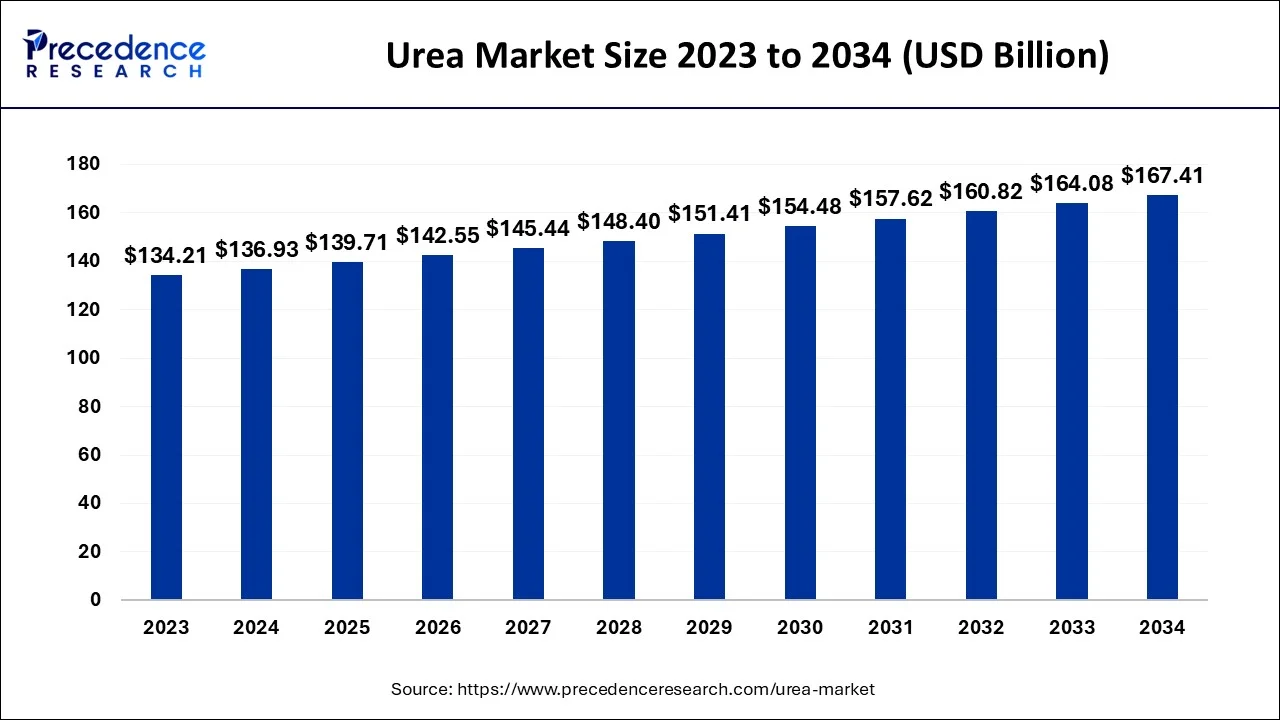

The global urea market size accounted for USD 136.93 billion in 2024, grew to USD 139.71 billion in 2025 and is projected to surpass around USD 167.41 billion by 2034, representing a healthy CAGR of 2.03% between 2024 and 2034.

The global urea market size is estimated at USD 136.93 billion in 2024 and is anticipated to reach around USD 167.41 billion by 2034, expanding at a CAGR of 2.03% between 2024 and 2034.

