January 2025

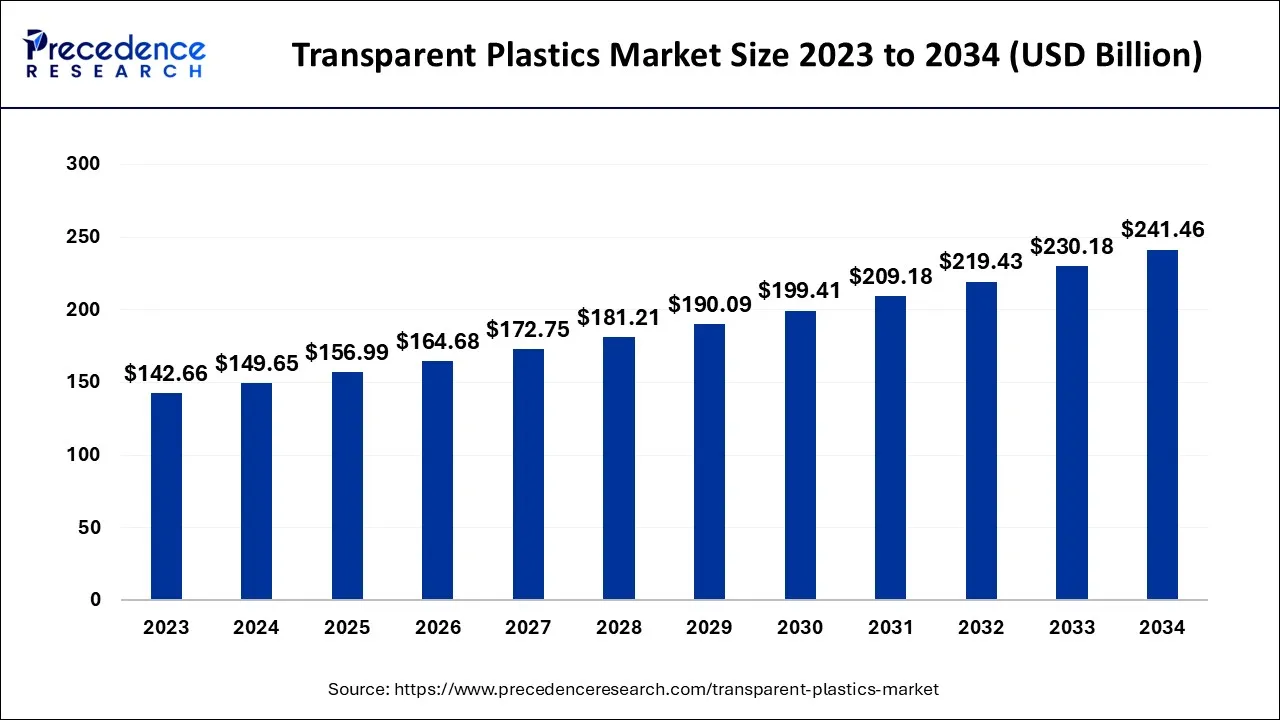

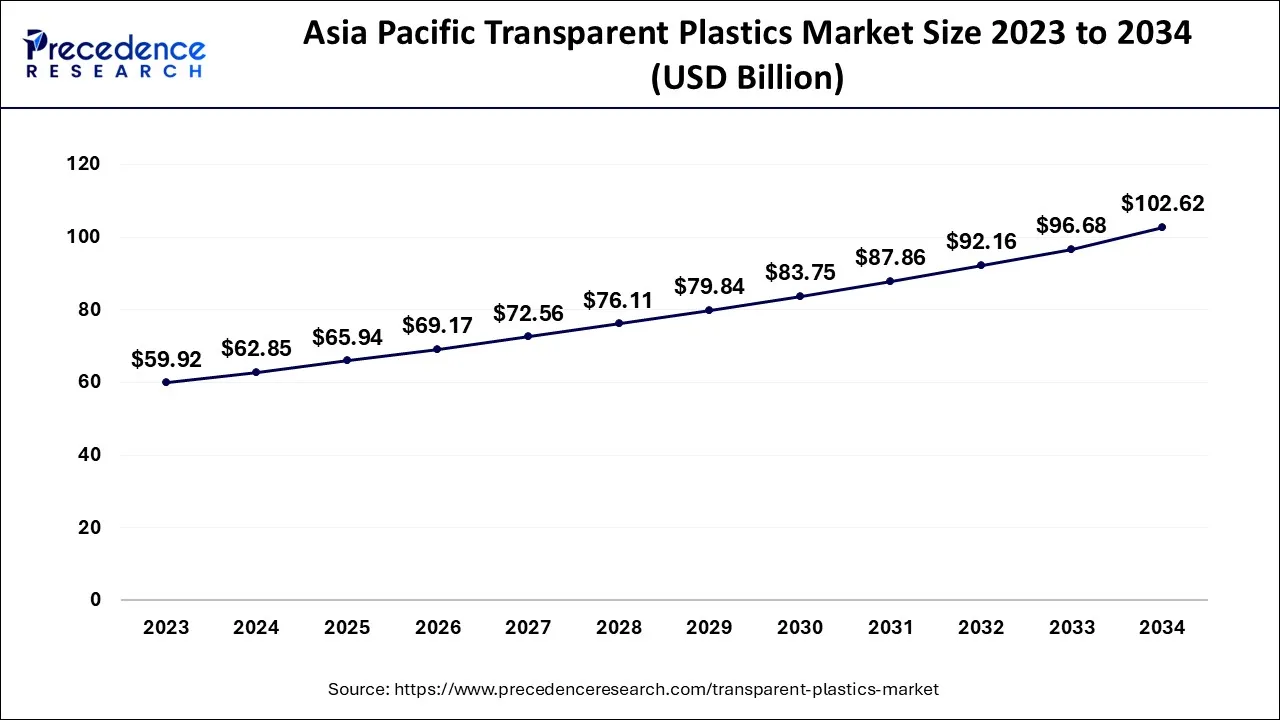

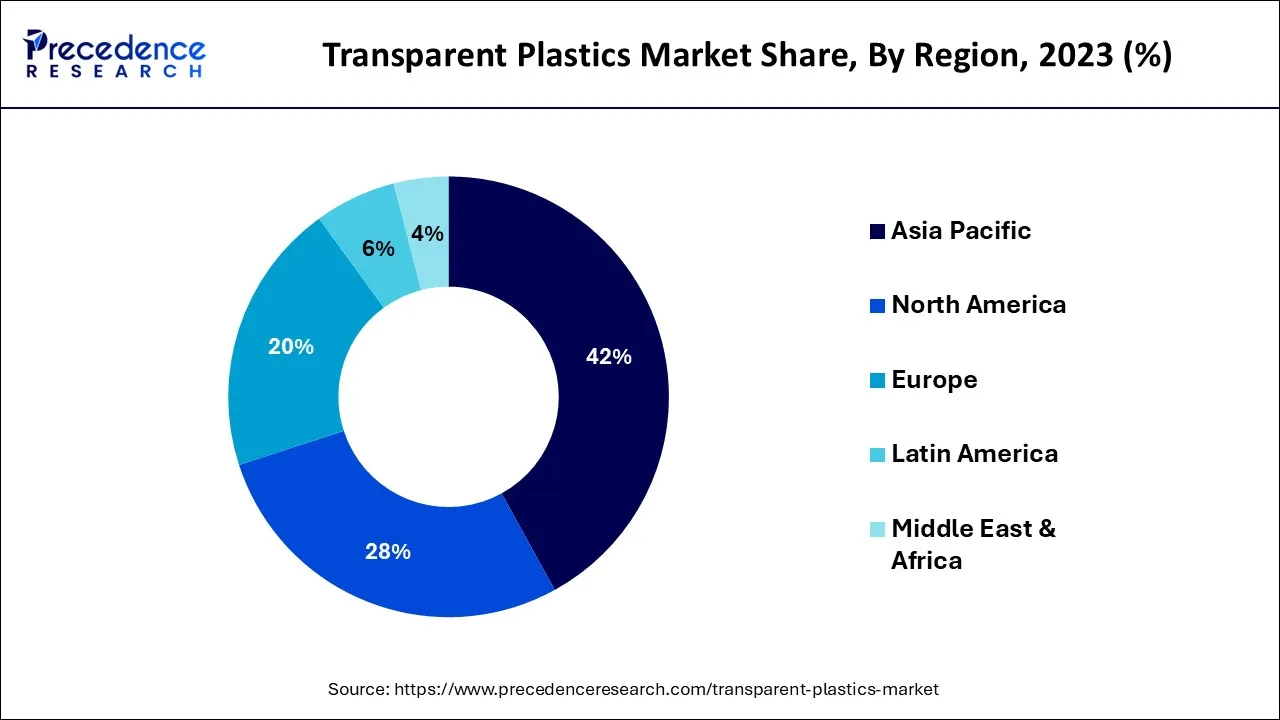

The global transparent plastics market size is predicted to increase from USD 149.65 billion in 2024, grow to USD 156.99 billion in 2025, and is anticipated to reach around USD 241.46 billion by 2034, poised to grow at a CAGR of 4.90% between 2024 and 2034. The Asia Pacific transparent plastics market size is calculated at USD 62.85 billion in 2024 and is estimated to grow at the fastest CAGR of 5.02% during the forecast year.

