January 2025

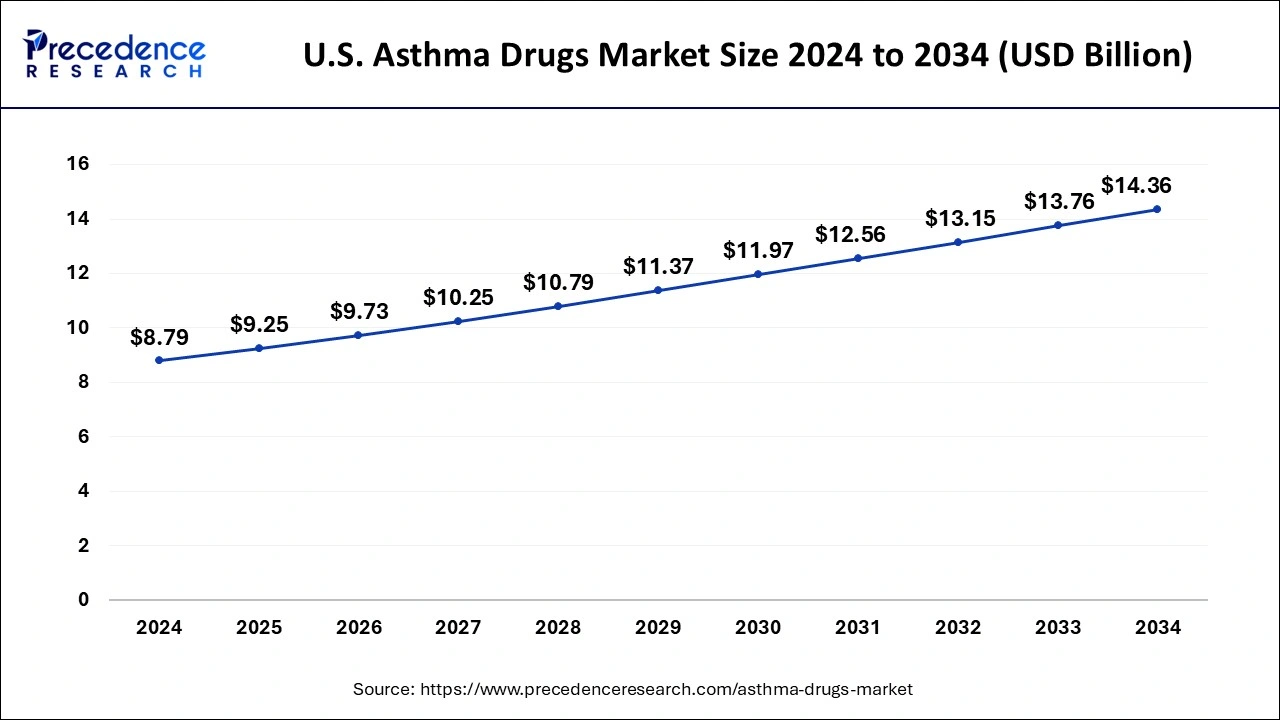

The U.S. asthma drugs market size is calculated at USD 9.25 billion in 2025 and is forecasted to reach around USD 14.36 billion by 2034, accelerating at a CAGR of 5.03% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. asthma drugs market size was valued at USD 8.79 billion in 2024 and is expected to be worth around USD 14.36 billion by 2034, poised to grow at a CAGR of 5.03% from 2025 to 2034. The rising prevalence of psychiatric illness is driving demands for asthma drugs in the United States. Growing advancements in research and technologies are driving the U.S. asthma drug market. Rising government initiatives in the R&D sector are leveraging the U.S. asthma drug market.

AI in clinical research is a game changer for the healthcare industry. The production of drugs with more efficiency, effectiveness, accuracy, and affordability has been possible thanks to AI integration in manufacturing industries. In asthma drugs, AI is playing a significant role in improving inhaler designs, nebulizers, and drug delivery devices to make them more intuitive, personalized, and efficient. The ability of AI to provide details of high-risk asthma patients through predictive analytics and machine learning is emerging in its integration into the asthma drugs sector. Moreover, AI-driven research is able to identify potential therapeutic targets and predict drug efficacy. The rising demand for personalized medicines and treatment solutions among pediatric and elderly populations is being made possible thanks to AI. The surge in the adoption of digital therapeutics and AI for patient support is projected to enhance patient outcomes and advance technologies and treatment solutions.

Asthma is a chronic respiratory condition characterized by inflammation and narrowing of the airways, leading to symptoms such as wheezing, shortness of breath, coughing, and chest tightness. It is a common condition, and its severity can vary from person to person. Management of asthma often involves the use of various medications, including bronchodilators and anti-inflammatory drugs.

