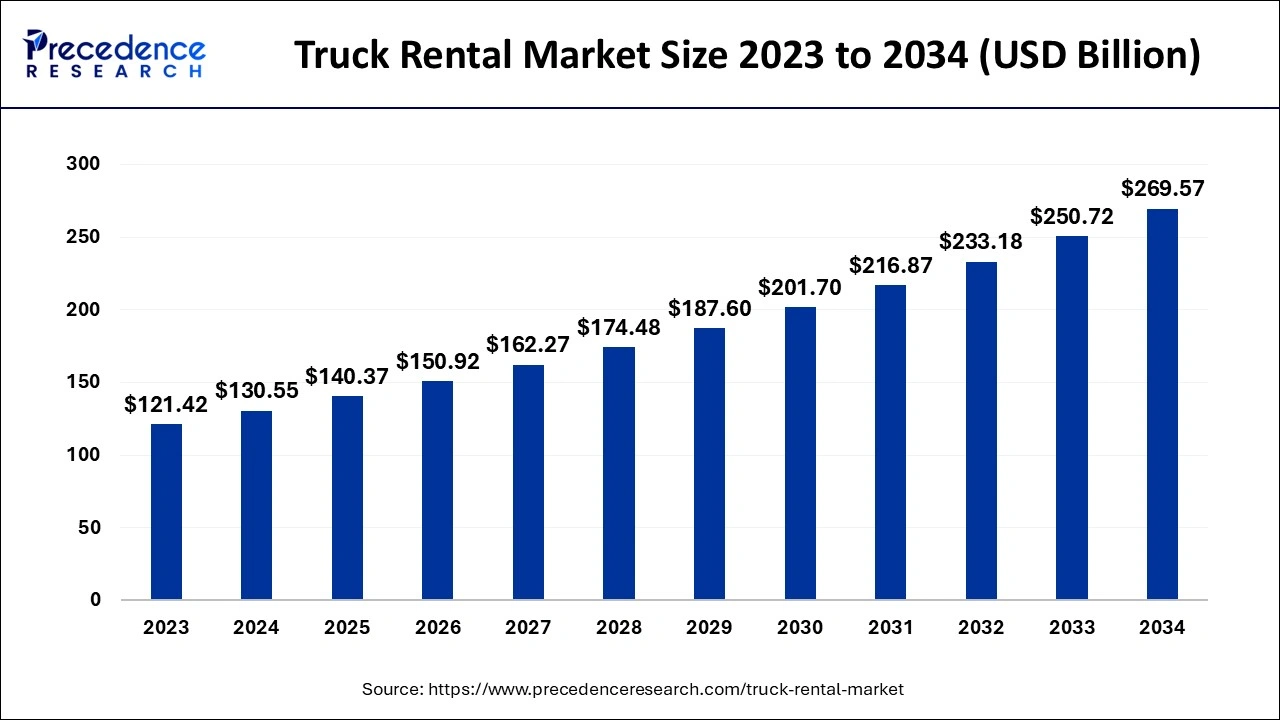

The global truck rental market size is calculated at USD 130.55 billion in 2024, grew to USD 140.37 billion in 2025 and is projected to reach around USD 269.57 billion by 2034. The market is expanding at a CAGR of 7.52% between 2024 and 2034. The Asia Pacific truck rental market size was valued at USD 5.35 billion in 2024 and is estimated to grow at a solid CAGR of 7.63% during the forecast period.

The global truck rental market size accounted for USD 130.55 billion in 2024 and is expected to surpass around USD 269.57 billion by 2034, growing at a CAGR of 7.52% from 2024 to 2034. The surge in the e-commerce industry is the key factor driving the market growth. Also, growth in online shopping along with the rising need for efficient last-mile delivery solutions can fuel market growth shortly.

