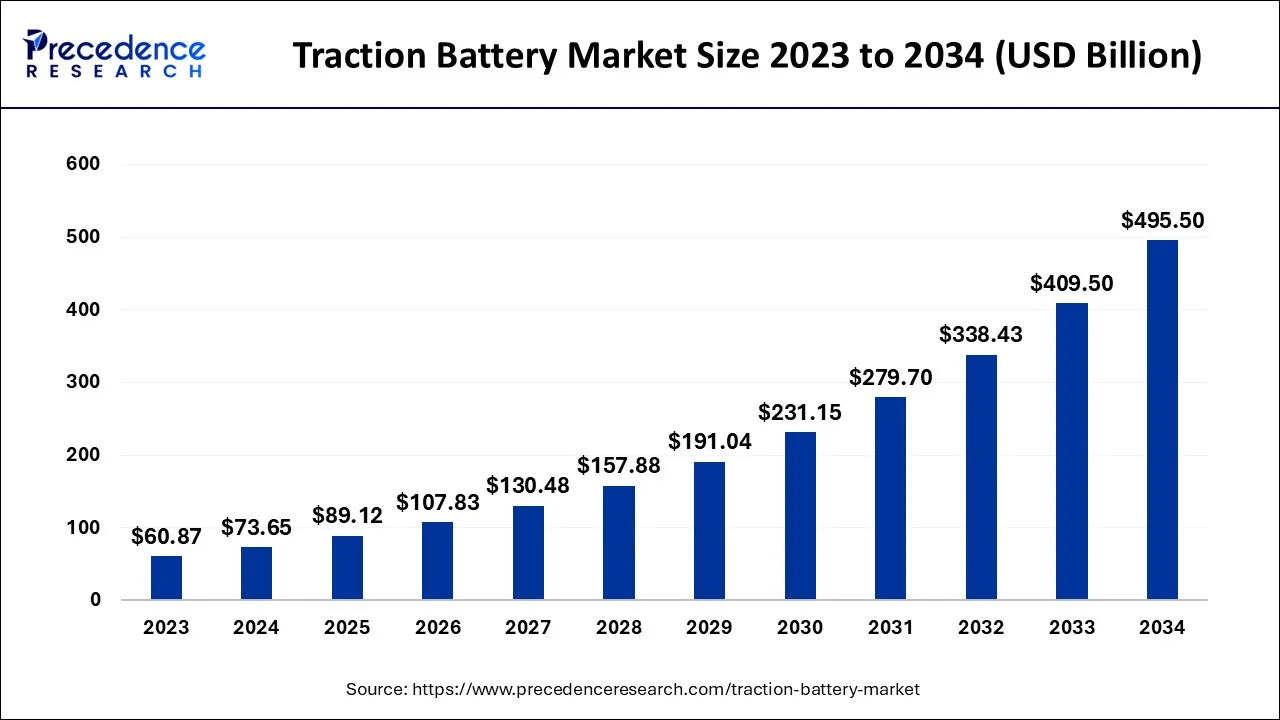

The global traction battery market size accounted for USD 73.65 billion in 2024, grew to USD 89.12 billion in 2025 and is projected to surpass around USD 495.50 billion by 2034, representing a healthy CAGR of 21% between 2024 and 2034.

The global traction battery market size is estimated at USD 73.65 billion in 2024 and is anticipated to reach around USD 495.50 billion by 2034, expanding at a CAGR of 21% between 2024 and 2034.

An energy storage system used in mobile vehicles is a class of industrial batteries called traction batteries. They are frequently found in forklift trucks, ground cleaning equipment, lifting platforms, electric vehicles, airport vehicles, mechanical handling equipment (MHE), and underground mining locomotives. They are most easily recognised by their PzS plate. The most popular traction battery, also known as an electric vehicle battery, is found in forklifts. The other main kind of industrial battery is stationary batteries. The R&D efforts to improve battery efficiency and lowering the unit consumption per charge have increased due to the rising demand for electric vehicles. Additionally, the competition among traction battery producers to provide highly effective traction batteries for electric and hybrid vehicles has intensified with the development of batteries with high energy density. All of these elements are anticipated to present significant prospects for the worldwide traction battery market in the future.

Government policies and laws encourage the production and sale of electric vehicles, which is anticipated to propel the global market for traction batteries. Additionally, as more people become aware of the harmful impacts of these pollutants, the market is predicted to grow as a result of the dedication to lowering petrol emissions. Traction batteries are also excellent for industrial use because to their extended service life, lightweight packs, and growing power storage capacity. Rapid industrialization causes e-commerce penetration to rise, and advancements in material handling technologies fuel the traction battery market's expansion. Research and development attempts to increase battery efficiency by shortening charge cycles have been sparked by the growing demand for the electric vehicles. The production of highly effective traction batteries for electric and hybrid vehicles will become more competitive as a result of the high energy density batteries.

Due to the rising volatility of fuel prices and growing environmental consciousness, there is a larger demand for the electric vehicles. Additionally, factors like the increased investment and the electrification of transportation will promote the growth of electric vehicles. Traction batteries, which power the electric motors in electric or hybrid vehicles, have increased significantly along with the market for electric vehicles. This may be one of the primary driving forces behind the market growth for traction batteries. Additionally, attributes like affordability, eco-friendliness, and recyclability are accelerating the industry's growth in the electric vehicle category and, as a result, the market's expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 73.65 Billion |

| Market Size by 2034 | USD 495.50 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | By Product Type, By Capacity and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Electrification of the transportation industry

It is projected that the need for traction batteries would rise throughout the anticipated period as a result of the electrification of the transportation industry. The global market for traction batteries is anticipated to be driven by the governmental initiatives and legislation supporting the development and marketing of electric vehicles. Due to factors such as increased forklift usage and the demand for electric vehicles, the market for traction batteries is expected to grow.

