January 2025

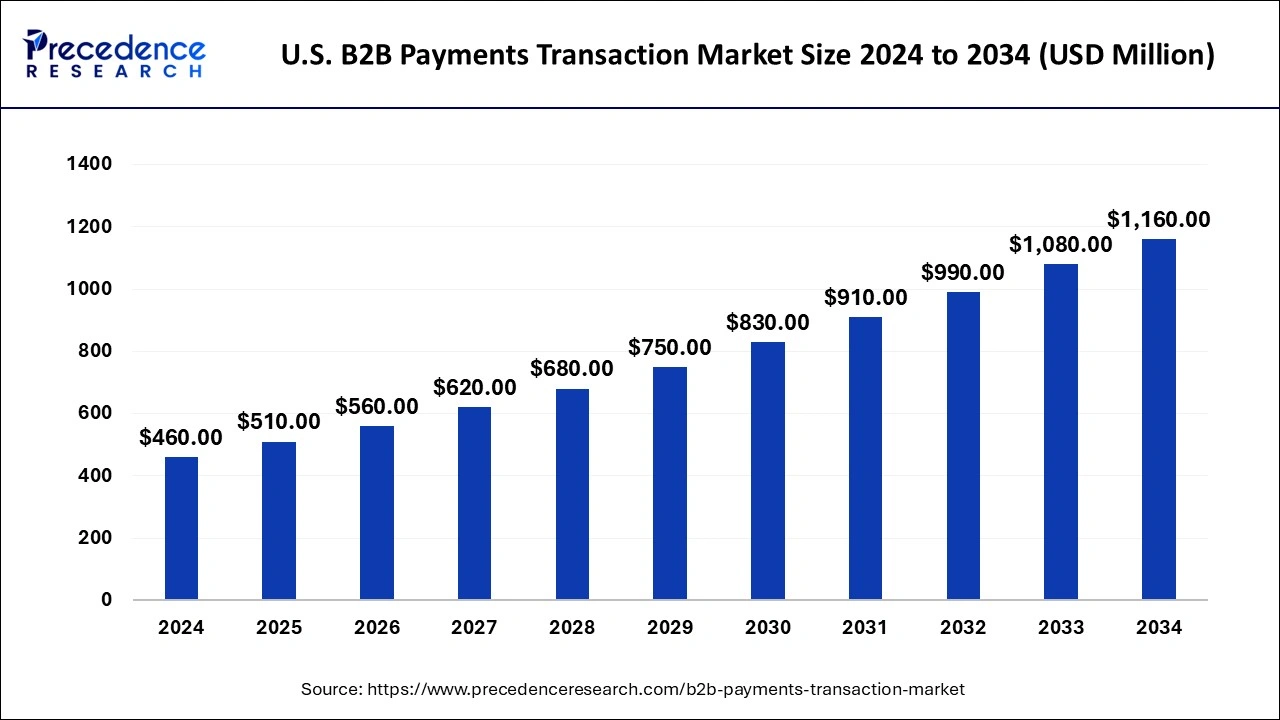

The U.S. B2B payments transaction market size market size is calculated at USD 510 million in 2025 and is forecasted to reach around USD 1,160 million by 2034, accelerating at a CAGR of 9.69% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The U.S. B2B payments transaction market size was estimated at USD 460 million in 2024 and is predicted to increase from USD 510 million in 2025 to approximately USD 1,160 million by 2034, expanding at a CAGR of 9.69% from 2025 to 2034. Integration of digitization and automation in the business payments are driving the growth of the market.

B2B payments are the process of payment from business to business for the supply of services and goods. It can be the one-time payment or the recurring as per the agreement between the businesses. There are the major four type of the B2B payments methods are ACH credits, domestic wire transfer, cheque, and others. Technological adoption in the United States is transforming the payment process which is observed to supplement the market’s growth. The evolution in the digital payment transforms the payment methods makes it faster, efficient, safer, and cost effective that contributed to the expansion of the U.S. B2B payments transaction market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.69% |

| Market Size in 2025 | USD 510 Million |

| Market Size in 2024 | USD 460 Million |

| Market Size by 2034 | USD 1,160 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Payment, Payment Mode, Enterprise Size, and Industry |

Growth of B2B e-commerce market

The rising B2B e-commerce activities in the United States is driving the demand for the B2B payment transaction process. B2B e-commerce is the online shopping experience that takes place between the two individual businesses which allows the businesses to buy or sell the products or services electronically. B2B e-commerce application transforms business operation and makes it rapid, efficient, and budget friendly. The rapidly growing B2B eCommerce industry allows the business to access new customers and suppliers, regardless of their location. The rising adoption of advanced digital technologies into the business is accelerating the expansion of the B2B e-commerce industry.

