January 2025

US Automotive Aftermarket (By Product: Battery, Tire, Filters, Brake Parts, Turbochargers, Lighting & Electronic Components, Body Parts, Exhaust Components, Wheels, Others; By Application: DIFM (Do it for Me), DIY (Do it Yourself), OE (Delegating to OEM’s), By distribution channel, Wholesalers & Distributors, Retailers; By certification: Certified Parts, Genuine Parts, Uncertified Parts) - Regional Outlook and Forecast 2025 to 2034

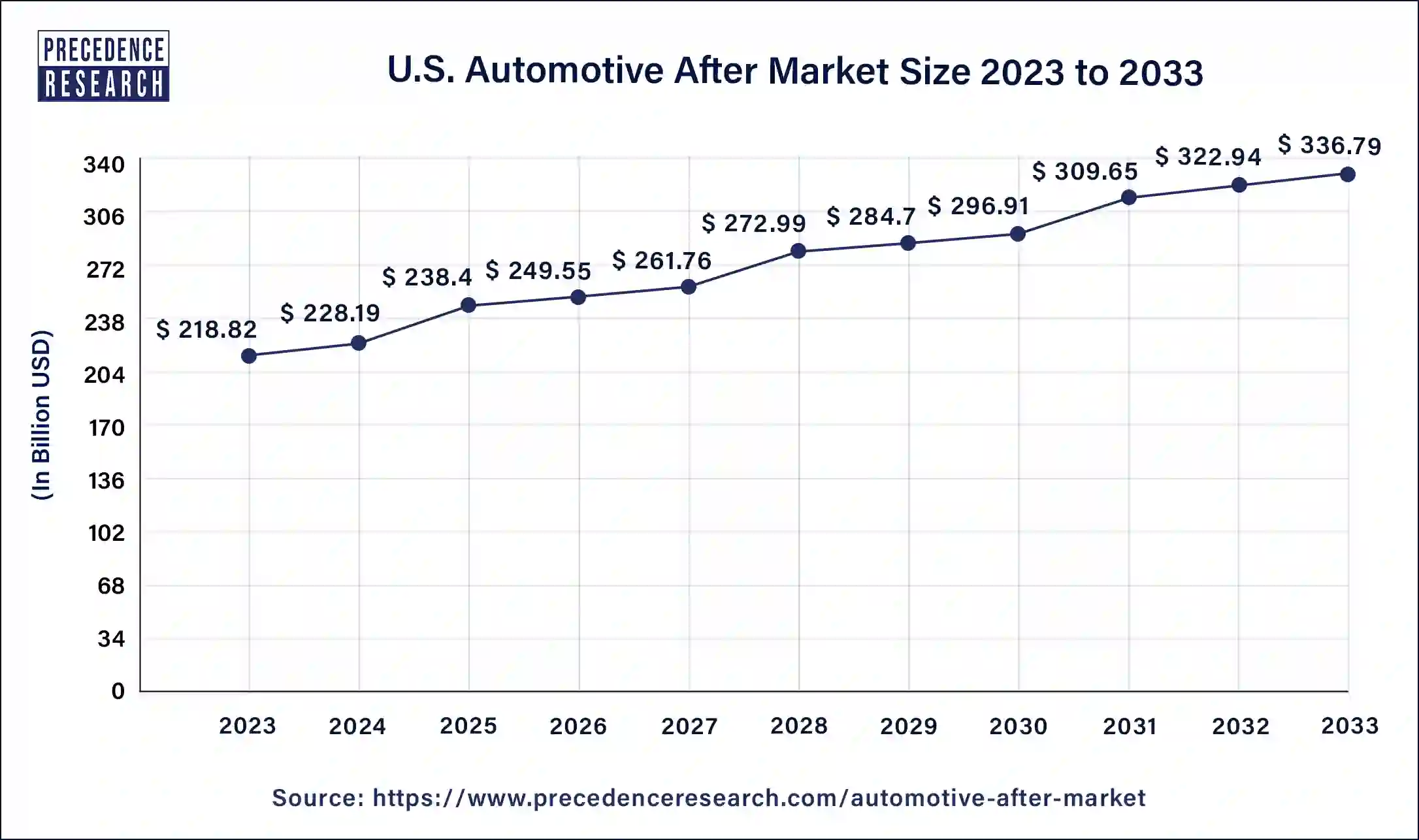

The US automotive aftermarket size reached USD 218.82 billion in 2023 and is estimated to surpass around USD 336.79 billion by 2033, growing at a CAGR of 4.42% from 2024 to 2033.

US Automotive Aftermarket Overview

The expanding electric vehicle (EV) population necessitates specialized infrastructure, services, and parts for software updates, charging systems, and battery maintenance. Sensor-equipped and telematics-equipped vehicles produce data, which makes individualized service recommendations and predictive maintenance possible. Online sales are growing because they are convenient and have competitive prices.

Possibilities for aftermarket manufacturers to create training materials, diagnostic tools, and repair kits tailored to EVs. With flexible delivery options and individualized product recommendations, they improved online shopping experiences. More reasonably priced, refurbished, and recycled parts are available.

Subscription-based programs provide flexible and convenient car care and maintenance options. Creating software, diagnostic tools, and maintenance kits tailored to electric vehicles. Preventive repairs and customized service recommendations are provided via data-driven maintenance platforms.

Drivers

Modern cars have sophisticated parts, intricate electronic systems, and cutting-edge technologies. Many customers and even some vehicle repair companies may require additional knowledge and abilities to maintain and repair this complexity. Therefore, the need for aftermarket services to handle these complications is rising. Modern automobiles last longer because of advancements in engineering and manufacturing despite their increasing complexity. The need for aftermarket services is further increased because automobiles require regular maintenance and repairs as they age. Thereby, the rising complexity of modern vehicles is observed to act as a driver for the