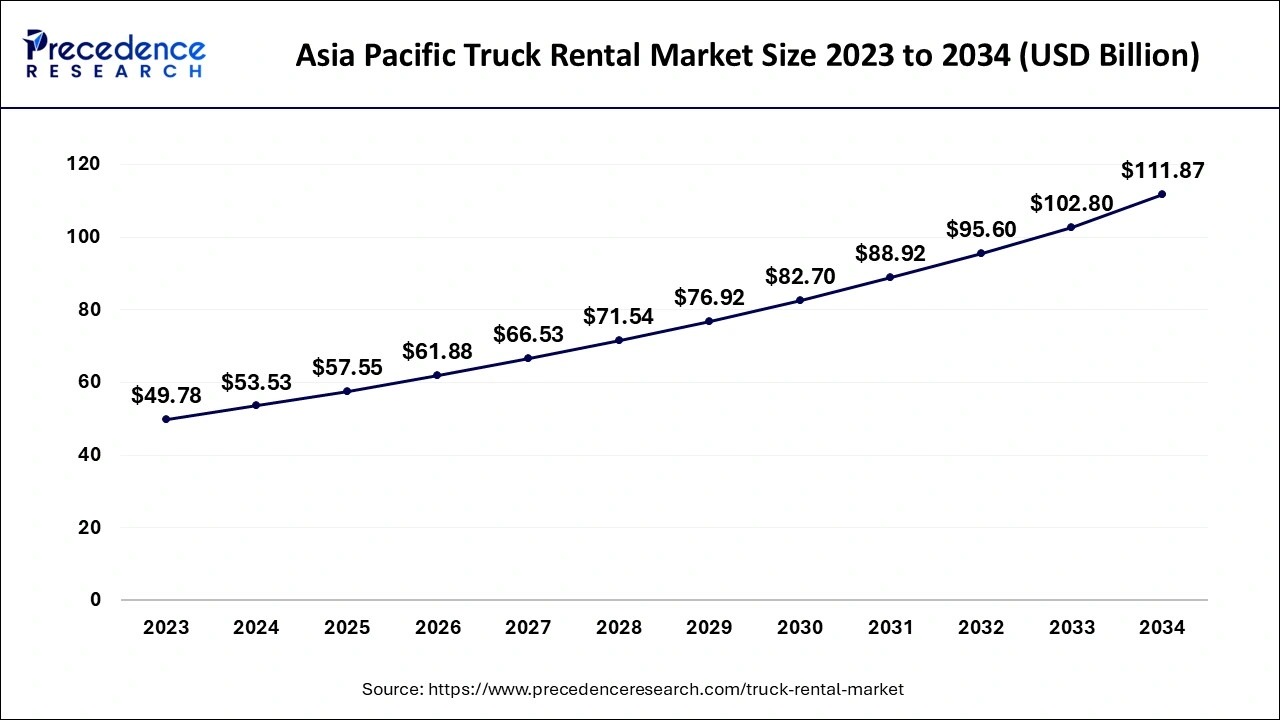

The Asia Pacific truck rental market size is evaluated at USD 53.53 billion in 2024 and is projected to be worth around USD 111.87 billion by 2034, growing at a CAGR of 7.63% from 2024 to 2034.