The U.S. asthma drugs market is composed of key players, regulatory authorities, marketing agencies, and entities involved in the research and development of asthma treatments. According to the American College of Allergy, Asthma, and Immunology, asthma affects 7.7% of Americans, approximately 24.9 million of them comprise 4.6 million children and 20.2 million adults. More than 900,000 ER visits and 94,000 hospital inpatient stays were recorded by asthma patients. An estimated $50 billion is spent on asthma-related expenses each year. Nearly one-third of the more than 3,500 individuals who die from asthma each year are 65 years of age or older. The rising prevalence combined with growing costs of treatment is a major aspect of the U.S. asthma drug market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.03% |

| U.S. Market Size in 2025 | USD 8.36 Billion |

| U.S. Market Size by 2034 | USD 14.36 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Medication, By Mode of Administration, By Source, By Organization Type, and By Application |

Growing prevalence of asthma and government initiatives

The U.S. prevalence of asthma has been on the rise, contributing to a growing patient population. This increase in the number of asthma cases is a significant driver of the demand for asthma drugs. According to an AAFA article from September 2022, there are over 25 million asthmatics in the United States. Additionally, about 15 million persons in the U.S. suffer from COPD, according to an NIH paper from March 2022. Besides, the rising initiatives by the government also propelled the market expansion in the country.

High cost

One major issue affecting the U.S. asthma drugs market is the high cost of its services and products. Many patients, particularly those with inadequate insurance coverage or those belonging to low-income communities, may find the expense of drugs, including inhalers and oral medications, to be an overwhelming burden. Subpar asthma management may result from access to essential drugs and preventative measures being restricted due to the high cost of therapy.

The research and manufacturing process of drugs is one of the factors contributing to the high cost of asthma therapy. The total cost is increased by clinical trials, regulatory approvals, and research and development. The high cost is also influenced by the ongoing need for innovation and the release of newer, more potent treatments. Thus, hampering the market growth.

Growing FDA approvals

The discovery of novel drugs is critical for pharmaceutical research and development and patient treatment. Repurposing existing drugs that may have anticipated effects as a potential candidate is one way to meet this vital goal. The subsequent increasing FDA approvals of these new as well as repurposed drugs is expected to offer a lucrative opportunity for the asthma drugs market growth over the forecast period.

The quick relief medications segment held the largest share in 2024.. Quick-relief medications, also known as rescue medications, are a crucial component of asthma management. They provide rapid relief from acute asthma symptoms by bronchodilating and easing airway constriction. Common quick-relief medications include short-acting beta-agonists (SABAs).

Advances in inhaler technologies, such as the development of smart inhalers, aim to enhance patient adherence and monitor medication usage. Smart inhalers may have the potential to impact the market by improving the management and tracking of quick-relief medication use. Thereby driving the segment growth.

The inhalers segment dominated the U.S. asthma drugs market in 2024. The segment is observed to sustain the position throughout the forecast period. The segment expansion is attributed to the increasing advancements in inhaler technology, including smart inhalers. The integration of digital technology into inhalers, known as smart inhalers, has been a growing trend. These devices may include sensors to track medication usage, provide reminders, and offer insights into asthma management.

The public segment dominated the U.S. asthma drugs market in 2024. Public organizations often launch health education campaigns to raise awareness about asthma, its symptoms, triggers, and the importance of proper management. These campaigns may influence public perception and encourage individuals to seek appropriate medical care, potentially impacting the demand for asthma drugs. The rising demand for biosimilar and generic medicines is the major factor driving the segment expansion due to their easy access and cost-effectiveness. Expanding healthcare infrastructure and government investments and funding for healthcare services are leveraging the segment to grow.

The adult segment dominated the market in 2024, and the segment was observed to sustain its dominance in the market during the forecast period. According to the American College of Allergy, Asthma, and Immunology, the prevalence of asthma is greater in adults (8.0%) than in children (6.5%). Such disparity promotes greater efforts for the treatment of asthma in the demographic, greatly driving the growth of the adult segment in the U.S. asthma drugs market.

The pediatric segment is expected to grow at the highest growth during the forecast period. Asthma is one of the most common chronic conditions in children. The prevalence of pediatric asthma has been increasing in the U.S. The high incidence of asthma in children contributes to the demand for asthma medications specifically designed for pediatric use. The growing environmental irritations, including smog and air pollution, are majorly impacting children's health. Additionally, the growing incidence of pediatric asthma has increased awareness and led to innovations for the development of novel yet efficient treatment solutions. The rising demand for advanced and proper treatments is leveraging the segment growth.

Leader’s Announcements

In September 2024, Sanofi received the US Food and Drug Administration (FDA) approval for its Dupixent (dupilumab) as an add-on maintenance treatment for adults with inadequately controlled chronic obstructive pulmonary disease (COPD) and an eosinophilic phenotype. It is the first biological medicine that was approved in the US to treat these patients.

In May 2024, Amgen presented novel respiratory data at the American Thoracic Society (ATS) 2024 International Conference, taking place May 12-22 in San Diego.

By Medication

By Mode of Administration

By Source

By Organization Type

By Application

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

March 2025

March 2025