April 2025

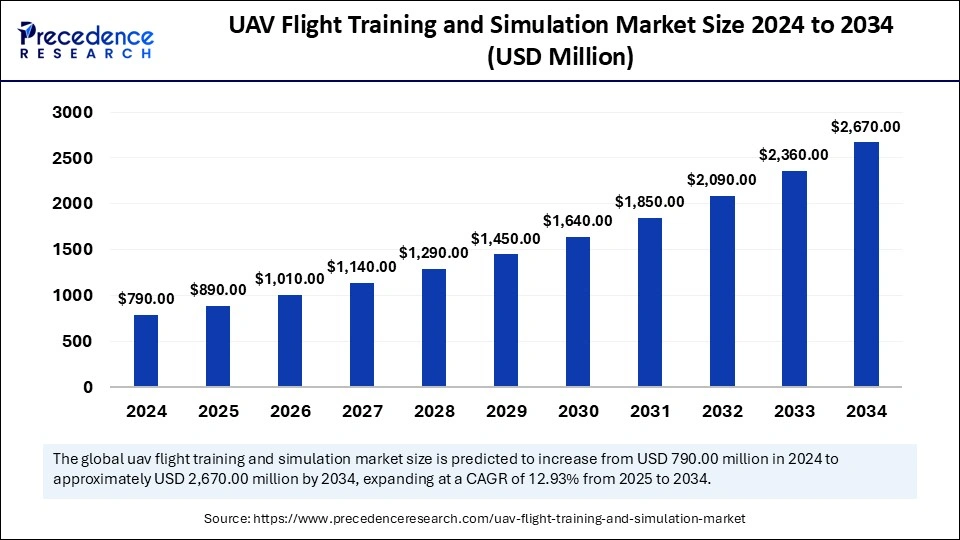

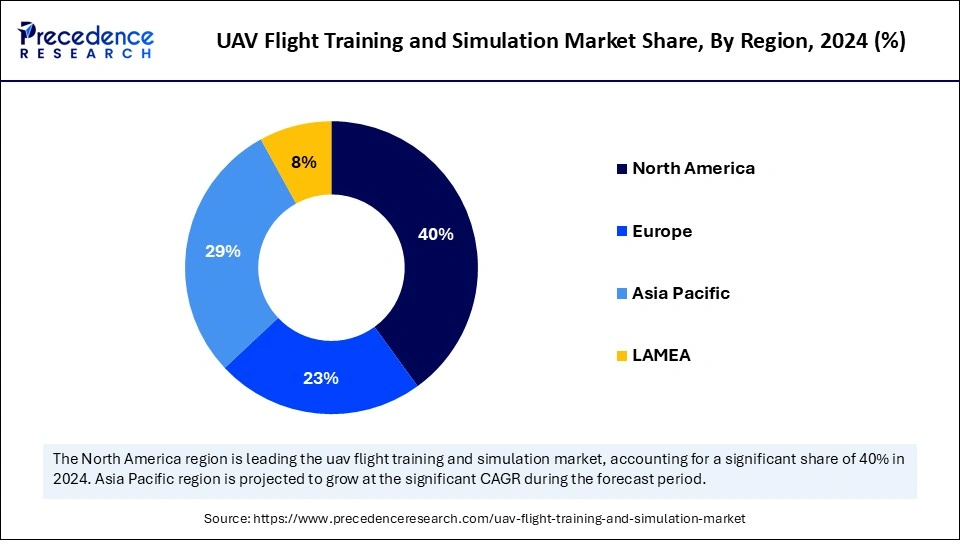

The global UAV flight training and simulation market size is calculated at USD 890 million in 2025 and is forecasted to reach around USD 2,670 million by 2034, accelerating at a CAGR of 12.93% from 2025 to 2034. The North America market size surpassed USD 320 million in 2024 and is expanding at a CAGR of 12.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global UAV flight training and simulation market size was estimated at USD 790 million in 2024 and is predicted to increase from USD 890 million in 2025 to approximately USD 2,670 million by 2034, expanding at a CAGR of 12.93% from 2025 to 2034. The demand for UAVs has increased in various industries, such as military, agriculture, and civil applications, driving the global market. Regulatory requirements for training and certificated UAV pilots are driving significant approaches in market growth.

The integration of Artificial Intelligence in the UAV flight training and simulation market has driven highly realistic and dynamic training environments. AI has improved realistic simulation and predictive maintenance areas. The real-time data analysis and decision-making ability of AI is improving the safety and effectiveness of unmanned aerial vehicle (UAV) flight training and simulations. The requirement of customized training and simulations according to end-user needs can be fulfilled thanks to AI implementation with UAV training and simulations.