There is different type of the B2B ecommerce models as per the requirement and goals of the business, some of the popular types are direct-to-business (D2B), marketplaces, procurement, e-procurement, B2B2C, wholesale business, manufacturer business, and distributors business. The expansion of the B2B e-commerce industry is driving the requirement for the safe and efficient payment transaction process that accelerating the growth of the U.S. B2B payments transaction market.

Security threats

Security incidents can disrupt B2B payment processes, causing delays, disruptions, and financial losses for businesses. Downtime resulting from security breaches can impact business operations, customer relationships, and revenue generation. B2B payments often involve the exchange of sensitive financial information between businesses. Data breaches can occur if security measures are not robust, leading to the compromise of sensitive data such as bank account details, credit card numbers, and personally identifiable information (PII).

Advancements in the payments and software solutions

The digitization and the technological advancements in the payment methods are transforming the payment and financial transaction. The evolution of digital payment enhances online shopping, paying bills, and money transfer experiences. It makes it safer, quick, efficient, and accessible. Digital payment is highly serving cross-border business and generates more financial opportunities in the growing economies. The technological development in payments and software solutions like digital wallets, IoT and connected commerce, instant cross border payments, peer-to-peer (P2P) payments, B2B payments system.

While in the B2B payment system it provides the cost effective, integrated, digital–first, and fast service with the full-service automation, system-wide security, streamlined payments functions, interdepartmental functionality, real-time tracking capabilities. These payments and software solutions can help in optimizing the business operations and sales. Thus, the ongoing research on the advancements in the payment and software solutions in the B2B payment transaction is observed to offer a set of opportunities for the U.S. B2B payments transaction market.

The domestic payment dominated the U.S. B2B payments transaction market with the largest share in 2024. The rising industrial and commercial infrastructure in the United States are driving the various business opportunities in the market. The increasing business rates are driving the demand for the advancement in the domestic payments process.

The domestic payment is the payment made within a certain area in which the client and the merchant account are registered in the same country. The increasing domestic commercial activities are driving the expansion of the domestic payment segment.

The ACH segment dominated the U.S. B2B payments transaction market with the largest share in 2024. An ACH (payment) is a Bank-to-Bank payment transaction that occurs when a client enables an originating institution or business to debit their bank account directly. The cost of an ACH transaction differs significantly from the cost of a credit card transaction. When it comes to receiving large payments, ACH transactions can be more cost-effective because they have a flat transaction cost (rather than a percentage of the transaction value). Businesses who employ ACH payments have more flexibility and control over their payment terms due to the cost difference.

For example, LiquidInvoice allows its ACH clients to offer early payment incentives. LiquidInvoice gives an incentive for businesses to use its services for larger payments and transfers by charging a flat price per ACH transaction rather than a percentage of the overall transaction value. Manufacturing and non-profits, in particular, are well-suited to ACH payments and the benefits they provide.

Manufacturing accounts for approximately a third of all B2B payments. Smaller businesses, with annual revenues of $8 to $50 million, are more likely to have inefficient legacy accounting systems that prohibit them from sending invoices on time and keeping track of outstanding payments. They can establish the net conditions and even offer incentives for early payment using ACH payments.

The large enterprise segment dominated the U.S. B2B payments transaction market in 2024. Large enterprises comprise the high transactional value that drives the demand for the efficient payment transaction process that drives the demand for the B2B payments transaction method in the large enterprise. B2B payment transaction plays an important role in large enterprises with the seamless transaction of services and goods, pay employees, maintaining supply chain, and management financial commitments effectively.

Industry Insights

The manufacturing segment dominated the U.S. B2B payments transaction market with the largest market share in 2024. Manufacturing segments hold the largest size of the global B2B payment market even across the region of North America. Manufacturing includes a huge and complex process of acquiring several suppliers. The increasing demand for the specified software for keeping track of the payments.

The adoption of the B2B payment software helps to automate the operation and keep track of all the different invoices and payments. The system allows the manufacturers to save time, cost, and enhances efficiency. The advancement and the development in the manufacturing industries in the economically developing countries are contributing to the expansion of the B2B payments transaction market.

The BFSI is the second largest segment with a significant growth rate during the forecast period. The increasing banking and financial sectors globally and the growing rate in domestic and international business trades and payments are driving the growth of the segment. The advancement in the digitization of payment methods and the rising technological integration in the BFSI industry are driving the expansion of the U.S. B2B payments transaction market.

By Payment Type

By Payment Mode

By Enterprise Size

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024