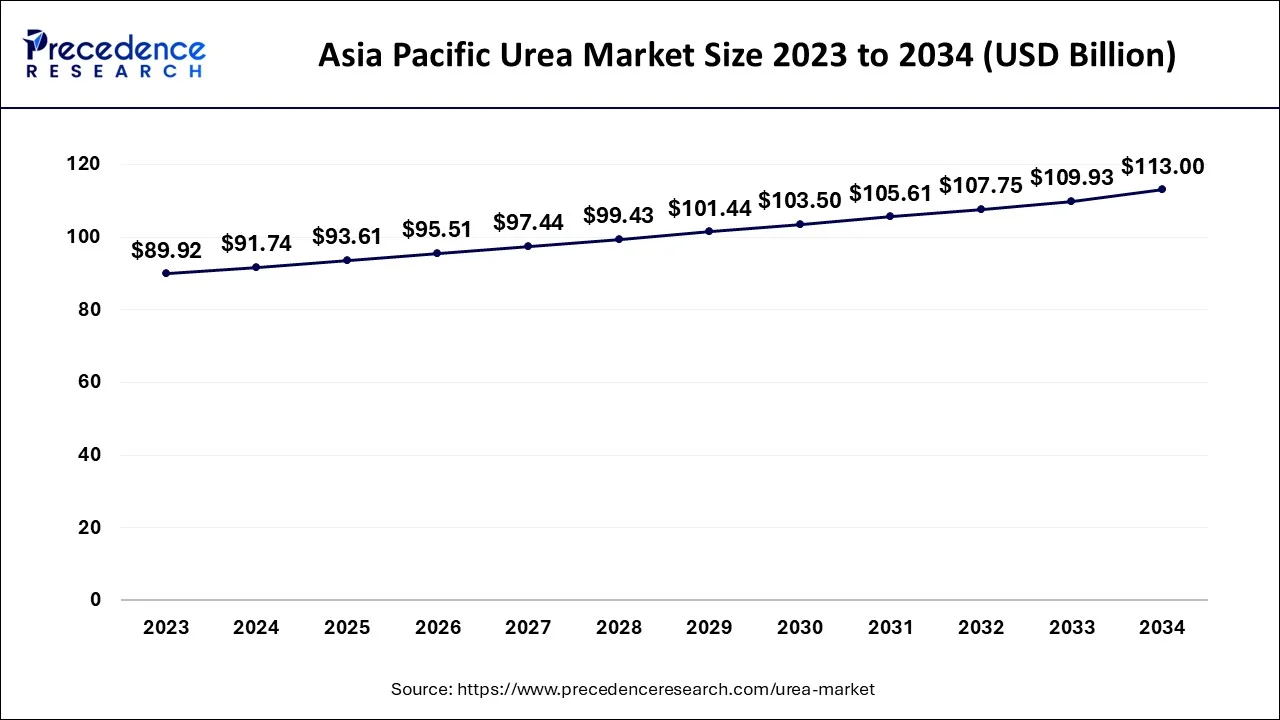

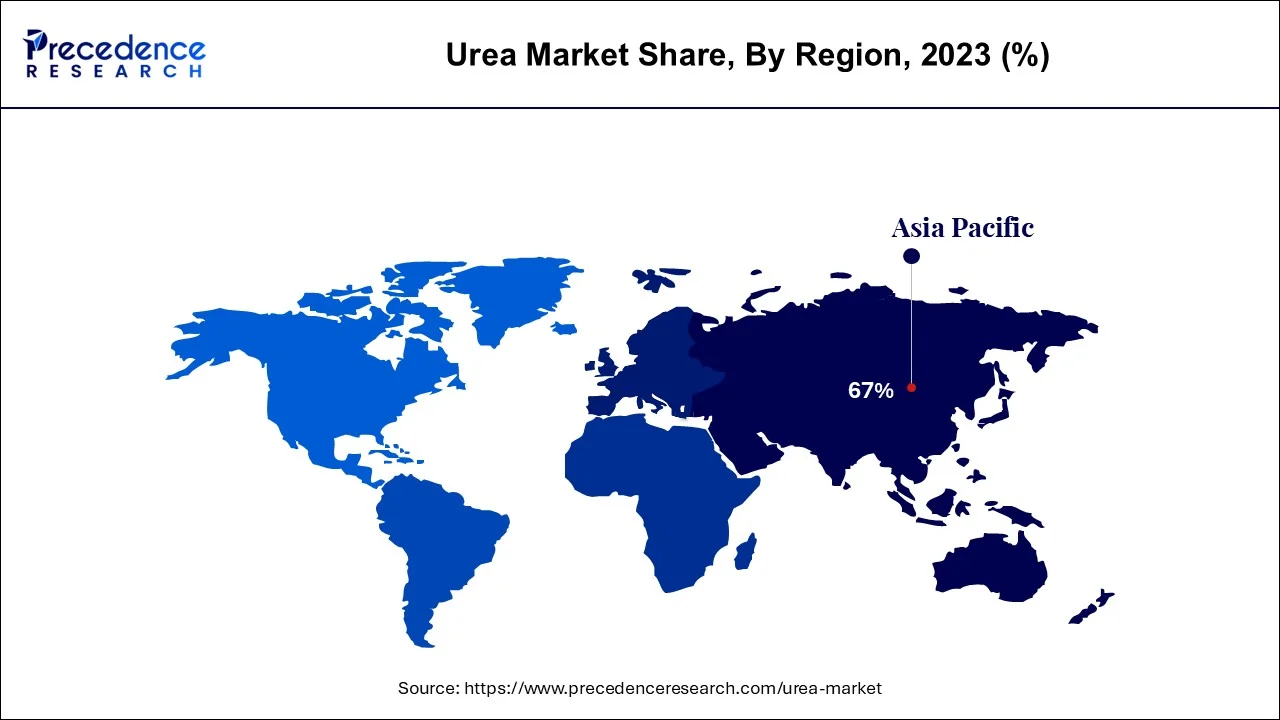

The asia pacific urea market size accounted for USD 91.74 billion in 2024 and is expected to be worth around USD 113 billion by 2034, growing at a CAGR of 2.10% between 2024 and 2034.

The region's population is rapidly increasing, which raises the demand for food. In order to boost crop output per hectare of farmland, this has resulted in a rise in demand for fertilizers. Also, the market for feed-grade materials in the area is being driven by rising use in the livestock feed business. To meet the rising demand, a surge in carbamide manufacturing has been caused by all of these variables.

China, which ranks first in terms of production and consumption worldwide, is followed by India, Indonesia, Japan, and South Korea in terms of market share. Local authorities in the area are also helping farmers by offering incentives for the purchase of fertilizers to boost food crop production.

For instance, the Indian government announced a subsidy for the fiscal year 2022-2023 of almost USD 270 billion. Carbamide is heavily imported into Europe from the Middle East and Asia. Technology advancements in the product, supported by rigorous restrictions, are anticipated to lower carbon emissions as well as input prices.

The region's market is being driven by its well-developed automobile industry. It's because more people are using it to cut back on nitrogen oxide pollution caused by fuel burning. The region's automobile industry is likely to experience a boom in demand as a result of tightening laws aimed at reducing greenhouse gas emissions.