The global transparent plastics market is expected to be valued at USD 149.65 billion in 2024 and is anticipated to reach around USD 241.46 billion by 2034, expanding at a CAGR of 4.90% over the forecast period from 2024 to 2034.

The Asia Pacific transparent plastics market size is accounted for USD 62.85 billion in 2024 and is projected to be worth around USD 102.62 billion by 2034, poised to grow at a CAGR of 5.02% from 2024 to 2034.

During the forecast period, the Asia-Pacific region is anticipated to lead the market. The explosive demand for transparent plastics from major end-use industries including construction, packaging, electronics, and automotive, among others, is responsible for this region's rise. The expansion of these end-user businesses fuels the need for transparent plastics by driving up industrialization while also upgrading consumer lifestyles and per capita income. Through innovation, sustainable change, reasonable pricing, and sales execution techniques, businesses in this region are quickly adjusting to this changing landscape and generating attractive revenues. Therefore, as a result of the aforementioned reasons, this region is anticipated to hold a large market share for transparent plastics throughout the projected period.

The global market for transparent plastic is anticipated to grow during the projected period as a result of increased demand from end-use sectors including construction, automobile, and consumer products. Additionally, it is anticipated that the worldwide transparent plastic market would grow due to the prolonged shelf-life of packaged food items and the ease of customizing. In addition, rising demand for transparent plastic is predicted to support the expansion of the global transparent plastics market in emerging nations like China and India, where it is widely utilized for food and beverage packaging.

Compared to other materials like glass and metal, plastic has the benefit of being lighter. Plastics are widely used in many end-use sectors because of their strength, beauty, performance, and ease of handling. Due to their great energy efficiency, aesthetics, design, flexibility, and cost-effectiveness, plastics are replacing conventional materials like glass in building applications including the construction of windows and frames. For instance, the windows use polycarbonate material. Plastics have a low thermal conductivity, which lowers heating and cooling costs while providing protection from severe weather. Transparent plastics are also proven to be more lucrative than other materials in the packaging business.

| Report Coverage | Details |

| Market Size in 2024 | USD 149.65 Billion |

| Market Size by 2034 | USD 241.46 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, Polymer Type, Form and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