These preferences consider several variables, such as evolving lifestyles, economic concerns, environmental concerns, and technological improvements. Customers are looking for more customized and environmentally friendly transportation options, so aftermarket goods and services are in high demand. For example, the growing demand for EV charging stations and associated accessories results from the increasing popularity of electric vehicles (EVs). Similarly, the demand for personalization and customization has driven the market for aftermarket components like linked automobile technologies, performance increases, and cosmetic modifications.

Furthermore, as automobiles grow increasingly intricate and advanced, buyers want aftermarket systems that provide connection, safety, and convenience features. The development of aftermarket items like sophisticated navigation systems, collision avoidance systems, and smartphone integration has been fueled by this trend.

Restraint

Rise of electric vehicles (EVs)

In contrast to conventional internal combustion engine vehicles, electric vehicles have fewer moving parts. This means that parts like spark plugs, belts, and filters frequently changed in conventional cars are either absent in EVs or require less regular maintenance. This decline in part demand directly impacts the merchants and aftermarket suppliers who depend on selling these components. The aftermarket for parts intended for conventional vehicles is well-established, but the one for electric car parts is still growing. Because of this, it can be difficult for aftermarket companies to find and carry parts designed specifically for electric vehicles while competing with OEMs that can control most of the supply chain.

Opportunities

Aftermarket electric car parts (EVs) will become increasingly in demand as more EVs are driven on public roads. This covers EV-specific accessories, batteries, electric drivetrain parts, and charging stations. The number of EVs on the road will increase demand for infrastructure related to charging. The aftermarket sector may utilize this by offering cutting-edge charging options for homes, businesses, and public areas.

For aftermarket businesses, subscription models offer a reliable source of income, facilitating more stable and effective financial planning. Aftermarket companies can boost client relationships and increase lifetime value and loyalty by providing subscription-based services like maintenance, repairs, and part replacements. By renovating and remanufacturing used parts rather than creating brand-new ones, adopting circular economy concepts can assist aftermarket businesses in cutting waste and lessening their environmental effect. Remanufacturing and refurbishing items can result in cost savings for organizations and consumers as they are often less expensive than manufacturing new ones.