Ammonia and carbon dioxide are combined to create ammonium carbamate, which is used commercially. Furthermore, ammonium carbamate breaks down to produce solid urea (carbamide). The product became a well-liked option as a nitrogen source in the fertilizer sector since it is enhanced with nitrogen. The protein needs of ruminant animals can be adequately satisfied by feed quality. It is widely used in various industrial applications because of its outstanding chemical properties. Consequently, a promising market picture for versatile utilization is anticipated soon.

Production technology advancements like Blue Urea offer significant potential for business expansion. This novel product is created in a reaction environment that is attenuated. This is accomplished by utilizing the raw components carbon dioxide, nitrogen, and water. Renewable energy sources, such as wind turbines placed nearby or at a site of usage, provide the energy needed for production. Hydrogen is created during the reaction through the electrolysis process.

At the point of usage, the equipment can be stored in an ISO container that is standardized. Delocalizing production in this way reduces transportation-related expenses and emissions. This method aids in reducing emissions of several pollutants linked to conventional industrial processes. Also, this method produces products that are devoid of pollutants, making them perfect for usage.

There has recently been a significant increase in the demand for carbamide from the manufacturing industries due to its numerous industrial applications. Because it has the potential to generate hydrogen connections that interpenetrating helices, it can trap various chemical molecules. Due to this characteristic, it can be used to separate the mixture and to produce aviation fuels and lubricating oils.