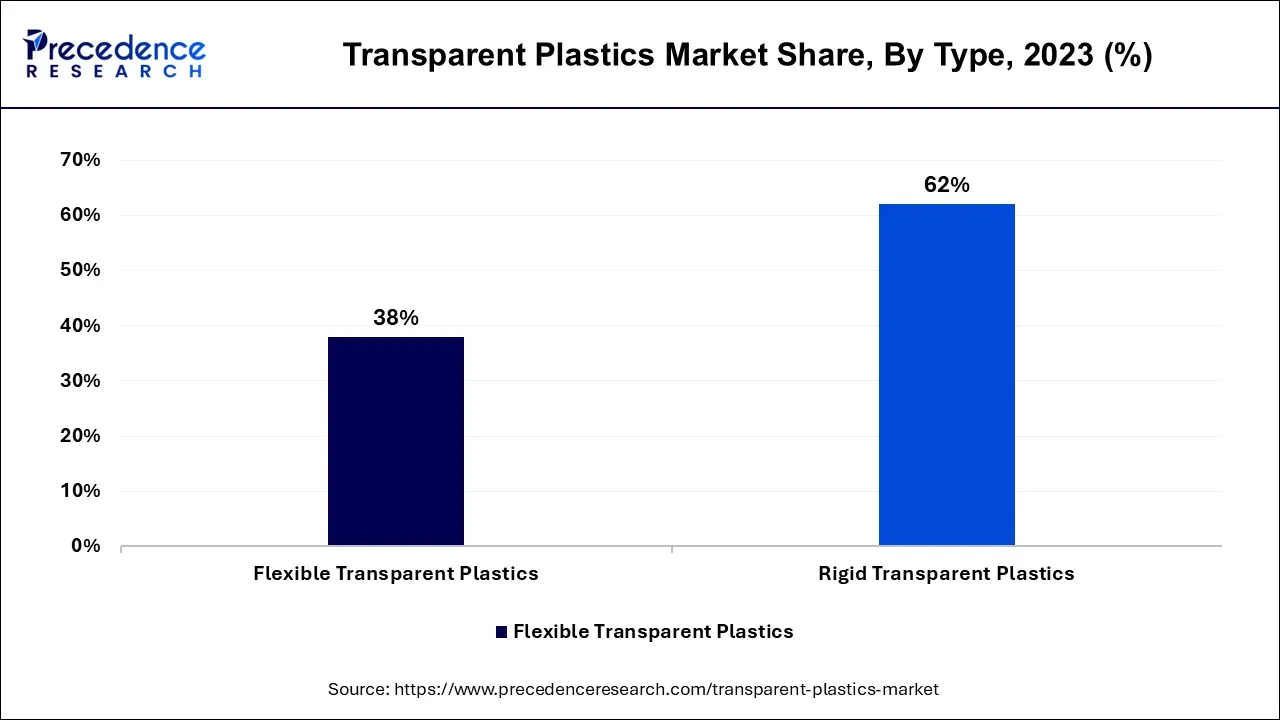

According to type, the flexible transparent plastics market is anticipated to expand at a rapid CAGR over the next years. In this area, polytetrafluoroethylene (PTFE) is the substance that works well. Flexible packaging is coveted for its affordability, sustainability, use, and beauty.

This type of packaging also has the advantage of allowing textual information, such as product instructions, to be printed on the label. Additionally, PTFE is an affordable alternative for a variety of sectors, including oil and gas, chemical processing, industrial, electrical/electronic, and construction.

The packaging and films category, which in 2023 held a sizeable portion of the transparent plastics market, is anticipated to expand at a CAGR of 7.5% from 2024 to 2034. Due to the majority of customer demands, the packaging and film sectors are quickly moving toward lightweight, transparent, and durable materials. As a result, there is an increasing need for polyethylene terephthalate films and sheets since they have these qualities and are relatively affordable. Transparent polymers like polyethylene terephthalate films are mostly replacing conventional films because they are safer, more cost-effective for food packaging, and stronger across a wider range of temperatures. According to the Ministry of Economy, Trade, and Industry of Japan, polyethylene films and sheets totaled 2.4 million metric tons of processed plastic in 2020. This significant production volume demonstrates the rising demand for and consumption of plastic films as well as the wide range of packaging uses in the automotive, food and beverage, chemical, pharmaceutical, and other sectors.

As a result, throughout the forecast period, the packaging and films sector will be the largest and fastest-growing section within the application segmentation of the market. During the projected period, the aforementioned reasons are anticipated to fuel demand and market expansion for transparent plastics.

The majority of the transparent plastics market in 2023 belonged to polyethylene terephthalate (PET), which has received approval from the Food and Drug Administration in several nations and numerous other health-safety organizations worldwide for its suitability for contact with food and drinks. PET, also known as polyethylene terephthalate, is becoming the material of choice for packaging foods and drinks across the world because of its distinctive qualities, which include clarity, good barrier characteristics, ease of handling, low weight, safety, and recycling.

PET, an affordable thermoplastic polymer with exceptional mechanical, thermal, chemical, and high tensile qualities, is made of polyethylene terephthalate. For the production of water bottles, fibers, films, and soft drink containers, it is the most extensively used transparent material. They are widely utilized in a variety of sectors, including electrical and electronic, building and construction, automotive, and medical. Additionally, the most recycled plastic in the world is polyethylene terephthalate (PET). The market for transparent plastics is dominated by polyethylene terephthalate due to the aforementioned characteristics.

In 2023, the rigid category controlled a large portion of the transparent plastics market. T Since rigid clear plastics are excellent for usage in a variety of applications thanks to their advantageous characteristics including the nature of the mix, physical features, and simplicity of consumption, the rigid plastics market is anticipated to maintain its dominance during the projected period. Because of their affordability, sustainability, beauty, and rigidity, rigid transparent polymers are favoured. These translucent polymers also have the benefit of enabling the labeling of textual information, such as product instructions. Thus, it is anticipated that the rigid segment would rule the transparent plastics market throughout the projected period as a result of all the aforementioned aspects.

Segments covered in the report

By Type

By Application

By Polymer Type

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

January 2025

August 2024