The tire segment dominated the US automotive aftermarket in 2023. As a result of wear and tear, punctures, and other damage, tires on the millions of cars on the road always need to be replaced. As a result, new tires are consistently in demand. When it comes to their cars, buyers put performance and safety first. Tires have a significant impact on handling, traction, and stopping distance. For this reason, many drivers are prepared to spend money on premium tires to guarantee the best performance and safety.

The battery segment is the fastest growing in the US automotive aftermarket during the forecast period. As automobile batteries have a limited lifespan, there is an increasing need for battery replacements as the number of vehicles on the road rises. The average age of cars on American roadways has been continuously growing, which has increased demand for batteries and other replacement parts.

The battery market has expanded due to the growing appeal of electric vehicles. The general trend toward electrification has increased demand for batteries and related services, even if EVs require different types of batteries than conventional vehicles.

The DIFM (Do it for Me) segment dominated the US automotive aftermarket in 2023. Due to their increased complexity, modern cars need specific tools, equipment, and knowledge to be maintained and repaired. Many car owners rely on specialists to complete these activities because they need more time or expertise. When opposed to do-it-yourself projects, professional service centers usually provide greater quality repairs. For the peace of mind of their clients, they frequently offer warranties on their work, have access to OEM (Original Equipment Manufacturer) parts, and employ skilled technicians.

The DIY (Do it Yourself) segment is the fastest growing in the US automotive aftermarket during the forecast period. With the wealth of internet DIY guides and resources, many customers are increasingly confident handling simple auto maintenance and repairs. Due to the growth of internet merchants specializing in automotive tools and parts, it is now simpler for customers to obtain the necessary supplies to undertake do-it-yourself maintenance. In addition, many physical stores currently have a wide range of tools and vehicle parts for do-it-yourself enthusiasts.

The wholesalers & distributors segment dominated the US automotive aftermarket in 2023. Distributors and wholesalers combine goods from different producers and deliver them to retailers and repair shops effectively, streamlining the supply chain. This guarantees a continuous supply of parts and accessories to satisfy customer demand. Due to its frequent regional presence and vast networks, it can serve a broad spectrum of customers nationwide. This extensive coverage guarantees product availability and rapid delivery, essential in the quick-paced automotive sector.

The retailers' segment is the fastest growing in the US automotive aftermarket during the forecast period. The need for vehicle parts, accessories, and services is growing due to aging car fleets, increased mileage, and a desire for personalization and customization. The number of consumers opting to perform regular auto maintenance and repairs on their own is growing, which increases the sales of tools and components in shops.

The expansion of e-commerce platforms and online marketplaces has led to a rise in sales in the retailer category by simplifying the process for customers to access and compare a wide range of automotive products at reasonable prices.

The certified parts segment dominated the US automotive aftermarket in 2023. Industry standards are followed, and extensive testing is performed on certified parts to guarantee superior quality and dependability. Customers and expert mechanics who value lifespan and performance are drawn to this assurance. It assures customers of their legality and adherence to industry standards by complying with government legislation and safety norms. In terms of vehicle safety and emissions management, compliance is especially important. They are made to fit and work with various car makes and models, meeting or surpassing OEM standards. This compatibility lowers the possibility of future problems and minimizes installation errors.

The genuine parts segment is the fastest growing in the US automotive aftermarket during the forecast period. As authentic components are more compatible, reliable, and high-quality than aftermarket equivalents, many car owners choose them. Original equipment manufacturers (OEMs) frequently provide warranties for genuine parts, giving customers peace of mind and guaranteeing the quality of the product. To preserve the integrity and functionality of their cars, some customers have strong brand loyalty to car manufacturers and prefer to utilize original parts.

Segments Covered in the Report

By Product

By Application

By Distribution Channel

By Certification

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025