Moreover, it helps to separate paraffin. The substance is used in the automobile industry to lower nitrogen oxide pollution caused by gasoline combustion. The aqueous solution, for instance, is injected into the exhaust system by BlueTec solutions. In a catalytic converter, ammonia breaks down the emission of nitrogen oxides into water and nitrogen.

| Report Coverage | Details |

| Market Size in 2024 | USD 136.93 Billion |

| Market Size by 2034 | USD 167.41 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 2.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Grade and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing usage in the fertilizers segment

The market growth of urea has been aided by the expanding agricultural industry. Most markets, including those in North America, and India, use urea and its compounds extensively as fertilizers. The market for urea is being driven up by the rising need for N-fertilizers to encourage plant growth. Also, due to the product's growing use in the region's agriculture sector, developing nations including those in South Asia and Latin America are projected to have higher than-average demand for it.

In addition to these uses, urea is also used to make urea-formaldehyde resins, diesel exhaust fluids, melamine, and animal feed, and the demand for these products is rising. The market is expected to expand throughout the forecast years because to the rising product demand from the automotive industry for diesel exhaust fluid, which is used to convert nitrogen oxide from the exhaust into harmless nitrogen and water and meet strict environmental standards.

Rising awareness about organic farming

Urea costs are rising together with the cost of petroleum and natural gas everywhere in the world. As a result, countries like India, Brazil, Australia, Japan, and others that depend on the import of oil and gas for production have seen an increase in their import costs. The main fertilizer used in agriculture, both alone and in conjunction with other fertilizers, is carbamide. It has led to higher input costs for agriculture and higher ammonia and carbon dioxide emissions.

The biosphere and human health are both negatively impacted by ammonia generated during application, and carbon dioxide is a powerful greenhouse gas. This has led to many governments all over the world pushing various forms of alternative agricultural techniques, including organic farming and natural farming with no budget.

For instance, the Paramparagat Krishi Vikas Yojana programme, a special initiative of the Indian government, promotes several forms of chemical-free farming systems (PKVY). Such attempts from influential consumers could impede business expansion.

High applicability of technical grade urea

Technical grade is utilized as a raw material in the production of urea-formaldehyde resins, stabilizers in nitrocellulose explosives, and adhesives like urea-melamine-formaldehyde used in marine plywood. It has a variety of uses in the cosmetics and pharmaceutical industries. It provides the hydrogen needed for fuel cells that generate electricity after rehydrating goods.

It is a crucial raw material for the production of many pharmaceuticals and chemical intermediates and is used as a component in products including hair removal products, bath oils, conditioners, disinfectants, skin softeners, lotions, and more. Deicers used by airports, yeast nutrients, tobacco flavoring additions, protein denaturants, and radiological detectors used in various diagnostic procedures are examples of further commercial applications.

The category with the biggest market share in 2023 was the fertilizer grade segment, and it was anticipated that it would remain in that position for the foreseeable future. It is a result of the growing usage of fertilizers to boost crop productivity. The population has increased dramatically in recent decades, particularly in developing nations in Africa and Asia.

Food demand has increased as a result of this. Also, this has put more strain on the scarce agricultural land, leading to an increase in fertilizer use. Other sources of animal feed are now necessary because of the decline in pasture and grazing land caused by increased industrialization. Due to this, the demand for feed-grade products to supplement the diets of cattle and other ruminant animals has increased.

The agriculture sector accounted for the largest portion of the global market in 2023. It is a result of the extensive usage of carbamide fertilizers to boost crop yields. Transporting and handling in agricultural applications are made simple by the granular and pilled forms. It is either spread on top of the soil or combined with it. It may be used mechanically or manually. Depending on the needs of the crop and the soil, it is used both before and after planting. Because of the scarcity of protein-rich feeds and the expensive cost of protein supplements, carbamide is being used as an alternative feed additive.

A product of feed grade has about 45% nitrogen, which is equal to 280% crude protein. The animal feed market is anticipated to develop as a result of declining grazing land availability and rising costs of traditional animal feed. The market's quickest growth is anticipated to occur in the chemical synthesis category. To create resins, pharmaceutical and cosmetic formulations, and other specialty compounds, technical grade materials are frequently employed.

Additional uses include the production of exhaust fumes fluid, research and development, as a hydrogen source, as a de-icing agent, as a flame-proofing agent, as an ingredient of cloud seeding agent, as a plankton nutrition in ocean nutrition experiments, and others. The variety of applications in various end-use industries is what is fueling the expansion of the other segment.

Segments Covered in the Report:

By Grade

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client