The automated scenarios generation ability of AI helps to create broad training scenarios, such as complex situations like unexpected malfunctions, airspace conflicts, or challenging environmental conditions, to improve pilot decision-making skills and advance training prospects. AI not only has improved training and simulation settings but also helps students develop and engineer their own drones and system features. The rising personalization insights due to AI integration are holding great market potential in the forecast period

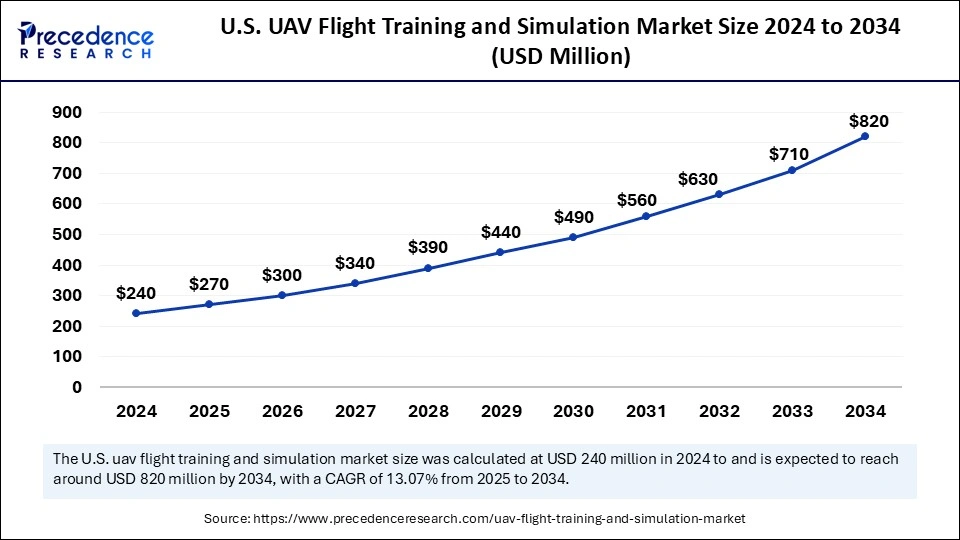

The U.S. UAV flight training and simulation market size was exhibited at USD 240 million in 2024 and is projected to be worth around USD 820 million by 2034, growing at a CAGR of 13.07% from 2025 to 2034.

North America dominated the UAV flight training and simulation market with the largest share in 2024 due to the increased adoption of drones in defense and military applications. The presence of key competitors and advanced technology integration approaches are driving the adoption of UAV flight training and simulations in North America. Additionally, strict regulatory guidelines have shifted the region toward a surge in drone application along with strict regulatory standards and safety requirements. The strong focus on training and simulation solutions in ensuring the proficiency and safety of UAV pilots is rapidly transforming UAV flight areas in the region.

The robust aviation industry of the United States plays a pivotal role in the region's UAV flight training and simulation market expansion. The United States is leading the regional market because of the country's high defense expenditure and the presence of key market players. The demand for UAVs in commercial applications has increased in the U.S. United States has scaled up its UAV utilization for military operations like intelligence, surveillance, and reconnaissance (ISR) missions, combat, and other missions. Collaboration between major organizations and academic institutes is likely to transform the aerospace industry settings in the United States.

Asia Pacific is expected to host the fastest-growing UAV flight training and simulation market during the forecast period. Asian government is focusing on providing significant training and simulation for UAV pilots to improve the aviation industry. Asia faces challenges of regulatory policies and high initial investment costs, despite that, rising defense expenditure and increased adoption of UAVs in industries like aerial surveys, photography, and agriculture are boosting the market.

Countries like China and India play a crucial role in the regional market by increasing the adoption of drones to improve intelligence, surveillance, and reconnaissance (ISR) mission capabilities. Indian government initiatives to promote the use of UAVs, such as “Make in India” initiatives, play a favorable role in market growth.

The UAV flight training and simulation market reflects the education and practical process of training individuals to operate unmanned aerial vehicles (UAVs) in simulated environments. The market is a rapidly growing industry with an increased need for UAVs in the military, commercial, and recreational sectors. Virtual and augmented trading has gained popularity in recent years. The well-established aircraft industry in the United States, China, and India is leveraging major investments in UAV flight training and simulations to advance education and training.

Growing emphasis on improving safety and efficiency in UAVs and reducing risk in actual flight training are driving the adoption of drones. Increased utilization of UAVs in military and defense and commercial applications to improve intelligence and surveillance, driving major influence on market growth. Government initiatives for promoting the importance of education and knowledge on training and regulatory requirements of proper training and certifications are fueling the need for advanced UAV training and simulations.