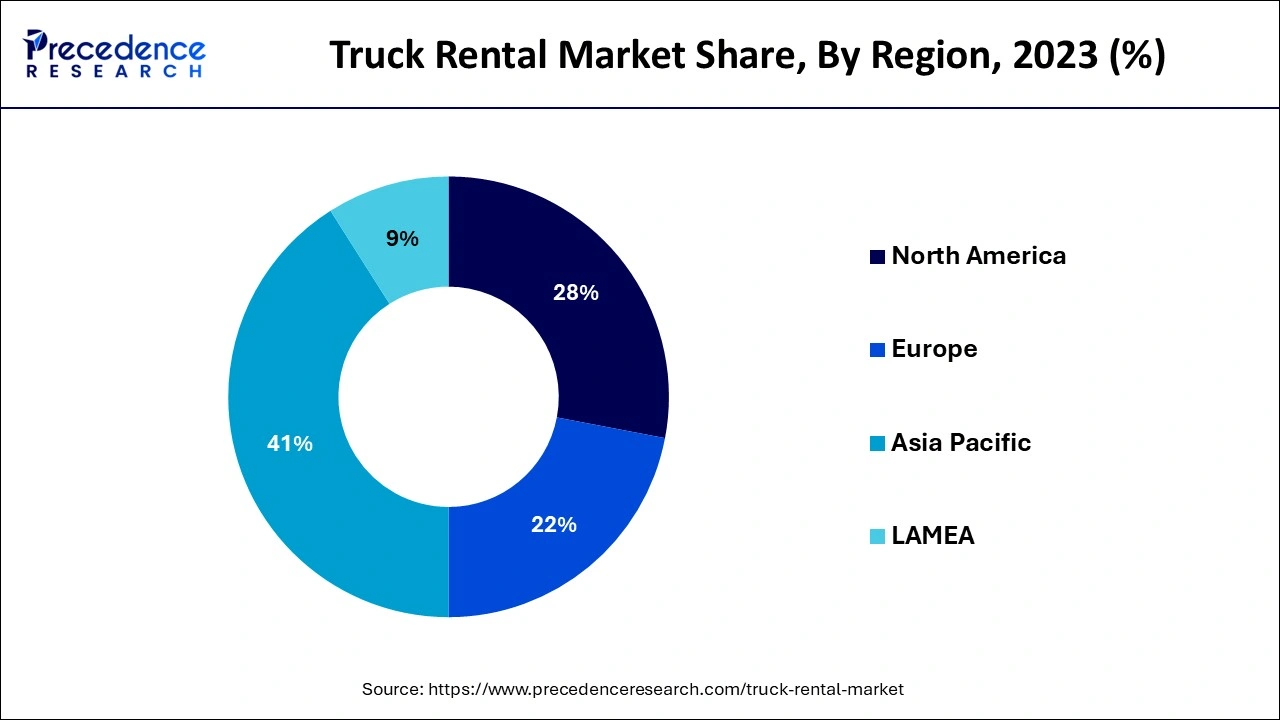

Asia Pacific dominated the truck rental market in 2023. The dominance of the region can be linked to the rising urbanization and industrialization which is stimulating the demand for truck rental services in this region. Furthermore, Introduction of numerous new infrastructure developments in countries such as India, China, and Japan are also opting to create new growth opportunities in the truck rental market.

North America is expected to show the fastest growth during the projected period. The growth of the region can be driven by the increasing need for urban delivery services created by the growth of on-demand services and online shopping. Moreover, Urban areas in North America face difficulties related to congestion and restrictions on vehicles. The truck rental market in the US is witnessing substantial growth in the North American region due to the diversification of services provided by rental companies.

Truck rental is a process of hiring or leasing business trucks which generally serves agencies or companies that have their own truck fleets. Renting a truck reduces the operational cost and risk associated with seasonal transport demand. Renting a truck with full-service lease cuts the financial liability of maintenance, vehicle replacement and servicing. These factors help in the expansion of truck rental market growth.

Role of AI in the Truck Rental Market

AI technology can transform the way truck rental operations are performed optimize the rental processes and customer experiences, and contribute to the best industry practices. Furthermore, Artificial intelligence algorithms can simulate human intelligence while performing tasks related to truck rental operations, such as fleet optimization, reservation management, and maintenance scheduling.

| Report Coverage | Details |

| Market Size by 2034 | USD 269.57 Billion |

| Market Size in 2024 | USD 130.55 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.52% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Truck, Duration, Propulsion, Service Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising focus on total cost of ownership

Industries across the globe have become more focused on the total cost of ownership than ever before. Efforts to boost the same area drive the adoption of truck rental on a grand scale as companies look to grow their profits and minimize risks. Additionally, demand for deliveries across the world is growing rapidly, and this trend is enabling delivery service providers to use truck rental services. Trucks are a massive investment, so most delivery providers opt for these services.

Driver shortage and training issues

The industry faces a lack of skilled drivers which can affect the availability of trucks for rental services and impact service quality. Moreover, drivers have to be trained and licensed to operate different types of rental trucks can further constrain the truck rental market growth. Truck rental providers also struggle to maintain optimal operational costs, hindering market growth.

The growth in global industrialization and urbanization

As the world economy undergoes substantial growth, industrial zones and urban areas will experience improved development and infrastructure. This progress is mainly facilitated by logistics and transportation, with commercial vehicles (CVs) acting as a fundamental element in establishing a robust global infrastructure. Furthermore, heavy-duty trucks like Light Commercial Vehicles (LCVs) play an important role in advancing industrial development in tasks such as trailer towing.

The light-duty segment led the truck rental market in 2023. The dominance of the segment can be attributed to the growing demand for sophisticated transportation solutions among local and small-scale businesses. Light-duty trucks benefit companies like food vendors, local delivery services, and tradespeople. Additionally, the availability and affordability of rental services make these businesses work more efficiently without the economic burden of buying a vehicle.

The heavy-duty segment is expected to grow significantly over the forecast period. The expansion of the segment is driven by the growth of the supply chain sector and logistics. As global trade grows and supply chains become more tedious, there is an increasing requirement for reliable transportation of goods over large distances. Also, players in the logistics sector often seek to rent heavy-duty trucks to maintain seasonal demand during peak periods.

The short-term segment led the market in 2023 by holding the largest truck rental market share. This is due to the surge of the gig economy along with the growing number of self-reliant contractors in the transportation and logistics sector, which fuels the growth of short-term truck rentals. Moreover, freelance drivers and on-demand delivery offerers prefer short-term rentals to fulfill particular job requirements, which drives the growth of the segment in the truck rental market.