Cost

The price of manufacturing and acquiring these batteries is one of the major obstacles for the market for traction batteries. For many users, the high cost of traction batteries in comparison to conventional gasoline-powered vehicles might be a major deterrent to adoption. These batteries are expensive to produce because they need raw minerals like lithium, cobalt, and nickel, which are expensive. The recent fluctuations in the cost of these materials have also added to the high price of the traction batteries. As a result, the demand for traction batteries is constrained because many consumers are still hesitant to move to EVs.

However, as technology advances and economies of scale are realized, it is anticipated that the cost of manufacturing and acquiring traction batteries would decline. The price of traction batteries is anticipated to fall as more businesses enter the market and production volumes rise, making them more affordable and available to a wider spectrum of consumers.

Technological advancement

The development of recycling technology to recover valuable elements from spent batteries represents a sizable opportunity for the traction battery business. The quantity of spent batteries that will need to be disposed of in the future years will increase along with the demand for EVs and traction batteries. Recycling these batteries can help to recover key components like lithium, cobalt, and nickel that can be used to make new batteries, lowering the need for fresh raw materials and the negative environmental effects associated with their extraction and processing.

Recycling can assist in lowering the price of making new batteries in addition to lowering the demand for raw materials making them more accessible and inexpensive to a wider variety of consumers. Recycling can do this by recovering useful materials from used batteries.

Many businesses have already made investments in recycling technologies, and numerous countries are putting laws and rules in place to encourage the recycling of the traction batteries. For instance, by 2030, automakers must ensure that at least 50% of the weight of their EV batteries is recovered and utilised, according laws adopted by the European Union.

Impact of Covid-19:

Numerous businesses, particularly the market for traction batteries, have been significantly impacted by the COVID-19 epidemic. In electric vehicles (EVs), which have become more and more popular in recent years, traction batteries are frequently used. However, the epidemic has disrupted the production processes and the supply chains, which has decreased the EV demand and, as a result, the market for traction batteries were also impacted.

The pandemic's disruption of the supply chain is one of its most significant effects on the market for traction batteries. Lockdowns and travel restrictions were enacted in many nations, which reduced the amount of components and finished goods produced and distributed. As a result, raw minerals like lithium, cobalt, and nickel which are essential for producing traction batteries are in limited supply. As a result, the cost of creating the traction batteries has climbed along with the price of these materials.

The pandemic has also resulted in a decline in the EV demand, which has had a big influence on the market for traction batteries. The demand for cars has fallen overall as more people work from home and travel less. As a result, EV production has decreased, which in turn has decreased demand for traction batteries.

Additionally, the pandemic has a negative effect on consumer spending power, which lowers the market for the EVs. In light of the fact that many individuals are out of the work or struggling financially, they are less inclined to buy a new car, especially if it is more expensive than a typical gasoline-powered car.

The traction battery business has seen some good things come out of the pandemic, though. Many stimulus packages put in place by the governments around the world to jump-start their economies feature policies to encourage the use of EVs. For instance, several governments have offered subsidies or tax breaks for the purchase of electric vehicles, which has assisted in boosting demand.

Additionally, the epidemic has brought the sustainability and the need to lower carbon emissions back into prominence. The demand for EVs and traction batteries has surged as a result of the aggressive goals many businesses have set for lowering their carbon footprint.

The lead acid-based sector, which generated the most revenue in 2023, is expected to expand at a fastest CAGR throughout the course of the forecast period. Road vehicles, locomotives, industrial forklift trucks, and other vehicles are typically powered by lead acid-based traction batteries, which has spurred the growth of the automotive and transportation industries. According to a research published by the Indian Ministry of Commerce and Industry, the transport sector in India is expected to grow at a CAGR of 5.9%, making it one of the fastest-growing sectors. The development of the market for lead-acid traction batteries may benefit from this.

The less than 100 Ah segment, which generated the most revenue in 2023, is projected to expand at a quickest CAGR over the course of the forecast period. The market growth might be boosted by the growing demand for hybrid electric power devices in small-scale enterprises, where traction batteries with capacities under 100 Ah are frequently employed to power compact industrial machinery systems. They are also ideal for use as a backup rechargeable battery in non-plug-in hybrid vehicles like the Honda Civic hybrid and others due to characteristics including enhanced longevity and maximum charge cycles. This might fuel the market for traction batteries with a capacity of under 100 Ah.

According to the application, the electrical vehicle sector topped the global market in 2023 and is predicted to expand at a remarkable CAGR during the following five years. Growing environmental awareness has accelerated the adoption of electric vehicles, where traction batteries are frequently used to power the electric motor in battery-operated vehicles and hybrid electric vehicles.

The traction battery market in Asia-Pacific had the largest market share in 2023 and is anticipated to expand at the fastest CAGR during the forecast period. The growing demand for consumer goods has spurred the growth of the industrial manufacturing sectors in countries like China, India, and others that use traction batteries to power industrial equipment systems. This could lead to the growth of the traction battery market in the Asia-Pacific region. Growing environmental concerns and government initiatives have also encouraged the development of electric vehicles, which commonly use traction batteries to power electric motors. For instance, Business Standard research predicted an increase in electric vehicle sales in India between 2020 and 2023. Sales of traction batteries for electric cars are anticipated to increase as a result, creating lucrative market potential.

Recent Developments:

Segments Covered in the Report

By Product Type

By Capacity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

November 2024

July 2024