Increased adoption of UAVs: The adoption of UAVs has increased in various institutes such as military, recreational, commercial, and civil, driving the need for trained and certified UAV operators.

Advanced technologies: Technological advancements in simulations, including virtual reality, are improving the effectiveness and education of UAV flight trading and simulations.

Integration of cutting-edge technologies: Implementation of advanced technologies such as cloud-based simulation and AI and Machine Learning integrations is enabling advanced access to simulation training and improving effectiveness.

Regulatory requirements: Strict regulatory guidelines for the requirement of proper training and simulations for UAV pilots are playing a significant role in market expansion.

Government initiatives: Government initiatives and promotion of programs for advanced taring and simulations are driving the market. Growing collaborative approaches between public-privet organizations to support UAV flight training and simulation are leveraging growth insights.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,670 Million |

| Market Size in 2025 | USD 890 Million |

| Market Size in 2024 | USD 790 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Adoption of innovative technologies

Technological innovations such as increased autonomy, enhanced sensor capabilities, and improved payload capacities in UAVs are driving the need for the UAV flight training and simulation market. The market is further witnessing significant growth due to increased virtual training and integration of cloud-based simulations and AI and ML technologies. The implementation of such innovative technologies is enabling more realistic and adaptive learning. Technology innovations are further improving the effectiveness of training.

The reduction of costs associated with UAV flight training and simulation are extreme benefits that have been approached due to the implementation of cutting-edge technologies. Increased urbanization and traffic concerns are driving the adoption of UAVs with more safety and efficiency approaches. Additionally, the growing developments of unmanned traffic management systems to manage UAV traffic and allow safe and more efficient UAV operations are merging the market.

The high cost associated with UAV flight training and simulation is the major restraint of the UAV flight training and simulation market. The complex nature of UAV flight training and simulation contributed to the high cost. UAV flight training and simulations require customizations to fulfill the needs and demands of end-users, making it more expensive. High-performance computers, sensors, and simulation software are the major requirements of UAV flight training and simulations, which can lead to high costs. Additionally, the need for cutting-edge technology integrations can be expensive. The high cost of UAV flight training and simulations is hampering adoption rate and market competition.

Cloud-based training

The implementation of cloud-based training offers advantages of scalability, accessibility, cost-effectiveness, real-time data analysis, and updates. In the UAV flight training and simulation market, cloud-based training enables pilots access to training programs simultaneously from anywhere and anytime. The high cost associated with UAV flight training is the key challenge for the market. However, cloud-based training is enabling cost-effective approaches in the training program, making training more effective.

Real-time data analytics and updates help to get access to realistic scenarios and help to identify areas more effectively. Cloud-based applications facilitate collaborations between operators, instructors, and training organizations, which helps to provide real-time updates and essential support during training. Cloud-based training is making it easier for the adoption of UAV flight training and simulation programs in commercial and recreational operators.

The HALE UAV segment has contributed the largest UAV flight training and simulation market share in 2024 due to increased demand for specialized training programs. HALE UAVs need specialized training and simultaneous due to their complex operations, such as high-altitude flight, advanced sensor systems, and long endure missions. HALE UAVs are highly used in surveillance, military, and commercial applications. The ability of HALE UAVs to fly at high altitudes and a higher speed makes them the ideal choice for military and defense applications. The growing adoption of HALE UAVs in various applications is driving further developments and advancements in their capabilities.

The MALE UAV segment is expected to grow at the fastest rate over the forecast period due to increased demand for sophisticated training programs. MALE UAVs need the implementation of specific training modules, including mission planning, autonomous flight modes, sensor management, and communication protocol. Growing investments by organizations' training programs, including advanced simulation systems and experienced instructors due to the complexity of operating MALE UAVs, are leveraging the segment growth.

The defense and military segment dominated the global UAV flight training and simulation market in 2024. The adoption of drones has increased in defense and military applications. The increased utilization of high-altitude long-endurance capabilities (HALE) in these applications requires sophisticated training systems to replicate these features for realistic simulations. Ongoing defense and military investment in advancing UAV capabilities and spending on UAV training and simulations are leveraging segment growth.

However, the civil and commercial segment is projected to witness significant growth in the forecast period due to the increased utilization of drones for civil and commercial applications such as aerial photography, inspection, agriculture, surveying, and aerial imaging. With strict regulatory guidelines for proper training for drone operations, commercial pilots play a vital role in segment expansion. The growing emphasis on commercial applications for the requirement of trained and certified UAV pilots is driving the growth of UAV flight training and simulations in civil and commercial applications.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024