The long-term segment is expected to grow significantly during the projected period. The expansion of the segment is credited to the increasing depreciation risk coupled with the rising focus on the core vehicle operations by end users. Furthermore, trucks and commercial vehicles can lose value as time passes, substantially impacting a company's balance sheet. This segment copes with this issue by transferring the burden of loss to the rental company.

The internal combustion engine (ICE) segment led the truck rental market in 2023. This is because of the strong presence of firm Infrastructure and support systems. The infrastructure supporting ICE trucks, like maintenance facilities and refueling stations, is widely available and well-established. This wide network offers reliability and convenience for businesses that depend on ICE trucks.

The electric segment is estimated to grow significantly over the studied period. The growth is linked to the increase in urbanization and the deployment of low-emission zones in various cities. These zones limit access to areas with huge pollution levels, which makes electric trucks reliable for operations in these zones. This alignment with urban climate policies propels the segment growth.

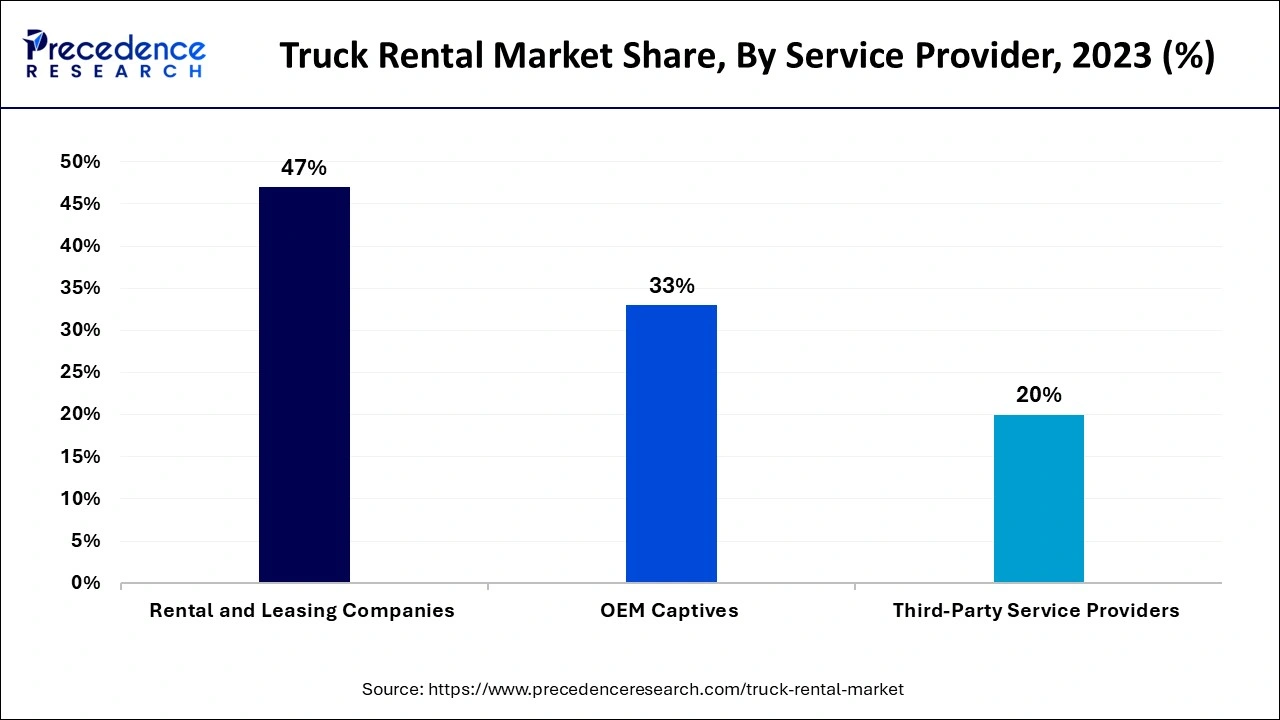

The rental and leasing companies segment led the truck rental market by holding 47% market share in 2023. The dominance of the segment is attributed to the enhanced services and customer support provided by these players. Many companies provide value-added services, including 24/7 roadside surveillance and catering leasing solutions specific to business needs. These developments in customer support and service quality enable rental and leasing options to be more favorable to many businesses.

The OEM captives segment is projected to grow significantly through the forecast period. Owning customized financing options that are more appealing than those offered by traditional lenders. OEM captives provide lower interest rates and flexible payment schedules. These flexible financing solutions reduce the financial burden linked with acquiring new trucks and, hence, optimize the supporting fleet.

Segments Covered in the Report

By Truck

By Duration

By Propulsion

By Service Provider

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client